Author: God’s grace

Dear friends, another big melon has recently exploded in the blockchain circle!Russian President Putin’s adviser directly spoke at the Oriental Economic Forum – the United States is secretly planning a “financial reset” and intends to use cryptocurrency and gold as tools to erase its huge $35 trillion in government bonds in one fell swoop!

This is not a conspiracy theory, but what Putin adviser Anton publicly said at a formal press conference: “The United States is trying to rewrite the rules of the gold and cryptocurrency markets. Don’t forget the size of their debt – $35 trillion. These two areas are essentially an alternative to the traditional global monetary system.”

Debt crisis, heavy burden on the United States

Let’s first see how scary US debt is.

at presentU.S. Treasury bonds have reached $37.43 trillion, has increased by more than 10 times since 1981.Just the interest you have to pay every yearBreakout $1 trillion, has become the third largest expenditure in the US fiscal, second only to social security and military expenses.

How do the Americans plan to pay off such a huge debt?The answer may shock everyone – they may not have planned to “honestly” return at all!

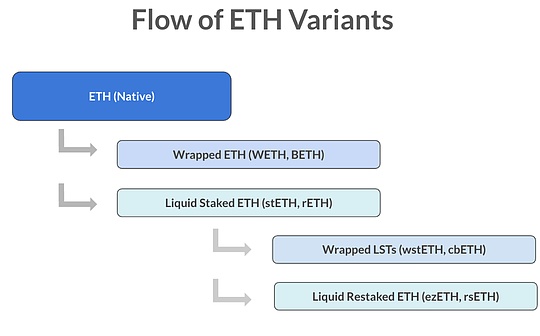

Cryptocurrency becomes a “life-saving rope”?

Putin’s adviser revealed that the United States plans to devalue its debts by converting them into dollar stablecoins, allowing the United States to “start over”.It’s like “moving debt into the encrypted cloud” and devalued it with one click.

The United States does have big moves in stablecoins.In July this year, President Trump signed the GENIUS Act, establishing a regulatory framework for US stablecoins.

Former House Speaker Paul Ryan even said bluntly: “The dollar-backed stablecoins provide demand for U.S. public debt and provide a way to keep up with China.”

Stablecoins: “New Buyer” of U.S. Treasury

Stablecoins have become an important participant in the US bond market.

-

Tether, the largest stablecoin issuer, has increased its holdings of US Treasury from 63 billion to US$127 billion

-

Circle holdings rose from 9 billion to $24 billion

-

The two account for 3.2% of the short-term bond market

what does that mean?Stablecoin issuers have become important buyers of U.S. bonds, creating new demand for U.S. debt.

History repeats itself?”Traditional Operation” in the United States

Putin’s adviser also pointed out that this is not the first time the United States has done such a thing.He will take the American plan toThe 1930s and 1970sThe approach is comparable, and the United States plans to solve its financial problems again “at the world’s cost”.

The difference is that this time the tools are no longer traditional financial derivatives, but “substitutes” of the two traditional monetary systems, crypto assets and gold.

Big Boss’ View: The US dollar plight boosts the rise of crypto

Founder of Bridgewater FundRay DalioSimilar views have been made.He believes:

The debt difficulties of the US dollar and other reserve currencies are threatening its attractiveness as reserve currencies, and thisIt is one of the factors driving the price rise of gold and cryptocurrencies.

He even said that cryptocurrency has become a kind of“Alternative currency with limited supply”.If the dollar supply increases or demand drops, cryptocurrencies can become an attractive alternative.

Former IMF chief economistKenneth RogoffFrom the perspective of “underground economy”, it is pointed out that cryptocurrencies are eroding the US dollar.Dominance in the global underground economy (size approximately US$20-25 trillion), which weakens the dollar hegemony from another dimension.

Bitcoin’s “digital gold” attributes

In this financial game between big countries, Bitcoin’s status is becoming increasingly important.

In May 2025, the U.S. long-term Treasury bonds were sold.Bitcoin price hits record high, shows that under extreme market conditions, funds began to regard Bitcoin as an alternative to safe-haven assets.

Bitcoin even broke through the $100,000 mark, with a market value exceeding Silver and Saudi Aramco, becoming the seventh largest asset in the world.

China’s calm stance

China has maintained a relatively calm attitude amid this cryptocurrency fanaticism.

China did not blindly follow the trend, but chose a safe path.Promote the internationalization of the RMB, and passDevelop digital RMB, gradually enhance the RMB’s voice in the international financial system.This is in sharp contrast with the attitudes of the United States and Russia, showing China’s unique thinking on financial strategy.

This revelation from Putin’s adviser reveals to us a formationNew global financial landscape:

Traditional dollar hegemony is facing challenges, cryptocurrencies and gold have become new gaming tools, and countries are preparing for the upcoming financial change.

The United States is trying to resolve the debt crisis through cryptocurrency, Russia launches its own stablecoin, and China vigorously develops the digital RMB – this “currency war” without gunpowder is quietly escalating.

What role will cryptocurrencies play in the future financial world?Will the dollar hegemony be over?How should we protect our wealth?

These questions may be the real thoughts brought to us by Putin’s revelations.