Author: Chaos Labs; Translation: @bitchainvisionxz

1, risk curation and on-chain capital allocator (OCCAs) the rise of

DeFi has entered a new stage of structuring: institutional trading strategies are being abstracted into composable tokenized assets.

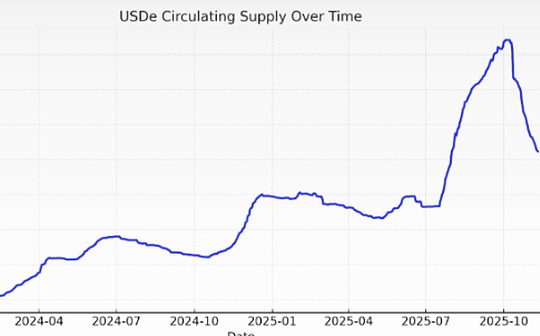

This trend started with the rise of liquid collateralized tokens (LSTs), and the launch of tokenized basis trading by Ethena Labs became a key turning point for DeFi structured products.The protocol packages strategies into synthetic dollars by hedging Delta risks, converts strategies that require 24-hour margin management into one-click tokens, and redefines users’ expectations for DeFi.

Yield products that were once exclusive to trading desks and institutions have now become mainstream – USDe has become the fastest stablecoin to reach a total locked-up amount of US$100 billion.

Ethena’s success confirms the market’s deep demand for tokenized access to institutional strategies.This shift is reshaping market structures and sparking a new wave of “risk curators” or on-chain capital allocators (OCCAs) – companies that encapsulate return and risk strategies into more streamlined user interfaces.

2, risk curators andOCCAsWhat is it?

The industry has yet to agree on a unified definition of risk curator or OCCA.The label covers a variety of designs, but the common core is a repackaging of interest-generating strategies.

OCCA usually launches branded strategy products, while risk curators mainly use modular currency markets such as Morpho and Euler Labs to realize profits through parameterized vaults.The total value locked (TVL) of these two types of applications will surge from less than US$2 million in 2023 to US$20 billion (an increase of approximately 10,000 times).

This raises a series of fundamental questions:

-

Where do the deposits go?

-

What protocol and counterparty risks are funds exposed to?

-

Are risk parameters adaptive?Can it be effectively dealt with even in the face of real volatile events?What assumptions does it rely on?

-

How liquid is the underlying asset?

-

If you encounter concentrated redemptions or runs, what are the exit paths?

3, Where are the risks hidden?

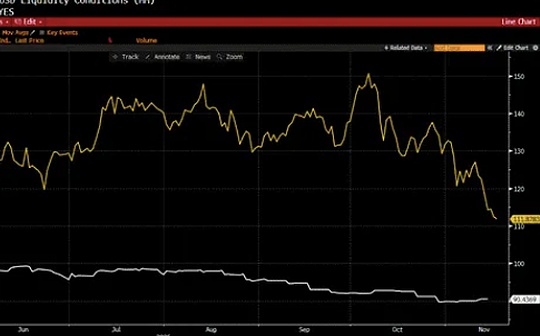

On October 10, the largest altcoin crash in the history of cryptocurrency swept CEX and perpetual contract DEX, triggering cross-market liquidation and automatic deleveraging (ADL).

However, delta-neutral tokenized products appear to be unaffected.

Most of these products operate like a black box, with little information disclosed except for the advertised annualized rate of return and broad market commitments.A few OCCAs will at most indirectly disclose protocol risk exposures and strategic directions, but key information such as real-time data at the position level, hedging channels, margin buffers, dynamic asset endorsements and stress marking strategies are rarely made public – even if they are disclosed, they are often selective or delayed.

Due to the lack of verifiable labeled data or channel-level traces, it is difficult for users to determine whether their risk resistance is due to sound design, luck, or delayed financial confirmation; in most cases, users cannot even know whether actual losses have occurred.

We will analyze four common design flaws: centralized control, asset rehypothecation, conflicts of interest, and limited transparency.

Centralization risk

Most of the packaged revenue-type “black boxes” are operated by an external account (EOA) or a multi-signature wallet controlled by the operator, which is responsible for the custody, transfer and deployment of user funds.This centralized model shortens the path to catastrophic losses due to operational errors (such as key compromise or signer coercion).It also re-enacts the common pattern of bridging attacks that dominated the industry in the last cycle—even without malicious intent, a single compromised workstation, a phishing link, or an insider abusing emergency privileges can wreak havoc.

Rehypothecation risk

In some income-based products, collateral is reused along the vault chain.One vault deposits funds into or borrows against another vault, which in turn cycles into a third vault.The investigation has recorded a circular lending model: deposits are “laundered” by multiple vaults, inflating the total lock-in value, forming a recursive casting-loan (or borrowing-supply) chain, amplifying systemic risks.

conflict of interest

Even if all parties involved have good intentions, setting optimal supply/borrowing caps, interest rate curves, or choosing the perfect oracle solution for a product is no easy task.These decisions come with trade-offs: a market that is too large or uncapped can exhaust exit liquidity, making liquidations unprofitable and induce manipulation; conversely, a cap that is too low can restrict healthy activity; and an interest rate curve that ignores the depth of liquidity can leave lenders in trouble.When the performance of curators is measured based on growth, the problem will become more prominent – the incentives of curators and savers may diverge.

Missing transparency

October’s market purge exposed a simple problem: users lacked monitoring data that could verify the location of risks, how they were marked, and the real-time existence of asset backing.Due to risks such as front-running, short squeezes, etc., it is not always wise to publish positions in real time.But a certain level of transparency is compatible with the business model: portfolio-level visibility (not tick-by-tick data), reserve composition disclosures, hedging coverage by asset class, etc. can all be verified by third parties.These systems also provide proof of reserves and access governance without exposing sensitive transaction data through dashboards and reporting on reconciliation of escrow balances, escrow/hedged positions and liabilities.

4, feasible path forward

The recent wave of curated products is pushing DeFi from its early core principles of non-custodial, verifiable, and transparent to a more institutionalized operating model.

There is no original sin in this transformation.The maturity of DeFi has created space for structured strategies, and these strategies will inevitably require a certain amount of operational discretion and centralized components.

However, accepting complexity is by no means the same as accepting opacity.

The goal is to bridge the gap with the spirit of DeFi by creating a viable middle ground where operators can manage complex ledgers while maintaining transparency for users.

To achieve this goal, the industry should advance in the following directions:

Reserve certificate:Break through the limitations of surface annualized rate of return (APY), disclose underlying strategy details, and introduce regular third-party audits and PoR systems.Users need to be able to verify asset endorsement at any time.

Modern risk management:Pricing and management solutions for structured income products already exist and are adopted by top DeFi protocols such as Aave.The Chaos risk oracle optimizes protocol parameters through a framework that reduces centralized single points of failure, while maintaining the health and safety of the currency market.

Reduce the risk of centralization:This is not a new problem.Bridging attacks have forced the industry to confront escalating keys, signer collusion, and opaque emergency permissions.We should not forget the lessons of history: adopt threshold signatures or hardware security modules (HSM); implement separation of key ownership; separation of roles (proposal, approval, execution); real-time fund allocation and minimum hot wallet balance; withdrawal whitelisting of custody paths; time-lock upgrade mechanism with public queue; and strictly scoped, revocable emergency permissions.

Limit systemic risk:Collateral reuse is an inherent feature of products such as insurance or rehypothecation.Rehypothecation behavior should be restricted and disclosure mandatory to avoid the formation of a closed casting-lending loop between related products.

Interest Alignment Transparency:Incentives should be as transparent as possible.Clarifying the curator’s interest orientation, related party network and change approval process can transform the black box into a contract that can be evaluated by users.

Standardized construction:Venture curation is already a $20 billion industry.This segment needs to establish minimum standardized specifications, including a unified classification system, mandatory disclosure requirements and event tracking mechanisms.

By implementing some of its commitments, the curation market can retain the advantages of a professional structure while protecting user rights with transparency and verifiable data.

5, conclusion

The rise of OCCA and risk curators is the inevitable result of DeFi entering the structured product stage.Since Ethena proved that institutional-grade strategies can be tokenized and distributed, the formation of a professional allocation layer around the currency market has become a foregone conclusion.This layering itself is not a problem; the problem is that the operational freedom it requires increasingly replaces verifiability.

The solution is clear: issue proof of reserves linked to liabilities, disclose incentives and related parties, limit rehypothecation, reduce single points of control through modern key management and change control, incorporate risk signals (not just prices) into risk parameter management.

Ultimately success depends on being able to answer three key questions at any time:

-

Are my deposits backed by assets?

-

What protocol, venue or counterparty risks am I exposed to?

-

Who controls the assets?

DeFi doesn’t require choosing between complexity and fundamental principles.The two can coexist, and transparency can scale with complexity.