Author: Cycle Capital, Lisa

Since the “924” new policy, China’s stock market has experienced an epic surge.The policies of the three financial ministries and the meeting of the Political Bureau of the Central Committee boosted market sentiment beyond expectations, and the A-share and Hong Kong stock markets ushered in a strong rebound, leading the global market.But after the National Day, the market turned to decline under the extremely optimistic general expectations. So is this round of market a flash in the pan or the bottom has emerged?This article will try to make a judgment from the perspective of analyzing the domestic economic fundamentals, policies and the overall valuation level of the stock market.

1. Fundamentals

Overall, the domestic fundamentals are still relatively weak, with some signs of marginal improvement, but no obvious turning point signals are seen.During the National Day holiday, consumption prosperity increased year-on-year and month-on-month, but it has not yet been reflected in some of the main economic indicators.In the coming quarters, China’s growth may show a moderate recovery trend amid policy boost.

In September, the manufacturing purchasing managers index (PMI) was 49.8%, up 0.7 percentage points from the previous month, and the manufacturing industry’s prosperity rebounded; the non-manufacturing business activity index was 50.0%, down 0.3 percentage points from the previous month, and the non-manufacturing industryThe economic level fell slightly.

Affected by factors such as the high base in the same period last year, in August, the profits of industrial enterprises above designated size fell by 17.8% year-on-year.

In August 2024, the national consumer price rose by 0.6% year-on-year.Among them, food prices rose by 2.8%, non-food prices rose by 0.2%; consumer goods prices rose by 0.7%, and service prices rose by 0.5%.On average from January to August, the national consumer price rose by 0.2% compared with the same period last year.

In August, the total retail sales of consumer goods was 387.26 billion yuan, an increase of 2.1% year-on-year. Sales price index of second-hand residential properties in 70 large and medium-sized cities in August 2024

Sales price index of second-hand residential properties in 70 large and medium-sized cities in August 2024

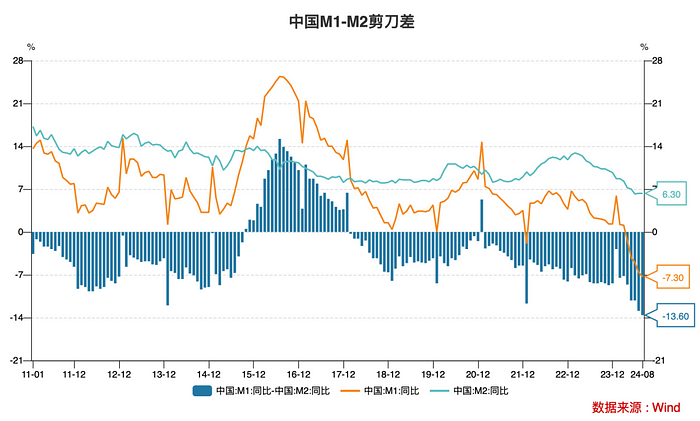

Judging from the financial forward indicators, the overall social financing demand is relatively insufficient. Since the second quarter, M1 and M2 have slowed down year-on-year. The scissors gap between the two has risen to a historical high, reflecting that demand is relatively insufficient and the financial system has certain idleness, and the effect of monetary policy transmission has been hindered.Short-term economic fundamentals still need to be improved.

II. Policy

Based on the phased bottom characteristics of the A-share market in the past 20 years, the policy signals are generally strong and need to exceed investors’ expectations at that time. Historically, it is a necessary condition for A-shares to stabilize and rebound.The recent policy has exceeded expectations and the policy signals have been revealed.

On September 24, 2024, the State Council Information Office held a press conference, and the Governor of the People’s Bank of China Pan Gongsheng announced the creation of new monetary policy tools to support the stable development of the stock market.

The first is to create convenient exchanges between securities, funds and insurance companies, and support qualified securities, funds and insurance companies to use their own bonds, stock ETFs, and Shanghai and Shenzhen 300 constituent stocks as asset pledges to obtain liquidity from the central bank.This policy will significantly improve institutions’ fund acquisition ability and stock increase ability.The first phase of the first phase of the operation of the first swap convenience is 500 billion yuan, and the scale can be expanded in the future depending on the situation.

The second item is to create a special re-loan for stock repurchase and increase holdings, guide banks to provide loans to listed companies and major shareholders, and support repurchase and increase holdings of stocks.The first period of the repurchase tool is 300 billion yuan, and the subsequent amount can also be expanded as appropriate.

On September 26, 2024, the Central Financial Office and the China Securities Regulatory Commission jointly issued the “Guiding Opinions on Promoting the Entering of Medium- and Long-term Funds in the Market”, covering measures covering 1) Cultivating the capital market ecology of Changqian Changtou, 2) Vigorously developing equity public offeringsFunds and support for the steady development of private equity funds, 3) Improve supporting policies for medium and long-term funds entering the market, etc., with a total of three connotations and 11 key points.

The root cause of China’s current growth problems is the continued credit contraction, the continued deleveraging of the private sector, and the failure of the credit expansion of government departments to effectively hedge.The reason for this situation is that the return on investment is expected to be low, especially the sluggish real estate and stock market prices, and the second is that the financing costs are not low enough.The core of this round of policy changes is to follow the two ideas of reducing financing costs (lowering multiple interest rates) and boosting investment return expectations (stabilizing housing prices and providing liquidity support for stock markets). It is a right medicine, whether the medicine can cure the disease.To achieve medium- and long-term sustainable reinflation, subsequent structural fiscal stimulus and actual policies are required, otherwise the market recovery may be short-lived.

At 10 a.m. on October 8 (Tuesday), the National Development and Reform Commission held a press conference of the State Council. Zheng Zhanjie, director of the National Development and Reform Commission, and Liu Sushe, Zhao Chenxin, Li Chunlin, and Zheng Bei introduced that “systematically implement a package of incremental policies and solidly promote the economy.The upward structure is better and the development trend continues to improve”, and answered questions from reporters.The rising sentiment was fully fermented during the National Day holiday. The market generally believed that A-shares bottomed out and reversed. Morgan Stanley believes that the policy volume required to promote the rebalancing of the economic structure from investment to consumption is about 7 trillion yuan within two years.Market participants have high expectations for fiscal policy, so the market will pay more attention to the National Development and Reform Commission’s announcement, but there was no drastic fiscal countercyclical adjustment policy that was generally expected by the market at the meeting, which was also a reversal of the market after the National Day.main reason.

3. Valuation

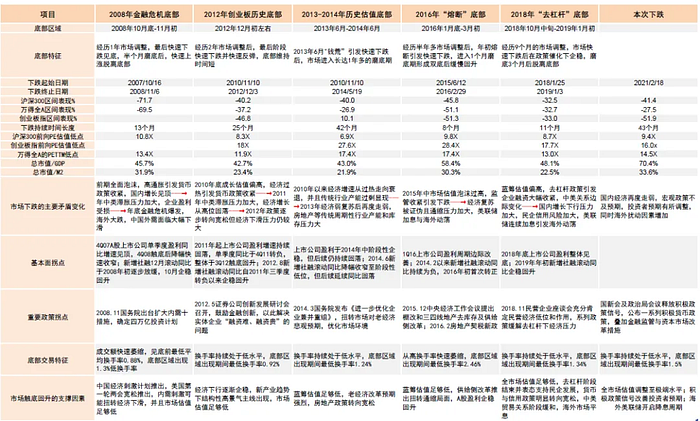

After sorting out the bottom characteristics of the market in previous markets, this round of market has shown bottom characteristics from the perspectives of the length of the decline, the degree of the decline, and the valuation level.

Note: This decline involves market data as of September 27, 2024 Source: Wind, CICC Research Department

As of about 9th of the 10th, the valuation level of A-shares has recovered to around the median.

In historical vertical comparison, the rebound was relatively high at the end of September, and it had reached the PE multiple of the expected economic acceleration of the epidemic restart in the early 23 years.In a horizontal comparison of major global markets, the valuation of the Chinese market relative to emerging markets is still the lowest in the Asia-Pacific region, close to South Korea’s level.

In summary, the key to market reversal lies in the confirmation of medium-term fundamental signals. The fundamental data has not yet appeared. The recent short-term rise is mainly driven by expectations and funds. Missing the opportunity (FOMO) makes sentiment accounted very quickly. RSITechnical indicators such as (relative strength indicators) will have certain “overdrafts” in the short term.The market under high volatility is often accompanied by overreaction, and the pullback after a historical surge is both a technical need and a reasonable one.After monetary policy is increased first, whether subsequent fiscal policies can be followed up is the main factor affecting the upward pace and space of the stock market in the near future.Just like the art of the Fed’s expected management, it is not suitable to add another fire in a crazy and radical market environment, but things will be smooth when things are slow, and water will overflow when they are full.From a long-term perspective, the author believes that the recent decline is an adjustment rather than an end of the trend. The medium- and long-term A-share bottom has been seen, and the main rise has not yet arrived.