Author: Justin Bons, Founder of Cyber Capital Source: X, @Justin_Bons Translation: Shan Oppa, Bitchain Vision

Ethereum (ETH) is facing a difficult problem: it cannot maintain high fees due to lack of scalability.Meanwhile, the usage and expense of layer two networks (L2) are hitting record highs, while these networks are lobbying to reduce ETH capacity.This situation has gradually evolved into a parasitic relationship that is eroding the foundation of ETH.

Imbalance between expense income and inflation

Ethereum’s handling fee revenue has dropped significantly since EIP-4844 (Proto-Danksharding).The reason is simple: L2 network is charging all the fees.Because of this, the consumption of handling fees can no longer catch up with inflation.L2 gradually took over transaction execution, resulting in Ethereum’s inflation rate remained high, far exceeding its previous level.

The rise of L2 not only divided the entire Ethereum ecosystem and split it into a competitive camp, but also broke down liquidity and composability, causing the ecosystem to become fragmented.Given the economic incentives of L2, a shared sort-like solution is simply not feasible in reality, just like the L1 extension.This series of problems pushes users toward a highly centralized L2.

The centralization and governance dilemma of L2

Today, the top ten L2s are all at risk of stealing user funds and scrutinizing them.Ironically, when Ethereum initially formulated the “L2 Extension” roadmap, it was rationalized in the name of decentralization.But the reality is that this approach eventually becomes a “bait and switch”, putting Ethereum in a centralized decision-making process.The Ethereum community completely rejects on-chain governance, and the only result is that ETH development is effectively centralized control.

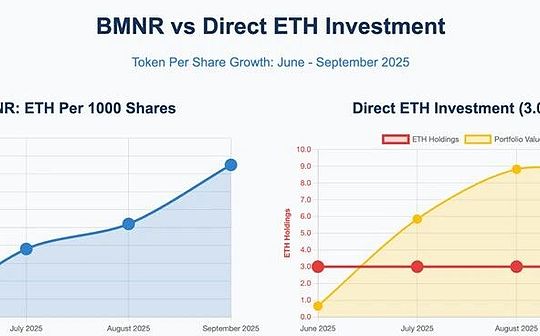

As L2 currencies gradually dominate the ETH ecosystem, it has become impossible to return to L1 expansion.In the hypothetical scenario, even if ETH achieves L1 expansion through new technological breakthroughs, all L2’s tokens and equity prices will collapse overnight, becoming obsolete and useless.L2 is actually stealing ETH users and fees, pretending they are “one” with ETH, but that’s far from it.At best, they are competitors, and at worst, it is a vampire attack that slowly sucks ETH’s life.

The future trend of L2 and ETH

If L2 continues to migrate or becomes the new L1 directly, Ethereum will inevitably decline.That’s why in some cases we’ll be optimistic about L2 instead of ETH.ETH is sacrificing itself for L2, even if it hurts crypto-punks.Ironically, ETH is repeating the same mistakes as BTC, taking the same path of corruption and capture, exposing systemic problems in governance.

ETH currently has little hope of recovery as its leadership has compromised to L2.Any effort to expand ETH will destroy the capital and expenses earned by L2, and venture capital cannot benefit from the expansion of L1.These parasites distort public resources into rent-seeking platforms for venture capital chains, seriously damaging the long-term development of Ethereum.

Conclusion

Under the current situation, Ethereum is undergoing a profound internal struggle.The rise of L2 seems to have brought convenience to users, but in fact it is eroding the foundation of Ethereum.The ETH community must revisit the on-chain governance and expansion roadmap to avoid an irreversible path to recession.