Source: Chain Tea House

Curve Finance is a DEFI platform focusing on stable currency exchange. Its founder Michael Egorov has a long -term use of the platform to manage tokens CRV as a mortgage and borrow a large number of stable currencies from multiple DEFI platforms.Egorov’s borrowing position faces liquidation risks.

On the evening of June 13, Arkham posted a statement saying that the founder of CURVE Michael Egorov was worth nearly 9 -digit borrowing positions ($ 141 million CRV), and a total of more than $ 1 million of bad debt was generated on the Curve’s borrowing platform Llamalend.Essence

Specifically, Egorov uses a large number of CRV tokens (about 141 million US dollars) for mortgage, borrowing stable coins from multiple DEFI platforms, mainly CRVUSD.Egorov conducts borrowing operations on multiple platforms (such as LLAMALEND, INVERSE, UWU Lend and Fraxlen), and the annual interest rate of these platforms is as high as 120%.

Since the turmoil has been revealed, the price of CRV has plummeted by nearly 25%in a short period of time, from 0.35 US dollars to $ 0.21, triggering the clearing mechanism of multiple platforms.

This is not the first time that Michael Egorov has been liquidated for the first time. In November 2022, there was a large short point on the market that tried to short CRV, which was called the first DEFI defense war.In order to fight against this short -term behavior, CURVE founder Michael Egorov has adopted some air -seduce strategies to try to stabilize CRV prices.Through these strategies, CRV prices have not only fallen, but have picked up. Egorov won a staged victory in confrontation with the short.

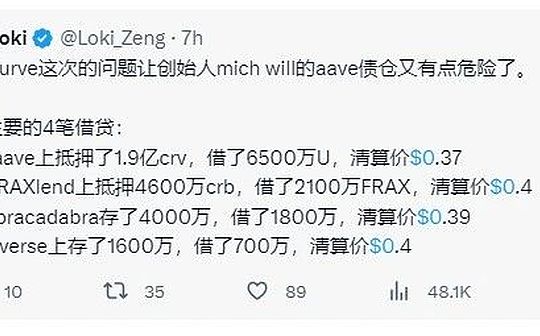

The second time was in August last year, Michael Egorov mortgaged 292 million CRVs on AAVE, FraxLend, Abracadabr, Inverse and other borrowing platforms, with a value of US $ 181 million and borrowed $ 110 million.Near $ 0.4.

In last year’s liquidation, in order to avoid the decline in the price of CRV, Michael Egorov sold the liquidation and sold 159.4 million CRVs to 33 investors or institutions in exchange for OTC off -site transactions, in exchange for 63.76 million stable coins to repay the loan, save savingYour own position.

In addition, in the second round of DEFI defense, Egorov also received the support of many well -known investors and institutions, including Wu Jihan, Du Jun, Sun Yuchen, etc. They purchased a large number of CRV through OTC transactions to help stabilize the market.

However, for this liquidation storm this year, although the founder of CURVE Michael Egorov responded in social media that day, the CURVE team and I have been trying to solve the problem of liquidation risks today, but as the public knows, all his loan positions have been liquidated.

Based on this dilemma, in the third round of DEFI defense, Michael Egorov performed indifferently, basically did not make up the position and save.

Why is Michael Egorov so calm?Because he “profit” from it.

Regarding the CRV position liquidation, Eric.Eth, the core developer of Ethereum, said that the founder of CURVE has not been “lost” because CRV was liquidated. He received a $ 100 million in income from a $ 140 million CRV position.

Michael Egorov’s income principle is similar to that of traditional stock borrowing operations. By using the Curve Dao token (CRV) as a mortgage, a large number of loans have been borrowed on multiple DEFI platforms, but here, the mortgage is cryptocurrencies instead of stock stocks instead of stocks.Note.

Traditional stock loans usually refer to individuals or institutions to mortgage their stock to financial institutions to obtain loans.This operation can help holders get liquidity funds without selling stocks, while continuing to enjoy the value -added potential of the stock.

Although Egorov did not sell his CRV tokens directly, he also realized that some of the tokens were converted into available liquidity funds by borrowing it as a mortgage.This operation can be regarded as a variant of equity cash, because he has obtained cash flow through mortgage token instead of selling tokens directly.

Of course, after watching the calmness of Michael Egorov in these days, it was basically determined that he had given up CURVE and wanted to finally get a lot of money before pushing up.Compared with the acquisition of this forced discount, the mortgage CRV is indeed more profitable for him.

But on the other side, investors face disaster.

The remaining lending platforms caused by the decline in price, Fraxlen’s lenders suffered millions of dollars of liquidation. According to LOOKONCHAIN monitoring, some users were liquidated by 10.58 million CRV (3.3 million US dollars) on FraxLEND.

The same huge losses also faced early CRV investors and other investors in their ecology. According to DEFILLAMA data, as of June 18, CURVE’s TVL has dropped to $ 1.9 billion, compared with $ 23 billion in high 2022 highs,TVL has shrunk to less than one tenth, and its ranking in the DeFi market has also dropped to 15.

Of course, in the face of this liquidation storm, some people support and profit.For example, CHRISTIAN, co -founder of NDV NDV and NFT giant whale, said that 30 million CRVs were obtained from Michael Egorov to support the future of Curve and DEFI.It is reported that the CRV purchased off the venue of Christian is about $ 6 million, that is, the price of each CRV token is $ 0.2, according to the current US $ 0.28, the book has a record of about 40%.

Regardless of the follow -up direction of this incident, from the current attitude of the founder Michael Egorov, CURVE has no way to go.The two King Fried products that were once talked to Uniswap’s head -of -headed products were stirred up by the founder himself, and had to make people sigh.Of course, from the perspective of these Defi defense war, the development of the Defi track is currently in many shortcomings. I hope that the project party will lead to precepts.