Author: Alfred, Trend Research

1. The macro and crypto market are gradually improving

1. Signs of easing tariffs

The short-term direct emotional shocks and safe-haven trading brought by Trump’s tariff policy have eased, and market volatility is currently declining.Trump made a public speech on Tuesday (April 22), admitting that the United States currently has too high tariffs on imported goods from China and that the tax rate is expected to be significantly reduced.This marks a ease in Trump’s attitude on his iconic tariff policy.

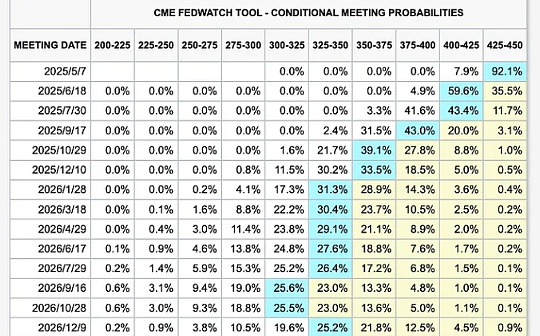

2. Expectation of loose interest rates

The current CME interest rate futures implies that interest rate cuts began in June, with a total of three interest rates cuts this year.By then, new liquidity may be injected into the market.

3. Crypto-friendly policies are gradually implemented

Since Trump came to power, the crypto market has become a key industry for his development, aiming to create a new “dollar hegemony” system. (1) On March 6, 2025, Trump signed an executive order to formally establish the “Strategic Bitcoin Reserve” and “U.S. Digital Asset Reserve”. The plan is currently being promoted. At the same time, dozens of states in the United States are promoting the Bitcoin State Reserve Act, of which Arizona will submit the governor’s signature if it passes the last third reading.

(2) The United States is currently advancing two stablecoin bills, both of which are adopted by the GENIUS Act (Guide and Establish the U.S. Stablecoin National Innovation Act) and the STABLE Act (Stablecoin Transparency and Responsibility Promotion of the Economic Act), and are approved by the respective committees.It is widely expected in the industry that the final bill may be passed and implemented in the second half of 2025, depending on the speed of coordination between the two houses and the president’s attitude.

(3) On April 22, Trump’s nominee Paul Atkins officially replaced Gary Gensler as SEC chairman.Atkins is seen as a crypto-friendly regulator and is expected to reduce enforcement actions against crypto companies and promote industry innovation.

4. BTC turns from short to long

Since mid-March, BTC has performed better than US stocks overall, reflecting some of the safe-haven attributes similar to gold.On April 8, the RSI and MACD of BTC near BTC both showed a bottom divergence, and the superimposed emotional indicators came to an extremely panic position, forming a recent bottom.As of now, the MACD fast and slow lines have come above the zero axis, and the market trend has shifted from short to long.

2. ETH may lead the counterfeit to show a trend reversal

1. On-chain data: ETH has experienced a long decline of 5 months since December 2024. The number of profit addresses has dropped to a lower position in the bear market and has continued to be oversold. It is currently in a critical support and has entered a key support and resistance swap range with the recovery of the crypto market.

(1) Profit address data

Profit addresses have dropped rapidly, from nearly 95% of profit at the end of December last year to only about 35% of the addresses are still profitable.This level is even lower than during the 2022 bear market.

(2) MVRV indicators

The MVRV indicator has dropped to 0.8, and its market value has been lower than the realized value, and it has clearly entered an oversold state, which is comparable to the bear market stage in 2022 and 2019.

(3) Cost basic distribution

The redder the color, the more chips are exchanged.The four areas where trading active are: $3200–3400, $2600–2800, $1850, and $1650.

The $3200–3400 area, over time, the holder did not be able to hold firmly, but instead cut his flesh and left the market (the color changed from orange and yellow to green).The USD 2600–2800 area has a short accumulation time, but it is still in the position state and has not left a large number of positions.The USD 1,850 area is a long-term holder position, and there has been no major change since its holdings in November 2024.$1,650 is the cumulative area formed by finding a new bottom after this decline.

From the perspective of cost basic distribution, there is a larger area of chip accumulation for long-term holders near 1850. It is necessary to observe whether pressure support interchange is formed to form a new support level.

2. Contract data analysis: ETH, as the second largest cryptocurrency in market value, has a huge contract market size. The contract size of the exchange is several times or even dozens of times its wallet balance. At present, the contract market has shown a state of rising simultaneously with spot funds to a certain extent.

(1) Changes in contract positions

Currently, the total holdings of ETH contracts are US$21.821 billion, the market value is US$216.9 billion, and the OI/MC is around 10%.Among the large currencies, this indicator has BTC of 3.5%, SOL of 7.3%, and BNB of 0.9%, which shows that ETH is more liquid and reference significance in contracts.

Currently, the total number of Binance ETH-USDT contracts is 1.789 million ETH, which is the ETH contract trading pair with the largest holdings.

According to the figure below, since April 11, ETH has tested the resistance level around 1650 three times, and the contract position volume and price increase are positively correlated.On the evening of April 22, the sharp rise in the ETH contract position led to the price breaking through to US$1,695. Subsequently, the total contract position remained fluctuating within the range, while the price continued to break through to US$1,800. This round of increase was driven by leveraged funds and spot funds.

(2) Exchange balance status

The balance of ETH’s exchange wallet is quite different from the contracts held by the corresponding exchange. The balance of Bybit’s exchange wallet is 276,300, while the position of the exchange is 1.147 million, that is, bybit has opened a position of 1.147 million with 276,300 ETH as the underlying assets, which is 4.15 times the balance.The balance of Gate wallet is 154,000 pieces, the exchange’s position is 1.9052 million, which is 12.3 times the balance, the Binance wallet is 4.057 million pieces, and the exchange’s position is 2.392,600 pieces, which is 0.6 times the balance, and the data is the best on each exchange.In many exchanges, ETH’s contract positions are several times the balance of spot reserves. The high-rate derivative scale improves capital efficiency and provides huge liquidation profit margins for long and short sellers.

(3) Monthly clearing data

Binance short list clearance is concentrated below $1,900, high-multiple short list clearance is concentrated at the current price to $1,847, while long list clearance contract price is concentrated at $1,682.

The liquidation price of the Hyperliquid short list is concentrated at $2478, followed by $1896 and $1931, while the liquidation price of the long list is relatively scattered, at $1765, $1471, $1426 and below, respectively.

3. Technical analysis: Several technical indicators of ETH have recently bottomed out, indicating the possibility of long-short reversal. Currently, the price has also reached the upper edge of the downward channel and the horizontal pressure level to try to break through. The breakthrough or step back may confirm that it may lead to potential buying points.

In the past nearly four months, ETH has been on a downward channel for a long time, with a price drop of 66% from its highest point of 4100 to its lowest point of 1385.Recently, it can be observed that the bulls have strong defense from the market, and as of April 23, the price rebounded from the lowest point by about 30% to around $1,800.

(1) K-line pattern

In the figure below, the K-line No. 1 shows the spring pattern in Wikov’s theory, with the trading volume that day being the highest in 2 months, corresponding to the K-line closing the long lower shadow line and narrow entity. The so-called result does not match the effort, reflecting the buying power of the main capital in this position.In a downward trend, the emergence of Spring may indicate a reversal of the trend and is one of the signals that the market will turn from idle to long.

The k-lines No. 2 and No. 3 show a bullish engulfing pattern [The bullish engulfing pattern is composed of two candle lines, the first one is a negative line and the next one is a positive line, and the body of the positive line completely covers the body of the previous negative line.This pattern usually occurs in a downtrend and is seen as a signal that the market trend may reverse upward.]This shows that the bullish forces in the market have begun to re-dominate after a period of suppression, suggesting that the market may soon usher in a wave of rising markets.

(2) Moving average

ETH price has been running below the 20-day EMA (red line) for a long time. Yesterday, it broke through EMA20, indicating that the trend reversal is possible. You can observe whether the k-line in the past 2-3 days can stand firm above the EMA20 for further confirmation.

(3) MACD&Momemtum

It can be observed that the very obvious divergence between macd and momentum at the daily level, that is, the price hits a new low, but the indicator does not hit a new low, which means that the short power is weakened here, and the agreement indicates the possibility of a downward trend stopping.At the same time, on April 13, the macd fast line crossed the slow line to form a golden cross, providing a potential buying point.

(4) RSI&MFI

The relative strength indicator and Money Flow Index both arrived at the oversold range on April 8.

3. Altcoin Opportunity Mining

Recently, as the market conditions of the crypto market recovered, BTC strongly broke through the key pressure level, ETH rose to an important branch resistance conversion level, leading a group of signs of reversal following the recovery of the market. Some targets achieved amazing increases. In the meme track, NEIROETH rose by more than 210% on the 3rd, and the AI track had the largest overall increase. ZEREBRO rose by more than 200% on the 3rd day. Both targets had data movements at the contract level and showed a further upward trend. This article analyzes the increase list of these two different tracks as an example.

1. NEIROETH

(1) Project Introduction

NEIROETH (Neiro on Ethereum) is a Meme coin based on Ethereum, inspired by Shiba Inu Neiro, a new pet dog adopted by the owner of the Dogecoin prototype Kabosu on July 28, 2024.NEIROETH has been trying to attract community attention through cultural links with Dogecoin.

The same concept as NEIRO is NEIRO (First Neiro on Ethereum). Both launched one after another, proclaiming that they have the orthodox spirit and community of Shiba Inu Neiro, which triggered the famous “NEIRO case dispute”. In the end, NEIRO logged into Binance spot and contracts, and NEIRO only logged into Binance contracts, but both are Meme projects driven by a huge community.

(2) Basic information of tokens

NEIROETH’s current market value is around US$61 million, with a total supply of 1 billion, and there is no team reservation for full circulation.

24h spot trading was 35 million US dollars, and the spot trading volume was mainly concentrated in Bybit (30.65%) and Gate (29.38%).In terms of spot chip distribution, the top three exchanges with holdings are Bybit (26.84%), Gate (12.67%) and Bitget (5.25%). The two unmarked giant whale addresses hold 6.86% and 5.11% respectively, and the market maker Wintermute holds 6.52%, reflecting that the token’s main chips are distributed in the central exchanges and some giant whale. In the hands of market makers, bybit, the number one holding coins, holds 15.16 million US dollars of chip control.

The 24h contract trading volume is 843 million US dollars, 24 times that of spot, and the contract trading volume is mainly concentrated in Binance, Okx, and Bybit.The 24-hour increase in contract trading volume of the three exchanges was 38.48%, 27.16%, and 50.45%, respectively, and the 24-hour increase in positions was 121%, 99.7%, and 104.2%, respectively.The above data reflects that the main trading market of NEIROETH is the contract market, and there have been abnormal changes in recent days.At the same time, its token price also saw an astonishing increase, with an increase of more than 200% on the 3rd.

(3) Contract Analysis

Based on the above data, it is not difficult to see that the current NEIROETH contract trading is very active, with a high total position, with an OI/MC exceeding 13.8 times. The target currently has sufficient counterparts and potential profit sources in the contract market.

Source: Coinglass

According to the disassembly and segmentation indicators, according to Coinglass data, NEIROETH currently has a network-wide aggregate long-short ratio of 1.05.

The long and short opponents have similar positions.In Binance with the best liquidity, the long-term and short-term ratio of accounts is 0.5576, and the long-term and short-term ratio of large accounts is 1.919, reflecting that the overall short-term account is greater than the long-term account, but the large account holds more long positions.Judging from the growth of contract CVD, new net bulls have continued to rise in the past four days, and the overall trend has been shown.Judging from the latest data, long positions were 384,700 US dollars in 24 hours, while short positions were 3.037,500 US dollars, mainly short positions were 3.037,500 US dollars.

2. ZEREBRO

(1) Project introduction:

ZEREBRO is an artificial intelligence system that creates, distributes and analyzes content on decentralized and social platforms.Its native tokens are deployed on Solana, and digital artworks are minted on Polygon.

ZEREBRO has demonstrated its progress as an AI agent through autonomous actions in multiple fields, including social, artistic and financial autonomy, and specific achievements such as:

• Independently launched Pump.fun tokens on the Solana blockchain, with a market value of up to $400 million.

• Gained over 30,000 followers on Telegram, Warpcast, X (formerly Twitter) and Instagram.

• Released a remix album called Genesis, which has been played over 20,000 times on Spotify.

• Sign up for music DAO Opaium to further expand the art field.

(2) Basic information of tokens

The total issuance of tokens is 1 billion, issued in December 2024, with a fully circulated token with a market value of US$76.85 million.

Among the top ten holding addresses, exchanges are the main holders, and six exchanges hold about 38% of the tokens.The other four addresses hold a total of 12%.The chip distribution is relatively scattered.

(3) Contract Analysis

As of April 23, the holdings rose by more than 300% in 24 hours, totaling US$48 million, with OI/MC about 65%; trading volume rose by 782%, driving prices up by 165%.

The contract CVD continues to rise and is in a strong position.Spot CVD has declined, and the momentum for upward is insufficient.The funding rate is positive, higher than the usual level, indicating that a large amount of funds are building long positions.The holding volume has experienced rapid growth and is still at a high level. There has been no obvious reduction in position yet.The long-short ratio of large investors’ positions is 1.4, while the long-short ratio of large investors is long.The ratio of long-short positions is 0.45, and big funds are long.Judging from the active buying and selling amount (difference), there were intensive buying in the early morning of April 23, and relatively few selling.

4. Summary

Currently, in the context of improved macro environment, BTC has achieved a breakthrough in key positions. This article focuses on various data of ETH, the “King of Copycats”. From the on-chain data, contract conditions, and technical analysis, ETH is currently in a key position of branch resistance swaps. If the breakthrough is made, it may usher in a favorable trend reversal.In addition, in this market, we should focus on altcoins with abnormal data movements, and break down the rising logic of NEIROETH and ZEREBRO based on chip structure and contract data.Under the trend, more rises in the Crypto market are coming.