Source: Coinbase; Compilation: Bitchain Vision

The demand indicator for ETH is improving, while the supply of available-for-sale ETH seems to be tight.Stablecoin supply on Ethereum is accelerating, with strong momentum over 30 days and ETF capital flows maintaining net positive growth – both indicators suggest new purchasing power is coming (Figure 1 and Figure 2).

Figure 1. Ethereum Stable Coin Supply

Figure 2. Net Ethereum ETF traffic

Meanwhile, cross-chain bridge traffic has stabilized with intermittent inflows, indicating that activity will gradually regain the Ethereum settlement (Figure 3).

Figure 3. Ethereum Bridge Inflow

Meanwhile, the 30-day net exchange flow is negative, meaning that tokens continue to move out of the order book, which mechanically reduces short-term selling pressure, even if the composition of circulation changes – smart contract balances have been on a downward trend, indicating that some tokens are out of the DeFi wrapper but do not necessarily return to the exchange (Figure 4 and Figure 5).

Figure 4. Changes in net positions on the exchange in 30 days

Figure 5. 90-day change in Ethereum supply locked in smart contracts

We believe that the surge in validator exit queues is a special, Kiln-driven event that now limits supply for sale but can create uncertainty pressure later.After leaks of partner APIs related to SwissBorg’s staked-SOL vulnerability, Kiln opted out of all ETH validators as a precaution and returned ETH to (its main agency) customers, although Kiln has not reported any ETH losses.This particular behavior—rather than the overall system’s shift in staking risk appetite—will push the exit queue sharply and extend the wait time (to 45 days), but the queued ETH still lacks liquidity before it is completed, reducing the immediate selling pressure (Figure 6).As the surge stems from preventive exits from individual providers, we believe it is similar to centralized operational churn rather than a change in the overall system’s preference for staking risk.This inventory is not available for sale until exiting finalization, so there is no increase in instant float.

If the exited ETH is re-staked or returned to the institution for custody, we believe that its impact is basically neutral.However, if a considerable portion of ETH is transferred to the exchange, the market will gain new potential supply.Even if the mechanical supply path proves neutral, we believe that cognitive effects may still put pressure on ETH, as the configurator will include higher operational or counterparty risk into the price and demand a higher risk premium.This caution may reinforce itself in the sell-off:A large amount of staking can block the exit queue and extend redemption time – actually forcing people to sell at unfavorable prices.

Figure 6. Ethereum exit queue increases due to Kiln pressure

Positions support upward trend, but also increase vulnerability to shocks.The open interest of ETH perpetual contracts is close to the cyclical high and the capital market continues to maintain positive growth, which indicates that the leverage mechanism is too high, which may not only drive the trend to continue, but also magnify the liquidation risks around negative catalysts (Figure 7).The options market also reflects this balance: the one-month 25 Delta slope is slightly biased towards put options (although it has declined from last week), while the six-month tilt is nearly flat (and falling),This suggests that short-term event hedging is relatively neutral with the medium-term position—we believe these conditions support a “buy on dips” environment (Figure 8).

Figure 7. Ethereum open contracts and perpetual financing rates

Figure 8. Ethereum Options 25 Delta Put Options-Call Option Skew

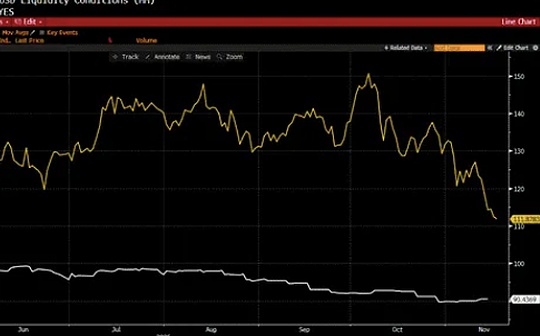

The overall valuation is slightly warm, but not delightful, so the results are vulnerable to the tug-of-war between new demand and supply.The MVRV Z value compares the market value of ETH with its on-chain “cost basis” (realized value) and measures this gap based on its own historical volatility (a cycle temperature indicator that measures the gap between the price and the price actually paid by the holder).Currently, ETH is in a warm zone: holders make profits, but the valuation is still below the previous burst extreme (Figure 9).From this point of view, we thinkThree levers may influence the market trend: (i) Macro liquidity——We are positive as the broader liquidity situation improves risk appetite;(ii) Liquidity of specific assets——We also have a positive attitude, the circulation of stablecoins is constantly expanding, and the net inflow of spot ETFs in recent times is positive;(iii) Derivatives Position——The position is still at a high level, and if the position is closed, it may exacerbate the pullback., but we believe that the overall combination is still similar to the “buy on dips” model rather than an explosion in the late stage of the cycle.

Figure 9. Ethereum MVRV Z score