Author: Balaji Srinivasan, author of CTO, The Network State before Coinbase; compile: 0xjs@作 作 作 作 作 作 作 作

Any election cannot be repaid US $ 175 trillion in debt.Only the money printing machine can.

Because as Musk, Dalio and others are aware of …The western world is moving towards a more serious sovereign debt crisis than 2008EssenceJust like they have been lying about Biden’s dementia, they are lying about the economic situation.So they will print a lot of money.

Look at the data, you can judge yourself.

1. Emergency loans are more than 2008

First of all, do you know that the Fed’s emergency loan issued in 2023 is more than during the 2008 financial crisis?As the U.S. government first sold billions of dollars in bonds to financial institutions, and then depreciated it through unexpected interest rate hikes, the banking system was able to maintain their lives.

Just look at this chart in the United States.The blue convex at the bottom left is a loan in the 2008 crisis.Purple is COVID.The giant orange/blue -green monster on the right represents the banking crisis in 2023.See how much higher than in 2008?

2. The loan amount exceeds the new crown epidemic

Second, do you know?During the period of “Bayeng Prosperity”, there are more borrowings in the United States than during the new crown epidemic?Regardless of whether the new crown epidemic should be regarded as a financial crisis.At least the borrowing rate during the new crown epidemic is about 0%.But now, the U.S. government has borrowed historic huge amounts of funds during peace … and interest rates are as high as 5%!This is the behavior of a desperate person using a credit card to explode the bill.

3. Interest expenditure exceeds national defense expenditure

Third, do you know that all these borrowings have made the interest expenditure of government bonds the largest single expenditure in the government?More than national defense, social security or any other expenditure.As of 2024, the primary use of all taxes (and printing US dollars) was to pay for bond holders.Even so, anyone who purchased US Two (or other bonds) has disappeared in the past few years.For all wars and all benefits, buy first and then pay.It can be seen from the chart that the payment time has arrived.

4. Further depreciation in the dollar

Fourth, do you know, the dollar depreciated at least 25%in just four years?You may know this from the personal experience of inflation.However, Larry Summes estimates that the decline in purchasing power is even larger than this. If the loan repayment caused by rising interest rates has increased significantly, the average annual number will reach 18%.Within four years, this depreciation number will far exceed 25%of the value of the dollar.

5. China further sells US Treasury bonds

Next, do you know, China (the largest foreign buyer in U.S. Treasury) has been accelerating the selling of US Treasury bonds?This is a bit technical, but China is the “external investor” in the United States, just like investing in your new venture capitalist of your technology company is external investors.Even if you only buy your 5% equity (or debt in this case), they will set prices for other people.It also shows that external demand is strong, and these demand comes from those who do not have to buy.But now external demand is crashing:

6. Buy more gold in the BRICS countries

But isn’t the US dollar be a means of storage?What else will you buy if you don’t buy US Treasury bonds?China is the leader of most countries outside the United States.These countries have begun to hoard the historic quantity of gold, and Western countries have been selling gold.Please see:

7. It is more than the dollar than ever before

Okay, how about the US dollar as a trading medium?Well, China -If you don’t know, it is the number one trading partner of most countries in the world at present -it has just turned to RMB for cross -border foreign exchange transactions.

8. The effect of sanctions is lower than ever ever before.

Well, but can’t the US dollar continue to be used as sanctions weapons?Doesn’t it need to enter the US financial system?In fact, it does not need.All sanctions against Russia are actually more harmful to Europe than harm to Russia.Europe needs oil and gas in Russia, but Russia has other customers.Therefore, according to data from the World Bank (not Russian sources!), Russia has just surpassed Japan and became the global economy ranked fourth in GDP calculated based on purchasing power.

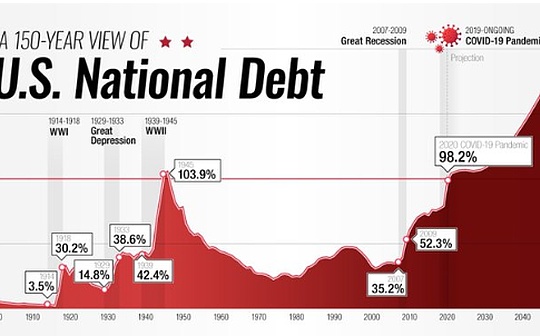

9. The debt in peacetime is approaching World War II

But what about the US military?Can’t it eventually launch a war to protect the US dollar?This is a long topic, but please see the chart below.Today, the United States is on the surface of the “peace period”.But its debt is equivalent to the World War II:

Similarly, this is another topic, but the United States has neither funds nor manufacturing foundation to launch continuous military operations on opponents like China.You can’t fight with your factory -especially when you have no money.

10. Real debt exceeds any empire in history

Finally, the most important number in the entire topic is $ 17.53 trillion.When you consider all benefits such as social security and medical insurance, this is actually the real debt of the United States.And this number itself is also increasing rapidly.Don’t believe me, believe in the financial report of the US government in February 2024:

The $ 17.53 trillion and Druckenmiller have always used about $ 2 trillion in numbers. Druckenmiller considers all factors to indicate all the liabilities of the US government.Of course, we are currently in the field of monopoly currency, because::

a) The entire federal government only earned about 2 trillion US dollars last year

b) This number itself is affected by deficit expenditure

c) Since 2020, the US dollar has actually fallen by about 25%

d) If you liquidate, the “US $ 177 trillion” in the value of assets will plummet

e) … or if the financial crisis occurs, or both,

Then $ 175 trillion debt cannot be repaid.The U.S. government has almost no enough money to repay its debt.It promised everyone (from allies to retirees), but could not be fulfilled at all.Continuing power in this kind of loss will become very bad, and most people cannot really understand.

The dollar is becoming less important

In short: I haven’t started yet.I can show more charts, and there are more videos from investors from bonds, real estate and technology from all over the world. They have seen what is happening.

But if you are honest, the status of the US dollar is rapidly declining.It is no longer an indispensable asset before.Summary:

a) China does not need US dollar to trade, and they use RMB instead of US dollars.

b) BRICS countries do not need US dollars to save, they buy gold instead of US bonds.

c) Russia does not need US dollar to survive. They are the fourth largest economies that are rejected by the US economy.

d) However, the United States needs to accept the US dollar as many countries as possible, because its level of borrowing surpasses the new crown epidemic, World War II and any empire in history.

So, what will happen next?I have some ideas, but first of all, we need to reach an agreement.