author:Tanay Ved&Matías AndradeSource: Coin Metrics Translation: Shan Oppa, Bitchain Vision

Key points:

-

Nine Ethereum spot ETFs will debut on July 23, with fees ranging from 0.15% of Grayscale’s Ethereum Mini Trust to 2.5% of Grayscale’s ETHE.

-

Ethereum has a market capitalization of $420 billion, accounting for about one-third of Bitcoin’s $1.3 trillion market capitalization, and ETH’s daily spot trading volume is about half of BTC’s trading volume in Coin Metrics’ credible exchanges.

-

33.2 million ETH (28% of supply) are pledged on the Ethereum consensus layer, of which 13.5 million ETH (11% of supply) are locked in smart contracts, and 12.5 million ETH (10% of supply) are currently tradingInside.ETFs can further stimulate prices by locking funds into assets that have been fully utilized.

The launch of Bitcoin Spot ETFs in January marks the end of a decade-long wait, with people more broadly investing in the largest crypto assets through the well-known regulated investment tools.The recent 13-F document disclosed the companies behind the $16 billion inflow of capital in these products (and increasing).With this development, market attention naturally shifted to the next frontier: Ethereum (ETH).With a market cap of $420 billion today, ETH is a logical successor, and it is only a matter of time before its ETF approval is, not a matter of whether or not.The U.S. Securities and Exchange Commission (SEC) unexpectedly approved spot Ethereum ETF in May, which made ETH’s status as a commodity, further strengthening the value proposition of the asset class.Now, just 6 months later, the spot Ethereum ETF is about to be launched.

In this issue Coin Metrics Network StatusIn the report, we explore in-depth the launch of spot Ethereum ETFs, supply and demand dynamics and their impact on Ethereum and the broader digital asset ecosystem.

Issuers in the ETH ETF Contest

9 Ethereum ETFs to debut on July 23,Expand the scope of financial products based on cryptocurrencies.Sponsored by traditional asset management companies such as BlackRock and Fidelity, as well as cryptocurrency local companies such as Bitwise and Grayscale, these products will track spot prices for Ethereum (ETH).By listing on public exchanges such as the Chicago Options Exchange (CBOE), the New York Stock Exchange (NYSE), and the Nasdaq, investors will now have another way to access ETH through major brokerage platforms, supplementing existing options such asUsers have their own wallet.

As the release date approaches, the cost war follows.The issuer has submitted a final S-1 registration statement, disclosing the management fees of their respective funds ranging from 0.15% of the newly launched Grayscale Ethereum Mini Trust (ETH) to 2.50% of the Grayscale Ethereum Trust (ETHE), which will be inConvert from its current trust structure to ETF at publication.Some issuers also temporarily waive fees, which is a strategic move to attract AUM, just like Bitcoin ETFs.

Background analysis of demand and short-term stress

Using as an indicator of the demand barometer of ETH versus BTC, we can understand the potential demand for Ethereum ETFs.

Ethereum (ETH) has a market capitalization of $420 billion, about one-third of Bitcoin (BTC)’s $1.3 trillion market capitalization.On average, daily spot trading volume (cross trusted exchanges) is half of BTC, reflecting relative market activity and liquidity.In the futures market, BTC’s openness is about 2.6 times higher than ETH on all exchanges and about 9 times higher on the Chicago Mercantile Exchange (CME).Prior to the launch of their respective ETFs, Grayscale’s Bitcoin Trust (GBTC) had an asset management scale (AUM) of about 2.8 times that of its Ethereum Trust (ETHE).Overall, these indicators indicate that inflows of ETH ETFs may roughly match the stated size difference between the two assets.

An important consideration is that the current ETF structure does not include staking, which brings opportunity costs to potential investors who abandon additional staking benefits.This restriction may impact demand for Ethereum ETFs in the near term and may spark discussions about developing more comprehensive ETH investment products that include staking gains.However, inclusion of stake also involves considerations on the proportion and rewards of ETH, overall cybersecurity, and regulatory transparency around Proof of Stake (PoS) consensus mechanisms.

Grayscale Fund Focus

As Grayscale’s Ethereum Trust (ETHE) transforms from a trust structure to an exchange-traded fund (ETF) at launch, it is important to consider the potential outflows of the product that may generate.

The dynamics of Grayscale’s Bitcoin Trust (GBTC) can be used as a precedent.Prior to the launch of the spot Bitcoin ETF, GBTC held approximately 620,000 BTC (about 3.1% of BTC supply) and total assets under management were approximately $30 billion.The conversion of GBTC from trust to ETF creates an opportunity for investors who previously purchased GBTC at a discounted price to exit capital or transfer to ETFs with lower management fees.As a result, GBTC’s Bitcoin holdings have decreased by about 55% to 270,000 BTC, putting downward pressure on the price of BTC.

Grayscale’s Ethereum Trust (ETHE), on the other hand, held approximately $10 billion in asset management before its launch, including 3 million ETH (2.5% of the ETH supply).While ETHE may experience similar capital outflows, a series of events that occurred before the launch of the ETH ETF and Grayscale’s Ethereum Mini Trust (ETH) may mitigate the extent of these capital outflows.

On the one hand, with the approval of the ETF in May, ETHE’s net asset value discount has rapidly narrowed, and investors have enough time to exit at a price close to par value.Additionally, the Mini Trust charges a 0.15% fee, providing a choice for cost-sensitive investors to transition to this low-cost product.10% of ETHE has been transferred as seed funds into a new mini trust product, resulting in a reduction of AUM by $1 billion or 300,000 Ether holdings.

ETH supply dynamics

The multifaceted utility of ETH gives it a relatively high speed (turnover rate) and has a significant impact on its supply dynamics into the ETF.

Ethereum (ETH) plays a vital role as a native asset in the Ethereum ecosystem.It is the backbone of the Proof of Stake (PoS) consensus mechanism, a means of payment for network fees, and is used as collateral or liquidity source for decentralized finance (DeFi) platforms such as lending applications and decentralized exchanges (DEXs)..In addition, with the development of the Ethereum Layer 2 ecosystem, more and more ETHs are being bridged to access infrastructure and services built on the Ethereum base layer.

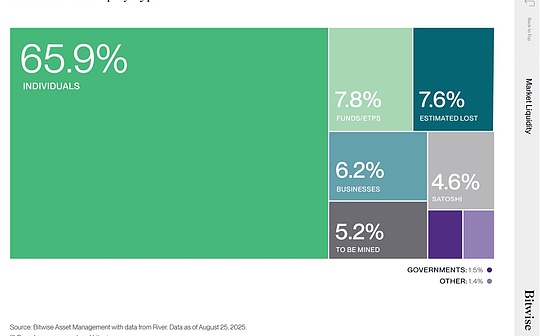

As of July 22,Of the 120 million ETH supply in circulation, 33.2 million ETH (about 28% of the supply) was pledged on the Ethereum consensus layer, and 13.5 million ETH (about 11% of the supply) was locked in various smart contractsOf the above, 12.5 million ETH (about 10% of the supply) are on the exchange.Total, this equals 39% of ETH supply is not readily available in the market, which does not include inactive supply.

The launch of Ethereum ETFs may further absorb ETH, which may limit available market supply.However, the extent of this impact will depend on the adoption rate of these newly launched ETFs.

Other Ethereum data worth paying attention to

Despite the recent trend of inflation, partly due to the growth of Tier 2 activity and lower expenses for Dencun, ETH supply has remained largely in deflation since the “merger” (-0.24%).The interaction between ETH’s limited supply and potential ETF inflows may initiate a flywheel of network activity and facilitate the overall economic status and on-chain indicators of ETH.

Increased activity on Ethereum, whether through increasing the supply of stablecoin, adopting L2 blobs or DEX transactions, may affect the basic expenses on the Ethereum main network, and in turn affect the ETH destruction rate.This will ultimately further limit supply, making prices more susceptible to changes in demand.

ETH performance and volatility

As shown by the ETH/BTC ratio, ETH’s performance relative to BTC has been in a consolidation phase since 2021.The ratio is currently 0.052, which is showing a downward trend compared to 0.084 at the time of merger.Since the launch of the spot Bitcoin ETF in January, ETH has returned 35%, lagging behind the performance of Coin Metrics’ total market index (CMBITM) and BTC, which are 41 respectively driven by surge in BTC demand.% and 46%.

To what extent the trend of ETH will change remains to be seen, however, the launch of spot Ethereum ETFs represents an important catalyst for the broader understanding and adoption of ETH as an asset, the Ethereum ecosystem and the digital asset industry as a whole.

in conclusion

While the initial focus may focus on the instant performance of Ethereum ETFs, their real impact will be revealed in the coming months.This time will provide insight into the demands of ETH ETFs relative to Bitcoin, the characteristics of these investment groups, and the broader impact on the Ethereum ecosystem, including network adoption, scaling infrastructure and applications.Nevertheless, the launch marks a key milestone in the expansion and maturity of the crypto asset market.By expanding accessibility to ETH and its ecosystem, the launch of ETH ETFs not only represents a new investment vehicle, but also is an important catalyst for Ethereum’s ever-expanding role in the global financial landscape.