Viewing the structural risks of pre-market trading market from the XPL event of Hyperliquid platform

Author: danny Source: X, @agintender How the giant whale uses $XPL to trade in Hyperliquid before the market is right for the time, place and harvesting masters – that is,…

AI Agent Market Map: The craze fades and technology continues

Author: Jay Jo, Source: Tiger Research, Compiled by: Shaw Bitchain Vision summary After the token price plummeted, the AI Agent market lost its momentum, but technology development is still underway.Through…

Understand the invisible traps of DeFi derivative trading from XPL events

Author: K2 Kai; Source: X, @kaikaibtc This huge XPL liquidation staged on HyperLiquid is not an accident, because the previous JELLYJELLY incident is exactly the same. It is not a…

Hyperliquid: Timing is always the best entrance to breaking existing structures

Hyperliquid’s liquidity can always surprise or shock people. On August 27, just when Hyperliquid BTC spot trading volume was second only to Binance, and last month’s trading volume surpassed Robinhood.…

Can the DeFi protocol Lombard break through the narrative dilemma of the Bitcoin ecosystem?

Author: Haotian; Source: X, @tmel0211 Since the Buidlpad public sale has been launched, Lombard has been discussed recently.There is a voice called Lombard $BARD to Bitcoin, just like stablecoin giants…

Staking, ETF, reserve: Is Ethereum valuation being redefined?

author:imToken; Source: X, @imTokenOfficial; Compilation: Shaw bitchain vision Ethereum is at a rare moment, with multiple forces gathering. On-chain ETH staking continues to grow, creating a situation that can be…

From Pendle to Hong Kong parking space decode the nature of transactions in DeFi

Author: danny Source: X, @agintender We live in a world composed of expectations and reality.What is the value of the assets in your hands, whether they are a string of…

A complete guide to earning stablecoins

Author: imToken Source: X, @imTokenOfficial Compilation: Shaw bitchain vision Have you noticed that there have been platforms that recently advertised that USDC’s annual rate of return is 12%? This is…

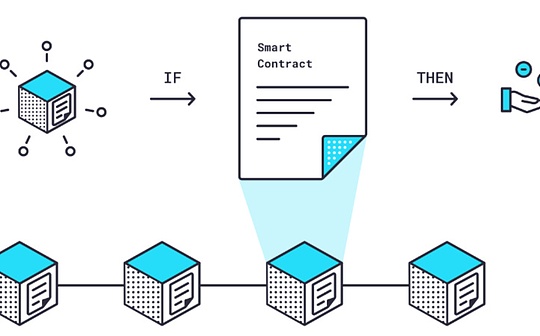

The Battle between oracle: Chainlink and Python Network

Author: ian.btc | workhorse Source: X, @0xWorkhorse Compilation: Shaw bitchain vision In the field of decentralized finance (DeFi), oracles are the backbone of the entire infrastructure.They determine the speed, accuracy,…

Inception Capital: Why We Invest in Theoriq

Theoriq is a DeFi project focusing on intelligence on-chain asset management, aiming to provide users with automated asset management services through a multi-agent architecture.Recently, the project completed a community round…