Author: Matt Hougan, Chief Investment Officer of Bitwise; Compiled by: Bitchain Vision

The “recipe” for cryptocurrencies to achieve high returns in the past 18 months is clear: combining a portion of ETP inflows with strong corporate treasury purchases can reap great returns.

Bitcoin follows this recipe, rising from $40,000 in January 2024 to around $112,000 today.Ethereum adopted the same strategy in April 2025, and since then the price has tripled to $4,500.

It is not surprising that this “recipe” works, essentially the classic supply and demand laws are at work.

● Since January 11, 2024, the Bitcoin network has produced 322,681 bitcoins, and ETP and enterprises have purchased more than 1.1 million.

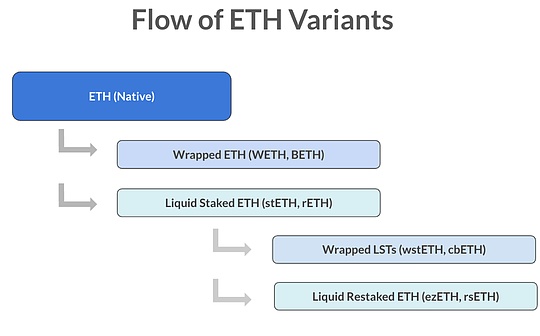

● Since April 15, 2025, Ethereum network has produced 388,568 ETH, while ETP and enterprise acquisitions have reached 7.4 million.

Prices usually rise when demand exceeds supply.

Why do I think SOL will be the next target?

Solana has the conditions to follow the above path.

Several issuers—including Bitwise, Grayscale, VanEck, Franklin Templeton, Fidelity, Invesco/Galaxy and Canary Capital—have submitted applications, planning to launch Solana ETP.The Securities and Exchange Commission (SEC) is scheduled to make rulings on these applications on or before October 10, 2025, which means that multiple issuers may push the listing of spot Solana ETP in the fourth quarter of 2025.

Meanwhile, over the weekend, three major companies—Galaxy Digital, Jump Crypto and Multicoin Capital—promised to inject $1.65 billion in cash and stablecoins into Forward Industries, a large publicly traded Solana treasury company.After the transaction is completed, the new company will start buying SOLs, pledging them, and strive to achieve excess returns.

It is worth noting thatForward Industries has appointed Kyle Samani, co-founder of Multicoin Capital, as chairman.Multicoin is one of Solana’s earliest investors, and Samani is also one of Solana’s most eloquent and firm promoters (You can read Multicoin’s latest investment discussion on Solan here).Michael Saylor once played a key role in promoting Bitcoin as the executive chairman of Bitcoin treasury company Strategy; Tom Lee also made similar contributions to Ethereum promotion as the chairman of Ethereum treasury company BitMine.If Samani can convey Solana’s value information in the same way on CNBC, Bloomberg and Fox Business, it will help drive the flywheel effect of investors’ demand.

What is the core appeal of Solana?

Of course, the existence of ETP and treasury companies alone does not guarantee that investors will buy it.Investors must be interested in these tools for fundamental reasons.A typical reason for optimism is that although the Ethereum ETF was approved in June 2024, it was not until April 2025 that as the market’s interest in stablecoins heated up and investors began to pay attention to the top blockchain in the stablecoin field, and Ethereum truly “ignited” the market.

So, what is the core appeal of Solana?

Solana is a competitor of Ethereum. It is a programmable blockchain that can support stablecoins, tokenized assets, decentralized finance (DeFi) applications and other scenarios.The biggest highlight of Solana is that it processes transaction volumes per second, and at the same time, the transaction costs are extremely low (a single transaction fee is less than $0.01), and the final confirmation speed is fast.In fact, the blockchain has recently passed a major technological upgrade proposal, reducing the final confirmation time of transactions from about 12 seconds to 150 milliseconds – the speed is comparable to “in the blink of an eye”.After the upgrade and launch, Solana will be among the fastest blockchain in the world.

Solana can achieve this performance because of its very different technical design from Ethereum – it does not rely on the Layer 2 network, which also makes the blockchain simpler and easier to use for users.

Critics argue that there is a key trade-off behind Solana’s high performance: Its decentralization is less and its network stability is more fragile.

Still, Solana has successfully attracted a large number of users.Among programmable blockchains, Solana ranks third in stablecoin liquidity (after Ethereum and Tron), and ranks fourth in tokenized assets.And its growth momentum is rapid: the management scale (AUM) of tokenized assets has increased by 140% since the beginning of this year.Solana supporters believe that among the blockchains that support the tokenization of mainstream assets on a large scale around the world, Solana is the only one who meets the speed standard.

A key difference in Solana

There is a significant difference worth noting between Bitcoin, Ethereum and Solana:Solana has a relatively small market capitalization.

As of September 7, Bitcoin’s market capitalization was $2.22 trillion, Ethereum was $519 billion, and Solana was only $116 billion.In other words, Solana’s market value is only 1/20 of Bitcoin, not 1/4 of Ethereum.

Judging from the market value of blockchain, even if the amount of funds flowing into Solana is relatively small, it may have a significant impact on its price.For example, the $1.6 billion SOL that Forward Industries plans to buy is equivalent to $33 billion in purchases if converted into the Bitcoin market.However, this impact will be offset to some extent by Solana’s higher annual inflation rate (about 4.3%)—Bitcoin and Ethereum’s annual inflation rates are about 0.8% and 0.5% respectively.

But overall,Solana’s current layout remains attractive.My advice: keep an eye on Solana’s dynamics in the coming months.