Xiao Yanyan, Jin Shi Data

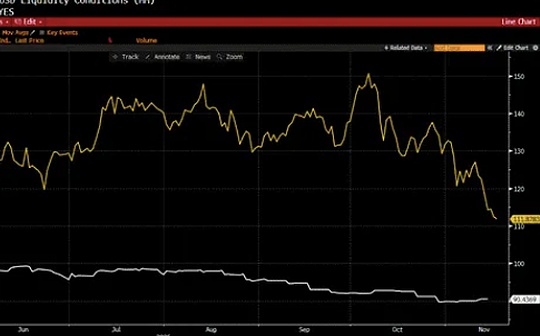

After hitting all-time highs just over a month ago,Bitcoin has now given up more than 30% of its gains since the beginning of the year.The digital currency frenzy is winding down as optimism over the Trump administration’s pro-crypto stance fades and overall risk appetite declines as a result of the recent cooling of highly valued tech stocks.

The market-dominating cryptocurrency fell below the $93,714 mark on Sunday and is below its closing levels late last year, when Trump’s election victory sent financial markets broadly higher.Bitcoin soared to a historical peak of $126,251 on October 6, but four days later, the price began to fall as Trump’s unexpected tariff remarks triggered global market shocks.

“The overall market is in risk-off mode.”Matthew Hougan, chief investment officer at San Francisco-based Bitwise Asset Management, noted,“Cryptocurrencies are the canary in the mine, the leading indicator that reacts first.”

Over the past month, many big buyers, from exchange-traded fund allocators to corporate treasury departments, have quietly exited the market.This has deprived the market of the flow-driven support that propelled Bitcoin to record levels earlier this year.

For much of this year, institutional investors have been a central pillar of Bitcoin’s legitimacy and its price.Bloomberg data shows,The ETF camp has attracted more than US$25 billion in funds, pushing the asset management scale to approximately US$169 billion..These steady flows of allocations have helped reposition the asset as a portfolio diversifier—a safe-haven hedge against inflation, currency devaluation, and political instability.But this ever-fragile narrative is unraveling again, exposing markets to a more insidious but equally destructive force:Fund withdrawal.

“This round of selling is caused by the combination of multiple factors such as profit-taking by long-term holders, institutional fund outflows, macro uncertainty, and the liquidation of leveraged long positions.” Jake Kennis, senior research analyst at Nansen, an on-chain analysis platform, analyzed, “What is clear is that the market has temporarily chosen to break downward after a long period of consolidation.”

One of the clearest examples of buying stagnation in the digital asset space is Michael Saylor’s company Strategy Inc.The software company-turned-bitcoin hoarder, once a model for corporate treasury allocation to cryptoassets, is now trading at parity with the value of its Bitcoin holdings — a sign investors are no longer willing to pay a premium for Thaler’s highly leveraged belief model.

Since bursting into the mainstream with a surge of more than 13,000% in 2017, Bitcoin has always been accompanied by cycles of surges and crashes.After a crazy rise at that time, there was a nearly 75% plunge in the next year.

“The sentiment in the crypto retail market is quite negative.” Hogan, who sees the current correction as a buying opportunity, said frankly, “Investors are unwilling to experience another 50% plunge, and people are avoiding this risk by leaving the market.”

Bitcoin has shaken investors this year: it fell to a low of $74,400 in April when Trump announced his tariff policy, and then rebounded to a record high before the recent pullback.This original digital asset accounts for nearly 60% of the total cryptocurrency market capitalization of approximately $3.2 trillion.

Market downturns hit smaller, less liquid tokens harder.These coins have historically been favored by traders due to their higher volatility and often outperforming during rallies.The MarketVector index, which tracks the coins ranked lower among the top 100 digital assets, shows that the sector has fallen by about 60% during the year.

“The market always ebbs and flows, and cyclicality in the crypto field is nothing new.” said Chris Newhouse, research director of Ergonia, a decentralized finance research institution. “But in the circle of friends, Telegram groups, and industry conferences, the general sentiment I feel is a cautious attitude towards capital allocation. There is no natural bull catalyst yet.”