Author: Jack Inabinet, Bankless; Compilation: Tao Zhu, Bitchain Vision Realm

Synthetic dollar soared.Ethena’s assets are quickly adopted in the encryption field!Why does the agreement urgently need to integrate USDE, and how does integration affect the price of tokens?

Given the extremely high yield generated by Ethena assets, SUSDE obtains the best return of stablecoins through capital/pledge payment, and USDE provides huge airdrops reward, so the demand for various types of financial products that can be synthesized from these assets can beHigh assets, users are willing to pay premiums!

PENDLE’s total lock value (TVL) has increased by 800 million US dollars in the past week, of which more than 40% of them have attributed to USDE.

PENDLE played an important role in promoting Ethena airdrops. Those who hold the USDE protocol income tokens (YT) buy the pure opening of the points generated by the tokens in exchange for fixed payment. This strategy is currently 135 SAT earnings per US dollar. Only onlyYou need to click on the capital to deploy every day.

In view of the large demand for the service, the potential of further expansion of deposits depends only on the willingness of Pendle to increase the limit.

Mantle laid the foundation for PENDLE’s success. He recently received his agreement deployment. The protocol on the first day of TVL soared to US $ 130 million and currently holds $ 160 million in deposits.

In order to make yourself the first choice for USDE points through Pendle, Mantle trades the award of 0.0012 EIGENLAYER points per day for users on the chain, and 13.8 million points per USDE 0.0012 Eigenlayer points!

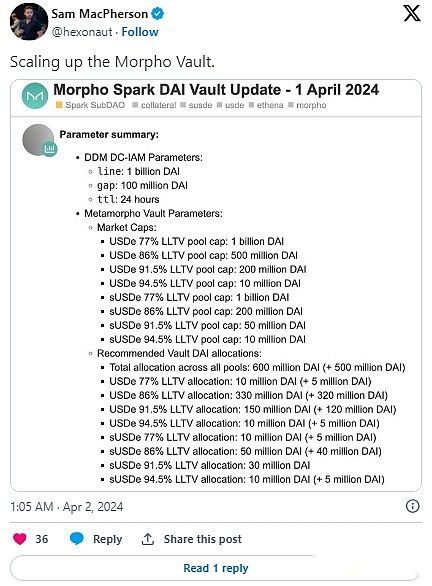

MakerDao also rides in the Ethena wave, casting DAI through Morpho with USDE and SUSDE mortgage.Although only 2%of the circulation DAI was mortgaged by these Ethena loans, the annualized return on the loan was 66%, which contributed 16%to the expected revenue of Maker.

The facility is expected to increase to $ 600 million in the near future and may increase the production line to $ 1 billion, which will enable MAKER to further increase revenue.

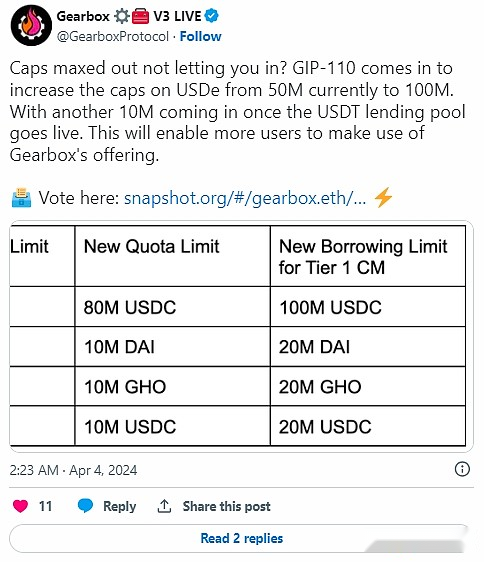

Gearbox is another protocol that allows Degens to speculate Ethena assets, allowing them to borrow stable coins to generate leverage positions for USDE and SUSDE.

Although the agreement doubled the loan capacity of USDE yesterday to increase from 50 million US dollars to US $ 100 million, these restrictions will be achieved soon, indicating that as long as Gearbox is willing to increase the upper limit, they can continue to increase deposits and income.

Although people are increasingly worried about Ethena’s long -term stability, integrating its assets seems to be the current magic weapon.

Compared with the total market value of cryptocurrencies in the past week, the tokens of the above agreement have increased by double -digit. The user’s interest in Ethena products has no sign of slowing down!

It will of course bring inherent risks to the financial melting of the US dollar stable currency.However, as deposits continue to increase, their projects may rise further.