Author: Jake Pahor, encrypted researcher; Translation: Bit Chain Vision Xiaozou

AAVE, GYROSCOPE and Beethoven X have this common point: they are based on powerful Balancer technology stacks.With the release of the upcoming V3, Balancer is about to bring the upgrade of truly changing the rules of the game.

This article is the latest research report in Balancer in February 2024, including the following content: 1. Overview, 2. Use cases, 3. Use, 4, benefits, 6, vault, 7, governance, team & amp, team & ampInvestor, 9. Competitors, 10. Risk & amp; Audit, 11. Conclusion.

>

The core of Balancer is a decentralized AMM protocol.However, when you conduct in -depth research, you will find that its team is building a powerful technology stack as a liquidity center for:

· New AMMS/DEXS being developed

· Income -based assets

· DAO governance

>

Balancer is not only a forward -looking DEX, but also a basic technology to cultivate future DEFI innovation.

Its unique structure simplifies the process of launching unique financial technology to the market.

For example, AAVE, Beethoven X, Radiant, and Fjord.

>

The Balancer V3 is expected to be released this year (the second quarter of 2024), which is what I am most looking forward to.

V3 promises to promote BALANCER to develop based on the innovation of V2:

· DEFI Income Center

· Innovative AMM deployment Launchpad release platform

>

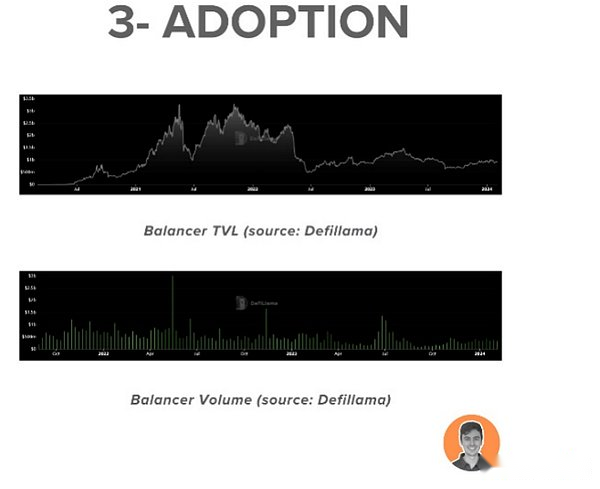

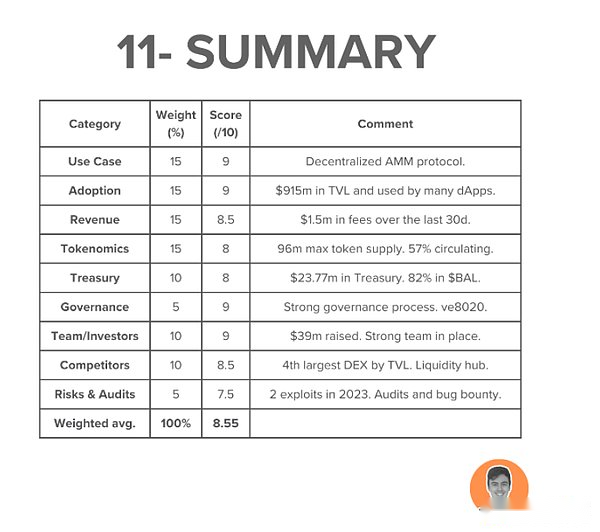

BALANCER TVL is currently $ 915 million.Ranked 23rd among all DEFI protocols and ranked 4th among other DEX protocols.

Although it is still 72%lower than the 3.310 billion US dollars in November 2011, Balanscer TVL has been rising slowly since July 22.Form a solid foundation.

>

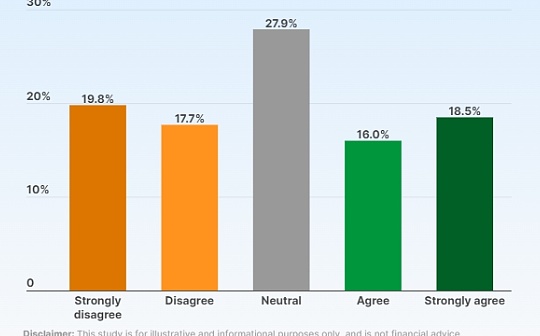

In the past 30 days, Balancer:

· The cost of $ 1.5 million

· Create a revenue of $ 649,000

According to DEFILLAMA data, Balancer ranked 35th in all Defi protocols and ranked 6th in Dex.

As of August 2023, the agreement charged 50%of SWAP exchange fees and 50%packaging tokens to the non -exemption pool.

>

There are two main tokens in the ecosystem:

· BAL – Governing tokens

· VEBAL -Time Lock Bal (80:20)

The VE8020 proposal proposed by Balancer is an innovative method that can solve some unilateral pledge problems faced by DAO governing tokens (such as CURVE).

Let us look at some key differences:

· The user obtains VEBAL by locking 80/20 Bal/Weth Balancer pool tokens instead of simply locking Bal.Even if most Bal tokens are locked, deep liquidity can be ensured.

The longest lock -up period is 1 year, shorter than VECRV’s 4 -year locking period.

>

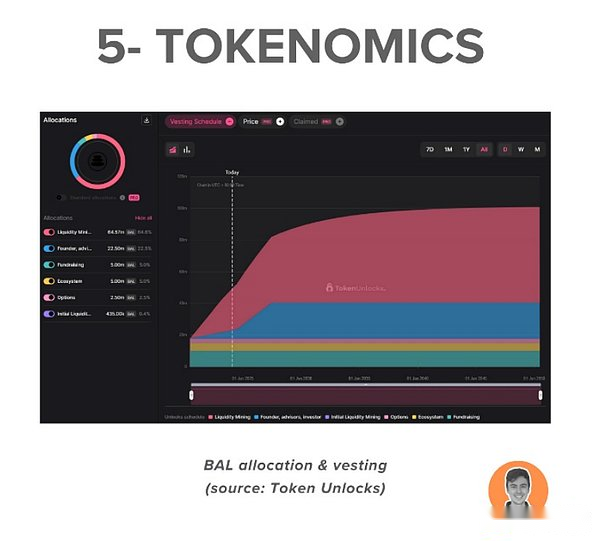

The current supply data is as follows:

· Circulation supply: 54.78 million pieces

· Maximum supply: 96.15 million pieces

· Market value: $ 195 million

· FDV: $ 342 million

· Market value/FDV: 57%

>

The current value of Balancer vault is $ 23.77 million.include:

· Bal worth $ 19.59 million

Other tokens (ARB, AETHBAL) worth $ 2.36 million (ARB, AETHBAL)

· Stable currency worth $ 1.133 million

· $ 390,000 BTC and ETH

These funds are currently holding more wallets by DAO.

>

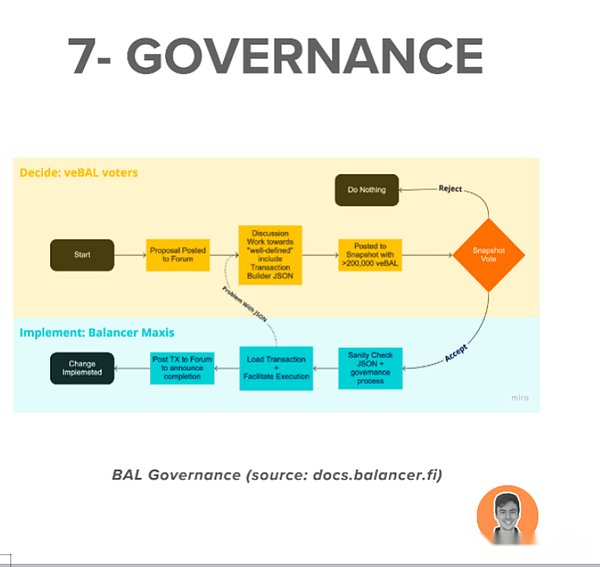

Balancer has deployed a reliable decentralized governance process, which has been running for a long time.

In addition, they also released the VE8020 proposal to significantly enhance the token economics of traditional DAO governance.

>

Balancer was founded in 2018 by Fernando Martinelli and Mike McDonald.

Since its establishment, Balancer has successfully raised $ 39.25 million.

Investors are famous institutions such as Pantera Capital, Blockchain Capital, Coinfund, Fenbushi Capital, and Arbitrum Foundation.

>

Balancer is a prominent DEX, and its competition platforms include Uniswap, Curve, Pancakeswap, Sushi and Thorchain.

However, Balancer has positioned itself as the best AMM and technology stack of the new project, which can support rapid expansion and construction.

>

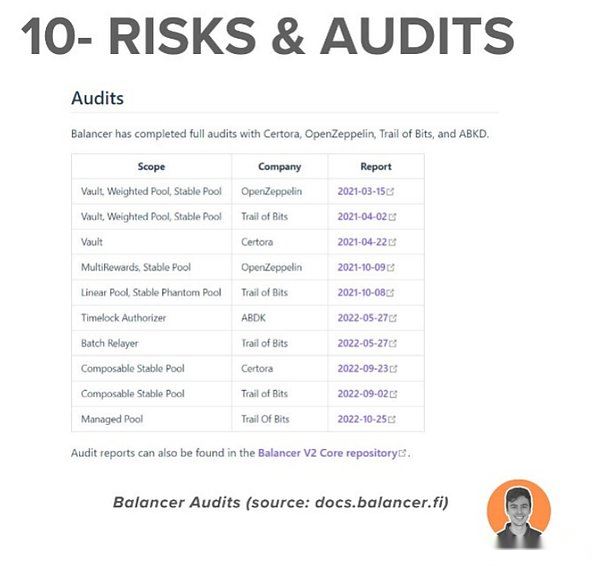

In 2023, Balanscer experienced two major vulnerabilities.One of them attacked the V2 pool, while the other was against the front -end attack.

It is worth noting that Balancer has maintained a high -amount BUG bounty plan (up to $ 1 million) after several rounds of audit.

>

Balancer is low -key, and its team has been constantly developing useful innovative products.

The upcoming catalysts are:

· Balancer V3 upgrade

· LSTS and income stable currency increase

· Governing token economics- VE8020 pool

The total weighted score is 8.55 points.