Press: The super parallel computer AO on ArWEAVE will be launched on the 27th. At the same time, the price of ARWEAVE tokens has recently risen.Make people think of the classic articles about Arweave, the founder of CDOT Network and a partner of Random Capital, and readers can relive.

ArweaveIt is a “atypical” blockchain project. Most people know nothing about it. Those who know a little about them often regard it as many accompanying runningFilecoinofDecentralized storage projectone.There are very few friends who have the patience to find the project of the project and the study of yellow books.Because the whole article is around the concept of unpopular- “Information permanent storage“The elaboration, no concepts such as expansion, cryptography innovation, DEFI support, value capture, etc. make the currency circle and chain circle bright.

Who will needPermanent data storageandPay for itIntersectionLife is only a century, why should we care about the knowledge and history of human preservation of human beings?

The founder and core team of Arweave have their own unique reasons.As arweaveYellow paperChinese translators, I intend to interpret Arweave from the perspective of typical currency circle and chain circle, so as to prevent domestic blockchain creators and investors and investors with this major innovation.First, please allow me to translate Arweave as “Avi“(Although this Chinese name is still discussed in the Chinese community, it is not finalized), To spread in the Chinese encryption community.

Avi and Filecoin/IPFS comparison

IPFS is the field of centralized storagePioneerFrom the launch of 2014, it has been freely growing like BT, and a lot of data has been stored.However, to make IPFS a commercially available storage system, rather than a random data sharing platform, it must be providedService qualityEssenceThis is the problem that Filecoin wants to solve, that is, the economic incentive of IPFS.From proposing the concept of Filecoin to this year’s main network, it is a long time.As a hardcourse technology such as developing IPFS and libp2pProtocol laboratory(Protocol Labs)Why is it difficult to Filecoin?

Filecoin protocol builds two markets: datastorageMarket and dataextractmarket.Users with storage demand to storage in the data storage market to state their own needs: I want to save data of ** size, ask for a copy of a copy, and store the ** day.Storage service provider in the market(Storage miners)For this storage demand quotation, users sign a contract with the miners and pay the fee.When users need to use data, they need demand on the data extraction market; then the miners will give off to meet the needs of data access.

The above process does not look complicated, but there are several difficulties in implementation:

-

Miners need to provide irreplaceable user dataCryptography certificateItems

-

During the validity period of the contract, the agreement should continue to check the miners to save the data as appointments.If a breach of contract, the miners will be fined;

-

forEncourage minersStorage data, so that the capacity of the storage data is more than the free capacity of the idleAdditional issuanceEssenceAt the same time, it is necessary to prevent miners’ injection waste data from fraudulent issuance rewards.

-

Decentralization is highThe network will not be controlled by individuals, institutions or government;

-

Widely usedAs a web3.0 full stack protocol, it is an ideal platform for various decentralized application innovation;

-

POA consensus will not be consumed in large quantitieselectricitySee the next chapter in detail;

-

Avi Agent Agent’s Native Tolerance AR has a low issuance rate,Good scarcitySee the next chapter in detail;

-

Highly programmable, Smart contract Turing is complete.Both DAPP and smart contracts use mature web technologies such as JavaScript, which is conducive to forming a widely diverse developer community;

-

Avi is very similar to Ethereum, and ICO is performed before the main network.After the main network is launched, functional tokens are distributed.ETH’s function is to pay the calculation and storage cost of Ethereum; AR’s function is to pay Avi networkStorage feeEssenceOver time, AR has been used more and more people, and the currency holders are becoming more and more scattered, which is in line with the community(virtual)Legal definition of goods.

Filecoin designCopy certificate(Pore)Solving the first problem, adoptingTime and space certificate(POTS)And the pledge mechanism solves the problem 2.AdjustEconomic model[1]And introduce authentication of real users to solve the third problem.

Although Filecoin solves the above problems to a certain extent, it is inevitable that there are some adverse consequences.FirstlyHigh system complexityIn addition to paying the necessary storage costs, the miners must also bear high proof costs and option costs for pledged FileCoin losses.You know, relatively speaking, calculations are more expensive than storage.According to the small -scale mining provided by Filecoin[2]Recommended configuration[3], 8TB SSD hard disk only costs $ 300, but AMD 3.5GHz 16 nuclear high -end CPU isNeed $ 700There are at least 128GB of memory with a cost of more than $ 500(As a comparison, the minimum memory of Avi mining is 8GB)Essence

High mining costIt will inevitably lead to the Filecoin systemHigh storage service priceEssenceIn addition, verifying the real user is a subtle problem. Verifying that it is too rigorous to affect the user experience. If it is too wide, it cannot prevent miners from disguising as a user. Verifying is meaningful, and the balance between it is difficult to grasp.

At the same time, Filecoin, as an encrypted asset, is highly related to the overall market market of the encryption market, that is,High volatilityEssenceIf the price of Filecoin plummeted, miners may be able to leave the market, causing user data to lose.In addition, the large price fluctuation also increases the mineral pledge Filecoin’sImplicit option costEssenceThe cost of implied options was ignored by most POS economic models. I think the option cost of at least the loss of the loss period should be considered(Some people even think that the option cost of the entire lock -up period should be calculated)Essence

The unlocking period is from the time limit for unlocking request to obtaining a circulation and token. During this period, the pledged person cannot transfer the token, which is equivalent to giving up a copyCurrent price European options(Different from American options, European options can only expire to exercise) [4]EssenceTaking Tezos as an example, the current price and exercise price are $ 2.53, and the annualized volatility is 185%[5], Unlocking period is 14 days(A longer unlocking period means higher option costs), No risk interest rate 4%(Do not affect the calculation results), Use the B-S option calculator[6], Get a European -style option value of 0.363 US dollars(Since the right to exercise is equal to the current price, the value of bullishness and optional rights is equal), Equivalent to 14.3%of the principal value.It can be seen that the hidden option costs caused by pledge should not be ignored due to the high volatility of the encryption and token.

The Filecoin protocol divides the storage and extraction into two markets.Two sets of incentive mechanisms and pricing mechanismsAnd the user’s data access rights are not guaranteed.Suppose you store important data through Filecoin and pay a certain amount of storage costs.Follow you or other users(For example, your customer)When visiting the data, it is also necessary to pay according to the quotation of the extraction market. If the market price is very high, it is equivalent to the data by the miner. “Hold“, The user is facing eitherPay a high priceOrMigration dataDilemma.

I read the Filecoin white paper in 2017, and then gave up the research on the project.The intuition of the programmer tells me that the complex exterior scheme is usually not successful.What is an extra -pushing scheme?It is a way that naturally you can naturally get the problem with the problem. It can also be called “Want to take it for granted“”.Filecoin’s external push method is: Since the miners need(Continuously)It proves that the user’s data has been properly preserved, and the agreement should contain a set ofCryptography algorithmImplement these proofs.As for highly complex proofs that inevitably bring problems with high system complexity and high cost, you can only stay slowly afterwards.However, Filecoin’s competitor, centralized cloud storage does not require proof and verification, and the signing between cloud service manufacturers and customers isLegal contractThe law guarantees customers’ access and pursuit rights.It can be seen that as long as the cost is high, decentralized storage is difficult to provide competitive prices.

SIAAs well asStorjAlthough the agreement is technically different from Filecoin/IPFS, they all belong toContractDecentralized storage protocol.That is, the user and the miner signed the contract through the agreement, the user pays the fee prescribed by the contract, and the miners bear the obligations prescribed by the contract.(Or user)Check the performance of miners(challenge)And punish breach of contract.The decentralized storage protocol based on the contract is facing the basic problems analyzed earlier.

The normal state of science and technology is that when most people try to solve complex problems with a “way for granted”, there are always peopleDo a different approachUsing other people’s never expected, it is usually a much simpler way to solve the problem.Sure enough, after three years in the field of decentralized storage, accidental opportunities let me know “AveaVE——The decentralized storage.

Only by understanding the difficulties of Filecoin can I understand Avi’scleverEssenceAvi is a complete decentralized storage protocol, which is not based on IPFS, or it is equivalent to Filecoin + IPFS.How can Awei solve the problem of miners’ certificates?The answer is no proof.The Avi Agreement adopts the mechanism to design the mechanism to encourage miners to save more data as much as possible, and prefer to store less copy.Scarce dataEssenceAs for how much each miner is saved and what is stored, it is a matter of the miners themselves, neither requires proof nor inspection.Just like the school hopes that students can study hard, they can use two methods.One is that the teacher stares at everyone every day. Whether he concentrates on listening and complete his homework, he will criticize the penalty station if he finds it seriously.Another method isTake the examNo matter how you usually study, finally speaking with the test scores, you can get a lot of prizes.Both methods can improve the learning effect, but apparently the latter one is much simpler.

The decentralized storage based on the contract is similar to “staring”, and the Avi agreement looks like “take an exam“This method is called incentive -based decentralized storage.It can be intuitively understood its advantages: Filecoin wants to manage thousands of different storage contracts, check the execution of each contract, and provide rewards or punishment respectively.Avi Agreement only handles one contract-All data permanent preservationEssenceTherefore, the agreement is very simple, the operating cost is low, and the price and reliability of the service are better than the contract -based system.

Avi’s “Access certificate“(POA)It is a simple expansion of POW.Each round of POW puzzles is with a certain past block(Memory block)Related, only storageMemory blockThe miners are qualified to participate in POW quiz.Because the memory block is randomly determined, it cannot be predicted in advance. Therefore, the more blocks stored in miners, the greater the chance of participating in POW quiz, and the higher the possibility of getting a reward for blocking.If the storage space of the miners is limited and the history of the whole block cannot be preserved, he will preferentially preserve blocks with a small number of copies in the network.Because the probability of each block is equal to the memory block, when a scarce block is selected as a memory block, only a few miners are eligible to participate in the POW competition, soStore scarce blockIt is more beneficial to miners.

If a friend may ask, if all nodes do not store a certain block, then this block will notPermanent lossIs it?That’s it, this possibility exists.However, we can quantify the risk of permanent loss of a single block[7]Essence

First need to be introducedReplication rateThe concept, the replication rate is the proportion of block history stored by miners.For example, a total of 100 blocks have been produced in the network, and the average miners are stored in 60 yuan, so the replication rate is 60%.The replication rate is also selected for a miner, he has itRandom selectionProbability of a certain block.Conversely, select a certain block and a miner randomly. The probability of miners without this block is 1-copy rate.When there are n miner nodes in the network, the probability of all miners without a certain block is (1-copy rate)^n.The probability of a loss of block is (1-copy rate)^n * total number of blocks.

Assuming that the Avi network has 200 miner nodes, the replication rate is 50%, and the total volume of the block is 2000,000. Then there is a probability of a loss of blocks at 6.223*10^-61, which is a minor probability event that can be ignored.At present, the miner nodes of Avi Network are about 330, the replication rate is 97%, and there have been more than 510,000 blocks.[8],existThe probability of block lossIt is much lower than the previous calculation results, in terms of order of orderPrivate key collisionThe probability is equivalent.And the assumptions of the above calculations are the history of random storage of miners to store blocks. Considering that the mining union preferential storage of scarce blocks, the possibility of losing blocks is lower.

The Awei agreement has only one market, and users alsoJust need to supportPay storage feeThe follow -up access data is free.This can be done because the Avi agreement uses a mechanism design similar to BT[9]All nodes in the network are equal(Do not distinguish miner nodes and user nodes)All nodes should quickly respond to the requests of other nodes as quickly as possible.Like BT, the more uplink contribution, the faster the downward speed.The selfish node will be reduced by other nodes and gradually exclude by the network.

The best way to comprehensively understand the design of the Awei agreement isRead the Yellow Book(Https://github.com/toliuyi/arweave_notes/blob/master/arweave-yellow-paper-cn.pdf)EssenceAlthough the yellow paper is long and there are many formulas, you don’t have to worry about it. You can understand the mathematical foundation of middle school.

Compared with Filecoin, Avi has two major advantages.One isLow costEssenceAlthough the Filecoin main network has not yet been launched, I make a prediction in advance: one year after the Filecoin main network is launched for one year(Economic model enters a stable state)The price of hundreds of copies of the 1MB file on the Avi Network will be stored by hundreds of copies, which will be lower than the price of 5 years on the Filecoin/IPFS network for 5 years, and the data access of the Avi network is permanent and free.Second, the incentive mechanism of the Avi Agreement makes data storage and accessMore reliableEssenceThrough simple and clever solving the biggest problem of decentralized storage, it does not require 200 million US dollars to raise funds and develop for three years. Avi Main Network has been launched for more than two years.

Avi is not a runner of Filecoin/IPFS, but the most promisingMake large -scale decentralized data storage a realityEncryption protocol.

Comparison of Avi and Ethereum

Avi rarely gets followedEthereumCompare, after all inWeb3.0In the protocol stack, they are at different levels, and they seem to be complementary.But in -depth study of the Avi agreement, you will find more possibilities.

Ethereum(And other smart contract public chains)SupportDecentralized application DAPPAnd life.DAPP is an Internet application that is performed fairly and transparently and cannot be controlled by individual or a few people.From the perspective of software architecture, network application(Including Internet applications and DAPP)Can be divided into performance, business logic and persistence(data)Three layers.We may wish to analyze the development bottlenecks of DAPP and the application potential of the Avi Agreement from these three layers.

So far, the performance layer of DAPP is still in the same state as the centralized web application, that is, the developer is deployed inCloud serverThen download to the user client execution.Therefore, developers and cloud service providers still have the right to stop and examine DAPP. Failors and attacks such as network interruption, server downtime, DNS hijacking, etc. still threaten DAPP of DAPPAvailability and securityEssenceIn addition, the cost of IT infrastructure of DAPP will increase with the number of users, so that developers must use some monetization means to maintain the operation of DAPP.Monetalization is either web2.0, that is,Trafficking; Either with the characteristics of encryption protocol, that is,IssuanceEssenceOnce the monetization fails, developers may give up the running DAPP, and users can only turn to find alternatives.And even if there are alternatives, they still face the same problem.DApps that can be maintained often encounter “Forced upgradeThe problem, that is, the new version is not necessarily more popular than the old version, but users cannot stop them from upgrading or continue to use the old version.

In summary, decentralized applicationExpression layerIt is still centralized and can still be controlled by individual or a few people.

The application layer of the Avi Agreement is calledForever(Permaweb)Its main(Not only)The application architecture isNo server(Serverless)Form.The development of no server DAPP is similar to the front -end development of traditional web. Developers use HTML, JavaScript and CSS development DAPP performance layers.The difference is that the deployment of the expression layer is not uploaded to the cloud server, but the packagingStore on Avi NetworkThe preservation cost is very low, and it is a permanent service.Users still use the original method to access DAPP. Avi DNS and TLS are compatible with ordinary browsers and do not require users to install and learn new clients.No matter how DAPP users grow, they will no longer bring expenses to developers.

Since Avi isDecentralization networkWhether it is a developer or Avi Miner, it cannot stop or review the user’s use of DAPP.Developers can develop new versions of DAPP, but the new version cannot cover the old version. Which version of the options are used in the user’s hands.It can be seen that Avi achieved the decentralization of the DAPP performance layer, so there are more and more DAPPs to put itExpression layerTransplanted to Avi, including:Synthetix Exchange, Tokenlon, Kyberswap, Uniswap, OASIS App, Curve.fietc.[10]Essence

It should be noted that the use of decentralized storage to realize the decentralization of the DAPP expression layer, this concept is not the creation of the Avi protocol.As early as 2014,Gavin woodDr. is describing the papers describing web3.0 network form[11]In the middle, “Static content publishing“It is one of the four basic components of Web3.0.The result of this thinking isSwarmproject[12]EssenceBoth Swarm and IPFS have been highly hoped to solve the problem of decentralization of the DAPP expression layer.But for a variety of reasons, this wish has not yet been realized.It was not until the Avi agreement appeared that the decentralization of the DAPP performance layer had a practical solution.

The smart contract public chain such as Ethereum is realizedDAPP business logic layer and data layerDecentralization, but it is well known to existScalability bottleneckEssenceExpansion and price are both two sides. The scalability limit comes from scarcity of computing and storage resources. In the decentralized network, the result of competitive use of scarce resources is high prices.Because the price is easier and quantified, this article is selected frompriceAnalyze the angle.

Look atData layerEssenceEthereum stores 256 -bit integer data to consume 20,000 GAS[13], Storage 1MB data requires 625 million GAS.20gWei at GAS price(The writing of this article coincides with the DEFI boom., ETH unit price is 400 US dollars calculated, the cost of storing 1MB data on Ethereum chainUp to $ 5,000, Obviously it is an unreachable high price.Most of the DAPPs with data storage requirements use hybrid storage schemes, that is, the hash has been stored on the chain with high -value data such as encrypted assets and hash, which is stored on the chain. Detailed data, multimedia data, etc. are stored under the chain.If you use a centralized chain data storage, such asRelated database or NOSQL databaseThen DAPP is still partially, and it will still be individual or a few people.(Cloud service manufacturers and developers)control.Therefore, many DAPPs are more inclined to choose decentralized storage, such as IPFS.

In this link, Avi provides a completely decentralized, low -cost, high -reliability permanent data storage, thus becoming Ethereum’s capable assistant.No need to sacrifice decentralization. At present, Avi stores 1MB dataOnly 0.1 centsEssenceYou read it right, it is one -million -in -one in Ethereum.Based on the current price, the 100 -year expense of 1MB data in Alibaba Cloud is 2.6 cents.And only supports redundant replication in the same city, data synchronization, and data access to network overheads.And Avi Network is the world’s five continentsHundreds of nodes redundant copy, Data synchronization and access to all free.You still have nothing to read. The decentralized Avi network has been stored than centralized clouds.Lower priceEssenceNo wonder there is solana[14], Skale[15], Prometteus[16]WaitData storage layerEssenceAnd NFT projects such as Infinft, Mintbase.io, and Machi X use Avi store NFT media resources, metadata and code[17]Essence

Smart contracts are dappBusiness logic layerEssenceSimilar to the data layer, the bottleneck of smart contracts is scalability / calculation cost problem.according toVitalik buterinEstimated that the calculation and storage cost of Ethereum is about 1 million times the Amazon Cloud service.[18]The estimation of the cost of DAPP data layer can also confirm this estimate.The fundamental reason for the high chain computing and storage cost is itsFull redundant architectureThat is, all the data on all chains are stored by each full node, and all calculations are performed at each full node.The idea of realizing public chain expansion isSystem, layered and distributionThree types.

AviSmartweaveSmart contract[19]It is completely unprecedented.Smartweave smart contract is a program developed by JavaScript, which is stored on the Avi network, so it is invariant.Submitted to the network with the contract code, as well as the creation of the contract.And Ethereum(And other public chains)Different smart contracts, Smartweave is not performed by miner nodes, but downloaded toContract callComputer execution.The execution process is from the state of the contract of the contract, perform all the transactions in the history of the contract in the history of the contract, and finally execute the transaction of the contract caller.After the completion, the contract caller submits the input and execution contract status of his transaction to the Avi network to enter permanent storage.The subsequent contract calls repeat the above process.

In other words, for a smart contract transaction, Awei NetworkJust one node——Profitter’s own node to execute(Note that Awei network does not distinguish between the entire node and the light client)EssenceDue to the execution of the callor node(At the same time verified)All transactions in the history of the contract, so he can get it without trust or relying on any nodeTrue calculation results(That is, a new state of smart contracts)EssenceTherefore, you can think of each Smartweave contract as Avi’sTwo -layer chainThe execution of smart contracts is the full synchronization and verification of the two -layer chain.This design makes DAPP business logic layerScalability/ Calculating cost difficulties are solved.Smart contracts can almost contain any complex computing without restrictions, and only need to pay very low marginal costs, because the computing equipment of the appliances has been purchased or rented for a long time.

Some friends may ask: With the increase in the number of transactions, isn’t the execution of smart contracts getting slower?This is true, but there is a way to think.For example, the caller is named the status of the contract, so as to formContract status snapshotEssenceIf the caller deserves trust(For example, the recipient is the situation of the smart contract developer), Subsequent caller can specify the status snapshot as the initial state, and only need to execute the transaction after the snapshot.Status snapshot does not necessarily lead to the expansion of trust collection. After all, the premise of reliable smart contracts has contained trust in the initial state.

Of course, Smartweave is still under development. The current version isV0.3EssenceThe above content should be regarded as a discussion on Smartweave potential.To achieve commercial use, Smartweave also needs to solve many problems, such asCombinedEssence

From my understanding of the SMARTWEAVE operating mechanism, there is no special technical obstacle to achieve combination of combination.However, I always think that the combined availability of the Ethereum smart contract “Too powerful“, It is difficult to limit the exponential growth of the complexity of the contract system.Looking forward to the SMARTWEAVE team has a more surprising innovation and make good use of the combined double -edged sword.

In summary, the Awei agreement supports DAPP to truly achieve comprehensive decentralization and solve the computing and storage that has troubled the public chain field for many yearsScalability / costquestion.In this sense, Avi should be attributed to Blockstack[20]Advocated “Web3.0 full stack protocol“, Not just decentralized storage.

Comparison of Avi and Bitcoin

BitcoinIt is the pioneer of the crypto protocol and the king of cryptocurrency.For a long time, there has been a topic in the industry: Is the status of the king of Bitcoin that may be replaced?EvenBitcoin BannerIt is also acknowledged that after 10 years of development, Bitcoin is no longer the most advanced cryptocurrency.But they think:Super sovereign value storage currencyIt is the biggest use case of cryptocurrencies.The Bitcoin Agreement has the longest running time, the highest reputation, and the best security.And the competitive barriers of cryptocurrencies are not technology, soLiquidityEssenceThe liquidity has a network effect, that is, the efficiency of products or services increases with the growth of users.Bitcoin agreement has been establishedLiquidity advantageThis advantage will only continue to increase with the popularity of cryptocurrencies.Therefore, the status of the king of Bitcoin is unshakable.

Can the advantages of liquidity network effects be broken?To answer this question requires quantitative research on network effects.I believe many people will think immediatelyMetkov’s LawThat is, the value of the network is directly proportional to the square of the number of users.Metkov’s law is the quantitative model of the first network effect, but research in recent years shows that the value of no network has grown according to Metcafif’s law. At least until the number of users is large, the network value growth curve is increased.Must become flat[twenty one]Essence

Study shown[twenty two], The network effect of some Internet business is n*log (n), part isSEssenceThe S -curve is the growth of the network value with the user. It is the exponential growth of the exponential type, then the growth rate slows down after the saturation.The important inference of the S -shaped curve is that the stronger the strong, the stronger the winner, but not the winner.If the network effects of all Internet platforms are in line with Metkov’s law, then in every segment of the Internet industry, it will formSingle widowThe situation.But reality is mostly in the world and China’s Internet industry, most of themSegmentationThere are more than one platform for a long time.

SoLiquidity network effectWhat curve(formula)increase?Assuming an encrypted asset, the average daily transaction volume of each participant accounts for one tenth of the total market value of the asset.The average daily turnover rate of 10,000 investors is 100%, and the turnover rate of 20,000 investors is 200%.That is, 10,000 investors have been added, and the turnover rate has doubled.If investors increase from 100,000 to 110,000, the turnover rate increases from 1,000% to 1100%, only one -tenth.soThe more investors, New investor’s liquidityThe smaller the contribution ratio, Its network effect and the number of participants are log (n).

The above quantification models and pictures of liquidity network effects all come fromMulticoin CapitalResearch[twenty three]EssenceThe conclusion of this study is very important. For example, the exchange competes with liquidity. After the head exchange reaches a certain scale, the value growth brings by the liquidity network effect will slow down, so that the latecomers have the opportunity to catch up.If the liquidity is the network effect of N*Log (N) or even N square, there will be no Binance, KUCOIN, and MXC out of the siege, and there will be no tens of thousands of exchanges.The quantity relationship of log (n) indicates that the liquidity is stronger, butDo not guarantee that the strong is HengqiangEssence

Another factor makes the liquidity advantage of Bitcoin more easily broken. I call it “Liquidity conduction“”.It is a new -born cryptocurrency that can be used to use the established global trading network, so as to follow the existing cryptocurrenciesSharing liquidityEssenceFor example, at the birth of Ethereum, infrastructure, including exchanges and payment platforms, has developed for 6 years, and they are easyIntegrated ETHEssenceAs long as ETH forms a high liquidity transaction with Bitcoin, it has indirect liquidity with the main legal currency. Therefore, Ethereum no longer needs to experience a long market introduction and infrastructure construction stage.currency.

In the state of free competition, the comparison between currency isMonetaryEssenceMonetary includes scarcity, exchanges, verifiable(Difficult forgery and easy to identify), Can be available, divided, and the cost of preservation, carrying and transferring.All cryptocurrencies are the direct descendants of Bitcoin, and they also inherit the powerful currency nature of Bitcoin.Before Ethereum, the theme of cryptocurrency innovation was “Better“, That is, creating more currency cryptocurrencies.For example, Litecoin, Dashi, star coinFast transfer speedThe transaction fee is lower.Zcash, MonroePrivateness is betterThe interchangeability is more guaranteed, but none of them threatened the status of Bitcoin.Because the improvement of quantity is not enough to challenge the advantages of the network effect, it must have quality innovation to achieve “Paradigm“”.For example, Microsoft did not invented a better large machine to defeat IBM, and Apple did not defeat Microsoft with better PCs.Revolutionary innovators are implemented to the hegemonyDecreaseOnly became the new king.

The industry generally recognizes that Ethereum is a representative of blockchain 2.0, because Ethereum is a new level of innovation.Introduce EVM, Make cryptocurrencies strongProgrammableEssenceInnovation innovation is not what you do, but I can do better, but what I can do.

Ethereum smart contracts can realize decentralized asset issuance, fundraising and asset transactions. In the last round of ICO waves, ETH was regarded as the mainCurrency and value storageUse, the demand for ETH soaring, has also promoted its market value to up to 60%of BTC.Of course, ICO existsSevere information asymmetry, It is inevitable that real estate has generally produced reverse choices and moral risks. Bubble rupture is an inevitable result.Highly programmable cryptocurrencies have endless innovation space.DefiThe rise will be the new round of the Ethereum Bitcoin.Unfortunately, the value capture mechanism of ETH is not sound. If EIP1559 is implemented in the early years, ETH should have entered the shrinkage stage. The Defi boom is likely to promote its market value beyond BTC.

There are two major investment themes in the encryption asset market:Sound currencyAnd web3.0.Improve currency is decentralized, super sovereign cryptocurrencies, so as toBitcoinRepresentative.Web3.0 is the application of blockchain technology and reconstructing social production relations. The representative project isEthereumEssenceI think the two major investment themes of currency and web3.0Can be both, That is, decentralized, highly programmable blockchain platforms can support Web3.0, and its native crypto assets have a sound nature of currency.EssenceThe new king should have the following nature: high decentralization(Implocked super sovereignty), Wide -purpose, low external nature, good scarcity, highly programmable and compliance.

In view of the scalability of Ethereum 1.0, it is difficult to last even if it is on the throne.Which project is the representative of blockchain 3.0?Ethereum 2.0, Polkadot, COSMOS and Avi Agreement are strong competitors.Avi Agreement is also availableKing of CryptocurrencyPotential:

Avi Economic Model Detailed Explanation

EncryptedEconomic modelHow to coordinate the service provider(miner)Service user(user)The interest relationship with the currency holder.Miners provide computing, bandwidth and storage resources for the encryption protocol network to ensure the safety and available protocols, and the user uses the agreement to pay the miners.The benefits of the miners are divided into two parts: First, the user pays directlyTransaction fee;Additional issuanceEssenceThe additional reward is the coinage tax that all currency holders shall be shared according to the number of currency.Among the economic models of almost all encrypted agreements, the main income of the miners is to increase the reward(Mint tax)EssenceFor example, although Bitcoin has been reduced by half after three additional issuance rewards, the additional rewards are still95% of the total revenue of the minersThe transaction fee accounts for only 5%.This is actually a mechanism for subsidies to subsidize the user’s use agreement.

In all the economic models I have studied, the economic model of the Avi Agreement Agreement isCoinThe most friendly.In the creation block, the protocol generates 55 million AR, and then each block will be issued.The calculation formula of the increase is as follows:

in:

Bring the constant into the formula and simplify the formula to:

The Avi agreement an average of 29 blocks after the creation block of 29 AR after the creation block, and the amount of issuance is halved each year. A total of up to 11 million AR is added.In other words, every year after Avi Main Online after June 2018, it will beDig out half of the remaining ARThat is, 5.5 million AR was excavated in the first year, 275 were digged in the second year, and 1.375 million in the third year …(Avi Main Network was launched in June 2018, and the release rewards were distributed for more than two months.)Essence

At the time of writing this article, Awei Network is facingHalf the second halved for the second time(It is expected to be around September 10, 2020)EssenceOne year after secondary half(That is the third year)The increase rate was 137.5/(5500+550+275) = 2.17%.By the fourth year, the addition rate of AR will be lower than the Bitcoin of the same period.

Another scarcity indicator may be more explained, and the mining rate = unleight / total amount.At present, there are only about 1.98 million ARs that are not mining.The mining rate is 3%EssenceAs a comparison, there are currently about 2.55 million BTCs that have not been adopted, and the mining rate is 12%.It can be seen that the amount of AR has a small amount, the faster attenuation of the increase is faster, and it has a typical characteristics of sound height of the currency.

However, please note that according to the numbers provided by the Avi team, the current circulation of AR is about 38 million, which meansAbout 26 millionAR is inNon -circulating stateEssenceI do n’t know that the ownership composition of this part of the token constitutes a unlocking plan, and it can only speculate that it belongs to early investors, teams and foundations.If someone knows this situation, please tell the author and be grateful.

The principle of Avi’s economic model can be roughly summarized as: user isStorage servicePay enough fees; minersIncome exceeds cost, Maintain a basic general fixed profit margin; almost all the revenue of AR -token value -added.Based on AR’s previous long -term consolidation currency price of 4 dollars, this year Avi miners have obtained the income from the addition of issuance to$ 5.5 millionThese income will be shared by hundreds of miners around the world.Compared with this, Bitcoin miners have obtained more than 10 million US dollars per day, exceeding $ 3.6 billion each year.

Avi POW(As part of the proof of POA access)useRandomx algorithm[twenty four]EssenceRandomx is a CPU -friendly algorithm that requires a large amount of memory execution. The advantage of special hardware is very small.Following the Avi AgreeRandomx[25]As a rightASIC miningLatest(Maybe it’s the last)Resistance.Given that Avi mining is not a simple computing power competition, and the overall income of mining is limited, Awei is likely to not form a special mining industry chain, but to maintain hundreds of mining nodes around the world.(Some nodes will become a mining pool)andHigher replication level levelThe consumption of network power is not high.Mainstream mining hardware is likely not to be ASIC mining machines, but ordinary commercial computers.

Of course, some people will sell Avi mining machines after AR’s heat is improved.At that time, you should understand that it was almost impossible for the Avi miner to bring decent returns.In the long run, Avi may be web3.0Decentralized CDN networkAt that time, CDN services for enterprises will be the core business model of Avi miners.

Avi and crypto asset investment

Since the beginning of 2013, I have invested in Bitcoin. In more than 7 years since then, I have heard many people talking about how to learn about Bitcoin, the first impression of Bitcoin, how to pass the huge wealth, and so on.There is a problem that has always troubled me:What determines our view of Bitcoin at the time?Most people don’t care about it. Some people believe that Bitcoin is a capital disk wearing high -tech coats. A few people invest in Bitcoin or start mining due to various psychological investment.Change destiny.

thisVery few peopleIt is often used as a genius that foresees the future.However, we must know that any novelty has an early group of early participants, but in countless novelty affairs, there are very few influence on society.Rather than seeing the early participation in Bitcoin as a talented man, it is better to say that they are lucky.But the question is, is this kind of fortune randomly coming to everyone’s head at a rough probability?With my thinking about this issue over the years, it may not be true.

For most people, the crypto asset marketAt most, it is a casinoEssenceThe several times or higher returns earned in the bull market can easily return to the market in the bear market, and even lose the principal.The root cause is that the failure rate of the encryption agreement is very high.The direct evidence is that the top ten cryptocurrencies of the market value list five years ago[26], To this dayMost of them have returned to zeroOr approach to zero.

The encryption protocol is not to solve all problemsUniversalEssenceThousands of encryption agreements on the market now try to establish various unbelievable Internet platforms.However, after five to ten years, a considerable part of the starting point of the encryption protocol will be proven to be wrong, that is, the encryption agreement is not suitable for these fields.In those applicable areas, because the encrypted protocol has a network effect and has no regional restrictions that can serve global users, the number of successful encryption agreements in the same field should be a handful.Therefore, in five to ten years, the vast majority of crypto assets in the existing market will be zero or close to zero.

Why is a rational investor willing to invest in zero -risk investment encryption assets?In the middle of 2014, Bitcoin was in the low valley of the previous round of bear markets. The U.S. Justice Office auctioned 100,000 Bitcoin in four public auctions.Silicon Valley’s famous venture capitalist and head of Defengjie investmentTim DraperMost of them were taken.After the auction, Tim Draper accepted the media interview with the logic of his buying Bitcoin.He said that Bitcoin is likely to be zero, but there is a certain probability of hundreds of times, so it is a good investment.Suppose that after five years he bought, the probability of Bitcoin 80% was zero, and the probability of 20% increased by 100 times.Then the expected return of this investment is82% per yearObviously higher than the risk -free return of long -term national bonds.

I saw the news of the auction and heard Tim Draper’s interpretation of his investment logic.I agree with his logic, so I used a funds that could be affordable to add Bitcoin.It turns out that this investment logic is established.

People who have succeeded in the encryption asset market are optimistic and concerned about big issuesLong -termEssenceThe so -called big problem is the basic problem that affects the development of the Internet and even human society.In 2011, 2013, and even 2015, you can list hundreds of reasons that Bitcoin will fail, and these reasons can also be standing.But if you pay attention to the following big issues(Or one of them)—— The Internet needs native one,No dependence on specific institutionsValue transmission;Internet platform and financial intermediaryMost of the profits of all social and economic activities have been taken;Central bankIt has been increasing the issuance of currency to promote economic development, and it will be recognized as the cross -era significance of Bitcoin.Moreover, a optimist, to believe that although Bitcoin has hundreds of reasons, it may also succeed.As for long -termism, andFocus on big issuesThis is two sides.If someone gets several times the profit, it is difficult to clear the position, it is difficult to believe that he really pays attention to big issues.

Permanent preservation of human knowledge and historyOf course, it is a big problem, and it is likely that its importance has no right right.After all, in terms of intelligence and physical fitness, modern people are no different from tens of thousands of years ago.We live a completely different life from the ancestors. The only reason is that we inherit and use the history of human beings in tens of thousands of years.The knowledge and experience of precipitatedEssence

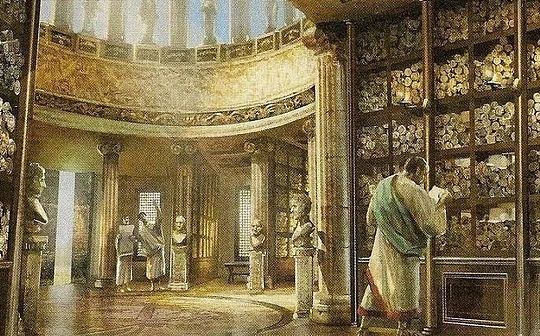

For the rulers of the Ptolemy dynasty,Alexander LibraryPerhaps it is just a rich embellishment.But for later generations, Alexander Library is much more important than Po -Pipo’s dynasty.Although Caesar was called the only creative genius of the Roman Empire.But Caesar’s Qianqiu Gongye can not make up for itBurning the fault of the Alexander LibraryEssenceDoes today’s technology have developed to the critical point, and the world can no longer rely on individuals, institutions or countries. No matter how powerful they are, they can permanently preserve the knowledge and history of all mankind?If this generation has achieved the great achievements of this ancient, how lucky we can participate in it!

So Avi is not a substitute or competitor for Filecoin/IPFS.The goal of Filecoin/IPFS is to subvert centralized cloud service manufacturers’ monopoly on the storage market. Of course, it is an important issue in the Internet industry, but compared with Avi’s goal, it is far from “Big problem“”.When I finished reading the Avi Yellow Book, it seemed as if the time and space shuttled back to the first to know Bitcoin.Will the miracle be staged this time?

Quotation literature

1. https://filecoin.io/zh-cn/2020 -ngineering-filecoins-economy-zh-cn.pdf

2. Labs, P. A Guide to Filecoin Storage Mining. Filecoin available at: https://filecoin.io/blog/filecoin-Guide-storage-mining/.

3. https://pcpartpicker.com/user/tperson/saved/h2bskl

4. Venturo, B. The Economics of Ethereum’s Casper. Medium (2018). 45F7247A2.

5.

6.

7. Project, T. A. Decentralised Storage: Incentives vs Contracts. Medium (2019). ENTIVES-VS-Contracts-B74EE0B7EFF1.

8. https://viewblock.io/arweave/stats

9. Bram Cohen. Incentives Build Robustness in BitTorrent. In Workshop on Economics of Peer-Toer Systems, Volume 6, Pages 68 {72, 2003. [19] Matt Coralo. Compact Block Relay. BIP 152, 2017.

10. Project, T. A. Arweave News: Jury. Medium (2020). Available at: https://medium.com/@arweave/news-july-7905d5e0c84f.

11. sApps: What web 3.0 looks like available at: http://gavwood.com/dappsweb3.html.

12. Swarm available at: https://swarm.ethereum.org/.

13. G. Wood, Ethereum: A Secure Decentralized General TRANSACTION LEDGER, in: Ethereum Project Yellow Paper 151 (2014).

14. Solana -Arweave Bridge: Arweaveteam Funded Issue Detail. Then, then

15. Skale Network -Arweave Bridge: Arweaveteam Funded Issue Detail. Then, then

16. Labs, P. New PRIMARY Storage for Ignite. Medium (2020). Available at: https://medium.com/prometeus-Network/new-torage-torage-site-94096e-94096e-94096e 2E8506.

17. Project, T. A. NFT PerManence with Arweave. Medium (2020). Available at: https://medium.com/@arweave/nft-with-A35b5d64eff23.

18. Wang, B. Ethereum is about 1 Million Times Less Efficient for Storage, Network and Computation. Next Big Coins (2018). .io/Ethereum-IS-About-Million-Times-hess-efficient-for -stor1-network -and-computation/.

19. Project, T. Ath Antroping Smartweave: Building Smart Contracts with Arweave. Medium (2020). SmartWeave-Building-Smart-Contracts-With-Rweave -FC85cb3b632.

20. https://www.blockstack.org/

21. Odlyzko, Andrew & Tilly, Benjamin. (2020). A refutation of Metcalfe’s Law and a better estimate for the value of networks and network interconnections.

22. The network eFFECTS Bible. NFX (2020). Available at: https://www.nfx.com/post/network-effects-bible/.

23. Kyle Samani, on the Network Effects of Stores of Value. Phoenix available at: https://multicoin.capital ols-of-value/.

24. Tevador. Randomx. Https://github.com/tevador/randomx, 2019.

25. Shevchenko, A. & amp; Shevchenko, a. Monero Penalizes GPU and Asic Mining with Randomx Upgrade. Crypto Briefing (2019). eFing.com/monero-penalizes-gpu-money-randomx/.

26. Muhammedabdulganiyu42@gmail.com The rise & amp; fall (and rise & amp; fal) of the top 10 cryptocurrencies … Merchant Machine (2018). ttps: //merchantmachine.co.uk/cryptocurrencies/.