Author: Andrew Kang, co-founder of Mechanism Capital; Translation: Bitchain Vision xiaozou

I’ve recently been able to learn about Tom Lee’s ETH investment theory, which is probably the most ridiculous collection of financial illiteracy arguments I’ve ever seen.Next, let’s analyze it one by one.

Tom Lee’s theory is based on the following five points:

Stablecoins and real assets tokenization adoption;

Digital oil analogy;

Institutions will purchase and pledge ETH to provide security guarantees for their asset tokenized networks and serve as operating capital;

The ETH market value will be equivalent to the sum of the value of all financial infrastructure companies;

Technical analysis.

1. Stable coins and real assets tokenization adoption

The argument holds that the growth of stablecoins and asset tokenization activity should drive up trading volumes and in turn drive up ETH fees/income.It seems reasonable on the surface, but just take a few minutes to check the data and you will find that this is not the case.

Since 2020, the value of tokenized assets and stablecoin transaction volume have increased by 100-1,000 times.Tom’s argument is simply a misunderstanding of the value accumulation mechanism, which may make you mistakenly think that the handling fee will scale year-on-year, but in fact its actual level is almost the same as in 2020.

The reasons are as follows:

Ethereum network upgrades improve transaction efficiency;

Stablecoins and tokenized asset activities flow to other chains;

Tokenization of low-liquidity assets almost does not incur any handling fees.Tokenized value is indirectly positively correlated with ETH income.Someone can tokenize a $100 million bond. If it trades every two years, how much fees can it incur for ETH?About $0.1?The handling fee incurred by a single USDT transaction is more.

Even if the tokenized trillion-dollar assets are, if their liquidity is low, it may only add $100,000 to ETH.

Will blockchain transaction volume and handling fees increase?Yes, but most of the fees will be captured by other blockchains with stronger business expansion capabilities.In the field of traditional financial transactions being launched, other competitors are actively seizing opportunities.Solana, Arbitrum and Tempo have achieved major early results.Even Tether is supporting two new chains Plasma and Stable, both of which intend to transfer USDT transaction volume to their own chains.

2. Digital oil analogy

Oil is a commodity.The inflation-adjusted real oil prices have been fluctuating in the same range for more than a century, with only cyclical surges and declines.I agree with Tom’s view of ETH as a commodity, but that’s not a good deal.I don’t know what Tom is trying to argue here!

3. Institutions will purchase and pledge ETH to provide security guarantees for their asset tokenized network and serve as operating capital.

Have large banks and other financial institutions allocated ETH on their balance sheets?No.

Is there an organization that has announced relevant plans?Neither.

Will banks stock up on gasoline due to their continued energy consumption?No, because the proportion is too small, just buy it directly if needed.

Will banks buy shares of the asset custodians they use?Won’t.

4. ETH market value will be equivalent to the sum of the value of all financial infrastructure companies

I mean, this once again exposes the fundamental misunderstanding of the value accumulation mechanism, purely delusional.

5. Technical Analysis

I am actually a loyal fan of technical analysis and believe that objective application of technical analysis is of great value.But unfortunately, Tom seems to be using technical analysis to draw lines at will to prove his bias.

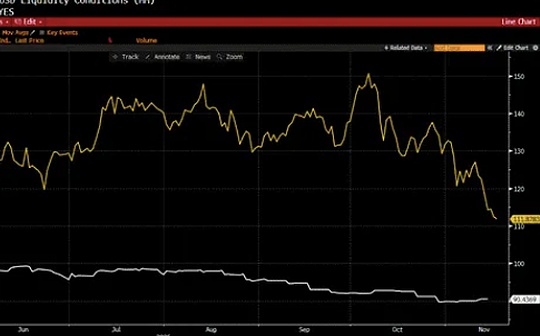

If you look at this chart objectively, the most significant observation is that Ethereum is in a multi-year fluctuation range.This is no different from the characteristics of crude oil prices fluctuating in a wide range over the past thirty years.We are not only in the range fluctuation, but have not broken through the resistance after reaching the top of the range recently.

If we want to talk about the difference, Ethereum’s technical aspects are actually relatively empty.I cannot rule out the possibility that it will remain in the $1,000-4,800 range over the long term.The past parabolic rise in assets does not mean that they will continue infinitely.

Long-term ETH/BTC charts are also misread.The pair is indeed in a multi-year volatility range, but in the past few years it has been mainly restricted by a downward trend and has only rebounded at long-term support levels recently.The driving factor of this downtrend is that the Ethereum narrative is saturated and fundamentals cannot support valuation growth.These fundamental factors have not changed.

Ethereum’s valuation mainly stems from the financial illiteracy effect.To be fair, this does create a considerable market capitalization (see XRP).But the valuation that financial illiteracy can support is not infinite.Macro liquidity maintains the suspension of ETH market value, but unless there is a major organizational change, it is likely to be destined to continue to perform poorly.