Right now, the Ethereum RestAKING track is in full swing. Eigenlayer cleverly packaged the “Ethereum Safety Consensus” into a product output, forming a POS chain pledge income closed loop. How can the POW chain BTC realize RestAKING?

Yesterday, @boundce_bit completed 6M financing led by Blockchain Capital, which attracted attention.How does it achieve BTC native asset RestAKing?Next, talk about my understanding.

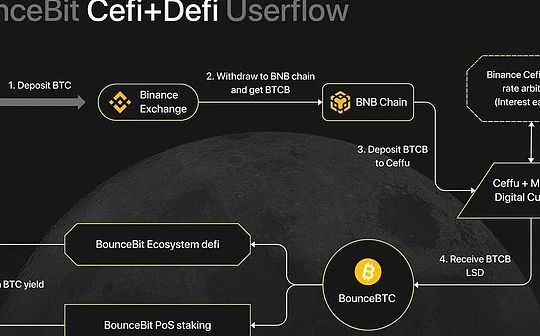

The original BTC assets, as mainstream assets with absolute consensus position, will appear in the mainstream public chain such as Wrapped to Ethereum and other mainstream public chains, which will appear in the optional pledged pledge list of borrowing platforms such as MAKERDAO and AAVE.Usually, the user pledged the BTC to generate the trusted centralized custody agency to generate the WBTC ERC20 tokens into the DEFI ecosystem of Ethereum.This is also a liquidity sharing solution, but there are two problems:1) The right to centralized the centralized subject is too large, and the security of asset cross -chain is attached to the centralized platform, which has limited the weight of this WRAP asset in the Ethereum system.Assets, and foreign assets will be vigilant;2) In the original POW native environment, the native BTC assets have no original income. It is difficult to derive the rich income model by the ecological overflow of other ecology that is equivalent to plundering his chain.The enthusiasm of user assets is limited.Based on this, we can infer that a native BTC POW chain wants to derive a reliable and diverse asset closed -loop gain model that can achieve diversified income. It requires two conditions:1) The POW chain must be transformed into a POS chain or has a exclusive POS chain. The node value of the nodes pledged the native assets to the voting right and consolidated the security of the POS chain, which will bring the foundation for native assets “benefits”;2) STAKING’s LSD voucher can circulate in its own extensive DEFI ecology to obtain various additional income. If it can break the limitation of this chain, overflows liquidity to the full chain and even the under -linked environment is better to gain.To understand this level, let’s look at the re -pledge solution provided by BoundceBit.Simply put: BoundceBit has built a Layer1 POS chain, which is parallel in BTC. It focuses on the issues of follow -up circulation and income of assets. It is not affected by the current technical restrictions of the BTC main network and the bottleneck of BTC Layer2 development. The goal is BTCNative assets bring a rich and diverse profit model, giving BTC Holder a optional coin -owned financial management.

How it works?

1) Bouncebit is not covered on the issue of “centralization” of the BTC native asset cross -chain, and is directly centralized. However, it chooses a compliant CEFI platform. Users can hold asset custody to Mainnet Digital and CEFFU and other compliance.Qualified hosting service platform.After the hosting, 1: 1 obtains Wrapped assets such as WBTC or BTCB, and such compliance custody agencies are more complete in terms of asset transparency and financial auditing, providing the trust guarantee for the subsequent POS chain.It stands to reason that BTC Holder can also directly cross the chain cross chain through the MPC cross -chain bridge and other technical methods. This is currently the mainstream asset cross -chain method of the two -layer chain.Due to the centralization of multiple signature subjects, it is no different from the centralization of compliance custody agencies.2) Users can pledge Wrapped assets and BoundceBit to the POS Validator verification system in the BoundceBit Chain. It is equivalent to providing network security for the POS chain with a double -generation coin pledge model, to obtain stable annual mining revenue, and LSD at the same timeThe voucher can get other mining income in a series of DEFI protocol derived from the POS chain.The annualized income of Staking is relatively fixed, and the possibility of the future development of chain ecology will have a lot of imagination. For example, other DEFI protocols, prophecy machines, cross -chain bridges, etc. can pledge the LSD to get new income, which means native nativeToken will benefit from the growth of the entire POS chain’s subsequent ecology.In order to quickly build an ecology, BounceBit supports connecting with other EVM chains, and developing this can easily and lower threshold migration.Of course, with the abstract opening of this layer of chain, it is equivalent to providing technical possibilities for LSD overflowing to other ecological acquisition income.3) EIGENLAYER’s innovation on Ethereum chain has proposed a very sexy narrative. The active node (AVS) on the chain can participate in the network governance of other chains, output the security consensus of Ethereum to other chains, and then obtain the re -pledge income outside the chainThis is the core reason why this wave of Ethereum Restaking is not afraid of consensus overload.Eigenlayer seized the modular tide, and more and more emerging chains were trying to pack the Validator verification ability overflowed by Ethereum into Ethereum safety consensus products output to the Ethereum.BoundceBit has grasped the stable currency holding demand of BTC asset Holder. At the same time, BTC is currently equivalent to a lone chain, which is not effective to infiltrate the liquidity with other all -chain environments.In response to this, Bouncebit has created a fresh narrative of DEFI+CEFI. The LSD voucher pledged by the user pledged on the hosting platform can obtain an incremental return on the original CEFI custody service platform.Behind this, a considerable income of a considerable chain financial market is anchored. This is really a sexy and imaginative narrative in the environment after the BTC ETF gets passed.Don’t forget, the compliant CEFI custody platform itself can also obtain a large number of off -site gains, such as pledge mining, lending services, investment products, etc. In order to avoid systematic security, this part of the assets will be transparent and publicly disclosed.Mechanisms and necessary asset use right authorization thresholds and so on.In my opinion, this is the core innovation brought about by BoundceBit’s POS chain for BTC native assets.BTC Holder requires a channel that can get diverse benefits. BoundceBit introduces the POS chain pledge mining mechanism with a compliance CEFI platform as its core. At the same time, LSD has extended LSD to a CEFI original income market with unlimited imagination space.

A set of RESTAKING closed -loop for BTC assets input.

Think from another angle, BTC ETF itself is also a huge RestAKing solution at a huge chain?This solution to combine the native income environment (POS pledge)+Web2 chain incremental income (custody income) on the web3 chain (POS pledge)+web2 chain is particularly suitable for the current BTC ecology.Not over.

The macro side can be in line with ETF potential growth opportunities, and the technical side can open up the follow -up opportunities of the BTC RestAKing market. The economic side can indeed bring triple benefits to BTC Holder, and provides the possibility of promoting the POS revenue model to promote the POW chain such as BTC.