Bitchain Vision Jessy

The Blast airdrop of multiple PUA users has finally ended, and the airdrop cannot satisfy everyone.The airdrop of Blast this time is sunny. Anyone who participates in the interaction can basically get the airdrop, which is equivalent to zero money, but the money is indeed small, and it is even less than 1U.The big players with the most airdrops have about 23 billion points, which can earn about 50 million tokens. Based on the initial issuance price of US$0.03, it is about US$1.5 million.

The community has also criticized this sunny airdrop method, especially its “killing big players” behavior has aroused strong dissatisfaction among big players. X user @Christianeth said that he deposited $50 million in Blast, butOnly $100,000 was received.Some people also complained that Blast points have been inflated seriously.

The Ethereum Layer2 project airdropped in recent months, including Blast, has been more or less criticized by the hair-brushing party members. The reason for everyone’s cursing is very simple.Not meeting their expected returns.Indeed, the big-haired era in the ARB era is unlikely to reappear in the Ethereum ecosystem.

The landing of the airdrop boots from Blast this time also marks the change of the airdrop era.After issuing coins, we should pay more attention to the development of Blast itself.Founder Tieshun is really a liar as everyone says?Is Blast really just a capital market?

Airdrop problem is not really big

In this round of airdrops, 17% of the total BLAST (17 billion) will be allocated to users, with 17% of the composition including: 7% of Blast points, 7% of Blast gold points, and 3% of the Blur Foundation.

The specific details are as follows:

1.Blast points: 7,000,000,000 (7%).Users connecting ETH or USDB to Blast guide the initial liquidity of the Blast ecosystem and earn Blast points in the first phase.These users will receive a reward of 7% of the total BLAST supply.

2.Blast gold points: 7,000,000,000 (7%).Users who contribute to the success of Dapp will receive Blast Gold Points and will receive a reward of 7% of the total supply of BLAST.

3. Attribution: The top 0.1% of users (about 1,000 wallets) will linearly attribut partial airdrops within 6 months.According to the activity in the first phase, the attribution needs to reach the monthly points threshold.

4. Blur Foundation: 3,000,000,000 (3%).The Blur Foundation will receive 3% of the total BLAST supply for distribution to the Blur community for traceability and future airdrops.

Currently, the top few individual airdrops rank as follows:

From the above ranking, we can also see that real big players with points can actually get more tokens and returns, although the behavior of killing big players also exists. For example, X user @Christianeth said that he deposited 5,000 on BlastTen thousand US dollars, only received an airdrop of 100,000 US dollars.

When the Blast main network was launched in March, there were many criticisms about Blast airdrops. At that time, the Blast main network was launched. Users who pledged Ethereum on the test network found that everyone needed to transfer the points obtained from the assets and pledge to the main by themselvesOnline, for this, a large amount of gas needs to be burned, and the maximum amount is even more than 50U.Blast was also questioned that the contract is not very secure. Before the main network was launched, it was just a smart contract. After the user’s money was deposited, it would be transferred to a wallet with more than one sign, and after the money was received, it would beDeposit to Lido and start financial management.

But these harmless problems did not stop the pace of Blast’s development.This year, the airdrop finally landed.And it is precisely thanks to the airdrop method that Blast marketing has been successful.

The most different thing about Blast and the previous Layer2 airdrop method is that it provides a platform for pledge and interest generation. Users deposit mainstream assets into Blast, not only airdrop expectations, but also puts the assets deposited by users into the Blast chain into LDO.Wait for the platform to pledge and generate interest.

When the user pledges the tokens into Blast, he will intervene in other pledge agreements according to the type of tokens.For example, if you deposit it into DAI, Blast will be placed in MakerDAO, and ETH will be placed in Lido.Blast’s native stablecoin USDB is used to settle the proceeds back to users.

Blast uses the most straightforward airdrop incentive to attract users to enter and increase the amount of locked positions on it.Moreover, the incentive method of airdrop is a simple and crude “three-layer hierarchical pyramid scheme”. This method has been proven to be effective many times. Currently, Blast’s TVL volume ranks third in Ethereum Layer2, ranking ARB and Base.back.

From this point of view, this influence is undoubtedly very effective. Although Blast has been criticized by the hair-brushing party, airdropping is a win-win situation.It’s not just Blast’s airdrops. From the airdrops in recent months, the hair-pushing parties should recognize that the era of hair-pushing through a large number of accounts with zero-cost hair-pushing or low-cost hair-pushing has ended in the short term. Now it’s about the amount of funds.and depth of participation.

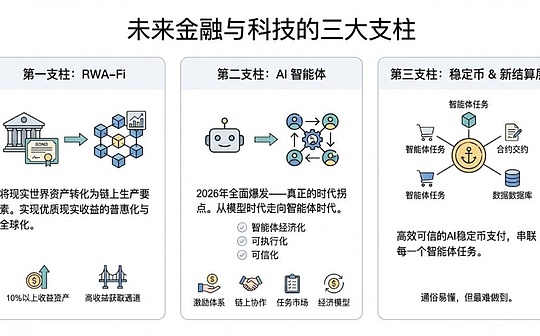

Stake Layer2 on the surface, but you want to get a full stack chain inside

Blast positioning itself is different from other Layer2’s “Stake Layer2” new narrative, but in fact it is Ethereum staking mining and contract mining through Blast users. It is the same for the user to save money and enter platforms such as Lido, butBecause by depositing it through the middleman Blast, you can earn airdrop points.

In addition to this method of using airdrop marketing to create ultra-high TVL, Blast’s technology implementation itself is also innovative in Ethereum Layer2.

When many technical teams are constantly improving their chains, Tieshun actually uses OP Stack to quickly build a Blast chain, and then lay out the full stack chain on this basis. The Blast Foundation announced that it will be in the second stage.Will do this and said it will work with the community to develop desktop and mobile wallets designed for crypto-native users, aiming to provide a better experience than Metamask and accelerate user adoption through incentives.It can be seen that Blast is not satisfied with just making an L2 public chain, but hopes to make a full stack chain that can be fully integrated from the chain to the wallet to the cex.

One common feature of public chains is that they all have similar end-to-end user experiences.Each chain focuses on optimizing the technology itself, while relying on a third party to complete the rest of the stack.This approach is actually similar to Android, where they optimize the operating system and rely on third parties to do the rest.

The Android approach has been working for public chains so far, but it has also led to a fragmented and friction-filled ecosystem.

Unlike Android, Apple adopts a full stack approach.They build everything from software to hardware.And optimize throughout the stack.This approach greatly accelerated the evolution to the mobile terminal and formed the most valuable mobile terminal ecosystem in the world.

From this point of view, what Blast wants to do next is what Apple is doing.

From this point of view, Tieshun is actually a very ambitious developer. Although the price of its NFT market project Blur coin has been falling continuously, we may pay more attention to the innovations in the industry he is doing and whether it is truly implemented.