In late November 2025, the U.S. stock market experienced a dramatic reversal.Although Nvidia released quarterly earnings that exceeded expectations, the market failed to rebound as expected and instead accelerated its downward trend.This is not an isolated incident but a sign of broader economic pressures.The Dow Jones Industrial Average fell sharply by 386 points on November 20, closing at 45,752 points; the S&P 500 Index fell 1.5%, closing at around 6,500 points; the Nasdaq Index fell by 2.16%, closing at around 22,000 points.Although it rose in early trading that day, with the Dow rebounding to more than 700 points, the S&P rising by 1.9%, and the Nasdaq rising by 2.6%, selling orders emerged in the afternoon, causing the entire index to close down.Nvidia’s stock price went from opening up 5% to closing down 3%, highlighting investors’ growing doubts about highly valued technology stocks.

This phenomenon does not stem from Fed policy expectations – the bond market still indicates that the probability of a rate cut in December is over 70%.Rather, it reflects investor concerns about economic fundamentals, particularly labor market weakness, cockroach risk in private credit, and a rapid widening of spreads on riskier bonds.The interweaving of these factors has pushed risk assets such as Bitcoin down by about a third, erasing most of this year’s gains.Mainstream media outlets such as CNBC tend to blame Bitcoin’s decline on the Federal Reserve’s possible delay in December’s 25 basis point interest rate cut, but this explanation ignores deeper structural issues.Data shows that Bitcoin fell from a peak of $125,000 on October 6 to approximately $84,600 on November 21, a drop of 33%.This round of decline is not simply interest rate sensitivity, but a mirror image of the overall contraction in risk appetite.

Labor market worries: The flattening of the Beveridge Curve

The key to understanding the current market turmoil lies in labor market dynamics, not short-term swings in technology stocks.The Beveridge Curve, a measure of the relationship between job vacancies and the unemployment rate, is showing signs of flattening.This curve usually slopes downward, reflecting the inverse relationship between increasing vacancies and decreasing unemployment during economic expansion.However, data from September 2025 shows that the curve is flattening: the job vacancy rate remains at around 4.3%, the unemployment rate rises slightly to 4.44%, and matching efficiency decreases.The delayed September employment report released by the U.S. Bureau of Labor Statistics (BLS) showed that non-farm employment increased by 119,000, exceeding the 50,000 expected, but this concealed a more serious reality: for two consecutive months, agency surveys showed a net decrease in employment, and household surveys further shrank employment.

This flattening is due to structural friction: the skills mismatch has intensified, and corporate recruitment has turned to “poaching” the already employed rather than the unemployed, making it difficult to fill vacant positions.A study by the Federal Reserve Bank of St. Louis noted that job openings have surged since 2010, but matching efficiency fell below pre-pandemic levels in the second half of 2025.Earnings reports from retail giants like Target and Home Depot reinforced the trend: Target warned of slowing consumer spending and Home Depot reported weak demand in the construction industry.Even though Wal-Mart’s third-quarter profit exceeded expectations, its management emphasized that “consumers’ cautious spending” has become the norm.These data are not isolated cases, but a macro mirror image of the flattening of the Beveridge Curve, indicating that a hiring slowdown may turn into large-scale layoffs.

Economists are divided on this.Optimists such as David Mericle of Goldman Sachs believe that the unemployment rate is stable at around 4.3% and wage growth is moderate (average hourly earnings increase by 3.5% annually), supporting the “soft landing” narrative.But pessimists warn that the flattened curve resembles a precursor to 2008, when declining matching efficiency triggered a credit crunch.Susan Collins, president of the Federal Reserve Bank of Boston, said the labor market is “in the right place” but needs to be wary of downside risks.If November data (expected to be released in December) confirm this trend, the unemployment rate could rise above 4.5%, pushing the Fed to shift to more aggressive easing.

The “cockroach” effect of private credit: A warning from Blue Ou Capital

The knock-on effects of labor market weakness are amplifying risks in the private credit sector.This is calledThe $3 trillion market for “shadow banking”, which was supposed to fill the gap caused by the withdrawal of traditional banks, but was exposed to vulnerability due to the proliferation of “junk loans”.“If you see one cockroach, it means there are more,” J.P. Morgan CEO Jamie Dimon warned on an October analyst call. That’s true: 2025 has already seen the bankruptcies of several private credit-backed companies, such as auto financing company Tricolor (losing $170 million) and parts supplier First Brands.

The Blue Owl Capital incident became the trigger.The firm announced in early November the merger of two private credit funds: OBDC, a $17.1 billion publicly traded fund, and OBDC II, a $1.7 billion non-traded fund, in an effort to “eliminate duplicative costs.”However, panic arose after the details were revealed: OBDC II investors were unable to redeem their funds during the merger period and needed to exchange shares with OBDC stock price (20% discount), which was equivalent to a forced loss of up to 20%.Investor protests raged, and law firm Glancy Prongay & Murray launched a securities fraud investigation.Lanou quickly canceled the merger on November 19, saying that “current market conditions” were not suitable to proceed.OBDC II will resume quarterly redemptions in the first quarter of 2026, but this concession has exposed a deeper problem: redemption pressure has reached a critical point.

The cockroach effect of private credit stems from leverage and opacity.The fund is highly leveraged (average leverage ratio 4-6 times), and its assets are mostly loans to medium-sized enterprises, which are sensitive to labor costs.As the Beveridge curve flattens, corporate profits come under pressure and the default rate rises to 2.5% (up from 1.8% in 2024).The International Monetary Fund (IMF) warns that the interconnectedness of shadow banks and traditional banks is increasing: European and EU banks have tens of billions of dollars in exposure to private credit, and if a wave of redemptions triggers a fire sale, it will contaminate the entire system.The Blue Owl incident is not an isolated case: UBS’s O’Connor Fund has already faced huge redemptions in October, forcing a similar “extended pretense” strategy.Industry insiders such as Ares co-president Kipp deVeer admitted that “the combination is healthy, but market sentiment is sensitive.”

This event marked the shift from a “golden moment” to a “painful trade” in private credit.According to Bloomberg Intelligence analysis, private credit issuance will reach US$570 billion in 2025, but accelerated redemptions have led to liquidity drying up.If the Fed does not intervene, the default rate may rise to 5%, repeating the impact of the 2020 epidemic.The optimistic view is as Apollo executive John Cortese said, “This is not a systemic risk, but a cyclical adjustment.”But Dimon’s “cockroach” metaphor reminds: opacity amplifies uncertainty, and investors should be wary of contagion.

A wake-up call for high-risk bond spreads: Triple-hook surge

Private credit opacity manifests itself through high-risk bond markets.Junk bond spreads—the difference between the yields on risky bonds and Treasuries—are a barometer of market risk appetite.Starting from October 7, 2025, the spread of triple-hook bonds (CCC grade and below, the highest risk) has risen sharply: from about 800 basis points (bp) at the end of August to about 850bp on November 20, an increase of 27bp, while the overall high-yield bonds only expanded by 13bp.ICE BofA CCC and following high-yield index option adjusted spreads (OAS) show that liquidity pressure is emerging: sales are hindered and price fluctuations intensify.

This surge coincided with the peak of Bitcoin: Bitcoin peaked at $126,000 on October 6, and then the negative correlation between the triple hook spread and crypto assets reached -0.75.The reason is leveraged trading: investors withdraw money from risky assets and seek safety.The default rate of triple-hook bonds has reached 4.2%, higher than the historical average of 3.5%, dragged down by consumer-related industries, such as subprime mortgages and retail.Steven Oh, global head of fixed income at PineBridge Investments, noted that “the slightest sign of trouble triggers caution.”

The connection with private credit is obvious: Shadow banking assets are mostly junk-like loans, and redemption pressure has forced funds to sell public market bonds, exacerbating the widening of interest rate spreads.Morgan Stanley estimates that private credit will reach US$5 trillion by 2029. If the triple hook spread exceeds 900bp, systemic selling will be triggered.Analysts are divided: Janus Henderson believes that spread tightening is sustainable due to strong corporate earnings (S&P 500 third-quarter earnings increased 13.4%).However, Goldman Sachs warned that trade tariffs could push up inflation by 0.5-0.75 percentage points, further depressing risk appetite.

A crossroads for the Fed: The game of December rate cut

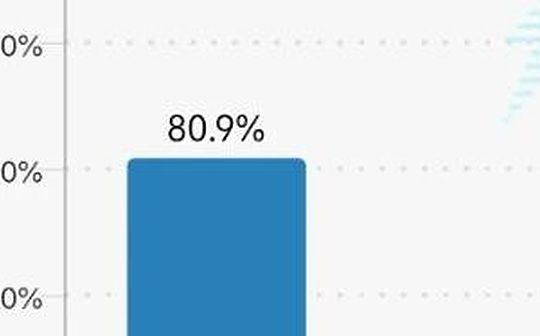

Fed policy expectations are supposed to stabilize markets, but current data creates a dilemma.After the September meeting, the federal funds rate dropped to 3.75%-4%, two consecutive 25bp rate cuts.However, the minutes of the November meeting showed that divisions within the committee had intensified: hawks such as Kansas City Fed President Jeffrey Schmid were concerned about tariff inflation, while doves such as Dallas Fed Vice Chairman Lorie Logan advocated further easing.The CME FedWatch tool shows that the probability of a rate cut in December dropped from 98.9% in October to about 67% on November 21, reflecting data uncertainty.

Chairman Jerome Powell emphasized on October 29 that a rate cut in December is “far from a foregone conclusion.”New York Fed President John Williams’ comments on Friday boosted the market. He said there is “room for further interest rate cuts in the near term” and lowered interest rates to a neutral level (about 3.5%-3.75%).Director Philip Jefferson added that the downside risks to employment are greater than the upside risks to inflation, but they need to be “slowly advanced.”However, Morningstar chief economist Preston Caldwell predicted that December may be skipped given that September data “did not worsen as expected.”

Weakness in the labor force supports a rate cut, but stubborn inflation (core PCE 2.6%) and a lack of government shutdown data add to uncertainty.Deutsche Bank maintained its forecast for a 25bp interest rate cut, but said it was “close to a decision.”If it is skipped, the reduction may be made in the first quarter of 2026; if implemented, it will strengthen confidence in a soft landing.But Powell needs to bridge the differences to avoid a recurrence of similar dissent in 2023.

Bitcoin and the Mirror of Risk Assets: From Boom to Crash

Bitcoin’s plunge is the concentration of the above pressures.On November 21, the price dropped to $84,600, a 33% decrease from the peak in October, erasing all gains in 2025.The Fed is not the only factor: leverage liquidation amplifies fluctuations, and the leverage of perpetual futures on exchanges such as Coinbase reaches 10:1, causing a small correction to trigger a chain of selling.ETF outflows of $1.8 billion reflected institutional withdrawals.

The correlation with triple-hook spreads reveals the essence: risk capacity shrinks.Bitcoin, as a high-beta asset, is sensitive to private credit redemptions—a shadow banking collapse would drain liquidity.Standard Bank estimates that if Bitcoin falls below $90,000, half of the positions held by currency holding companies (such as MicroStrategy) will be “underwater.”101Blockchains predicts that the year-end price range will be between US$100,000 and US$135,000, relying on the halving effect and institutional adoption.But Siebert Financial analyst Brian Vieten views it as a “bull market correction” and there have been five 20-30% corrections in history.Pessimists warn that if the private credit crisis deepens, Bitcoin may fall to $25,000, repeating the 75% collapse in 2018/2022.

Expert Insights and Outlook: The Deeper Meaning of Risk Aversion

The current resurgence of risk aversion in the market sounds familiar – similar to the 2022 tightening cycle.Earnings reports from Target, Home Depot and TJX indicate cooling consumption, overshadowing Nvidia’s AI optimism.CEO Jensen Huang reiterated that Blackwell chip demand is “exploding” and denied that there is an AI bubble, but the stock price reversal shows that investors prioritize economic fundamentals.

Angelo Kourkafas, senior strategist at Edward Jones, believes that Nvidia’s financial report “supports the AI narrative”, but short-term returns are questionable.Investing.com analyst Thomas Monteiro said the AI revolution is “far from its peak.”However, Sara Devereux, director of bonds at Vanguard, warned that there will be only 1-2 interest rate cuts in 2026 to reach a neutral level.According to Reuters analysis, the “golden narrative” of private credit has faded, and the Blue Ou incident indicates painful transactions.

Looking forward to 2026, if the Beveridge curve further flattens and the three-hook interest rate spread exceeds 900bp, a wave of private credit defaults may trigger a systemic event.The Fed needs to weigh whether it can cut interest rates to calm employment or keep inflation under control.Investors turn defensive: Gold is the safe haven of choice, and central banks will purchase record amounts of gold in 2025.European stock markets may benefit from concentrated risk diversification.In the end, average (beverage) dominates Nvidia, and the economic cycle, not the technology bubble, determines the direction.