Source: Trustlesslabs, Medium

introduction

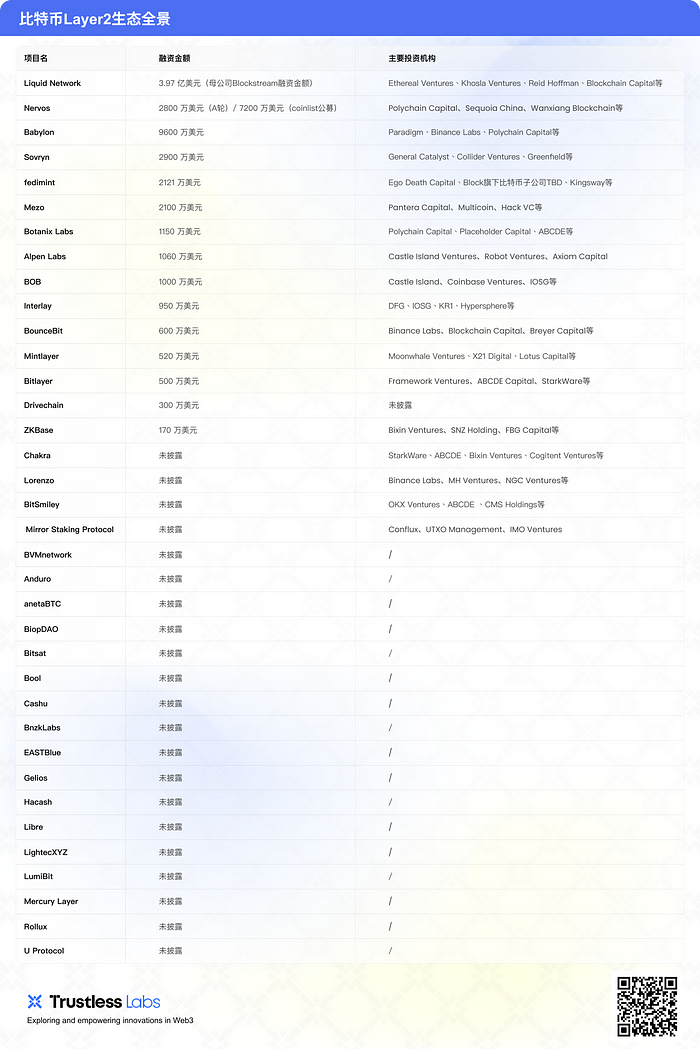

Today, blockchain technology is changing with each passing day, Bitcoin is not only widely accepted as a digital asset, but its underlying technology is constantly evolving and innovating.With the gradual expansion of Bitcoin’s ecosystem, various Layer2 solutions have sprung up like rain, which aims to improve the scalability, efficiency and security of the Bitcoin network.This article will explore multiple innovative Bitcoin Layer2 projects. Through the detailed analysis of the technical principles, team backgrounds, financing conditions, and development roadmaps of these projects, we will understand how they promote the innovation and development of Bitcoin ecosystems.

BABYLON: Cross -chain pledge and Bitcoin economy security

Babylon uses the native pledge of Bitcoin (BTC) through cryptography to provide other blockchain provides a security guarantee for equity (POS).This mechanism not only brings chain income to BTC, but also attracted widespread market attention.

In terms of technology realization, Babylon’s pledge process depends on cryptography completely, without a third -party bridge or custodian.BTC pledges can achieve pledge through transactions with two UTXO outputs.The first UTXO is written in the lock script. After the expiration, the pledged person can unlock the BTC with a private key; the second UTXO is transferred to the temporary Bitcoin address.Code science standards.When the pledgers run the POS chain node and verify the only effective block, sign it with the EOTS private key.

If the pledged operator operates honestly, only one signature of one effective block will be awarded by the POS chain; if you try to sign two blocks at the same time, the EOTS private key will be launched, and anyone can use the private privately.The BTC of the key to the pledged pledge achieved the penalty, prompting the pledged to maintain honesty.BABYLON also provides BTC timestamp service, and the checkpoint data of any blockchain checkpoint will be uploaded to the OP_RETURN of BTC to enhance security.

Babylon’s pledge is a cross -chain pledge. The pledged Bitcoin retains the script on the Bitcoin network. The pledgers can specify the verification person to earn benefits on the corresponding POS chain.By pledged the BTC to provide economic security for other POS chains, BTC can obtain revenue without leaving the main network. It has opened a new track for BTC pledge and will greatly change the BTC ecological gameplay.

According to DEFILLAMA data, the current BTC market size is more than $ 10 billion, of which the active income is 4 billion US dollars, and the yield is between 0.01%and 1.25%. Generally, it is necessary to entrust a third -party CEFI institution or bridge or package BTC.The pledge rewards of POS blockchain are usually ranging between 5%and 20%.Through Babylon’s pledge business, BTC does not need to host to third -party institutions, and can get 50 times the traditional BTC income, which has huge growth potential.

Nevertheless, most BTC holders are passive holders, 25%of BTCs have not been used for more than 5 years, and 67%of BTC holding time for more than 1 year. Therefore, it is difficult to persuade BTC holders to participate in pledge.BABYLON is undergoing pledge of testing networks and is planned to launch the main network test on May -June. It has not yet announced the launch of the liquidity pledged BTC voucher assets.

Babylon was founded in 2022 by David TSE and Fisher YU professor of Stanford University.Professor YU is a member of the American Academy of Engineering and is famous for its fair scheduling algorithm in the field of wireless communication.On December 7, 2023, Babylon completed a $ 18 million financing, Polychain Capital and Hack VC led, Framework Ventures, Polygon Ventures, Okx Ventures, and iosg Ventures.On February 24, 2024, the Binance Lab announced the investment in BABYLON.In May 2024, Babylon completed a new round of financing of $ 70 million and Paradigm led.

Chakra: Bitcoin re -pledge agreement driven by ZK

Chakra is a Bitcoin re -pledge agreement driven by ZK, aiming to establish a safe Bitcoin POS system.By using ZK-Starks and middleware chain, the Chakra network has established a native modular paradigm for the expansion of the BTC ecology.On April 30, Chakra announced the completion of a new round of strategic financing. Starkware, Bixin Ventures, Cogotent Ventures, etc. participated in the investment, and the specific amount and valuation information was not disclosed.

Chakra aims to solve liquidity and interoperability challenges, and releases the huge value of Bitcoin.With the help of Chakra, other BTC second -layer solutions can focus on the execution layer without paying too much attention to the settlement of Bitcoin infrastructure.

Chakra networks unlock liquidity through shared settlement layers and obtain economic security, and then empower the BTC ecological participants.The projects and DAPPs of BTC Layer2 will benefit from the strong liquidity network effects in this security and vibrant ecosystem.

By generating UTXO containing time locks, Chakra allows Bitcoin to pledge without transferring assets without transferring assets.Chakra uses stark to implement the proof system.Compared with Snark, Stark provides a zero -knowledge certificate solution that does not require credible settings. Chakra uses Starks technology to realize ZK light clients.And security.By introducing Cairovm, Chakra further enhances the scalability and transparency of the system.

Nubit_org: Agreement to expand the availability of Bitcoin data

Nubit is a protocol for BTC expansion data usability (DA) scenario. It organizes a DA chain similar to Celestia by running POS consensus and regularly upload Nubit’s DA data to the main BTC chain.Nubit has no intelligent contract capabilities and requires Rollup based on its DA.The user uploads data to Nubit. These data are confirmed to enter the “soft confirmation” state by POS consensus, and then Nubit uploads the data root to the BTC main chain to complete the final confirmation.Users need to upload data labels in the BTC main chain to query the original data in the Merkel Tree of Nubit nodes.

At present, there are already 100 BTC L2 on the market. If you choose to upload the DA to the BTC block, even if the BTC block is filled, the main network can only support up to 20 L2.Therefore, how to connect with BTC and use its security guarantee, there is a huge narrative gap, Nubit’s DA re -packaging idea is an interesting solution.

Nubit has carried out the first round of Pre-Alpha Testnet. Users can earn points or run light nodes by linked BTC accounts.The first round of the test network has ended and plans to conduct the second phase of the test network.Nubit’s angel round financing participants include Boundce Finance and BRC20 founder Domo, and completed $ 3 million Pre-SEED round financing. DAO5, OKX Ventures, Primitive Ventures and others participated.

Lorenzo: BTC’s liquidity pledge protocol

Lorenzo, based on Babylon, is a liquidity pledge protocol that provides a rapid deployment service of L2-As-A-Service, which aims to reduce the pledgee’s penalties and release the liquidity of pledged BTC assets.The pledgers deposit the BTC into Lorenzo’s multi -signal address, which can obtain the equal amount of STBTC on its chain as a liquidity proof and receive the pledge income.

The Lorenzo chain itself is shared by Babylon Bitcoin. It is an EVM compatible Bitcoin L2. In the future, it will use a modular method to help more BTC L2 deployment.The Lorenzo chain is the direct interoperability of these L2 chains.Currently, Lorenzo has announced cooperation with Babylon, Boundcebit, etc., and plans to launch a test network based on the COSMOS architecture.It is currently in Babylon’s fourth test network cooperation to conduct liquidity re -pledge testing.

According to ROOTDATA, Lorenzo was invested by Binance, MH Ventures, and NGC Ventures. The specific details were not announced.Currently Lorenzo announced the start of the pre -pile Babylon event and jointly organizing the Bitlayer Mining Gala Heiter Mine Festival. Users can pile the BABYLON activity page to pile the BTC to get STBTC. All Lorenzo will receive BabyLon as soon as Lorenzo participated in BABYLON.Praising, but due to the upper limit of the Babylon pledge, the actual pledge progress may be determined by the pledge limit that may exist in BABYLON.

bitsmiley_labs: Comprehensive DEFI protocol for Bitcoin ecology

BITSMILEY is a comprehensive DEFI protocol for Bitcoin ecosystem, including excess mortgage stable currency issuance, decentralized lending and derivatives.BitusD is an excess mortgage stabilizer issued based on Bitsmiley. The mechanism is similar to MakerDao. Its decentralized borrowing implementation is similar to Compound.BitusD can be implemented on both L1 and L2 of BTC. Based on the Bitrc-20 standard distribution, it supports upgrading, casting, and destruction functions, which is convenient for stable currency on the BTC main network.BITSMILEY also developed AMM Bitcow, which is used for stablecoin, and is deploying testing on multiple BTC L2.

Bitsmiley is invested by Okx Ventures, ABCDE Capital, Forsight Ventures, WaterDrip Capital, Kucoin Ventures, CMS Holdings, Arkstream Capital and other institutions.Bitsmiley issued Ordinals NFT M-Bitdisc-Black in the early days of the project and obtained better market feedback. The NFT was also used as a ticket to participate in the test network.

Build_ON_BOB: BTC EVM side chain architecture

BOB is a BTC EVM -side chain architecture implemented using the OP super chain SDK. The packaging BTC on ETH such as WBTC and TBTC is used as the GAS cost. In the future, the security of BTC will be introduced to the BTC through the new POW mining protocol.At present, the BOB test network has been running for several months and has a certain ecology. On May 1, the main network was officially launched.In the first stage, more than 40 projects have been deployed in the chain and have more than 300 million TVL.The second phase of deposit activities are undergoing the second phase.SPICE points accumulated by deposits correspond to the $ BOB token.

The pre -pledge of participating in BOB needs to be operated on ETH’s main network. If it is BTC, it needs to be a cross -chain to $ TBTC and $ WBTC, and the income rate is 1.5 times.The reward multiple is 1.3 times and accepts Alex, ETH, ESOV pledge, and the reward multiple is doubled.BOB has strong resources. It cooperates with the largest listed mine company in the United States to launch BTC L2, and announced that Coinbase’s 10 million US dollars investment has greater potential.

Botanix Labs: EVM equivalent L2 on Bitcoin

BOTANIX Labs has an EVM equivalent L2 on Bitcoin, running by POS.Users can deposit BTCs into multiple signature addresses to participate in L2’s pledge or bridge BTC to L2 to participate in the ecology.It is characterized by these BTC assets protected by decentralized multi -sign -in network SpiderChain.

By pledged the BTC, it became a verified node to participate in POS and multi -sign -in network SpiderChain. Botanix used the Bitcoin block hash value as a source. The node was randomly selected to participate in the POS outlet.L2’s assets on BTC are all protected by multi -sign -in network SpiderChain. The nodes randomly form a multi -signal group to control the BTC in the multi -signal address. The cost of evil is high, because the BTC pledged BTC can be punished.

On May 7, 24th, Botanix Labs announced that it had received $ 11.5 million in financing. O (founder of BRC20) and other series of angel investmentParticipate in the investment.

Botanix’s test network has been running for half a year, and users can participate in the test and receive a series of NFT vouchers.Botanix Labs has established L2 on BTC since 2022. It has a certain technical strength, and the test network is a better participation opportunity.

BOUNCE_BIT: BTC and Restaking Infrastructure

BoundceBit is a BTC -based life -based and RESTAKING infrastructure, integrates CEFI and DEFI business, and uses BTC pledge guarantee blockchain security.Boundcebit itself is also a BTC EVM L2, L2’s POS Staking pledged original generations BB or BTC assets.The absorbed BTC assets are custody in the centralized custody service supported by the Mainnet Digital and CEFFU, and the BTC assets deposited by the user have become Bounterbtc on the BoundceBit, which can be pledged to other verifiable networks to earn verification income.BoundceBit brings triple benefits to users: the main network BTC asset custody income, the income of ST project on the chain, and RESTAKING reward.

Boundcebit is supported by Binance and will provide 8%of the tokens to BNB pledgors of Binance Megadrop.

citrea_xyz: ZK Rollup in enhanced Bitcoin block space

Citrea is a ZK Rollup based on Bitcoin (BTC) enhanced block space function. It is developed by the Chainway team and focuses on early implementation of Bitvm verification.The Citrea network handles transactions in ZKVM and generates ZK proves that these proofs are engraved in the BTC block and implemented optimistic verification on the BTC main network through BITVM to ensure that Citrea’s settlement and data usability are processed by Bitcoin’s main network.

Citrea realizes the asset bridge between L2 and BTC’s main network through the trusted bridge Clementine.When the user needs to transfer the BTC from L2, transfer the assets into the withdrawal contract of L2 and attach the BTC address. The operator of the bridge first transfers his BTC asset to the user.Every six months, the Clementine Bridge conducts interrupt inspections. Operators need to withdraw the BTC of the deserved BTC with the original data of the transaction and SPV withdrawal, and the Citrea’s ZK certificate.If operators do evil, challengers can initiate challenges, expose the original data of the transaction, prevent operators from extracting the BTC in the bridge to ensure the safety of bridge assets.

At present, Citrea has completed a $ 2.7 million seed round financing, led by Galaxy. Participants include Delphi Ventures, Eric Wall, Anurag Arjun, Batux, Igor Barinov, and James Parillo.

Mintlayer: Bitcoin side chain based on POS

Mintlayer is a Bitcoin -side chain based on equity proof (POS), using verified random functions (VRF) to ensure stable block speed.Mintlayer uses the UTXO structure like BTC, so you can directly enjoy the various advantages of the BTC network.The tokens issued on the Mintlayer do not require smart contracts, but add notes through UTXO, similar to the btc chromosomal coin; you can also use UTXO atomic exchange to create hash time locked and exchange with BTC main network assets. This is EVMThe BTC L2 with the account structure cannot be achieved.

Mintlayer hatched the Chain -based DEFI product Atomiq Defi. Using the characteristics of atomic exchange, it allows to directly interact with the main network BTC in Atomiq DEFI.Mintlayer’s tokens $ ATMQ will be issued at the end of the second quarter.

NERVOSNETWORK: POW and UTXO model smart contract platform

NERVOS is a smart contract platform based on the workload proof (POW) and UTXO models. In 2024, it proposed a comprehensive expansion of the BTC ecosystem solutions and issued RGB ++ Bitcoin first -layer asset issuance and expansion agreements.NERVOS is based on the accumulation of UTXO models for many years. Its RGB ++ and UTXO homogeneous binding scheme directly uses the native ability of BTC, which is highly associated with the BTC main network.

RGB ++ issues assets on the main network of BTC, which has a binding relationship with Bitcoin UTXO.Users can choose to “jump” RGB ++ assets to the NERVOS network.The jumping BTC trading will output a specific UTXO on the main network and trigger related shadow transactions in the NERVOS network. RGB ++ asset information is written in NERVOS UTXO. The unlocking condition is a specific BTC UTXO.Users can enjoy smart contract capabilities and lower fees in NERVOS, and higher performance. They can also jump assets back to the BTC main network through homogeneous binding.

Based on the above -mentioned homogeneous binding ideas, Nervos also released the UTXO Stack application chain architecture, similar to OP Stack of Ethereum, and developed its own lightning network.NERVOS has the current most complete BTC ecological extension solution.

Mezo: BTC L2 based on TBTC

MEZO is a BTC second -layer network based on TBTC. It uses the COSMOS EVM architecture to realize the asset transfer of BTC to Mezo L2 through the multi -cross -chain bridge of TBTC.Mezo introduced HODL PROOF’s side economics, similar to the VE33 of BTC Staking.Users can lock the BTC to participate in the consensus in Mezo. The longer the lock time, the more pledged verification weights and rewards are doubled.

The POS of Mezo is divided into the BTC part and the original currency MEZO part, which can be rewarded as Vemezo as a reward. The incentives are divided into different incentive pools. The total incentives are obtained by BTC pledges, and 2/3 by Mezo pledges.Mezo has completed $ 21 million in Series A financing, led by Pantera Capital, and Multicoin, Hack VC, Draper Associations, etc. participated in the investment.MEZO has launched early deposit activities, which can access native BTC, WBTC and TBTC. It is expected that the main network will be launched in the second half of 2024.

BVMNetwork: Support the Rollup-AAS platform that supports infinite extension

BVMNetwork is a Bitcoin L2 protocol on a Bitcoin.It is characterized by the L2 -related L2 -related L2, and each L2 is optimized for specific purposes.

The positioning of BVMNETWORK is Rollup-Aas (Rollup As a Service).Technically, BVMNetwork uses a model similar to EVM, using Bitcoin as a data layer to achieve trading consensus.By using TXWriter and TXReader, BVMNETWORK can embed BVM transactions into Bitcoin trading and ensure that all BVM nodes are consistent on the Internet.TXWriter is responsible for embedding BVM transactions into Bitcoin transactions, similar to Ordinals technology.TXREADER is responsible for filtering BVM transactions in each new Bitcoin block.BVMNETWORK is a multi-layer architecture based on OP-Rollups, including data availability (DA), smart contract platforms, Sequence, Rollup nodes, execution engines, settlement and bridges.BVMNETWORK provides a complete custody solution. The user can deploy a BVM Chain with only a few clicks and select the configuration that is most suitable for its application.

At present, the market value of $ BVM is $ 143M, the total supply is 100m, and the circulation is 23m.The tokens were held on March 24, 2024, and are currently in the pledge stage.Users can pledge BVM tokens to dig Shard (BVM’s governance tokens), and the annualized return rate (APR) given by the official website is 50%.You can also participate in the excavation of other newly launched BTC L2 token.

The BVM team has now released multiple BTC L2. Alpha Chain is the first BTC L2 network. NAKA is used for L2 for the BTC DEFI business., RuneChain is a BTC L2 focusing on Rune transactions. Bittendo is a BTC L2 that supports Gamefi. Bloom is a BTC L2 that supports BTC pledge and re -pledges.Essence

The BVM team is rapidly iterating, and the project and hotspot are fast.The above projects are mostly used for old holders and potential new user airdrops, and the old assets are used to participate in the IDO.The BVMNetwork team is composed of some Bitcoin OG members who are active on Twitter. The team participated in the development of BTC L2 Trustless Computer in 2023. At that timesuccess.

Bitlayerlabs: BTC L2 project based on Bitvm

Bitlayerlabs is the first Bitvm-based Bitcoin 2-layer network (L2). It supports multi-virtual machines and EVM compatibility and uses OP-Rollup technology.On March 27, 2024, it was announced that the 5 million US dollars seedlings were announced by Framework Ventures and ABCDE CAPITAL.Other participating agencies include Starkware, OKX Ventures, Alliance DAO, UTXO Management, etc.Okx strategic financing was obtained on May 19, and the amount was not disclosed.

The positioning of Bitlayerlabs is OP-RollUp. The asset bridge is planned to use DLC and Bitvm, which allows users to take out the assets (escape channels) on the BTC when there is a problem with the main network.Through Bitvm, Bitlayerlabs can build a complete computing layer of Turing on the Bitcoin stack, and use basic construction blocks (such as hash locks, time locks, and large main roots) to create systems that can process complex computing and contracts.Bitlayerlabs supports multi -virtual machines, including EVM, Cairovm, Solvm, and Movevm.

But the current main network uses the POS + multi -sign bridge.BitLayer plans to minimize Bitvm implementation in Q2 in 2025 to replace the current bridge scheme.

At present Bitlayer has released the main network V1, and announced the developer incentive plan and early supporter NFT activities.Currently, it is jointly carried out mining activities with Lorenzo, Bitsmiley, Avalon, Bitcow, Pell, ENZO, Bitparty, and the event will last for two weeks, as of June 10.

The reality of the roadmap, Bitlayer will realize the main network V2 in September 2024, and transform into an equivalent Rollup model. The Sequencer+DA mode is launched, based on the DLC/BITVM technology protocol to ensure user asset access.In June 2025, the main network V3 was achieved, and the L1 verification challenge was used to use BITVM to achieve BTC security equivalent. The BITVM-based OP challenge and the BITVM scheme DLC-FTestors used for asset escape.

Alpen Labs: Modular ZK-Rollup project

Alpen Labs is committed to developing ZK-Rollup technology. Although the disclosed information is less, its team and financing background are quite good.The project is positioned as modular ZK-Rollup, native ZK verification device and optimistic ZK bridge.

The ZK verification technology of Alpen Labs still continues the idea of Bitvm, but it designed a ZK Snark verification device SnarkNado, which is dedicated to Bitcoin. Compared with Bitvm verification device design, the rotation of interactive verification can be reduced, thereby increasing feasibility.Some code has now been open.

On April 10, 2024, Alpen Labs announced the completion of a $ 10.6 million seed round financing, and the actual financing was completed in 2023.Investors include Castle Island Ventures, Robot Ventures, Axiom Capital, etc.CEO and founder Simanta GAUTAM founded Alpen Labs in 2022, focusing on BTC and ZKSNARKS.GAUTAM graduated from MIT, as research intern in Mit, NASA, Amazon and other institutions, and founded Synapse.Alpen Labs has not published code on GitHub, and the route map has not yet been released.

Anduro: The side chain system supported by Mara, a MARA launching in Nasdaq

Anduro is a multi -sided chain platform incubated by Marathon Digital Holdings, a NASDAQ, to provide side chain solutions.

Anduro designed two side chains: BTC compatible Coordine and ETH compatible Alys.Coordinal is an UTXO chain that supports innovations such as Ordinals and other protocols, and ALYS targets physical RWA assets.

All Anduro side chains are mined with Bitcoin, and their native assets Anduro BTC are linked to BTC 1: 1.Anduro side chain meets the native attributes of Bitcoin to the maximum extent, including blocks generated by the use of workload proof (POW).

ANETABTC: Wrapped BTC based on Cardano and Ergo

ANETABTC is a Wrapped BTC project based on Cardano and ERGO, which aims to achieve the DEFI liquidity of BTC on these two chains.Through smart contract casting and redemption of ANetabtc, ANetAbtc enables BTC holders to participate in various activities in Cardano and ERGO’s DEFI ecosystems, such as borrowing, transaction and liquidity mining without abandoning the holding of BTC.

AnetABTC’s tokens include $ CBTC, $ Neta, and $ CNETA. Among them, $ CBTC is the Wrapped BTC token cast on Cardano and ERGO networks by anchoring BTC.At present, $ CBTC is still being cast, and the TGE of $ CNeta has been completed.$ CBTC is the Wrapped BTC of the project, which currently casts 17.6.$ Neta and $ CNETA are the tokens of the project with a total supply of 2 billion, which are issued on Erico and Cardano, respectively.The market value of CNETA is currently 2.53m, and it has all circulated, and 70%of them are allocated.

At present, the ANETABTC project has launched the V1 version of the main network. The V2 version of the test network is expected to be launched in the second quarter of 2024. The V2 version of the main network is planned to be launched in the third quarter of 2024, and the V3 version is planned to be released in 2025Essence

The project was founded by Austin Regron. He has many years of development experience and focuses on introducing BTC into Cardano and ERGO ecosystems.The co -founder Willie McClinton is a student who studies a doctorate in MIT. He has participated in the development of the project but has withdrawn.

BIOPDAO: OP ROLLUP project that supports the BRC-20 protocol

BIOPDAO is a project based on OP Rollup. It focuses on supporting BRC-20 and other protocols, and provides BIOP Virtual Machine (BVM) to support smart contracts.The goal of the project is to create an efficient, safe and scalable Layer 2 solution.The main tokens of BIOPDAO are $ BIOP, with a total supply of 21,000,000.At present, the market value of $ BIOP is about $ 500,000, while FDV is US $ 2.5M.BIOPDAO plans to launch three versions of L2 blockchain: V1, V2 and V3.The V1 version is scheduled to be launched in the first quarter of 2024. The V2 version is scheduled to be launched in the second quarter of 2024. The V3 version is planned to be launched in the fourth quarter of 2024.Although the code of BIOPDAO is open source, the current project is slow and the completion is not high.

Bitsat_official: Integrate AI into the ZK-Rollup project of BTC L2

Bitsat is a full -chain interoperability protocol compatible with EVM and COSMOS, which aims to integrate AI into Bitcoin second -level network (L2).

The core of Bitsat is Hyperlayer, a high -performance, scalable platform, which is used to deploy and run distributed AI applications on the Bitcoin network.Technical features include ZK-Connector to achieve efficient transmission of data and assets. VM Engine is compatible with Ethereum virtual machine (EVM), as well as asynchronous high-performance consensus mechanisms, providing high-performance and scalability.

The project has not yet published relevant Tokenomics information.The route map of Bitsat includes the test network on Q2 in Q2 in 2024, and the main network V1 on the Q4 of 2024.

BOOL_OFFICIAL: decentralized, safe bitcoin verification layer

BOOL is a modular data availability (DA) layer, using ZK, MPC, and Tee (trusted execution environment) technology.

The project is positioned as a decentralized and safe Bitcoin verification layer that provides MPC -based distributed key management.Technical features include the use of the Dynamic Hidden Committee (DHC) and the loop to verify the status of members of the Ring VRF protocol, and perform all key management processes in the trusted execution environment (Tee).In terms of Tokenomics, the total amount of $ BOOL is 1 billion, and the initial distribution is 500m.

The route map includes the completion of code audit in June 24 years, the main network of the main network in July, and the opening of BTC pledge in August and later.Code open source, high completion, waiting for audit.

Cashubtc: Emphasize the BTC project of privacy protection

Cashu is a free open source Chaumian Ecash system, which is built for Bitcoin and integrated in depth with the lightning network to ensure privacy.More recognized by the BTC core community.Cashu is positioned as an open electronic cash agreement called Cashu Nut. It uses blind signatures to protect user privacy. Trading is right.

Technical features include the operator of the lightning node as the user’s custodian on the lightning network, while issuing electronic cash to users.Cashu is an open source protocol, which has multiple system support and application.

BNZKLABS: BTC L2 project based on ZK-Rollup

The BNZKLABS plan supports the preface of the BRC20 protocol (ZKTOKEN), and then supports BRC721 (ZKNFT) and other protocols. The current progress is not enough and no code is seen.In terms of Tokenomics, the total supply of $ BNZK tokens is 21 million, the team reserves 10%, the ecosystem is rewarded by 20%, the public sales and private sales are 40%, and the mining award is 30%.The route chart includes the test network in April 24 and the main network on September.The current degree of completion is very average, no code is seen.

DriveChain Layertwolabs: Bitcoin side chain technology

Layertwo Labs is proposed by BTC DriveChain to create a Bitcoin side chain team.DriveChain is a BTC -side chain technology that combines mining, which aims to upgrade as a soft fork of Bitcoin and proposes a new way of side chain interconnection.

Paul Sztorc, the proposal of DriveChain, is the founder and CEO of Layrtwolabs. He is a former researcher and statistician of Yale University. He is also a senior practitioner of Bitcoin. He has elaborated the concept of DriveChain in BIP300 and BIP301.

DriveChain is a BTC -side chain technology. Through the hash rate custody mechanism and miner scoring system, it will achieve the large -scale side chain expansion of Bitcoin without changing the core safety and decentralized characteristics of Bitcoin.The basic mechanism is to create a new Bitcoin address. Any funds sent to this address will be locked. Only when all miners agree can these funds be expected.The miners reached a consensus through the “scoring” system. Once the score of a certain transaction is high enough, the transaction will be released, and the funds will be transferred from the side chain to the main chain.

DriveChain allows Bitcoin network to use new use cases through side chain experiments, such as issuing assets, complete private transactions, status blockchain contracts, etc., without having to sacrifice the core security and decentralized characteristics of Bitcoin.The roadmap of the project has begun to implement, and the test network has Launcher of Linux, Mac and Windows.The code is open source, the completion is better, and the update is frequent.

In December 22, the financing was raised 3M dollars, and it was not disclosed.

EastBlue_iO: L2 solution focusing on large -scale applications

EastBlue is a L2 solution focusing on large -scale applications. It relies on Near and uses RollUP technology and multi -virtual machine support.

The project is based on ROLLUP. It aims to use Near’s chain signature and account aggregation to introduce new programmable layers through the EAST account insurance library model (AVM) to solve the problem of congestion and expansion caused by Ordinals, and improve the smart contract capabilities of BTCEssenceEastBlue realizes a new cross -chain trading paradigm by transferring account ownership to smart contracts.

At the $ East airdrop on March 22, 2024, the Paras token holder is given priority.The token supply is 1 billion, and the $ East is dynamically issued according to ecosystem behavior and performance, and it has a lock -up period of 5 years.Most tokens (52%) are allocated for community construction and ecosystems.The pledge function will be launched, but the complete roadmap has not been found, and the project code is not seen.

Tokenomics allocation rules are as follows:

Fedimint: The open source protocol of community custody and trading Bitcoin

Fedimint is an open source agreement between community hosting and trading Bitcoin, which aims to emphasize privacy protection and reduce dependence on large centralized exchanges.The co -founders include Justin Moon and Obi NWOSU, the co -sponsor of AustinbitDevs.com and the CEO of the former British Bitcoin Exchange Coinfloor.The project has completed $ 4.2 million seed round financing and $ 17 million in Series A financing, with a total financing of US $ 21.21 million.Fedimint released the version of V0.3.0, which made great progress in the automation test of version compatibility.

Geliosofficial: Support Runes standard and EVM -friendly BTC L2

GELIOS is a Bitcoin L2 that supports Runes standard and EVM -friendly, which aims to promote communication and seamless cross -chain interaction between applications.As the DAPP layer of Bitcoin, Gelios can transfer BTC and WBTC to Gelios to release the potential of BTC Defi.The project has cooperated with AVE.AI, OKX, Bitget, Gate, Unisat and so on.At present, Crimson Heart, a two -dimensional card placement game, has been deployed to the Gelios network.

GeliOS’s initial supply is 210,000,000 $ GOS, the initial market value is $ 40 million, and the initial liquidity is 100 ETH.$ GOS has been launched on Alphanet and can be traded with ETH on Uniswap.RoadMap includes three stages: airdropping: test network (over), Alphanet (currently) and main network (not starting).

HACASHCOM: Bitcoin solutions for multi -layer capacity expansion and status channels

Hacash.com is a project dedicated to solving the problem of Bitcoin capacity. It realizes the one -way transfer of bitcoin through Layer 1, and pays the status channel in Layer 2 to further propose the Layer 3 idea to achieve ecological expansion.

Since the operation of the HACASH LAYER 1 network in 2019, it has adopted a workingload certificate (POW) consensus mechanism to achieve coins, distribution and settlement through three POW currencies: HACD, BTC and HAC to solve the problem of lack of currency attributes in Bitcoin.Layer 2 is mainly used for large -scale payment to build a payment settlement channel chain, and at the same time as the infrastructure of Layer 3.Layer 3 supports multi -chain interaction and application ecosystems to support asset issuance, smart contract operation, and data interaction and cross -chain on the chain.The founding team includes Ken You, Trevor Stoll and Leo Yang.The project has been crowdfunding for $ 60,000 for listing on the MEXC exchange.It is currently in the test network stage.

Bitcoin can be transferred to HACASH unidirectional to maintain its ownership and native value attributes. The total supply is maintained at 21 million pieces, and the smallest Satoshi unit is circulating in HACASH.BTC transfer has led to the creation of HAC, and the circulation of HAC has gradually decreased. After 1.05 million BTC transfer, only 1 HAC is generated for each BTC transfer.The total supply of HACD is about 16.77 million. It is generated through the bidding of mining and HAC. The difficulty of mining has gradually increased. The maximum daily output is 58. It is expected that all HACD will take 800 years, but may never produce all HACDs.

interlayhq: Bitcoin support assets that realize cross -chain interoperability

Interlay’s flagship product is “Interbtc”, which is a one -to -one Bitcoin -supported asset with a completely mortgaged one -to -one Bitcoin, which realizes the interoperability between multiple blockchain ecosystems, while maintaining the nature of Bitcoin’s anti -review.Technically, Interlay V2 introduces the native DEFI function. By creating the market that cater to Bitcoin holders and establish deep liquidity in these protocols, users can easily access Bitcoin’s DEFI use cases, such as SWAP, BORROW & AMP;Lend, Multi-Chain BTC, Stake BTC.Users can cast IBTC 1: 1 after locking BTC, use IBTC as a mortgage for DEFI transactions to obtain income, and then redeem BTC.Interlay has been audited by Informal Systems, Quarkslab, NCCGROUP, Security Research Labs.The founding team includes Alexei Zamyatin and Dominik Harz, both of which are PHD of the British Empire Institute of Technology.Up to now, Interlay has completed two rounds of financing, with a cumulative financing of 9.5 million US dollars. The most recent financing was December 21, 2021, with a financing amount of $ 6.5 million. Investment institutions include iOSG Ventures, DFG, Hypersphere, etc.

Libreblockchain: Fast, cheaper Bitcoin L2

Libre is a Bitcoin Layer-2 solution that makes Bitcoin and Ordinals faster, cheaper and easier to program.Libre.org is a new multi -in -one platform for Bitcoin order, which provides functions such as search, wallet, trading market, inscriptions.Libre does not need token, built -in TypeScript and other top languages. Use BTC to join in a few seconds without KYC.Libre is dealt with 4000+ transactions per second, zero transaction costs, with aMM on the chain.Libre’s main network was launched on July 4, 2022, and released 10 million libre airdrops, and only 277,000 were recognized.Libre also launched the test version of the BRC 20 DEX and mobile APP to facilitate user transaction inscriptions.

Lightecxyz: ZKP -based Bitcoin Layer2 solution

Lightecxyz aims to use ZKP to technology to build Bitcoin Layer2, which includes OPZKP and ZKBTC.Opzkp is completed by transferring complex calculations to the chain and generating a concise proof, and then verifying the proof of calculation of calculation under the chain through the introduction of new operating codes in the Bitcoin script language.This solution compensates for incomplete restrictions on the Bitcoin Turing, making it possible to deploy various applications on Bitcoin.OPZKP has a complicated technology and a long development cycle.ZKBTC is an application based on OPZKP, which realizes the cross -chain bridge based on ZKP between Bitcoin and Ethereum.This scheme allows users to deposit Bitcoin into the designated address to cast one-on-one ERC-20 token $ ZKBTC with bitcoin.The entire process generates ZKP proof through the chain, and then verifies the proof on the Ethereum smart contract, and the corresponding quantity of $ ZKBTC tokens is found after the transaction is confirmed.The user needs to destroy the corresponding amount of $ ZKBTC token when redeeming it, and generate proof outside the chain to verify that the Bitcoin is redeemed after passing.The Lightec team does not master the private key of the specified address throughout the process to ensure security and decentralization.

The Lightec team is actively developing the ZKBTC project, and it is expected to go online for a few months.At the same time, they initially build the token economic model to support the further development of the OPZKP proposal and promote the construction of the Bitcoin Layer2 ecosystem.

Liquid_btc: The fast, secure and confidential Layer2 solution of Bitcoin

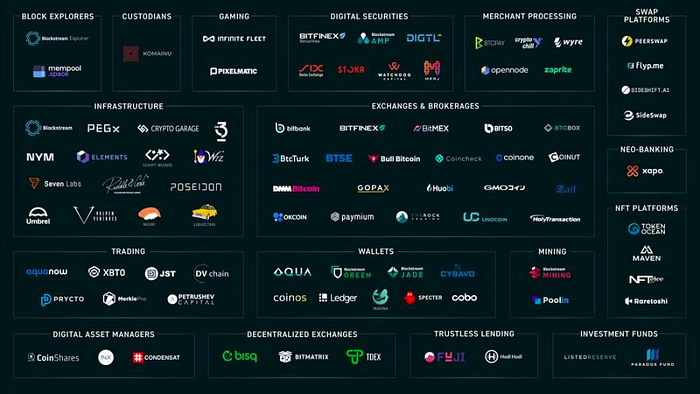

Liquid Network is the Layer2 solution of Bitcoin, which provides fast, secure and confidential settlement and digital asset issuance, including stablecoin, securities tokens and other financial instruments.Liquid Network uses a special federal Byzantine Agreement (FBA) to compress the block generation time to 2 minutes.Confidential transactions and zero -knowledge proof of protection transaction amount and address information.Liquid Network allows users to use LBTC (Lightning Bitcoin) as a fast and private transaction with Digital assets that can be traded. At present, more than 3,700 LBTCs in circulation.

Liquid Network is governed by more than 65 Bitcoin -centered company distributed alliances, including Bitbank, BTCBOX, Aquannow, Bitcoin Reserve, Cobo, OpenNode, etc.Bitfinex Securities has launched the first bonusized debt at El Salvador to provide funds for New Hilton Hotel, and tokens will be issued on LIquid Network.

Liquid Network was developed by Blockstream. This company was established in 2014. Its products include liquid, Blockstream Green, etc.In 2014, the company raised $ 21 million in seed wheels, Ethereal Ventures, Khosla Ventures, Reid Hoffman, Blockchain Capital, Ribbit Capital, Mosaic Ventures, and FUTURECT VENTURES, and AME CL. Oud Ventures, Max Levchin, Nicolas Berggruen, Danny Hillis, Eric Schmidt’s Innovation Endeavors, Ray Ozzie participated in the investment.In 2016, a round A financing was 55 million US dollars, Horizons Ventures, Axa Strategic Ventures (AVP), BlockChain Capital, AME Cloud Ventures, Future Perfect Ventures, Khosla Ventures, Mosaic URS, Seven Seas Venture Partners, Batara Eto participated in the investment.In 2021, the round B financing was US $ 2.10 billion and a valuation of 3.2 billion US dollars. Bailie Gifford and Ifinex participated.

Ecological projects include wallet AQUA WALLET, DEFI products BISQ, Peach Bitcoin, Boltz, NFT project Tokenocean, and Sideswap, Debifi.

Lumibitl2: enhanced scalability, privacy and decentralized BTC Layer2 solution

Lumibit is a BTC Layer2 solution that provides enhanced scalability, privacy and decentralization with ZK-EVM.It has seamless general circuit design and efficient transaction verification of the migration of the Ethereum smart contract.Lumibit uses Type2 ZK-EVM, which is highly compatible with EVM and optimizes the data structure to improve verification efficiency.Integrating HALO2 zero -knowledge certification mechanism does not require credible settings to enhance security.Introducing an abstract account of the Omino Wallet, the user can use the local Bitcoin key to trade on the Lumibit chain.Lumibit test network has been launched.

MercuryLayer: Bitcoin L2, which focuses on privacy and efficiency

Mercury Layer is a Bitcoin L2. It focuses on enhancing privacy and efficiency through status chain and realizing the mortal transfer and settlement of Bitcoin UTXO.Mercury Layer uses the status chain and the blind method to jointly sign the technology to promote instant and free transactions without sacrificing funds for saving and security.

Mirror_L2: Bitcoin Layer2 solution for decentralized equity proof

Mirror Staking Protocol, formerly known as Mirror L2, is a decentralized equity proof (POS) BTC Layer2 solution, compatible with EVM and smart contracts, using BTC as GAS.Mirror Staking Protocol adopts overlapping group multiple signature (MSG) algorithms, which are jointly managed by hundreds of thousands of nodes to balance the BTC pledge rate, security and decentralization.Generate MBTC and EVM compatibility with BTC 1: 1, and has been used in the RESTAKING mechanism.

Mirror designed a set of node management solutions.The node was elected by the community through four rounds. The first round of 100 nodes gradually increased to 300, 600 and 1,000.The node must pledge at least 1 BTC to the mirror channel and serve as a decentralized network custodian for 12 months.The election champion will receive a bullish options reward of 1 million Mirr (mirror governance tokens), and the execution price is $ 0.12.

Seed wheel financing was conducted on March 4, 2014. Investors include Conflux, UTXO Management, and Imo Ventures. The amount has not been disclosed.In the future, Mirror Staking Protocol plans to establish TVL and ecosystems with other BTC L2 projects through the “Stake Once, Earn Twice” event.It was announced in March to complete the first round of financing and open the test network.Every time Redemption will get 10 points, and Minting will not get points.

Rolluxl2: Bitcoin Layer2 solution compatible with Ethereum smart contract

Rollux was developed by Layer1 blockchain SYSCOIN (SYS). It is an Optimistic Rollup that is equivalent to EVM. It is planned to switch to ZK -based Rollup in the future.Rollux supports nearly real -time transactions and contract deployments, protected by the Bitcoin network.Syscoin blockchain is a dual -layer blockchain based on POW consensus. The core is Syscoin blockchain. NEVM provides smart contract functions.

Syscoin was established in April 2014 and was developed by Layer1 blockchain Syscoin (SYS).SYSCOIN announced in June 2022 that he had obtained a $ 20 million ecological development fund.Syscoin has been launched in Binance, and the FDV is currently US $ 170 million.

SOVRYNBTC: decentralized transactions and borrowing platforms based on Bitcoin

SOVRYN is developed on the Rootstock (RSK). It is based on the decentralized transaction and lending platform of Bitcoin. It provides a full set of DEFI services, including stable currency, AMM, lending pool and deposit transaction.

Sovryn founder Edan Yago, graduated from the University of Traviv, is the founder of CEMENTDAO and Sovryn.John Light, the person in charge of the product, was once the director of the Aragon One governance.The project has gone through 4 rounds of financing: the seed wheel financing was US $ 2.1 million in 2020, Greenfield, Collider Ventures, Monday Capital participated; in January and March 2021, it raised $ 12.5 million successively; in April 2021, Anthony Pompliano, Cadenza Ventures, Gate Ventures, Ascendex, BLOCKWARE, CONSOLIDOD Trading; In October 2022, 5.4 million US dollars, General Catalyst, COLLIDER VINTERS, BOLLENGER Investm ENT Group, Balaji Srinivasan participated in the investment.

u_protocol: All -chain decentralization synthesis BTC

U Protocol is a native all -chain decentralized synthetic BTC, compatible with EVM. The main products are UBTC and U Bitcoin Thunder Network.UBTC is a decentralized Bitcoin for Layer 2, supported by the Wrapped Staked Ether and BTC.B of Lido.U_Protocol uses BTC to pricing, and the redemption mechanism can enhance the user experience by charging a one -time redemption fee to prevent frequent redemptions.The system sets the upper limit of the 1.10 BTC. When the UBTC: BTC exchange rate exceeds this level, the borrower can obtain real -time profits by maximizing the loan and selling UBTC.

ZKBASEOFFICIAL: infrastructure protocol based on ZK technology

ZKBASE provides expansion solutions for mainstream blockchains such as Ethereum and Bitcoin based on the zero -knowledge proof (ZK) technology, and provides includes decentralized exchanges, cross -chain bridges, second -layer payment, NFT markets and second -level domain names.A series of services.ZKBASE will release AMM ZKSWAP that supports BRC20 assets to improve market liquidity and capital efficiency.Compared with other agreements, ZKBASE technology focuses on privacy and rapid transaction processing, while providing more secure ways, which is equivalent to the security of the BTC network.Chief Strategic Officer Antonio Saaranen has served as the QTUM Foundation CSO.Hailan Jia, director of marketing and public relations, has served as senior public relations manager of Huobi Global Station.In 2020, angel round financing was 1.7 million US dollars and a valuation of $ 25 million. Investors include Bixin Ventures, SNZ Holding, FBG Capital, etc.

Conclusion

The number of Bitcoin Layer2 projects is growing rapidly, and there are currently nearly 100. In general, it can be divided into four categories.

The first category is the EVM -side chain. This is the largest number of projects. Most of them are mostly deployed EVM chains by Rollup modularized methods. Using POS consensus, the entrepreneurial threshold is low, and strong capital operation capabilities are required to effectively start.Some of these projects have tried to introduce the latest modularization solutions such as ZK.

The second type of project continues Bitvm’s design ideas and innovates in verification methods, which introduces BTC security to a certain extent.However, this type of project has chosen to go online to develop an EVM + POS main network to develop the ecology. It is essentially no different from the first type of EVM side chain. There are certain narrative expectations and often obtain some high financing. This is also VC.Circuit for centralized investment.

The third type of project focuses on BTC’s deposit pledge, and uses BTC as the assets pledged by POS. It introduces the concept of BTC pledge similar to Eigenlayer, trying to attract more BTC savings.The leading project BABYLON has innovated the cryptographic level on the pledge of BTC. Most of the other projects are innovated at the business level, such as introducing BTC pledge into CEFI to create more benefits.We believe that the mainstream of the BTC pledge will be the mainstream of the future ecology. Before the realization of BITVM, the pledge security guarantee will solve the BTC narrative problem of the above BTC EVM side chain.

The fourth type of projects have been explored more in the native BTC, such as further developing UTXO models, and trying to create new side chain asset binding solutions based on UTXO.BTC’s native exploration also includes the continued exploration of the joint mining side chain.There are also a few projects trying to promote BTC upgrades and introduce more script operators to expand the BTC ecology, which is currently the most DEGEN line.

The BTC ecosystem is in the rapid development stage, and various innovative projects are constantly emerging to solve the challenges of the Bitcoin network in terms of scalability, security and efficiency.From Babylon’s cross -chain pledge to Nubit’s extended data availability, from the Lorenzo’s liquidity pledge protocol to Bitsmiley’s comprehensive DEFI protocol. These projects have jointly promoted the diversified development of the Bitcoin ecosystem through different technical paths and business models.Through continuous attention and participation in these cutting -edge projects, communities and developers will be able to better grasp the future development trend of blockchain technology and jointly build a more efficient, secure, and diverse blockchain ecosystem.