Author: danny; Source: X, @agintender

Why is it said that 2025 will be “shipping as soon as the currency is listed”?Because in the business plan of the King-level project, there is never an item of “relying on technical services to make profits”. Selling Tokens is the only business model.

When Token = Product = Only Income, this industry is destined to be a capital game of beating drums and passing flowers around, rather than a BUIDL that creates value.

The period 2023 to 2025 is a period of structural transformation worth remembering in the history of the cryptocurrency industry, marking a fundamental decoupling between protocol utility and asset valuation.Traditional “Fujian businessmen” will shout “Jia lat” when they see it.

Introduction: The ruins of Ukraine and the calculations of the Fujian people

In the business world, Fujian merchants (“Min merchants”) are known for their keen business intuition: where there is a price difference, there is business; where there is chaos, there is arbitrage.Even during the war in Ukraine, there were Fujian people looking for opportunities to gain wealth and wealth in danger.

The Fujian Merchant Gang (“Fujian Merchants”) understood one thing well: in the gold rush, the most certain path to wealth was not speculative gold mining, but providing the necessary production tools (shovels) and logistical services to speculators.

In the context of the crypto economy, “selling shovels” theoretically corresponds to providing blockchain infrastructure (L1, L2, cross-chain bridge), and its revenue should come from gas fees and transaction throughput (“tolls”).However, with technology upgrades such as EIP-4844 and the oversupply of L2/L3 infrastructure from 2023 to 2025, the commercial viability of “selling shovels” itself as an independent revenue narrative begins to collapse.

As a result, the industry shifted to a distorted “global arbitrage” model.Project parties are no longer committed to selling infrastructure services to users, but have begun to sell the financialized equity (Token) of the infrastructure itself as a core commodity to retail investors.At this time, the “shovel” has been reduced to a traffic diversion tool/marketing carrier, and its sole purpose of existence is to justify the issuance of high-valued tokens.

This article will unpack the mechanisms of this shift in detail – specifically the “low liquidity, high FDV” phenomenon, predatory market maker structures, and the industrialization of airdrops – and conclude that the main commercial output of the 2023-2025 infrastructure cycle is not technological utility, but the systematic withdrawal of venture capital capital into retail liquidity.

Chapter 1: Fujian Business Prototype: Business Pragmatism and Global Arbitrage Network

1.1 The wisdom of secondary markets: from California to the world

The adage “sell shovels in the gold rush” is often attributed to the California Gold Rush of 1849.Back then, businessmen like Samuel Brannan made their fortunes not by panning for gold in river beds, but by monopolizing the supply chain of tools needed by miners.In the Chinese business context, especially for Fujian business gangs, this philosophy is not just a simple supply and demand relationship, it extends into a complex “global arbitrage” system.

As a province with many mountains and little land, Fujian faces the ocean, and its merchant class has historically been forced to live toward the sea.This geographical environment has given birth to a unique business DNA that mainly consists of two core tenets:

1. Risk transfer: Gold diggers bear all the risks of “not finding gold”, while merchants lock in profits in advance by selling tools.Regardless of whether the gold digger succeeds or not, the value of the shovel is realized the moment the transaction is made.

2. Networked arbitrage: Using close networks based on clan and kinship to move capital and goods between markets in different jurisdictions and at different levels of economic development.For example, goods are purchased from the coast of China, where production costs are low, and sold to African or South American markets with higher profit margins, using information asymmetry and regulatory gaps to earn the price difference.

This spirit of Fujian businessmen who “dare to take risks”, “love to work hard to win” and are good at using rules to arbitrage has found a perfect modern reflection in the digital ocean of cryptocurrency, which has no borders and is not yet fully regulated.

1.2 Parallel mapping in the crypto world: from Gas to governance rights

In the early days of the crypto industry (2017-2021), the “selling shovels” metaphor held true to a large extent.Exchanges (such as Binance, Coinbase), mining machine manufacturers (such as Bitmain), and Ethereum miners have earned huge cash flows by serving the speculative frenzy of retail investors.They strictly follow the merchant model: they take a commission (gas fee or transaction fee) from every transaction.

However, entering the 2023-2025 cycle, the market has undergone fundamental differentiation.

The impoverishment of “gold diggers”: Retail investors interacting on the chain have become cash-strapped and more savvy, and no longer easily pay high tolls.

Inflation for “shovel dealers”: Infrastructure projects are growing exponentially.The supply of “shovels” such as Layer 2, Layer 3, modular blockchain, and cross-chain bridges far exceeds the actual “gold mining” demand (real transactions).

Faced with the compression of profit margins on core services (block space), infrastructure projects began to follow the “intertemporal arbitrage” strategy of Fujian merchants, but with a financial engineering transformation: instead of exchanging goods on one shore for currency on the other shore, “expectations” (narratives) on one shore were exchanged for “liquidity” (US dollars/stablecoins) on the other shore.

Crypto VCs and market makers industrialize the arbitrage concept of Fujian traders:

Regulatory arbitrage: The foundation is registered in the Cayman Islands or Panama, the development team is in Silicon Valley or Europe, and the marketing target is retail investors in Asia and Eastern Europe.

Liquidity arbitrage: Obtain chips at a very low valuation (seed round) in the primary market, and dump them through market makers at a very high valuation (high FDV) in the secondary market.

Information arbitrage: Profiting from the huge information gap between the public narrative of “community governance” and the private terms of “insider unlocking”.

Chapter 2: Mutation of business model: infrastructure as a “loss diversion product”

2.1 The collapse of protocol revenue and the technological paradox

By 2025, the traditional “shovel selling” revenue model of Layer 2 expansion solutions is facing an existential crisis.The technical success of the Ethereum expansion roadmap, especially the implementation of EIP-4844 (Proto-Danksharding), introduced the “Blob” data storage space, which greatly reduced the cost of L2 submitting data to L1.

From a technical perspective, this is a huge victory, with user transaction costs falling by more than 90%; but from a business perspective, this has destroyed L2’s profit margins.In the past, L2 was able to earn high margins by reselling expensive Ethereum block space.Now, with data costs approaching zero, L2 is forced into a “race to the bottom”.

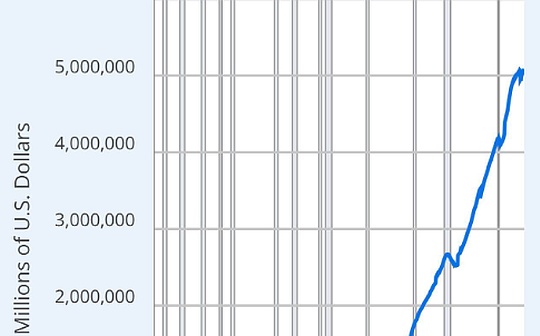

According to reports from 1kx and Token Terminal, although the average daily transaction volume in the first half of 2025 increased by 2.7 times compared with 2021, the total gas fee revenue of the blockchain network fell by 86%.This means that the price of “shovel” has become so cheap that it cannot support the valuation of the shovel-making factory, and miners can no longer afford the startup costs.

2.2 ZkSync Era: The disillusionment of the income illusion

The ZkSync Era provides one of the cruelest examples of the nature of income.Prior to the Token Generation Event (TGE) in June 2024, the ZkSync network generated huge daily orderer revenue, with peak daily revenue exceeding $740,000.On the surface, this is a thriving “shovel shop.”

However, this is actually a false prosperity driven by “airdrop expectations”.Users pay gas fees not to use the network (mining utility), but to purchase a potentially winning lottery ticket (airdrop).

Everyone knows what happened next. After the lottery (airdrop) was launched in June 2024, ZkSync’s daily income immediately plummeted to about $6,800, a drop of as much as 99%.

If a physical store’s customer traffic instantly drops to zero after it stops giving out coupons, it means there is no real demand for its core products.

2.3 Starknet: Extreme Mismatch of Valuation and Revenue

Starknet also demonstrates the absurdity of this valuation logic.Despite being a leader in zero-knowledge proof technology, its financial data cannot support its primary market pricing.

At the beginning of 2024, the fully diluted valuation (FDV) of Starknet (STRK) once exceeded US$7 billion, and even reached US$20 billion in the over-the-counter futures market.

At the same time, its annualized protocol revenue is only in the tens of millions of dollars after EIP-4844.This means that its price-to-sales ratio is as high as 500 times to 700 times.For comparison, NVIDIA, the real “shovel seller” in the AI field, usually has a market-to-sales ratio of between 30 and 40 times.

Investors buy STRK not based on discounting its future cash flows (traditional equity investment logic), but based on a game logic: believing that there will be buyers who “believe more in the narrative” to take over at a high price.

The traditional Fujian businessman’s model of “small profits, quick turnover, steady cash flow” has been abandoned in the currency circle, and has been replaced by a model based on financial alchemy: by creating technical barriers and narratives, a highly valued financial asset is created out of thin air and sold to retail investors who have no discerning ability.

Chapter 3: The mechanism of financialization: the “low circulation, high FDV” trap

In order to maintain the “selling Token” business model in the absence of real income, the industry has popularized a specific market structure between 2023 and 2025, namely “Low Float, High Fully Diluted Valuation” (Low Float, High FDV).

3.1 Warning from Binance Research

In May 2024, Binance Research published a paper titled “Low Circulation and High FDV: How did we get here?”》The blockbuster report conducted a systematic criticism of this phenomenon.The report pointed out that this distorted circulation chip structure has become an industry standard for infrastructure token issuance.

Operating mechanism

-

primary market pricing: Venture capital institutions (VCs) enter seed rounds with valuations of US$50 million to US$100 million.

-

artificial scarcity: When a project is listed on an exchange, only 5%-10% of the total supply is released.Market makers take advantage of this razor-thin liquidity and can push the price of a token higher with just a small amount of capital.

-

market capitalization illusion: A token with a circulation of 100 million and a unit price of US$1 has a “circulation market value” of US$100 million, which looks cheap (Small Cap).However, if the total supply is 10 billion, its FDV is as high as $10 billion.

-

systematic dumping: Over the next 3-5 years, the remaining 95% of tokens will continue to be unlocked.To maintain a price of $1, the market would need to absorb $9.5 billion in new money.In the market of stock game, this is almost mathematically impossible, and the price will inevitably collapse.

3.2 Psychological anchoring for retail investors

This structure accurately exploits the cognitive biases of retail investors.Retail investors tend to only focus on the “unit bias” (Unit Bias, thinking that $0.1 is cheaper than $100) or “circulation market value”, while ignoring the inflationary pressure represented by FDV.

For savvy VCs and project parties like Fujian businessmen, this is a perfect inter-temporal arbitrage:

a. They locked in huge returns on paper (100-fold increase from seed round to FDV).

b. Use retail investors’ pursuit of short-term price increases caused by “low circulation” as a source of liquidity for exit.

c. Through linear unlocking that lasts for several years, the selling pressure is dispersed and market liquidity is harvested like boiling a frog in warm water.

3.3 Data comparison: valuation gap in 2025

By 2025, this valuation bubble has become extremely deformed.According to a 1kx report, the median price-to-sales ratio (P/F Ratio) of Layer 1 blockchains is as high as 7,300 times, while the P/F ratio of DeFi protocols that generate actual cash flow is only 17 times.

This huge valuation gap reveals an obvious market truth – the valuation logic of infrastructure projects is not based on their profitability as a “shovel”, but on their ability to sell as a “financial asset”.The project party is essentially running a money printing factory, not a technology company.

Chapter 4: Changes in the currency circle from the perspective of Fujian merchants: from “selling services” to “selling goods”

4.1 Traditional “sell shovel” logic (2017-2021)

In the early ICO or DeFi Summer era, the logic was close to the traditional Fujian business experience:

Scenario: Retail investors want to dig for gold (trading/speculating).

Shovel: exchanges, public chain gas, lending protocols.

Logic: You use my shovel to dig gold, and I charge you rent (handling fee).

Token: Similar to “pre-sale service voucher” or “membership card”, it represents the right to use the shovel in the future or the right to dividends.

4.2 Alienation from 2023 to 2025: “Token is the product”

By 2025, with excess infrastructure (L2 flooding), “collecting tolls” is no longer profitable (Gas fees dropped to negligible).The project team and capital found that instead of working hard to make a good shovel to earn meager rent, it was better to directly sell the “shovel company’s stocks” (Token) as goods to retail investors.

In this new model:

The real product (Product): is Token.This is the only product that generates sales revenue (USDT/USDC).

Marketing materials (Marketing): They are public chains, games, and tools.The only reason for their existence is to provide a narrative background for the Token and increase the credibility of the “goods”.

Business model: Selling Token = sales revenue.

This is an extremely sad retrogression – the industry no longer pursues profit through technical services, but prices and sells “air” through financial means.

4.3 Production and packaging: high valuation endorsement and “credibility” game

If Token is a commodity, then in order to sell the commodity at a high price (ship it), top-notch packaging is required.

Institutional endorsement: not for investment, but for “OEM”

In the 2023-2025 cycle, the role of VC changes from “venture investor” to “brand franchisee”.

The truth about high-dollar funding: Starknet’s funding valuation is $8 billion, and LayerZero’s valuation is $3 billion.These astronomical valuations are not based on future fee income (Starknet’s annual income is not even enough to cover team wages), but on the expectation of “how many coins can be sold to retail investors in the future.”

The names of top VCs such as a16z and Paradigm are like the “Nike” logo affixed to Fujian shoe factories.Their role is to tell retail investors: “This product (Token) is genuine and worth buying at a high price.”

What’s interesting is, why can VC offer such a high valuation?Because retail investors believe that their buying price is the same as or even lower than that of top VCs. However, they do not know that the valuation is only lower, not the lowest.

4.4 KOL calls for orders: not just promotion, but a “distributor”

KOL no longer provides value analysis in this chain, but is a distributor at all levels.

Ship once the order is placed: The project party or market maker will give KOL low-price chips or “rebate”.The task of KOL is to create FOMO, maintain the popularity of “goods”, and ensure that there is sufficient retail liquidity to bear the selling pressure during the VC unlocking period.

Chapter 5: The Market Maker Industrial Complex: The Invisible Middleman

If Token is a commodity, then the market maker (aka Yezhuang) is the distributor.Between 2023 and 2025, the relationship between project parties and market makers has changed from service provision to predatory collusion. This is similar to the strategy of Fujian business gangs using clan networks to control channels, but its purpose is no longer to circulate goods, but to harvest rivals.

5.1 Loan + Call Option Model (Loan + Call Option)

During this period, the standard contract form between the project party and the market maker was the “borrowing currency + call option” model.

Transaction structure: The project party lends tens of millions of tokens (for example, 2%-5% of the circulating supply) to market makers as “inventory” without interest.At the same time, a call option is granted to the market maker, and the exercise price is usually set at the initial listing price or slightly higher.

Incentive misalignment:

If the currency price rises above the exercise price, the market maker exercises the option, buys the token at a low price, and then sells it to retail investors at a high price in the market to earn the price difference.

If the currency price falls, the market maker only needs to return the borrowed tokens to the project without bearing any capital losses.What’s more, in the early stage of listing, the chips are “poured” as much as possible to the destined people.

Market makers cease to be neutral liquidity providers and become speculators who are bullish on volatility.They have a strong incentive to create violent fluctuations and push the price above the strike price in order to complete the shipment.This model is mathematically destined that market makers must be enemies of retail investors.

5.2 Contract short squeeze: the most efficient way to “find a taker”

“The contract mechanism is the carrier of shipments” is the most ruthless trading technique in this cycle, and it has even spawned “narratives of delisting coins”, “narratives of killing hedging in pre-market trading”, etc.

What should we do when no one buys the spot (retail investors don’t take orders)?Make people who have to buy it.

-

Set up and control: On the eve of bad news or unlocking, the market is generally bearish and the funding rate is negative.

-

Pulling: Market makers use the concentrated spot chips (low circulation) in their hands to pull up prices with only a small amount of funds.

-

Short squeeze: short positions in the contract market are liquidated and forced to buy at the market price to close the positions.

-

Shipment: Project parties and market makers take advantage of the huge passive buying caused by short positions to sell the spot stocks in their hands to these “forced takeover” short sellers at high prices.

This is like a Fujian businessman who first released news in the market that “the price of shovels will be reduced.” When everyone was shorting shovels, they suddenly monopolized the supply and raised the price, forcing the short sellers to buy shovels at a high price to make amends.

5.3 Movement Labs Scandal: “Taking Banker” Written into the Contract

The Movement Labs (MOVE) scandal that broke out in 2025 completely tore open the fig leaf of this gray industry chain.

Coindesk’s investigation revealed that Movement Labs signed a secret agreement with a mysterious middleman named Rentech (allegedly associated with the market maker Web3Port), handing over 10% of the token supply (66 million) to its control.

The contract surprisingly contained clauses that incentivized market makers to push FDV to $5 billion.Once this goal is reached, the profits from the sale of tokens will be divided between the two parties.

When Rentech began selling tokens on a large scale in the market, Binance monitored the anomaly and suspended the relevant market maker accounts, and Coinbase subsequently suspended trading on MOVE.This incident proves that the so-called “market value management” is often the “pump and dump” written in the legal contract.

This is exactly the same as the early operations of Fujian businessmen in the gray area of global trade – using complex networks of middlemen and multi-layered shell companies to circumvent supervision and control pricing power – but in the encryption field, this operation directly robbed retail investors of their capital.

Conclusion:

If these projects are really in the “shovel business”, they will desperately optimize gas income and daily activity.But they don’t seem to care and are just building lofts in the sky.

Because their real business model: Produce Token at extremely low cost -> Price at extremely high valuation -> Sell in the secondary market through contracts and market makers -> Exchange back for USDT/USDC (real gold and silver).

This is why the cryptocurrency world in 2025 looks like a casino, because no one is doing business, everyone is doing transactions.

Chapter Six: New Market Pattern in 2025: Counterattack at the Application Layer

As the year progresses into 2025, market fatigue with the “infrastructure casino” model has reached a critical point.Data shows that funds and attention are shifting from the infrastructure layer, where shovels are sold, to the application layer, where gold is actually mined.

6.1 Transfer of public chain narrative to Dapp cash flow

The “On-Chain Income Report” released by the venture capital institution 1kx at the end of 2025 illustrates this phenomenon.

Revenue flip: In the first half of 2025, DeFi, consumer applications (Consumer) and wallet applications contributed 63% of the total fees on the chain, while the proportion of Layer 1 and Layer 2 infrastructure fees shrank to 22%.

Growth comparison: Application layer revenue increased by 126% year-on-year, while infrastructure layer revenue growth stagnated or even regressed.

Business Logistic Regression: This data marks the end of the era of monopoly profits for “shovel merchants”.As infrastructure becomes extremely cheap (and commoditized), value capture moves up to direct-to-user applications.Those DApps that can truly generate user stickiness and cash flow (such as hyperliquid, pump.fun) have begun to replace L2 public chains and become the darling of the market.

6.2 Token as a revaluation of customer acquisition costs

The industry has begun to re-examine the economic nature of “airdrops”.In 2025, Token will no longer be seen as a symbol of governance rights/dividend rights/status, but as bad news for customer acquisition costs (CAC) and market crashes.

Data from Blockchain ads shows that the cost for Web3 projects to acquire a real user through token incentives is as high as US$85-100 or more, which is much higher than the standards of the Web2 industry. This is a result of path dependence.

Projects like ZkSync, which spend hundreds of millions of dollars (denominated in Tokens) on incentives, find that these users are “mercenaries” – as soon as the incentives stop, the liquidity is withdrawn.This forces the project side to shift from an extensive “spreading money” model to a more refined “points system” and “real revenue sharing” model.

Chapter 7: Conclusion: The businessman’s festival is over

The cryptocurrency market from 2023 to 2025 will stage a drama of primitive accumulation of capital under the guise of “technological innovation”.The ancient wisdom of Fujian merchants – “Sell shovels in the gold rush” – has been twisted to the extreme:

-

Free shovel: In order to attract traffic, the price of real shovel (block space) is continuously reduced, even lower than the cost supply (through Token subsidy).

-

Factory securitization: Businessmen no longer make money by selling shovels, but by selling “stocks in shovel factories” (high FDV Tokens) to retail investors who think that the factory has a monopoly on gold mines.

-

Institutionalization of arbitrage: Market makers, VCs and exchanges form a close community of interests and complete the transfer of retail wealth through complex financial instruments (options, loans, contracts).

If we re-examine the currency circle in 2025 from the perspective of a Fujian businessman, we will see such a picture:

This group of people (project party + VC) originally claimed to build a house (Web3 Ecosystem) in Ukraine (a high-risk new area), but in fact they didn’t care whether the house could be inhabited or not.What they really do is:

First, a sign was inserted on the ground and a bunch of “Brick Tickets” (Tokens) were printed on this basis.

The Wall Street bosses (VC institutions) came to the platform and said that these brick tickets could be exchanged for gold in the future.

The loudspeaker (KOL) in the village was called to announce that the price of brick tickets was going to increase.

Finally, the contract mechanism was used to defeat those who wanted to short Brick Tickets, and they took the opportunity to exchange the waste paper (Token) in their hands for real money.

This is why it is said that “the currency is to be shipped.”Because in their business plan, there is never an item of “profiting from technical services”, and selling Token is the only business model.

When Token = product, this industry is destined to be a capital game of beating drums and passing flowers, rather than a value-creating business.This may be the biggest tragedy in the currency circle in 2025.

It’s not that there is no bull market for copycats, but that the bull market cannot tolerate copycats without cash flow.

Finally, we have to ask: Who is responsible for today’s high FDV and low circulation situation?Turn the token into the final product/service?

Is it a launch pad?meme?Exchange?VC?media?Trader?Analyst?Project side?— or all of us?