Author: Wei Xincheng, Cui Rong, Li Chong

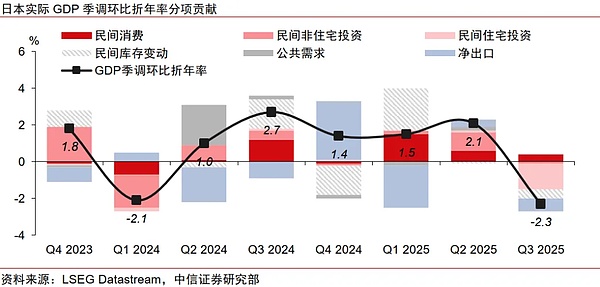

Japan’s virtuous inflation cycle has become more stable, and the Bank of Japan is about to raise interest rates again.The global market turmoil after Japan raised interest rates last summer was mainly caused by U.S. factors such as rising recession expectations and a shaken AI narrative. The reversal of carry trades was only a secondary factor that exacerbated risk aversion at that time. Last year’s “Black Monday” is unlikely to be repeated this year.

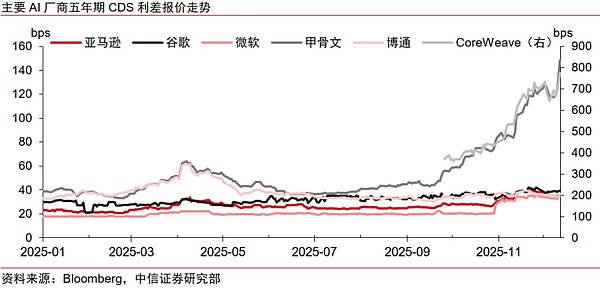

In the context of policy differences between the U.S. and Japanese central banks, the U.S. factor is the core thread of current global liquidity and U.S. dollar asset pricing.The current market doubts about the AI narrative are concentrated in a few companies with more radical business models. However, most AI leaders with relatively stable financial conditions can still maintain market trust. The industrial intelligence boom should continue to support the performance of leading US stocks in the short to medium term.

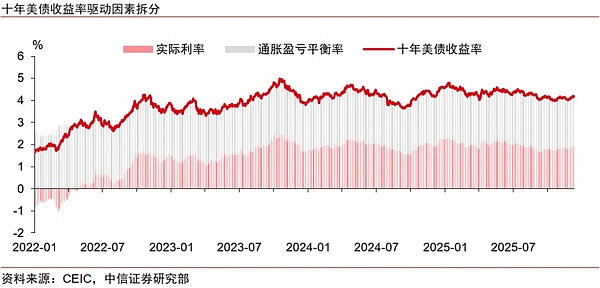

The allocation of long-term U.S. Treasuries during this round of risk-managed interest rate cuts is not cost-effective, while short-end U.S. Treasuries may benefit from the technical improvement in liquidity caused by reserve management purchase operations. The latter is better than the former.

Japan’s virtuous inflation cycle has become more stable, and the central bank has raised interest rates again

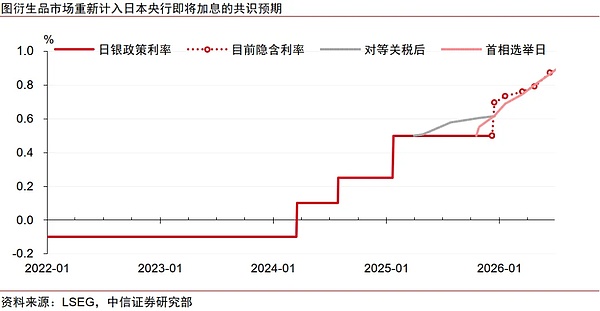

Japan’s positive cycle of price increases and wage increases has been increasingly intensified over the past three years. The traditional structural blockage of inflation has been eliminated, and the momentum of wage increases is expected to continue its solid performance.This is consistent with the previous outlook of the Bank of Japan (BoJ), which means that it is appropriate for the Bank of Japan to continue to reduce the degree of easing of monetary policy.

The impact of the Bank of Japan’s interest rate hike on global liquidity is not terrible

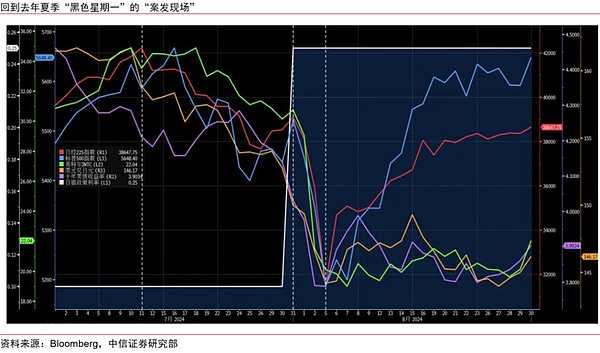

Many investors are still worried about the “Black Monday” after the Bank of Japan raised interest rates last summer, and are worried whether the new interest rate hike will “collapse” the global market again.

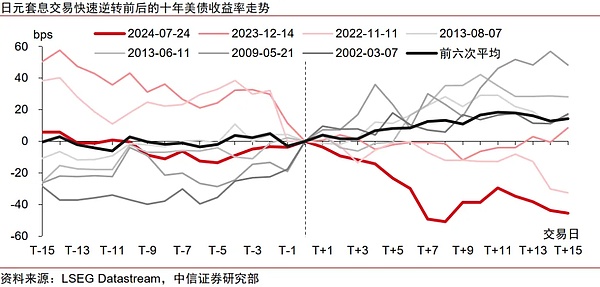

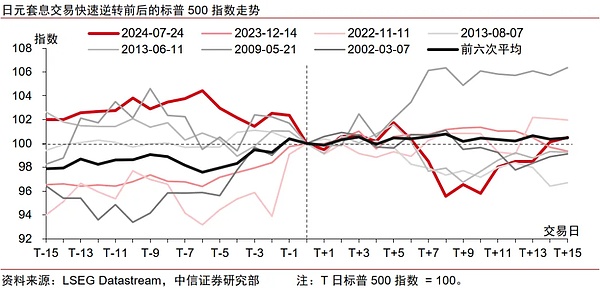

By summarizing the experience of seven rapid reversals of yen carry trades this century, we found that rapid reversals of yen carry trades may indeed suppress the performance of U.S. debt, but the extent of its impact should not be exaggerated. Its disturbance to U.S. stocks is usually short-lived. The spillover effects of the jump in long-term Japanese bond yields are more limited to major bond markets and Southeast Asian stock markets. Overseas funds may not necessarily flow back to Japanese stock and bond assets after the Bank of Japan raises interest rates.

Looking further back on the timeline, we believe that last summer’s “Black Monday” was mainly caused by U.S. factors such as rising recession expectations and the shaken AI narrative. The reversal of the yen carry trade was only a secondary factor that exacerbated the market’s risk aversion at that time.

The chaos in global markets last summer when the Bank of Japan raised interest rates is unlikely to be repeated this year

On the one hand, unlike last year, the current short-term financing cost of the Swiss franc is lower than that of the Japanese yen, and the Swiss National Bank may intervene in the foreign exchange market to promote the depreciation of the Swiss franc. Therefore, the Japanese yen is no longer the preferred financing currency for global carry trades, and the existing Japanese yen positions in carry trades may have gradually been taken over by the Swiss franc.

On the other hand, if previous experience still holds true, then even if the yen carry trade reverses again, the impact of the Bank of Japan’s potential interest rate hike on global market liquidity should not be too drastic.

In the context of policy differences between the U.S. and Japanese central banks, the U.S. factor is the core theme of U.S. dollar asset pricing.

For U.S. stocks, the market has been worried about the fragility of the AI narrative from time to time. Recently, the five-year CDS spreads of Oracle and CoreWeave have increased significantly. However, the CDS of most other leaders in the AI industry chain are still relatively stable. This shows that the market’s doubts about the AI bubble may be concentrated in a small number of companies with more radical business models, while companies with more stable financials can still gain the trust of the market.

In an environment where the Federal Reserve’s interest rate cut cycle has not yet ended, the overall financial risk of the AI industry chain may be relatively small, and the boom in industrial intelligence should continue to support the performance of leading U.S. stocks in the short to medium term.

For U.S. Treasuries, the Federal Reserve has a strong ability to stabilize employment during this risk-managed interest rate cut cycle. The resilience of U.S. economic fundamentals should continue to support real interest rates. Long-term U.S. bonds do not have good allocation value, while short-end U.S. bonds may benefit from the technical improvement of liquidity through reserve management purchase operations (RMP), so short-term bonds are better than longer bonds.