Author: Reya Labs, Medium; Compilation: White Water, Bit Chain Vision Realm

Launched Reya Network -the world’s first modular L2 to optimize the transaction optimization.

The network design creates the deepest liquidity, the best capital efficiency and the highest performance for DEFI traders and liquidity providers.

Why create Reya Network?

Reya Network is not another general L2.This is not another kind of hype.on the contrary,What we solve is the actual problem that cannot be solved by universal design in DEFI extensions.As the Defi OG team, we know what these problems are.The most important thing is that we have found methods to solve these problems.

The most important limit of DEFI expansion is the large -scale liquidity fragmentation that has appeared. Each new exchange based on common Rollup is competing for limited liquidity supply.

This has led to the shallow market of all exchanges and harmed the interests of traders and market participants.The general design has also inherited the problems such as the first operation and the harmful MEV, and there are performance restrictions due to the inability to perform parallel execution.

Reya Network has changed our way of thinking about expansion.We believe that the network does not need to be universal, but can be optimized for a single case.By focusing on a single case, we are not only limited to technological improvement, but also focus on financial logic and liquidity.therefore,Reya Network focuses on DEFI transactions and optimizes the three pillars of liquidity, capital efficiency and performance.

3 pillars of Reya Network

1. Liquidity

Capital invested in Reya Network is effectively used to support transactions through a novel passive liquidity pool mechanism.This design creates real -time sharing liquidity for all exchanges operating in Reya ecology, enhanced the depth of the market, reduced the threshold for market access, and enhanced the user’s trading experience.

But the benefits of liquidity are more than that.By incorporating financial logic into the network design, REYA acts as a clearing agreement across the exchange.This eliminates liquidity fragments and allows liquidity to organize as a network between exchanges.

As municipal merchants can freely share liquidity between exchanges, the growth of the ecosystem has enhanced the potential trading conditions of each exchange.In this way, we first created a “interoperable liquidity” flywheel in DEFI.

2. Capital efficiency

The margin engine logic is embedded in the REYA Network itself, which means that users have a margin account that can be used in multiple trading.In many ways, this created the first decentralized liquidation center.

Reya Network’s margin engine logic is the most advanced in the cryptocurrency field. It can provide traders with up to 3.5 times the capital efficiency improvement, and provide up to 6 times the capital efficiency improvement of LP.Any exchange on the REYA network will automatically inherit this logic as long as it runs on the network.

3. Performance

Performance improvement is crucial, so we make Reya Network faster as lightning.Reya Network’s block time is 100 milliseconds, and throughput is up to 30,000 trading per second, which is one of the fastest EVM Rollup.

In addition, the transaction is performed on the basis of “advanced first”, zero GAS fee, eliminating the first trading and harmful MEV.This function is constructed using the custom version of the Arbitrum ORBIT technology stack.Over time, more optimization will be made, including continuing to move the logic specific to the application to the network design itself.

The importance of performance cannot be underestimated -currently DEFI only accounts for less than 5%of all cryptocurrency transactions, partly because it cannot compete with the high performance and strong user experience of CEFI places.However, when performance improvement is combined with the fusion of modularity and underlying financial logic, we must start asking why we cannot finally capture the number of CEFI and make it the first chain.This will not only bring huge trading volume to Defi, but also greatly increase the transparency, stability and combinedability of all traders who join our Defi ecosystem.

Who supports Reya Network?

Reya Labs is the founder of Reya Network. It is operated by the Defi OG team. In the past, many successful startups have been launched, including Voltz Protocol. The company’s nominal transaction volume has increased to more than $ 30 billion in just 12 months.Essence

We have received the support of the most well -known people in the industry and raised nearly $ 10 million from venture capital companies such as Framework, Coinbase, and Wintermute.

In addition, we also get an incredible community support!Many of our community members have always completed the previous projects with us, and now help promote product development and accelerate the use of Reya Network.

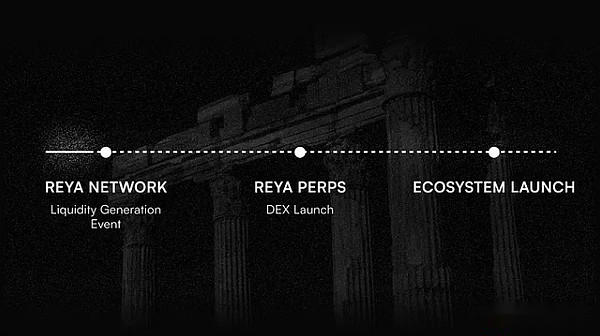

Future route map

Reya Network is a revolution in stages.

As a liquidity network, the first step in logical is to start the network through the flow of liquidity.This is why the liquidity generation activity (LGE) scheduled to be held in April on the route map is.For more details about LGE, please pay attention.

After LGE, we will prove the concept of Reya network through the deployment of permanent Dex Reya Exchange.Reya Exchange will become the first exchange on the network, and will also be used as a tool to attract more liquidity and traders, creating a strong network effect for subsequent exchanges.

Subsequently, Reya Network will open to other exchanges, and eventually become the foundation for the survival of the new generation of Defi.