ETH has been depressed for a long time, so I still have to give you a psychological massage.

One of the reasons for ETH’s long-term decline is that it is now in the stage of changing banks, and major Wall Street financial institutions are becoming new banks and gradually taking over the chips of the previous wild banks.

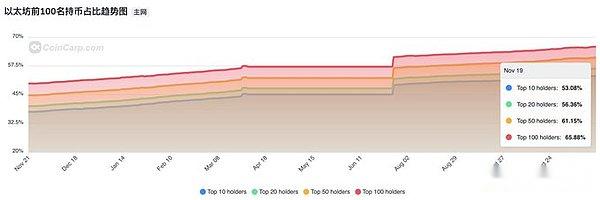

We can also obtain the following verification from the data: in the past year, the market share of the top 100 coin-holding addresses has been on the rise, and has now reached 66%, especially after the ETH ETF was approved for listing, there is a significantincrease.

This shows that the concentration of ETH is actually getting higher and higher.I have been buying the head address, but the price of ETH has not increased. What does it mean?

On the one hand, it shows that the dealer has been there and is continuing to absorb funds; on the other hand, it shows that there are a large number of turnovers in the market. Not only are retail investors losing chips, but this group of head addresses is also changing hands internally, that is, changing dealers.

You should know that ETH and BTC are the only two tokens with ETFs, and ETH has a very big advantage over BTC: staking income.

Once the ETF starts pledge income or even re-polization, the risk-free return of at least 3% per year is actually very good, especially compared with traditional financial products.

This is the potential of ETH that has not been released and the potential greatest benefit.

Naturally, traditional financial institutions will not let go of this cake and have a strong desire and motivation to become the new ETH banker.

However, ETH has been the main narrative in two rounds of bull and bear markets. There are naturally many long-term holders and the chips are relatively scattered. Therefore, the turnover time of this chip needs a relatively long time and it needs to be fully washed.

Therefore, it is necessary to suppress the ETH price for a long time and allow former long-term holders to lose their chips, such as popular SOLs for changing positions, so that the chips can be concentrated in the hands of new dealers.

Only after the new bank has enough funds will it be motivated to raise the ETH price.

This is a conspiracy.

Therefore, don’t throw away the truly valuable chips in your hands, namely BTC and ETH, and survive this long and painful wash-up to get the long-term benefits you really want.