Author: Ignas, encryption KOL; Compilation: 0xxz@bitchain Vision

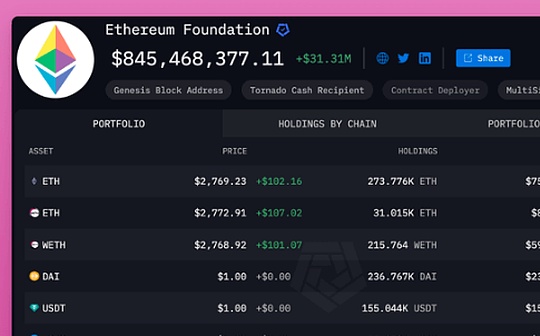

The Ethereum Foundation holds $845 million worth of ETH, accounting for 0.25% of the total ETH supply.

According to the latest report from the Ethereum Foundation, the Ethereum Foundation allocated $30 million in the fourth quarter of 2023, while in the third quarter of 2023, they allocated $8.9 million.

According to the latest report from the Ethereum Foundation, the Ethereum Foundation allocated $30 million in the fourth quarter of 2023, while in the third quarter of 2023, they allocated $8.9 million.

Here are some examples of spending:

-

Meetings around the world, “attract new Ethereum users through basic lectures and educate developers through technical conferences and workshops.” •

-

Online courses on core concepts and components of Zero Knowledge (ZK) systems.

-

“Email Wallet”, users can send cryptocurrencies via email without the need for recipient operations.

-

“Daimo” ERC-4337 Smart Contract Wallet: Stablecoins only, non-custodial, no seed phrases required.

The Ethereum Foundation seems to allocate grants for educational and niche (but cool) products that may not receive a lot of venture capital support.

This could explain why they are reluctant to fund DeFi protocols because they receive external funds from venture capital firms anyway.

However, there is a lack of a comprehensive and transparent total spending report.Who is auditing the Ethereum Foundation?

The latest report is for 2021, showing that the total expenditure on internal and external grants and bounties is $48 million.

The biggest expenses are:

• US$21 million for L1 research and development

• $9.7 million for community development, including grants and education

• US$5.1 million for internal operations (wage, legal fees, etc.)

Therefore, 10% of the total expenditure in 2021 is spent on paying developers’ salaries and supporting the maintenance of the Ethereum Foundation.

I must sayAlthough Polkadot faces controversy over its crazy spending, the report is at least transparent and can be found.

I kind of look forward to the Ethereum Foundation’s operations and reporting more transparently.

Just realized,The Ethereum Foundation’s latest spending is about $100 million a year, and it will run out of its ETH within 8 years.

They need to go up prices or start pledging to earn profits and provide funds for their operations for longer.