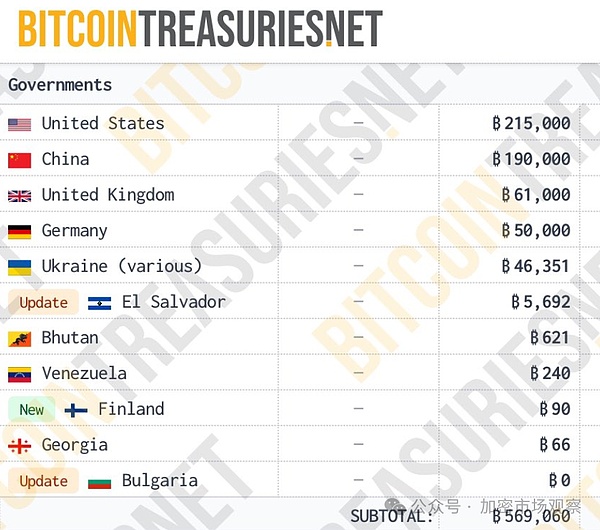

There has always been a saying in our crypto industry that is that governments in various countries have long held Bitcoin, of which the US government holds 215,000 Bitcoins and the Chinese government holds 190,000 Bitcoins.

The source of this statement is the largest case in the crypto industry that year, “PlusToken”,

In 2018, the PlustToken platform quietly spread in the currency circle. The platform used digital currency financial management as a packaging and tempted millions of people to participate with high profits.

According to Beijing Daily, in early 2019, the Yancheng Municipal Public Security Bureau set up a special task force to investigate the “Plus Token” platform.

In March 2020, the Ministry of Public Security deployed public security organs across the country to arrest all 82 core members suspected of pyramid scheme crimes.

In this case, the public security organs seized 190,000 Bitcoins, more than 27.24 million Yuzu coins, 830,000 Ethereum, etc. This case involves 9 digital currencies including Dogecoin, Bitcoin, Dash, Tether, etc..

A criminal lawyer said that after the platform is identified as a pyramid scheme organization, it is generally only held criminally responsible for the organizer and leader, which constitutes the crime of organizing and leading pyramid scheme activities.In judicial practice, other participants are generally not identified as criminal victims.

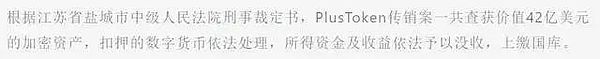

Therefore, after the relevant illegal gains are recovered, they will be confiscated according to law and will be handed over to the state treasury.

According to relevant media reports, this batch of digital currency assets is worth US$4.2 billion.

The 190,000 Bitcoins confiscated in this case are the source of the claim that the Chinese government holds 190,000 Bitcoins.

This batch of Bitcoin has been obtained today, and is worth US$12.7 billion per coin at 67,000 US dollars!

But if you think these 190,000 Bitcoins will be taken to this day, that may be too simple

Since 2020, Yancheng City’s fines and confiscation income has been dominating the list. A reporter once interviewed and called the relevant office of the Yancheng Finance Bureau to inquire about the reasons for the increase in fines and confiscation income.

Relevant staff said, “Traffic fines account for very little now, mainly because major economic cases have been cracked, such as fraud, so the public security has a large income from fines and confiscations.”

In addition, Wu said that after communicating with several OTC merchants, it was confirmed that the coins involved in Token Plus were sold a large part of the coins involved in the case between the end of 2019 and mid-2020 during the BTC$7000-$12000.The “earned funds and income will be confiscated according to law and handed over to the state treasury” in the judgment also confirms this statement to some extent.

At the end of 2020, after address tracking and analysis, there are also big Vs who believe that there seem to be 15,000 BTCs that have not been sold yet, and the address of 830,000 Ethereum has not changed.

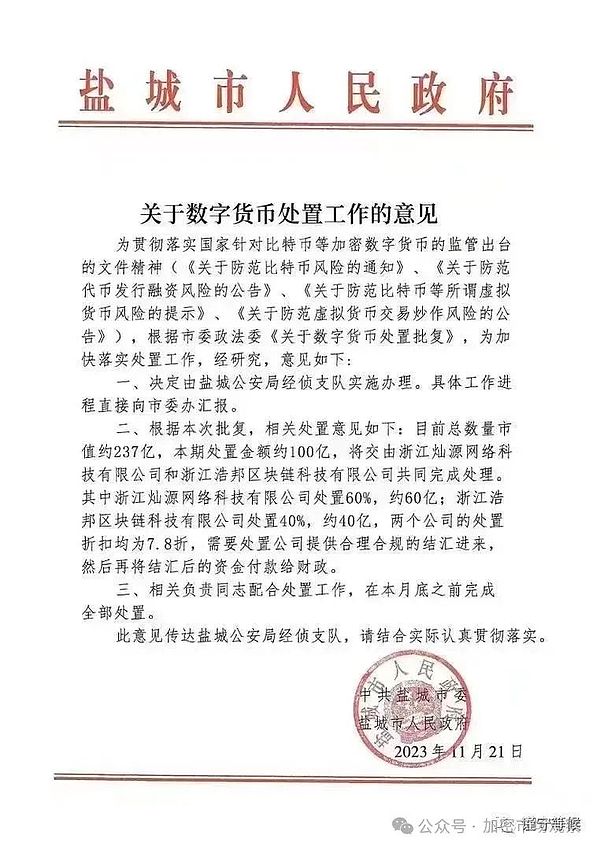

If this is the case, the approximately market value of the undisposed digital currency is more than US$3 billion, which is equivalent to the value of RMB 23.7 billion announced by Yancheng at the end of 2023.

If Yancheng really disposes of that batch of tokens, then there will be really not much left now…