Author: Jesse COGHLAN, Cointelegraph; Compilation: Five baht, Bit Chain Vision Realm

A bill that clarifies the role of American securities and commodity regulators in terms of supervision cryptocurrencies, before being delivered to the desk of President Biden, is moving towards an unknown future.

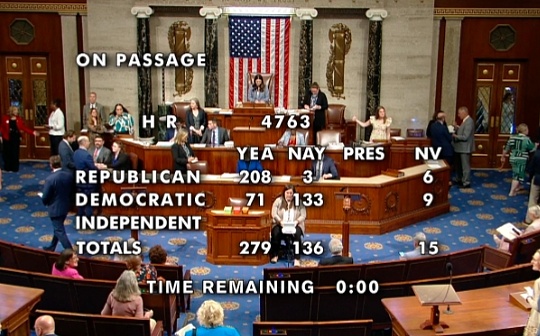

The Republican Party’s “21st Century Financial Innovation and Technical Act” (FIT21) (H.R. 4763) was approved in the House of Representatives on May 22 with 71 Democratic Democrats, 208 Republicans, and 136 opposition results.

It is unclear in the future of the Senate because there is no supporting bill and confronts Elizabeth Warren, one of the country’s largest cryptocurrency critics.However, the same Senate passed a resolution last week calling for the abolition of restrictions on banks and cryptocurrency companies to carry out business.

The House of Representatives’ final voting for FIT21.Source: American House of Representatives

The Senate consisting of 100 members considering that FIT21 may take a few months to consider that FIT21 may take a few months -there is no time limit for when the senators must take action.

Even if they do this, the bill may be assigned to a committee for several possible rounds of trials and hearing.If it can pass, then most people (51 senators) must vote in favor to pass.

Some of the contents of FIT21 may change, and members of the House of Representatives and Senate will hold a meeting to eliminate any differences in their respective versions.The bill will then return to the House of Representatives and the Senate for final approval.

President Biden will sign or reject Fit21 for 10 days.However, his government stated on May 22 that he opposed the passage of the bill, but did not indicate that he would veto the bill.

Even if Biden rejected FIT21, the two courtyards of the Republic of China can even pass the two houses by most of the votes, thereby overturning his decision.

Industry cheers pass

SEC Chairman Gary Gensler publicly opposed FIT21 on May 22, saying it caused “new regulatory gap” and threatened the stability of the capital market.Many people think that it is passed in the House of Representatives as an early victory of cryptocurrencies.

COINBASE CEO Brian Armstrong described the passage of the bill and the support of 71 Democrats as the victory of “comprehensive victory” and “clear cryptocurrency rules”.

“Jake Chervinsky) said:” A large number of Democrats voted for the current SEC to vote for the current SEC. “

Source: Jake Chervinsky

However, Gabriel Shapiro, a lawyer focusing on cryptocurrency, splashed a pot of cold water on the celebration. He argued on X that FIT21 would still give SEC “huge power”.

“It provides a dual regulatory system, which is managed separately by SEC and CFTC,” he added.”It achieves this by giving unprecedented power to the Commodity Futures Trading Council -the supervision right of the spot commodity market.”

FIT21 has largely handed over the control of cryptocurrencies to the Commodity Futures Trading Commission, which is regarded by the industry as a more relaxed regulatory agency than securities regulatory agencies.

However, the US Securities and Exchange Commission will have supervision rights for cryptocurrencies with insufficient centralization, but FIT21 will also create a way to sell as a commodity for cryptocurrencies.