Author: Mario Laul, Placeholder Researcher Source: Placeholder Translation: Good Ouba, Bit Chain Vision Realm

The decentralized public blockchain network has existed for about 15 years, and related crypto assets are currently undergoing the fourth main market cycle.Over the years, especially since the launch of Ethereum in 2015, people have spent a lot of time and resources to conduct theoretical research and development applications on these networks.Although impressive progress has been made in terms of financial use cases, other types of applications have been struggling. This is mainly due to the restrictions of fragmented by decentralization and fragmented by different ecosystems and standards.The complexity of seamless user experience.However, the latest technological progress inside and outside the blockchain industry not only makes more widely used applications more feasible.

The early adoption of the blockchain was driven by the very narrow definition of its core function:Realize the safety distribution and tracking of digital value without relying on centralized intermediaries such as traditional finance or government institutions.Whether we talk about the chain of the blockchain’s native alternative tokens (such as BTC and ETH), chain assets (such as national currency and traditional securities), it represents art, in -game items or any other types ofFor digital products or collectibles, the blockchain will track these assets for digital products or collectibles, and allow anyone who has Internet connections to trade globally without touching concentrated financial tracks.Given the scale and importance of the financial sector, especially in the context of digital development,

In this narrow framework, in addition to the classification accounts of basic assets and maintaining their decentralized network, there are currently five meaningful product market compliance blockchain applications: for the application of token applicationsApplications for procedures, applications for storing private keys and transfer tokens (wallets), apps used for transactions (including decentralized exchanges, also known as DEX), borrowing tokens applications, and token to tokensCompared with traditional legal currencies (stable currencies) have predictable values.As of writing this article, the popular cryptocurrency market data polymer Coingecto listed more than 13,000 separate crypto assets, with a total market value of about 2.5 trillion US dollars, and daily transactions exceeded 10 billion US dollars.Nearly half of the value is concentrated on a single asset BTC, and most of the other half is distributed in the top 500 assets.However, tokens are very long and growing, especially after the NFT is also included in it, showing how large the demand for blockchain as a digital asset classification.

Based on recent estimates,About 420 million people around the world hold cryptocurrencies, although many of them may never or rarely interact with decentralized applications.Leading hardware wallet manufacturer Ledger reported that its LEDger Live software per month is about 1.5 million active users, while popular software wallet providers Metamask and Phantom claimed that each monthly active users were about 30 million and 30.2 million.In addition, the daily DEX transaction volume is about 50-10 billion US dollars, the capital value of the capital locking on the borrowing market on the chain is about 30-30-30 billion US dollars, and the market value of about $ 130 billion in stable coins. These numbers represent the above five applications.The current level of adoption — is still low compared to traditional finance and fintech, but it is still important.It is true that these numbers should be viewed in the context of the recent surge in crypto assets, but as the blockchain becomes more and more legalized by supervision (the approval of the spot Bitcoin ETF and the customized regulatory framework of European MICA,Example worthy of attention), they may continue to attract new capital and users, especially in the context of increasingly integrated with traditional financial assets and institutions.

>

>

>

>

However, when it involves applications that can be constructed above the general programmable blockchain, tokens, wallets, DEX, lending and stablecoin are just the tip of the iceberg.One way to measure the situation of the blockchain is to use the blockchain not only as a enhanced asset classification ledger, but also a more common alternative to a centralized database and a network application platform. From the analysis, these five applications exclude these five applicationsEssenceIt is worth noting that according to the latest cryptocurrency developer report, the number of global developers is close to 30 million according to data from Electric Capital, and the number of active developers on public blockchain on public blockchain is still less than 25,000, of which only about 7,000Famous full -time developers.These numbers show that in terms of attracting developers, the blockchain is far from competing with traditional software platforms.However, the number of developers with at least 2 years of cryptocurrency experience has increased for five consecutive years. The industry has multiple ecosystems specific to the network. Each ecosystem has more than 1,000 contributors and attracts 90B+ venture capital.In the past 6-7 years.Although most of the funds are indeed used to build the underlying blockchain infrastructure and core decentralized finance (DEFI) services (the pillar of the economy on the emerging chain), people have also produced considerable interest effect on the use cases of core applicationsIt is non -financial, such as online identity, game, social network, supply chain, Internet of Things network and digital governance.How successful these types of applications are in the context of the most mature and widely used smart contract blockchain?

There are three main indicators that can be used as an agent for specific blockchain and applications: daily active addresses, daily transactions and daily payment fees.An important warning to explain these indicators is that they can be relatively easy to exaggerate, so they represent the most generous estimation of organic use.According to the data of the data polymer on the chain, in the past 12 months, 6 networks have performed well in all these three indicators (at least two of each network ranks among the top 6): BNB CHAIN,Ethereum, NEAR protocol, Polygon (POS), Solana and TRON network.Four of them (BNB, Ethereum, Polygon, TRON) are using a version (EVM) of the Ethereum virtual machine, which benefit from the extensive tools and network effects around Solidity (specially created for EVM).Near and Solana have their own execution environment, both are mainly based on Rust. Although more complicated, compared with Solidity, RUST has various performance and security advantages, as well as the booming ecosystem outside the blockchain industry.

>

>

>

All six on -the -chain activities on the six networks are mainly concentrated on the top 20 applications. In addition, daily active addresses (exaggerated agents of daily active users) will drop to thousands or even hundreds ofnetwork.As of March 2024, in the typical day, the top 20 applications accounted for 70-100%of all three indicators. Among them, TRON and Near concentrated the highest concentration, and Ethereum and Polygon concentrated the lowest.On all networks, the top 20 are mainly composed of applications related to the original of the original currency, wallet and core DEFI (transaction, lending, stable currency).Do not belong to these three applications.The bridge that is excluded between different blockchain and the market for transaction NFT (both should be included in the category of asset transfer and exchange). The remaining few abnormal values are usually games or social applications.However, in the case of five -sixths, these applications have a lower share in the entire network activity (less than 20%in the best situation of Polygon, but usually less than 10%).The only exception is Near, but its use is very concentrated. There are only two applications (KAI-Ching and SWEAT) that account for 75-80%of all activities on all chains, and the total number of applications with more than 1,000 daily active addresses is not the total number of applications.To 10.These applications have a lower share in the entire network activity (less than 20%in the best situation of Polygon, but usually less than 10%).The only exception is Near, but its use is very concentrated. There are only two applications (KAI-Ching and SWEAT) that account for 75-80%of all activities on all chains, and the total number of applications with more than 1,000 daily active addresses is not the total number of applications.To 10.These applications have a lower share in the entire network activity (less than 20%in the best situation of Polygon, but usually less than 10%).The only exception is Near, but its use is very concentrated. There are only two applications (KAI-Ching and SWEAT) that account for 75-80%of all activities on all chains, and the total number of applications with more than 1,000 daily active addresses is not the total number of applications.To 10.

>

>

All these reflect the early heritage of blockchain development and further consolidate its core value proposition as a digital asset ledger.The general criticism of lack of applications for blockchain is obviously unsure, because their main functions are the financial melting of programmable and secure settlement of tokens.Asset issuance, wallet, DEX (or more extensive exchanges), borrowing agreements and stable coins have such a strong product market, just because they are closely related to this purpose.Considering that these five blockchain’s relatively simple business logic and powerful positive feedback cycle, the first generation of the leading smart contract blockchain is often mainly dominated by applications that serve this narrow financial use case, which is not surprising.

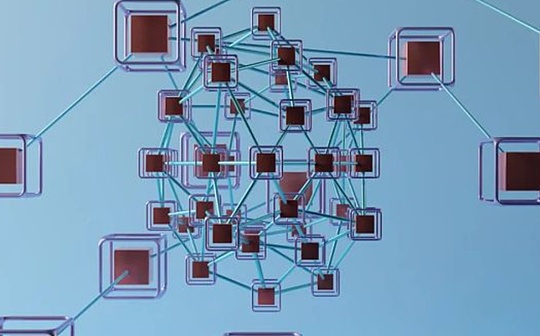

However, as far as the more ambitious vision of blockchain as a general application platform, where will the blockchain be placed?Over the years,The two biggest challenges faced by the encrypted industry are (1) Extended blockchain (in terms of throughput and cost), and (2) to achieve a relaxed user experience without sacrificing the decentralization of the underlying infrastructure and security guaranteeEssenceIn the context of extension, more integrated and modular Solana is usually used as examples of the former, while Ethereum and its continuous development of the second -level network (summary) ecosystem specific to applications are displayed.the latter.In fact, these two methods do not exclude each other, and there are considerable overlapping and fascinating pollination between them.But the more important point is that it depends on whether the discussed applications need to share the status and maximum combination of other applications, or do not care about seamless interoperability, and at the same time obtain a lot ofBoth have now obtained the option to prove the expansion of the blockchain.

In terms of the ultimate user experience of improving blockchain applications, it is also making significant progress.Specifically,Thanks to account abstraction, chain abstraction, proof aggregation, light client verification and other technologies, there are now methods to securely clear some major user experience obstacles that have troubled cryptocurrencies over the years: must store personal help words, require specific networks that are specific to the InternetTokens to pay transaction costs, limited account recovery options, and excessive dependence on third -party data providers, especially in the case of navigation between multiple independent blockchains.Combined with the growing decentralized data storage, verified chain computing, and other back -end services used to enhance application functions on the chain, the current and upcoming application development cycle will prove whether the blockchain will play its role as a role as a roleThe main role of global financial infrastructure, or serving the blockchain.As a more common thing.Given that a large number of cases other than DEFI will benefit from higher elasticity and data and transactions that are more user -centered, such as online identity and reputation, publishing, games, wireless and IoT networks (DEPIN), etc.Decentralization science (DESCI), and solving the authenticity of the digital content world generated by artificial intelligence, the latter is always eye -catching.Now it becomes feasible in practice.