A few days ago, I checked the Altlayer Air Investment Announcement that the address of pledged TIA and EIGENLAYER was eligible for air investment, but the details were not announced.

After studying Eigenlayer in the past two days, I found that it was still a very lively project, and I did not issue coins. Perhaps there were surprises in the future.

Altlayer pledged user airdrops for eigenlayer

What is eigenlayer?

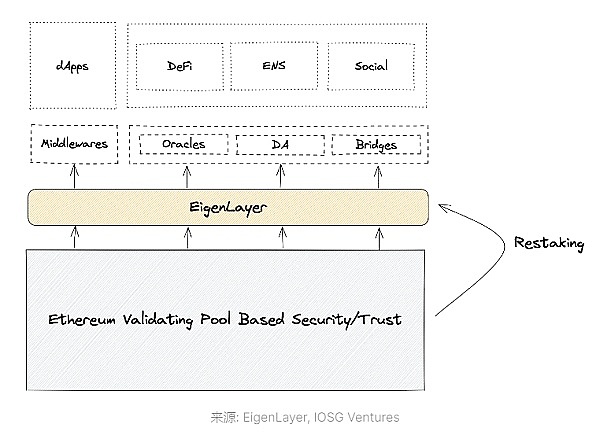

EIGENLAYER is an intermediate protocol based on Ethereum, introducing the concept of RESTAKE, so that Ethereum nodes can pledge their ETH or LSD tokens pledged into other agreements or services that require security and trust, so as to thus, therebyObtain dual benefits and governance rights.

Users who use the original pledge ETH or use the liquidity of tokens (LST) can join the EIGENLAYER smart contract to reintegrate its ETH or LST and extend the encrypted economic security to other applications on the network to get additional rewards.

With the help of Eigenlayer, Ethereum pledges can re -pledge their pledged ETH and obtain benefits.

For example, in the Lido pledge ETH and obtaining STETH, STETH can be re -pledged in the Eigenlayer protocol to obtain benefits; or the Rocket Pool Ether can be re -pledged to get additional benefits.

Utilizing the EIGENLAYER protocol, ETH can be reused, reducing the cost of the pledgee’s participation, and increasing the trust and protection of a single service. Using the collection security of ETH equity holders, creating a safe operation for innovation and market governance without licensed permits and market governance.environment.

Eigenlayer is a re -pledge agreement

How to participate in Eigenlayer pledge?

The EIGENLAYER main network was launched in June last year. Users can participate in two ways: Native Native Restaking and liquid RESTAKING.

Native pledge needs to run autonomous verification nodes. It has a high technical and funding threshold. It needs to be stored in 32ETH for verification and operating margin as a node.

Link wallets, create EIGENPOD, and save them in real time after being deposited into ETH.

The liquidity is re -pledged, that is, the user can pledge the pledge on the equivalent ETH obtained by platforms such as LIDO, Rocket Pool Eth, and then pledged in the EIGENLAYER protocol.

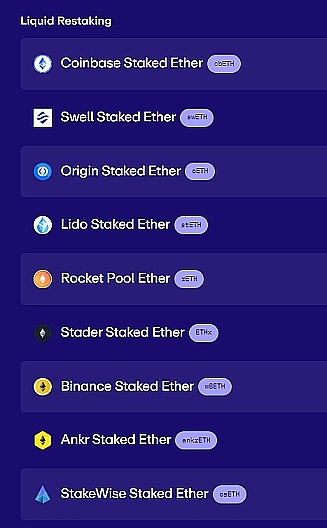

At present, Eigenlayer supports 9 liquid -liquid -derivatives such as LIDO STETH (STETH), Rocket Pool Eth (RETH) and Origin Staked Ether (OETH).

Eigenlayer supports 9 LSD

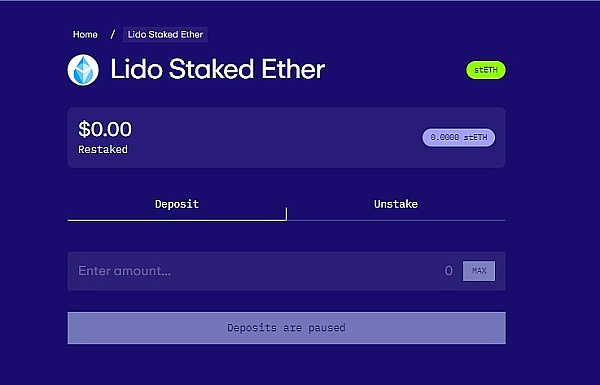

For example, pledge STETH, and click lido STETH on the official website app.eigenlayer.xyz, you can jump to the corresponding page pledge;

The STETH amount of the output and pledged pledge, click “Next” to complete the authorization (here it will be prompted to “customize the upper limit of expenditure”, the maximum selection) and confirm the two transactions, see the “deposit Successful” as a re -pledge success.

The EIGENLAYER protocol is the new exploration of Ethereum ecology.The first is to allow ETH pledges to pledge ETH and provide a security and trusted layer for other protocols; the second is to allow the new software modules in the ETH ecosystem to use the pledgee as a verification node to improve security and efficiency.

EIGENLAYER supports a variety of modules, such as consensus association, data availability layer, virtual machine, guardian network, prophet network, cross -chain bridge, threshold encryption scheme, and trusted execution environment.

The update of Ethereum is currently slowly advanced through a steady chain democratic governance method. Eigenlayer can allow innovation to quickly deploy it on the credible layer of Ethereum.Ethereum’s choice between rapid innovation and democratic governance.

Re -pledge agreement Eigenlayer

What is the future expectations of EIGENLAYER

Behind Eigenlayer is a young blockchain team with 30 members, more than 80% of which are engineers.

Eigenlayer has completed three rounds of financing, with a total of more than 64 million US dollars.

Among them, the latest A round financing was led by Blockchain Capital, and Coinbase Ventures, Polychain Capital, iOSG Ventures, etc. participated in the investment, with a valuation of up to 500 million US dollars.

EIGENLAYER is a new technical innovation agreement that reduces the threshold for project development and brings higher security and scalability to the Ethereum ecology.Security increases the value and influence of Ethereum.

The RESTAKING concept proposed for the first time has no competing products, and it is still in its infancy. There are fewer participants. This is also its future opportunity. From the perspective of the future prospects of financing and the track of the track, interactive users may have unexpected gains.

After ETF passed, BTC fell below $ 39,000

Of course, regarding the overall development of Ethereum ecology in the future, it is impossible to predict whether Ethereum will still become the mainstream in the next market cycle, and it is waiting for market verification.