Source: The DeFi Report; Compilation: Deng Tong, Bitchain Vision

We are experiencing (we think) a once-in-a-century structural change in world trade and global markets.

The changing world order

Now everyone is paying attention to the tariff issue.I understand, but we should not be distracted and we should not ignore the overall situation.Don’t forget,We are in the “fourth turning point” period – happening about every 80 years.

If you are not familiar with the “Fourth Turn”, Neil Howe and William Strauss define it as periods of turmoil and reconstruction that occur approximately every 80-90 years.During the fourth turning point, society enters an existential crisis, often catalyzed by war, revolution and other turbulent factors, during which old institutions are destroyed or fundamentally reshaped in response to perceived threats.

They tend to coincide with the end of a long-term debt cycle (which we are also experiencing).

This is the “cold winter” of history, and all aspects of life have undergone tremendous changes:

-

Social unrest

-

Political turmoil

-

Global monetary system reform

-

Economic and technological disruption

-

Cultural and moral reshaping

-

Geopolitical turmoil

In many ways, the “Fourth Turn” represents the reset of society, an era of destruction and rebirth.Historical examples include the American Revolution (1775), the Civil War (1861), and the Great Depression/World War II (1939).

The end of the “Fourth Turn” gave birth to the “First Turn”, optimism rekindled, and the new social order was consolidated.

Now, look around you.Look at how divisive the United States is.Look at inequality, class struggle, social war, the collapse of institutions in the United States and even globally, populism, geopolitical conflicts, the rise of cryptocurrencies and artificial intelligence such as Bitcoin.

You are going through the “fourth turn”.

Donald Trump is a byproduct of these potential conditions.He happens to be the product of the “fourth turning point”—a period when voters tend to elect “strongman” leaders to meet today’s challenges.

I share this because I believe you need to have the right perspective to see clearly what is happening today.If you don’t study history, you don’t have a point of reference to understand what we are going through.

We recommend you to read Ray Dalio’s “The Changeable World Order”, another great resource on this topic.

So in this context, Trump’s tariffs make sense, right?

About those tariffs…

Tariffs are not (real) tariffs

These tariffs seem unreasonable on the surface.Of course, the Trump administration will defend them in the media and launch the following debate:

-

Let manufacturing return to the United States

-

Treat Americans fairly

-

Reshape the middle class

Some statements are indeed correct.We know that the central U.S. has suffered a heavy blow over the past few decades as manufacturing shifts to China.But this still cannot explain the statement “Liberation Day”.Because the word “liberation day” itself is meaningless.

I don’t want to go into detail because I think everyone understands that the free market works better than a market that is distorted by government intervention.

So, what exactly happened?

We analyzed the tariffs Trump imposed on China during his first term, hoping to find some clues to explain all of this.As a result, we found a key clue and concluded from this:The tariffs imposed on other countries on “Liberation Day” are intended to put pressure on China.

What is this clue?

From 2018 to 2019, after the United States raised tariffs on Chinese goods, China actively turned exports to other markets and conducted them through third-party countries.Not only did Chinese companies lose sales, they found other buyers.For example, exports to the EU and ASEAN countries (Cambodia, Malaysia, Singapore, Thailand, Vietnam) have increased, making up for the losses in exports to the United States.By the early 2020s, China’s exports to the EU ($580 billion) exceeded those to the United States ($440 billion), a trend that began to accelerate after the United States imposed tariffs on China from 2018 to 2019.Many Chinese manufacturers also transport products through neighboring countries to circumvent U.S. tariffs.

A Harvard Business School study found that between 2017 and 2022, Vietnam made up nearly half of China’s losses in the U.S. import market (from $42 billion to $109 billion), while Vietnam’s imports from China climbed – a sign that Chinese products are being transferred through Vietnam.Similar patterns have been observed in Taiwan and Mexico.

In short, Chinese goods can arrive indirectly in the United States.In fact, China’s own statistics show that its exports to the United States have hardly dropped, while U.S. data shows that it has dropped sharply.

Data differences show that there is an “import gap” of more than $150 billion between China’s claimed exports and the United States’ claimed imports, which means that a large number of Chinese export products have been diverted or mislabeled.

Who benefits the most from it?Vietnam, Taiwan, Malaysia, Cambodia, Thailand, Mexico and Europe and other countries.

Who will be the biggest blow to the additional tariffs on April 2?

Cambodia (49%), Vietnam (46%), Thailand (36%), Taiwan (32%) and the EU (20%).

Have you begun to understand something?

We believe thatTrump does not really want to earn income by imposing tariffs on these countries.He wanted to force these countries into desperate situations and use tariffs as bargaining chips.We believe that the purpose of Trump’s move is to inspire these countries to keep Chinese products out through negotiations.In return, we speculate that he may provide lower tariffs, increased trade with the United States, and security.

We think Mexico and Canada may have agreed to keep Chinese products out.Why?Because neither of these countries are on the “Liberation Day” list.We also believe that Trump preemptively is strategically a message to other countries: if he can attack neighbors, no one will be spared.

It should be clear that we have no internal information about this and do not agree with this strategy.This is just a conclusion we draw after studying past tariffs on China and questioning the motivation for imposing reciprocal tariffs on all other countries.Our goal is to find signals among many arguments and play games based on incentive mechanisms.We think this is a showdown between the United States and China.

As Charlie Munger once said, “Give me some motivation and I can tell you the result.”The United States has a motive to impose tariffs on Vietnam (and other countries) in order to exclude China from these markets and to divert supply chains away from China.

Scott Besent

We think Scott Besent is the main designer of the program (and the one who convinced Trump to suspend 90 days to save the bond market).Yes, the man who had been involved in the overthrowing of the Bank of England may be trying to make China surrender now.

Bescent often makes remarks such as “China is the most imbalanced economy in world history” (referring to China’s trade surplus).If you’ve seen him interviewed by Tucker Carlson, you’ll find that almost all his comments are a foregone conclusion.We think he sees an opportunity to completely change China’s trade imbalances—and he deeply understands the leverage behind it all.For example, consider that the People’s Bank of China absorbs US dollars from exports and uses them to manipulate the RMB (to lower the export price).

We believe there is a bigger game in this.Remember, this is a macro perspective about the ever-changing world order.

What’s next?

negotiation.We believe the Trump team will seek to negotiate with all countries except China.

The market rebounded strongly on Wednesday after announcing a 90-day moratorium.It is worth noting that crypto assets rebounded weaker than stocks.

We currently see this as a bear market rebound.It is normal to have a callback of about 50% after a large sell-off.If the S&P index remains at 5,550 points and the Nasdaq remains at 17,600 points, we will reassess.

But the “biggest” opponent is China.We don’t think there will be any negotiations here.Trump doesn’t want to negotiate.He wants to win support from other countries on the Liberation Day list and then work hard to move the supply chain from China.This is a power struggle.This has nothing to do with tariffs or “fairness”.

If the United States reaches an agreement with countries such as Vietnam to keep China out, we should expect China to take more than reciprocal tariffs.

It should be clear that we believe that the market will regard the initial agreement statement as good news.But China’s counterattack may clear the market, as the market gradually realizes that the trade war may trigger a capital war, or even a fever war.Remember, we now have a 90-day trade suspension.But there is currently no solution that allows investors and business owners to plan the future with greater confidence.In fact, the opposite is happening as Trump once again raises China’s tariffs to 145%.

Now we see this report:

Bitcoin and risky assets

Looking ahead, the market environment of Bitcoin is beginning to improve.We recently allocated about 15% of our funds to BTC (entry price of $77,000) and allocated a small number of TIA (entry price of $2.34) as long-term holding.

Despite the uncertainty of the market, what makes us more optimistic about Bitcoin?

Given the market volatility, we believe that the time for improvement in liquidity conditions is approaching:

-

Inflation rate is 1.4% (according to Truflation data)

-

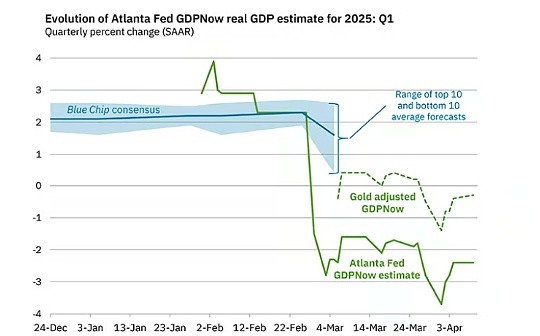

Economic growth is slowing down.We believe tariffs will accelerate this process.Meanwhile, the Atlanta Fed expects GDP to shrink by 2.4% in the first quarter.

-

The likelihood of a recession is quite high (we think it’s over 50%).We may have fallen into recession, according to the Federal Reserve Bank of Atlanta.

-

The Treasury needs to refinance $2.5 trillion in debt by the end of the year and issue another $2 trillion (to cover the deficit), and more will be issued in 2026.

-

The dollar fell sharply (to $100).

In addition, China has begun to stimulate the economy.We think there will be more stimulus in the future.As the yuan is under pressure and capital will flee China, we believe Bitcoin will usher in a buying (as it did when the Chinese yuan depreciated in 2015 and during the escalation of the trade war in 2019).

That being said, given the lack of certainty/resolution of Bitcoin’s volatility, tariffs and Chinese policies, and the recent close connection between Bitcoin and the stock market, we still tend to be cautious.

As far as momentum indicators are concerned, Bitcoin’s 50-day moving average fell below the 200-day moving average this week (“death cross”), and is currently trading below the crucial 200-day moving average.We are currently focusing on previous historical highs.If it falls below $70,000 ($70,000), a longer bear market will be further confirmed.Therefore, caution needs to be maintained.As things develop, we are also starting to see signs of weak sellers.We are paying close attention to this matter.

Below, we can observe how BTC performs after the “death cross”.

It is also important to consider that the Fed may be subject to certain restrictions in this regard.Bond yields rose again.If the Fed starts to relax policy, the long end of the yield curve may not be like this (as we saw last September).In this more stagflation environment, Bitcoin should perform well.But the challenge is that stocks (and altcoins) may not be the case.Given the correlation with the Nasdaq index and other risky assets, this could pose a resistance to Bitcoin in the near term.

in conclusion

-

We believe that on the ground of caution, we must focus on the overall situation.We believe we are in the early stages of a once-in-a-century event (in terms of its potential domino effect).If our judgment is correct, it will take time to solve the problem.Therefore, we want to be well prepared.certainly,We must weigh these views with the fact that if: 1) China sits at the negotiating table, 2) Trump retreats, 3) the court intervenes to prevent or lower tariffs, the situation may change rapidly.We just think that tensions and uncertainty may be further exacerbated in the short term.

-

We believe thatThe real game is to try to keep Chinese goods out of the door and prevent them from entering many key markets around the world.It is not clear whether the strategy will work.Our basic prediction is,China sees Trump’s actions as an opponent rather than a party seeking negotiations.We expect that the situation will escalate further.

-

Trump’s aggressive style is effective on many occasions.However, on this occasion, this may be a key flaw.Why?He can’t bully the bond market.The greater the pressure he puts on China, the greater the resistance from the long-term bond market.

-

Despite the 90-day pause, the market still has not found a long-term solution.In addition, considering the 145% tariff imposed on China, the revised tariff portfolio (10% on other products) is actually more harmful to consumers than the tariff portfolio implemented on April 2 (this is due to the quantity of goods imported from China).

-

If tensions with China escalate and economic conditions continue to deteriorate, we expect market prices to fall further and the Fed will take quantitative easing (or send a signal of quantitative easing).This will be a key catalyst for an aggressive return to risky assets such as Bitcoin.

We will continue to pay attention to the development of the situation.