Author: Chen Jian Jason, Source: Author Twitter@Jason_chen998

Recently, I have been too busy with the last time I owe everyone. I finally wrote freely.This round of prediction that the track track is really lively. The older brother LINK has done the first time the increase of 10 billion yuan in the market today, as well as the repeated “demon currency” TRB, and the cooperation with Flashbots last month to launch OEVThe solution has doubled three times UMA. This week, I cooperated with Polygon to solve@API3DAO through the release of ZK Layer2. This article focuses on what OEV is, why is it so important for the prophet and how to achieve API3 solutions.

The full name of OEV is the prediction machine to extract value Oracle Extractable Value, so it is a subset of MEV. MEV mainly achieves maximum extraction value by manipulating the sequence of blocks. In essence, artificial information is made to make money.OEVs in the field of prediction machine also have the same problems. After all, web3 has such a high -frequency trading market. The price is the most important cornerstone data of the transaction.I have always felt that Oracle’s original English meaning “God” is still very accurate. It really has the ability to “manipulate” the results as God’s hands. At present, the entire MEV field has generated net profit of $ 650 million.

OEV is the value of the prediction machine to use the upstream price of the transaction to grab the value that originally flows to the third party. Because the feding price of the prophecy needs to be submitted to the chainIn real time, the delay price difference will be generated in the middle. For example, the price of ETH assumes that there is a deviation of 1%. Now 1000U, the next update will be 990U or 1010U, but if the liquidation price of the user on a lending agreement is 1005U, then thenIt is too late to wait until the feding price of the prophecy machine, so in order to quickly sell the liquidation assets, the DEFI Agreement will usually provide huge liquidation bonuses, accounting for about 5%to 10%of the total amount.In the year, the liquidation of 2 billion U.S. dollars, more than 100 million US dollars as liquidation rewards, so both UMA and API3 hope to capture this part of the funds as much as possible and return it to the agreement and the user itself, and the API3 will also beTake the captured part of OEV to repurchase and destroy your own token to realize the positive feedback of the company’s empowerment to the currency price.

At present, API3 has access to 16 chains. It has cooperated with Polygon to launch a ZK Layer2 dedicated to OEV. Why should you send another chain as a service chain?

Here you need to extend a concept of concepts that are closely bound to the MEV. Order flow auction of OFA. It also resolves the MEV problem through the game mechanism to return the profit to users.Three parties go auction, and those with high prices can obtain the right to issue the transaction, so those who bid will evaluate the profit after obtaining the transaction to determine how much price, and a large part of the auction returns will be returned to users to compensate them to create creationValue.

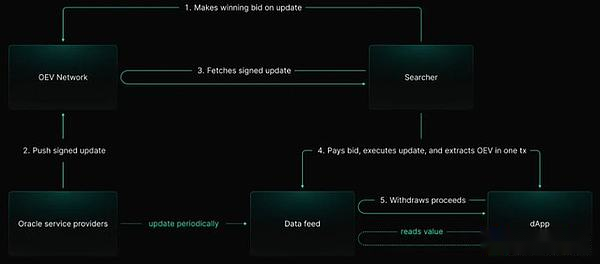

Therefore, the ZK Layer2 launched by API3 is a platform specializing in OFA to help use the API3 protocol to capture the value of OEV. API3 will give the highest bid for the power to update specific protocol data.The corresponding DAPP can immediately receive the income, so API3 has launched ZK Layer2 for this, and auctioned through ZK and chain to achieve efficient and timely and transparent and credible process throughout the process.

API3 completed 3 million US dollars in financing in 2020, including some old -fashioned institutions such as Placeholder, DCG, Hashed, etc., which sold a total of 10 million tokens, that is, the cost is 0.3, the lock is 2 years, and the linear release is 2 years.After the release is complete, it is basically full circulation, but please note that the API3 businessman is DWF. If you know all you know, judge yourself.