Author: Bradley Peak, CoinTelegraph; Compilation: Baishui, Bitchain Vision

1. What is reciprocal tariff?

Reciprocal tariffs sound like a trade term in textbooks, but their meaning is actually very simple: If a country imposes tariffs on your goods, you should take the same measures to fight back.It can be seen as a tit-for-tat strategy in global trade—a government can use this to say, “If you charge 20% of our exporters, we charge the same fee to your exporters.”

The roots of this concept can be traced back to the 1930s, when the United States passed the Reciprocal Trade Agreement Act.The goal at that time was to break trade barriers through mutual agreement rather than trade wars.But fast forward to today, the word makes a comeback—this time, it gets sharper.

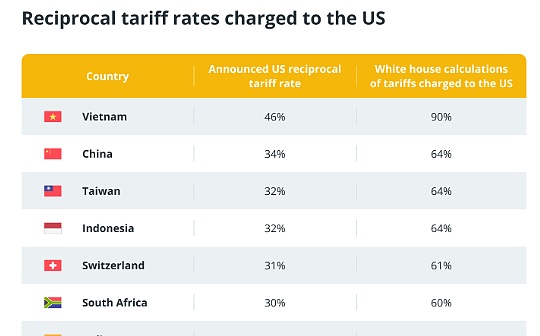

For example, in early 2025, in order to resolve what he believed was unfair trade behavior and a huge trade deficit, the U.S. government under President Donald Trump imposed a series of escalating tariffs on Chinese imported products.These tariffs were initially based on 10%, and after a continuous increase, the tariffs imposed on a variety of Chinese goods have reached an astonishing 145%.

China responded the same way, implementing its own series of reciprocity tariffs.Initially, Beijing imposed a 34% tariff on all U.S. imported products, which later increased to 84% and eventually reached 125%, targeting a variety of U.S. products, including agricultural products and machinery.

So, what does this have to do with encryption?You’ll get it—but first, let’s dig into how these tariffs actually work.

2. How do reciprocity tariffs work?

While the United States has recently adopted a formula based on trade imbalances to determine its tariff rates, other countries such as China tend to respond with their own set of tariffs that may not follow the same calculation method.

How the United States calculates tariffs

In 2025, the United States implemented a tariff strategy that calculates tax rates based on trade deficits with specific countries.The formula used is:

Tariff rate (%) = (US trade deficit with the country/US imports from the country) × 100/2

For example:

-

U.S. imports from China: $438.9 billion

-

US exports to China: US$147 billion

-

Trade deficit: US$291.9 billion

-

Deficit ratio: (USD 291.9 billion ÷ USD 438.9 billion) × 100 ≈ 66.5%

-

Tariff rate: 66.5%÷2≈33.25%

This practice led to the U.S. imposing a 34% tariff on Chinese imported products in April 2025.In addition, these new tariffs will not replace the old tariffs, but will be levied on their basis.So if a product already has a 20% tariff and now has a 34% reciprocal tariff, then the importer suddenly has to pay a 54% tariff.This jumping price increase will quickly lead to a sharp increase in the prices of foreign goods.

How China responds

When the U.S. imposes tariffs, China tends to retaliate against industries that are politically and economically important to the U.S., especially those that may affect the key voter base.

Target industries:

-

agriculture:China frequently targets American agricultural products such as soybeans, pork and beef.For example, in 2018, China imposed a 25% tariff on U.S. soybeans, which had a significant impact on farmers in states such as Iowa, which has soybean cultivation as its main industry.

-

Aerospace:In 2025, China suspended imports of Boeing aircraft and stopped purchasing aircraft parts from American companies, affecting the US aerospace industry.

Implementation in stages

China usually implements tariffs in phases to facilitate strategic adjustments and negotiations:

-

In early 2025, China initially imposed a 34% tariff on all U.S. goods as the United States raised tariffs.Later, in response to the continuous escalation of U.S. tariffs, this proportion increased to 84%, and eventually reached 125%.

-

As a retaliation measure, China has also imposed a 10%-15% tariff on various agricultural products such as corn, soybeans, wheat, etc. in the United States.

The United States uses specific formulas to calculate tariffs, while China is more of a strategic retaliation aimed at exerting economic and political pressure rather than directly matching tariff rates.

did you know?Policy makers sometimes choose slightly higher numbers to deliver a stronger political message—especially when they want to be tough on trade issues or take a tough stance against a particular country.The unified “34%” sounds more decisive and cautious than “33.25%”.

3. The economic impact of reciprocity tariffs

Reciprocal tariffs have an impact on the global economy in a very realistic way.Other countries also felt aftershocks when the United States and China began to attack each other with import taxes.

Global trade slows down

At the beginning of 2025, there was a grim news coming from the World Trade Organization: Global trade is expected to grow by about 3%, but now it is hardly growing, just close to 0.2%.The WTO directly points out the US’s radical tariff strategy and its domino effect on other economies.As countries took their own measures to deal with it, the goods were stopped.Exports are reduced, imports are reduced, and there are many uncertainties.

Developing countries are squeezed

Smaller economies such as Cambodia and Laos that rely on exporting cheap goods to large markets such as the United States have been hit particularly hard.When tariffs rise, U.S. buyers will retreat.This means fewer factory orders, unemployment and shrinking income in places that are difficult to withstand the shock.

Domestic prices rise

Meanwhile, American consumers are beginning to feel the pressure.The imposition of tariffs on Chinese goods has made everything from electronics to basic household items more expensive.Even U.S. companies that rely on imported parts pay more and pass those costs on downstream companies.Inflation is already high, and this will only add fuel to the fire.

did you know?The International Monetary Fund predicts that the trade war may reduce global GDP growth from 3.3% in 2024 to 2.8% in 2025.

4. The impact of reciprocity tariffs on cryptocurrencies

When governments began to impose tariffs on each other, they sent out signals of unstable situations—and financial markets hated uncertainty.Stocks, bonds, and cryptocurrencies react when global trade flows are disturbed.

Market fluctuations

In early April 2025, when the U.S. announced a 50% tariff on Chinese imported products, the cryptocurrency market responded quickly.Bitcoin price fell to $74,500, and Ethereum fell by more than 20%.The sharp decline highlights the sensitivity of cryptocurrencies to macroeconomic changes and investor sentiment.

However, things began to stabilize after President Trump suspended most of the tariffs for 90 days.As of April 22, Bitcoin has rebounded to more than $92,000, reflecting the cryptocurrency market’s responsiveness to policy changes.

Mining

US Bitcoin miners face increased operating costs due to tariffs on imported mining equipment.Miners are currently facing higher capital expenditures as tariffs on necessary hardware from countries such as mainland China and Taiwan at up to 36%.

This is especially difficult for smaller businesses.Larger companies may be able to absorb additional costs or renegotiate supplier agreements – but what about small or medium-sized mining companies?They are the ones who are squeezed.As profit margins shrink, some businesses may be forced to close or relocate to tariff-free jurisdictions.

did you know?Due to tariffs on mining hardware made in China, U.S. Bitcoin miners faced a 22%-36% increase in equipment costs at the beginning of 2025, causing some miners to consider moving their businesses overseas.

Investment Trends

Economic uncertainty often prompts investors to find safe havens — and cryptocurrencies increasingly meet this requirement.When traditional markets become turbulent due to factors such as global tariff escalation, many investors turn to Bitcoin and other digital assets to hedge inflation, currency devaluation or geopolitical risks.

Institutional interest has also increased significantly.As governments participate in trade wars and raise costs of cross-border operations, cryptocurrencies are starting to look like a more stable long-term investment.For example, in the first quarter of 2025, some hedge funds and sovereign wealth tools began to allocate digital assets to cope with these global macro pressures.

The U.S. reportedly establishing a strategic cryptocurrency reserve (both holding both BTC and ETH) clearly shows that cryptocurrencies are no longer a marginal asset in the eyes of traditional finance or policy makers.

5. Strategic considerations for cryptocurrency stakeholders

For anyone in the cryptocurrency space – whether you’re building infrastructure, mining cryptocurrencies, or managing investor portfolios – these policy shifts are very real and very relevant.

diversification

If you are a miner or a hardware-dependent startup that relies on a supplier or country to provide equipment?This is a responsibility.Tariffs can soar overnight, cutting your profits drastically and forcing you to take an expensive solution.

Diversification of supply chains—whether by purchasing from neutral countries or investing in domestic alternatives—can mitigate the blow.

Understand the regulatory environment

Cryptocurrency companies can no longer turn a blind eye to policies.Tariffs, trade barriers, sanctions – these are all forces that affect the market.If you are engaged in mining, cross-border payments or even just hardware transportation, you need to pay close attention to the development of local and international trade.

At this time, having the support of legal and trade experts is no longer a luxury, but a tool of survival.

Rethinking the narrative

This is a unique opportunity to reposition cryptocurrencies.When traditional economic systems are hit by trade wars and retaliatory tariffs, the idea of decentralized, borderless financial alternatives begins to resonate on a whole new level.

Cryptocurrencies have long positioned themselves as a tool to hedge inflation and achieve financial freedom.This information is more important than ever before, amid the context of global protectionism and intensified economic differentiation.

Smart projects and investors will tend toward this narrative, growing in the storm rather than simply experiencing the storm.