Well-known short-seller James Chanos has officially closed out his 11-month hedging transaction between Strategy ($MSTR) and Bitcoin, which means that his high-profile short-selling operation on Bitcoin-related stocks and Strategy, the benchmark stock, has come to an end.

The closing of institutional short positions is a trend reversal signal, which may indicate that the darkest days for Bitcoin reserve companies are behind them..

In recent weeks, the ecosystem of Bitcoin reserve companies has been hit hard.

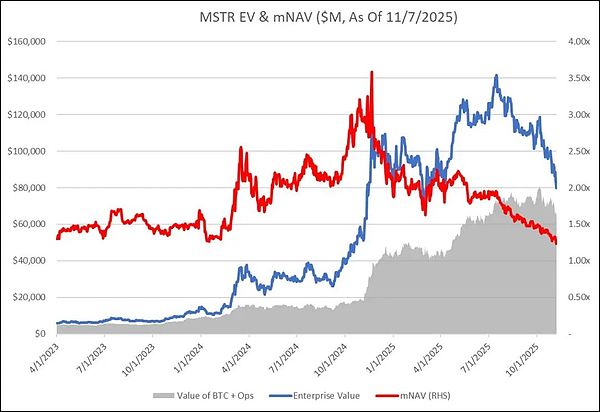

The stock prices of most related companies have fallen sharply from their highs earlier this year. Analysts have previously recommended that investors short stocks such as Strategy and solemnly warned that,A bubble has emerged in the Bitcoin reserve company space and could burst at any time without warning..

But just as the short-selling pressure reaches its peak, a turning point may be on the horizon.On Saturday, Pierre Rochard, CEO of The Bitcoin Bond Company and a senior expert in the field of cryptocurrency reserves, declared that the bear market for Bitcoin reserve companies is “gradually coming to an end.”

In his view, the liquidation of institutional short positions is one of the clearest signals in the industry, which means that the market wind direction may be changing:“The market is still expected to be volatile, but this signal is the key signal needed for a trend reversal.”

While this is far from cause for celebration, for investors who have long struggled with negative sentiment and troubled by adjusted net asset value (mNAV) issues, this hope is as precious as rain after a long drought.

James Chanos is the core figure among these short holders.The well-known investor has always been resistant to all assets related to Bitcoin.

This time he settled the hedging transaction between Strategy and Bitcoin that he had held for 11 months.Declaring the official end of his high-profile short selling against this “company’s benchmark company for hoarding Bitcoin”.

It is worth mentioning that the number of Bitcoins currently held by MicroStrategy has exceeded 640,000, and it continues to increase its holdings on dips.It operates as if its founder, Michael Saylor, has never heard of the concept of “risk management.”

Chanos confirmed this operation on the He posted: “In view of the fact that many people have come to inquire, I would like to confirm that the hedging transaction position between Maistri and Bitcoin was settled at the opening of yesterday.”

At the same time, institutional attitudes toward cryptocurrencies are quietly changing.Traditional financial giants have entered the game one after another. They are no longer naysayers;Becoming an industry stakeholder, market participant, and more importantly, a cryptocurrency reserve innovator.

JPMorgan Chase’s recent deployment in BlackRock’s spot Bitcoin exchange-traded products (ETF)-related business, as well as a series of custody and clearing cooperation agreements that have recently been intensively exposed, all show that corporate acceptance of Bitcoin is no longer a “wild and disorderly exploration”, but has gradually become a strategic decision at the corporate board level.

Whether it’s driving inflows into exchange-traded products, adjusting reserve yield strategies, or rating digital assets on par with real-world securities, the revolution is underway.

Of course, that doesn’t mean Bitcoin reserve companies will be free of volatility anytime soon.The uncertainty of the macro environment and the recurrence of regulatory policies are still the Sword of Damocles hanging over Bitcoin.

But the significance of the settlement of heavy short positions by well-known skeptics like Chanos is by no means as simple as a simple flow of funds.This is an important turning point in market psychology..

Both for Bitcoin price and the institutional narrative, the signals are clear:The darkest hour may be over, and the writers of the next chapter of the industry will no longer be the familiar faces of the past.