Author: Divine Grace

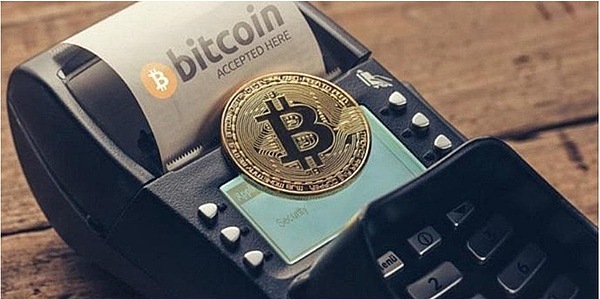

As soon as the retail giant takes action, the era of daily payments with cryptocurrency has officially arrived.

“Sir, would you like to pay with Bitcoin or Ethereum?” This may be a high-frequency line from a Walmart cashier in Detroit next year.On October 21st, CNBC revealed major news:Walmart, the world’s largest retailer, will accept cryptocurrency payments through its fintech subsidiary OnePay Cash.

This means that in the near future,U.S. consumers can directly use Bitcoin (BTC) and Ethereum (ETH) to shop at Walmart stores and online.

This is not a small experiment, but a key step in Walmart’s financial technology strategy.Unlike pioneers such as PayPal and Venmo, Walmart’s unique advantage lies in its150 million U.S. consumers reached weeklyand its vast physical retail network.

Three-layer layout: Walmart’s crypto payment strategic architecture

Traditional retail giants are venturing into cryptocurrencies. Instead of hastily accepting Bitcoin payments directly, Walmart has designed a sophisticatedThree-tier strategic architecture.

On the technical underpinnings, Walmart chose to partner with cryptocurrency infrastructure startup Zerohash.Zerohash recently raised $104 million in funding from Morgan Stanley and other institutions to provide compliant crypto trading technology support for financial institutions.

This cooperation model ensures that Walmart operates within a compliance and security framework,Avoiding the high costs and risks of building a self-built blockchain technology platform.

The middle layer is OnePay, a fintech platform controlled by Walmart.This company, co-founded by Walmart and venture capital firm Ribbit Capital in 2021, has a clear goal – to create a “US version of super app“.

Currently, OnePay offers high-yield savings accounts, credit cards, debit cards, “buy now, pay later” loans and even wireless communication packages.The addition of encryption functions completes the key puzzle of its digital financial ecosystem..

The top floor is the retail scene of Wal-Mart.OnePay has been deeply integrated into Walmart’s offline and online checkout processes, which means that the encrypted payment function can be used as soon as it goes online.Direct access to Walmart’s 150 million weekly shoppers.

Payment Process: Seamless Conversion of Cryptocurrency to Shopping Cart

So, how do you use cryptocurrency to pay for actual purchases?The whole process is almostNo sense of the technical complexities of cryptocurrency.

According to the plan, users can directly purchase and hold Bitcoin and Ethereum within the OnePay application.At settlement, the system automatically converts the cryptocurrency into cash at the real-time exchange rate, and then completes the payment.

This means that consumers do not need to worry about currency price fluctuations, and Walmart as a merchant still receives U.S. dollars.Perfectly avoids the problem of value fluctuations of cryptocurrency as a means of payment.

This “front-end cryptocurrency, back-end legal currency” conversion model is similar to the USDC payment solution recently launched by Shopify.The difference is that Walmart has something that Shopify can’t matchAdvantages of offline stores.

For consumers, the entire experience will be completed in the familiar Walmart shopping environment without the need for additional equipment or complicated operations, truly realizing “Use coins for shopping, zero payment threshold“.

The Big Picture: Walmart’s Fintech Super App Dream

Walmart’s move is far more than just adding a payment method. Behind it is its grand vision of building a financial technology “super application.”

OnePay has ranked fifth in the “Free Financial Apps” list of the Apple App Store, ahead of traditional financial platforms such as JPMorgan Chase and Robinhood.The addition of encryption capabilities will further enhance its competitiveness.

Walmart’s ambition is to make OnePay the entrance to Americans’ daily financial lives.From savings and credit to telecom services and now crypto asset trading, Walmart isCopying WeChat’s super app model in China.

Once this ecological closed loop of “retail + finance + encryption” is formed, Walmart will not only profit from product sales, but also share the value cake of financial technology.According to analysts’ observations, this move may “Changing Walmart’s position in U.S. fintech“.

Going further, Wal-Mart may use this to build an independent banking system.Closed-loop financial ecology, starting from the payment link, it may expand to a wider range of financial services such as lending and asset management in the future.

Market Impact: A Watershed Event for Cryptocurrency Mainstreaming

Walmart’s entry is a watershed event in the transformation of cryptocurrencies from investment assets to payment tools.

As one of the world’s largest retailers, Walmart’s endorsement provides support for cryptocurrenciesStrong trust endorsement, which will prompt more consumers and merchants to pay attention to and accept cryptocurrency payments.

What’s more, Walmart’s move could sparkknock-on effects from competitors.Just like Amazon is actively exploring stablecoins after Shopify launched USDC payments, the competition for crypto payments in the retail industry has begun.

It is worth noting that this development is also consistent with changes in the regulatory attitude of the United States.With the U.S. government’s openness to new technologies after Trump’s election,Mainstream financial institutions have begun to enter the cryptocurrency space on a large scale.

Morgan Stanley has announced that it will offer crypto trading access to retail clients through its subsidiary E-Trade, which is part of a larger trend.

Challenges and Considerations: Realistic Obstacles Faced by Walmart

Despite the promising prospects, Walmart’s path to crypto payments still faces multiple challenges.

Regulatory compliance is the biggest uncertainty.Different jurisdictions have different regulatory policies for cryptocurrencies. How Walmart promotes the popularity of payments while ensuring compliance will test its legal and compliance capabilities.

User acceptance is another challenge.Despite increased awareness of cryptocurrencies, average consumers still have concerns about their security and ease of use.Walmart needs to lower the user threshold through market education and interface optimization.

also,Technical security and system stabilityIt cannot be ignored either.The irreversible nature of cryptocurrency transactions requires the system to have extremely high security and stability, and any loopholes may lead to significant losses.

Walmart seems to be aware of these challenges. Its choice to cooperate with regulated technology partner Zerohash and adopt a phased rollout strategy show its ability toA careful balance between innovation and risk.

The future is already here.Traditional financial institutions such as Morgan Stanley have begun to follow suit, allowing retail customers to trade cryptocurrencies.Zerohash received US$104 million in financing from Morgan Stanley and other institutions, which also shows thatWall Street is accelerating the deployment of encryption infrastructure.

Retail experts believe that if OnePay can successfully integrate crypto payments into the Walmart ecosystem, it could become a “US version of WeChat Pay“A strong competitor, from daily payments to international remittances, and may even expand to scenarios such as encrypted red envelopes and supply chain finance in the future.

Although regulation and user acceptance are still challenges, Walmart has pointed out the direction for the retail industry: the future does not belong to those traditional giants who refuse to change, but to those who know how to build “Scenario + Technology + Compliance“The pioneer of complete ecology.