Source: VanEck; Compilation: AIMan@Bitchain Vision

Digital asset treasury is developing rapidly, with the most common options being BTC and ETH.Initially, entities chose BTC because of their powerful store of value attributes created through monetary policy.The key to this policy structure is the predictable issuance of BTC, which leads to a limited total supply of BTC.Recently, DAT (Digital Assets Tank) focusing on Ethereum has emerged.These emerging DATs believe ETH is a better choice for operating a treasury of digital assets, as savvy companies can participate in some novel financial activities to accumulate ETH faster than BTC.

BTC treasury can increase its holdings by raising additional purchases, implementing complex option strategies, or lending BTC, while ETH treasury has greater flexibility.ETH DAT can copy BTC DAT’s financial strategy and pledge its ETH to obtain Ethereum network income and inflationary issuance.In addition, they can participate in DeFi to earn additional income.However, in the discussion,People ignore the differences in basic principles between Ethereum and Bitcoin.Ethereum may form an economic system that is more beneficial to its token holders than BTC.

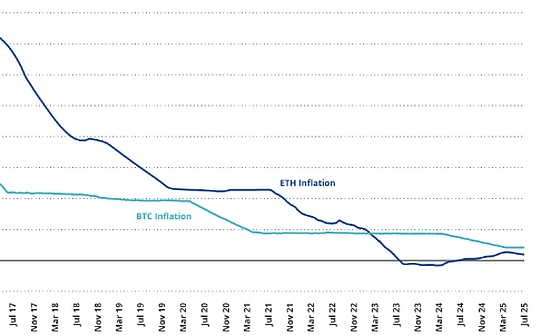

Ethereum celebrates its 10th birthday on July 30, 2025.Ethereum’s initial inflation rate is much higher than Bitcoin, at 14.4% and 9.3% respectively.However, Ethereum subsequently made two major economic policy adjustments, which brought its inflation rate below Bitcoin.

The first adjustment was EIP 1559, which was implemented in August 2021 and triggered the “destruction” of ETH’s underlying transaction fees.The consequence of this change is that the increase in Ethereum activity leads to a decrease in the total supply of ETH.

The second major policy change is Ethereum’s transition from Proof of Work (PoW) to Proof of Stake (PoS).The transition, known as the “merger,” took place in September 2022.The merger has reduced Ethereum’s inflation issuance from about 13,000 ETH/day to about 1,700 ETH/day, as it no longer needs to compensate miners who maintain their networks.

As a result, Ethereum’s inflation rate has been lower than BTC since March 8, 2023.sinceSince then, ETH supply has increased by only +0.2%, while BTC supply has increased by +3%..In fact, the combination of these two upgrades has led to a temporary reduction in Ethereum’s ETH supply.

From October 7, 2022 to April 4, 2024, the total supply of ETH decreased from about 120.6 million to about 120.1 million.During this period, an annualized inflation rate of -0.25% was achieved.Since then, due to the increase in Ethereum’s TPS transfer, the amount of ETH destroyed has decreased.The Ethereum network also accumulates an additional supply of +0.5%.At the same time, the supply of BTC increased by +1.1% during the same period.

Starting from March 8, 2023, ETH inflation rate is lower than BTCInflation rate

Source: Glassnode, as of July 31, 2025.

Source: Glassnode, as of July 31, 2025.

However, the superiority of ETH inflation policy may not last long.Bitcoin’s halving in April 2024 unsurprisingly reduced its inflation rate by -50%.at present,ETH has an annual inflation rate of +0.38% over the past year, while BTC has an annual inflation rate of +0.84%.In the next few halvings, BTC’s inflation rate will be close to + 0%.On the contrary, Ethereum’s inflation rate is difficult to predict, which may be as high as +0.5%, or it may be negative.Even if ETH’s current inflation trajectory remains the same,BTC inflation will not be lower than ETH until 2028.

One severely undervalued dynamic is the Bitcoin security budget issue.Bitcoin maintains inflation and issuance as an incentive for miners. If there is no inflation and issuance, it must rely on online transaction fees.Last year, miners made $278 million from transaction fees and $14.64 billion from network inflation.Obviously, if miners are not allowed to rely not only on transaction fees, their economic situation will have to be completely adjusted.As the halving occurs, the price of BTC must rise to bridge the gap in the reduction of network inflation to maintain the economic viability of miners.If this price trajectory does not appear, cybersecurity may have to adopt a different economic model.There are many potential solutions to this problem, and no change will have an ultimate impact on Bitcoin.But there will inevitably be winners and losers when adjusting monetary policy.

For example, one option to solve the security budget dilemma is that Bitcoin introduces inflation through a hard fork.Regardless of how it is implemented, it will undermine one of the community’s core criticisms of Ethereum, that Ethereum’s economic policies are too flexible.More importantly, it will allow Bitcoin holders to bear taxes that benefit miners.These political and economic decisions are not zero-sum games, while miner-centered Bitcoin systems tend to be more inclined to the interests of miners than token holders.In a proof-of-stake system like Ethereum, token ownership determines which fork the verifier will follow, as the stake will be transferred to the verifier who chooses the priority fork.By contrast, Bitcoin’s fork selection rules are ultimately determined by miners and nodes that maintain network security.Identity, there is a huge conflict of interest, favoring those who want to sell Bitcoin to fund their operations.Ethereum, which adopts the Proof of Stake (PoS) mechanism, lacks this dynamic mechanism.

While there are inherent economic tradeoffs in every system, the series of tradeoffs of ETH are good for ETH holders, as they ultimately determine where the network is going.Although BTC holders do have an influence on the Bitcoin network, their impact on network development is far less than ETH holders’ influence on Ethereum.therefore,ETH may eventually prove to beA better asset than BTC.