Source: Kaiko Research; Compilation: Deng Tong, Bit Chain Vision

1. The road of BTC’s 100,000 US dollars

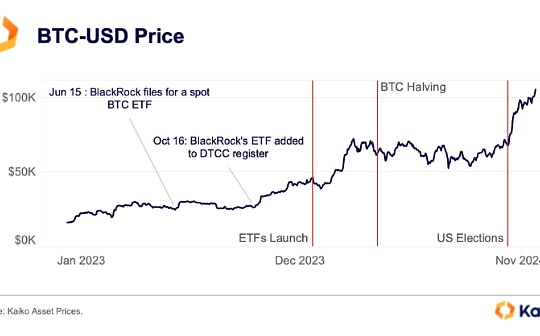

2024 is a successful year for Bitcoin.With the launch of the spot BTC Exchange Trading Fund in January, the market has gradually matured, and the fourth halves of the fourth time will be successfully proceeded.

Even several billions of dollars of liquidation and sales several times cannot prevent BTC from successful this year.The price of BTC priced at the dollar has risen by nearly 140%so far this year.Compared to other legal currencies (some of which have experienced a sharp depreciation in 2019), they have increased.

2. Stimulation of the United States election, watch the beta betting

The 2024 US election is of great significance to cryptocurrencies.Bitcoin or digital assets have never received so much attention on the world stage -at least not so positive attention.

President Trump expressed support for gradual supervision and public dialogue with the industry in the summer.Shortly after someone attempted to kill him, he even appeared at the Bitcoin Nashville Conference.Most people in the cryptocurrency community gathered around the Republican candidate and the final Democratic candidate Kamara Harris, and began to take some active measures around cryptocurrencies.

Prior to the November 5th election, Bitcoin appeared “Trump Trading Quotes” for market participants.A special election contract on Deribit attracted billions of dollars in transaction volume and unbound contracts before the election. Shortly after the election, it was bet on traders with a high historical high.They are right, and by November, BTC’s transaction volume has exceeded 75,000 US dollars.

The overall voting results of the Senate and the final voting results were widely believed to be beneficial to cryptocurrencies.As a result, BTC led the rise of crypto assets after the election, breaking through 80,000 US dollars on November 11.

As we shown above, the increasingly bullish mood has continued from the remaining time in November until December, and Bitcoin’s current historical high has exceeded $ 107,000.

3. Bitcoin’s fourth halving before the fourth time, the cost soared

The fourth halves of Bitcoin occurred on April 19 this year.On Saturday, the average trading cost of Bitcoin soared, reaching a record high of $ 146.This is obviously higher than the average cost of $ 3 on the day of Ethereum.

The historic surge in Bitcoin’s network costs may be the most important development in the fourth quarter.Despite signs of warning, it still surprised many market participants.

Ordinals founder Casey Rodamor announced that it plans to launch Runes, which is a protocol that can be replaced on Bitcoin on Bitcoin.However, according to the influence of Ordinals on transaction costs, users may have expected the rise in transaction costs, but historically rising still surprises many people.

Ordinals allows node operators to record data and images on the newly created Bitcoin blocks.These so -called “registration” is similar to NFT, which increases the demand for Bitcoin block space, and increases the cost of BTC miners.

The release of Runes is also performed in a similar way.The launch of the agreement has led to an increase in demand for block space, which will affect costs.

Fourth, Belide beyond the grayscale

The BTC ETF broke various records this year, and the total assets of 11 funds management rose to more than $ 100 billion.

Bellaide is a big winner, indicating that the main agencies are interested in Bitcoin and digital assets.Its spot BTC ETF manages the asset size of more than 55 billion US dollars, surpassing GBTC of GrayScale in a few months.GBTC was launched by digital asset management company GrayScale in 2013. It is a large -scale cryptocurrency priority product. The huge premium/discount of its net asset value means that the purchase of the institution is limited.Therefore, after the launch of ETF this year, it was quickly surpassed by Blackrol.

After the company decided to maintain the cost of 1.5%, GBTC was losing assets for most of this year.In the field of ETFs in the United States, companies are used to low costs. Therefore, most companies on Wall Street prefers Bellaide and Fidelity, not GBTC.

5. ETH/BTC ratio decreases

Since the merger, the ratio of ETH/BTC has continued to decline, and it has not shown signs of slowing down in 2024.This ratio compares the performance of two assets. When Ethereum performs inferior to Bitcoin, the ratio will decrease.

Other factors that lead to decline include the rise of Solana, because users have migrated to cheaper networks during the increase in speculative activities in March and the fourth quarter of this year.The MEME tokens (we will discuss it later) are many guess behind the scenes, and promote the transaction volume of Solana DEX sometimes surpassed Ethereum this year.

It fell to 0.033 in November, the lowest level since March 2021.What are the poor performance?Since the merger, ETH has faced huge pressure on supervision, because pledged in the United States has received close attention, causing SEC’s anger.

6. Slow start: ETH ETF launches

ETH ETF started slowly since its launch in July.Similar to the launch of the BTC ETF, Grayscale’s fund once again puts pressure on the market because digital asset management companies maintain the cost at 2%.

However, after the ETHE outflow of GrayScale decreased, the newly launched funds began to inflow at the end of 2024.Since the US election in November, the inflow of funds has increased significantly, and traders have also poured to CME ETH futures.This reflects similar activities that occurred during arbitrage transactions on the BTC futures in May and June.

ETH futures have not been closed, and the supervision prospects have changed, which has reversed the trend of ETH ETF. The net traffic turned to a positive value at the end of November and December.The net traffic since its launch has now exceeded $ 2 billion.Among them, more than $ 3 billion of funds flowed out of Ethe.

ETH will become one of the biggest winners of the Washington Special Administrative Regime.Although it lags behind Bitcoin this year, the change of regulatory transformation brought by the US government will benefit the second largest asset in market value.The clarification of ETH classification, goods or securities, and pledge may be the two main drivers for next year.

7. Microsterategy, which leads the trend, bought more BTC than ever before

In terms of buying BTC, Microslategy has gone through the busiest year so far.This business software company has transformed from its core business in many aspects this year.Michael Saylor, chairman and former CEO, even referred to his company the world’s first “Bitcoin Financial Company” in the third quarter performance report in November.

Since January, Microslategy has purchased more than 249,850 Bitcoin. Since the US election, the purchase speed has been accelerated. The holdings of the past month have almost doubled.The company has issued a number of convertible bonds to provide funds for its acquisition, which has aroused concerns from some market participants, that is, the plunge may have a adverse effect on the company, and may even be forced to sell.

At present, this strategy is playing a role.The rapid rise in the price of BTC and the bullishness of the market have caused the value of MSTR to soar to a record high.Since the breakdown of the Internet bubble in March 2000, MSTR has reached a new high for the first time in 24 years.

Although MicroStrategy is a pioneer for enterprises to buy Bitcoin, some Republican members want the US government to follow up.Senator Sima Lulis promised to establish a strategic Bitcoin reserve after winning the US presidential election in Donald Trump.

8. After the ETF is listed, the ALAMEDA gap has been narrowed

This year, the crypto market finally made the FTX collapse.The liquidity gap (or Alameda Gap) left after the closure of FTX and its sister company Alameda Research has been narrowed this year.

Driven by rising prices and the growing market share, the market depth of Bitcoin 1% this year is higher than the level of about $ 120 million before FTX.The recovery of Kraken, Coinbase and Lmax Digital is the most prominent.It is worth noting that the Bitcoin market centered on the institutional -centric LMAX market has reached a record of $ 27 million this week, which briefly exceeds BitStamp, becoming the third largest liquid Bitcoin market.

Nine, meme token fanatical

As mentioned above,The Meme tokens soared in different periods this year.Especially, due to the launch of Pump Dot Fun, the tokens on Solana have experienced significant growth. This is an agreement to launch the MEME tokens that allow anyone to issue tokens and start the establishment of word of mouth and participation from scratch.Lobricity.

However, familiar assets dominate the transaction volume of centralized exchanges to a large extent.Similar to the rise before 2021, the dog coins are favored by traders again -also due to the bullish mood after the election.After the President Donald Trump revealed that it was planned to set up the “Government Efficiency Department” (D.O.G.E.) led by Elon Musk and Vever Ramaswami, dog coins rose.

One of the new tokens launched on Solana this year is PNUT, which has attracted people’s imagination. It is inspired by Peanut the Squirrel (an influential New York pet). Its premature death has led to a large number of online support (And token issuance).

A trader even transformed PNUT’s $ 16 to $ 3 million in profit.PNUT currently trades on a number of large central exchanges, including Binance, Crypto.com and OKX.

10. Supervision caused changes in the stablecoin market market

Since June, European supervision has been reshaping the stable currency market.The Micro -Significant European Market Encrypted Assets Supervision (MICA) has triggered the wave of stable coins and product supply adjustments on the main exchanges.

Throughout 2024, the transaction volume of the euro against cryptocurrencies remained above the average level last year, indicating that demand continued to increase.Three months after Mica was promulgated, with the promotion of the rise of Mica’s alternatives, the stabilized currency market supported by the euro has undergone a major change.By November 2024, the euro -stabilized currency in MICA (including Circle’s EURC, EURCV of French Industrial Bank, and EURI of Banking Circle) had accounted for 91% of the market share.

After Binance was listed at the end of August, it has become the main participant in the euro -stabilized currency market, which is equivalent to Coinbase.Nevertheless, under the promotion of Circle’s Eurc, Coinbase is still the largest market, accounting for 47% of its share.

in conclusion

This year is an important year for the establishment of digital assets as feasible assets Wall Street investors.Time will tell us whether the industry can continue to grow in the next few months and years, but this rebound feels different.

The rebound in 2024 was built on the arrival of an old company with a risk framework (currently including BTC and ETH).With the change of regulatory and changes in market structure, it is expected that the rise in next year will surpass Bitcoin and expand to other assets.