Author: K2 Kai; Source: X, @kaikaibtc

This huge XPL liquidation staged on HyperLiquid is not an accident, because the previous JELLYJELLY incident is exactly the same. It is not a simple market fluctuation, but a blatant “liquidity hunting”.Precisely utilize the weaknesses of mechanisms, human nature and market structure.

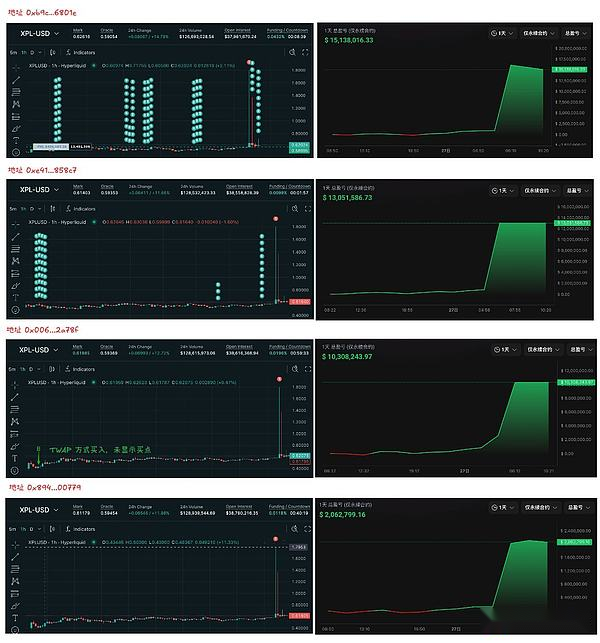

According to on-chain data monitoring, the core process of this event is as follows:

-

05:35 am: A giant whale with an address of 0xb9c…6801e suddenly invested a huge amount of USDC into HyperLiquid and opened a position with 3 times leverage to long XPL tokens.Its fierce buying momentum instantly swept the entire order book, causing the XPL price to begin to rise vertically.

-

05:36–05:37: Under the strong pull of the giant whale, the XPL price soared from nearly $0.6 to a peak of about $1.80 in just about 2 minutes, an increase of more than 200%.The sharp rise in prices triggered a large number of short positions, including the loss of about US$4.59 million from address 0xC2Cb and the loss of about US$2 million from address 0x64a4.

-

Make a profit quickly: When the price peaked, the giant whale quickly closed its position and locked in about $16 million in just one minute.At the same time, the other two collaborative giant whales also took profit at a high level.In the end, the three addresses made a combined profit of nearly $38 million.

-

Hold a position afterwards: It is worth noting that after completing the main profit operations, the giant whale still holds long positions of up to 15.2 million XPLs, with a market value of more than US$10.2 million, which shows that it may hope to continue to affect subsequent market trends.

A total of 4 main addresses participated in the $XPL hedging sniper, with a cumulative profit of US$46.1 million (Source: @ai_9684xtp)

Let’s take a look at how this targeted sniper was done?

Take advantage of liquidity disadvantages: The division of labor in the process is clear and the techniques are sophisticated.Data on the chain shows that at least 4 giant whale addresses participated in this sniping, sweeping away $46.1 million:

-

Take advantage of liquidity disadvantages: Why XPL?Because it is a pre-market contract, few people play with it, and the liquidity pool is as shallow as a small puddle.In this environment, the control of prices depends almost entirely on the amount of funds.The giant whale used three times the leverage to directly sweep the empty order, which took advantage of this structural asymmetry advantage and leveraged the entire market with a relatively small cost.

-

Creating chain reaction of bankruptcy: The price soared from $0.6 to $1.8, not by real money, but by the fact that the whales only used start-up funds and the real fuel were all short sellers.

I will explain this “death spiral” to you: the whale uses big orders to raise the price -> Your short order has exploded -> The system forces you to buy and close the position -> Your buy order further pushes up the price -> The next short position line has arrived… When the snowball rolls to the maximum, the giant whales calmly sell the chips to these passive buying positions at a high level, completing the harvest.

-

Highly coordinated combat: The flow of funds on the chain clearly reveals that this is not a single-soldier battle.At least four addresses appear in the source of funds, the rhythm of building positions, the movement of pulling the market and the rhythm of the outs and outs are like they come from training institutions one by one.

-

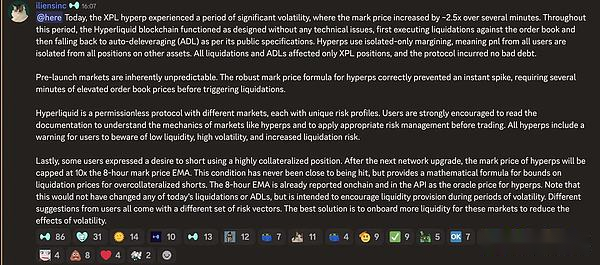

Amplified platform design defects: HyperLiquid’s internal pricing mechanism is not connected to an external oracle, which means that the price here is completely up to the people in the venue.It is precisely this that whales take advantage of it and “do whatever they want” in this shallow beach.What’s more ironic is that the JELLY JELLY incident a few months ago was the same recipe and the same taste.

JELLYJELLY Event Review

This XPL incident is not an isolated case.Just on March 26 this year, a similar JELLYJELLY token price manipulation occurred in HyperLiquid.At that time, a giant whale address first sold JELLY, causing a price plummeting, forcing the platform’s liquidity pool (HLP) to passively short.The address then quickly bought in the reverse direction, raising the price, causing the HLP treasury to lose nearly $12 million.Afterwards, HyperLiquid had to remove the transaction pair and compensate the damaged users.

Although the platform updated the leverage and liquidation mechanisms after the JELLYJELLY incident, the occurrence of the XPL incident shows that its system still has significant vulnerability when facing attacks launched by giant whales using funds and mechanism vulnerabilities.

Don’t want to be the next “meal on the plate”, please refer to the following articles

This XPL incident once again verifies a cruel reality:In a market with insufficient liquidity, retail investors are whales’ natural “opponent” and “fuel”.To avoid becoming victims of the next hunt, the following are crucial:

-

Don’t go to the “little pond” to play with sharks

Do not easily participate in pre-market contracts, new coins or small currencies leveraged trading.The water is shallow, there are few fish, and it is easy to start.If you have to participate, you must also regard it as a high-risk speculation. You can invest funds that can be reset to zero at any time. Do not have the fantasy of “grasping the big market”.

-

Leverage is the rope that hangs you

In this market, there is no difference between 2 times leverage and 20 times leverage, it is a matter of a moment.Always keep your position within the range where you can accept losses calmly, such as 5% of your total funds.Living is more important than anything else.

-

Beware of abnormal trading and capital flows

When you see a coin taking off vertically for no reason, the sell orders on the market are torn apart like paper. Don’t FOMO, run quickly!That is not the opportunity to get rich, it is the beginning of the massacre.A competent trader can pay attention to on-chain data (refer to on-chain data platforms Onchain Lens, Lookonchain, etc.), huge amounts of funds flow into specific platforms before attacking is a common red flag..

-

Don’t place bets in a casino with opaque rules

Before playing, spend five minutes to see if this platform has oracles and whether there is enough transaction depth.A good platform will find ways to protect you, rather than letting rules become a weapon for others to attack you.After the incident, HyperLiquid released an official statement, with only one sentence in the whole text saying “It has nothing to do with us, reflect on yourself.”

-

Don’t bet on a fantasy with your net worth

Whales make money from information gaps and rule loopholes, while many people lose money from fantasy of getting rich.Stop chasing those opportunities that do not belong to you, and focus on risk control, which is better than anything else.

One last sentence to remember:In this jungle, the most dangerous thing is never the rise and fall of prices, but the people who hide behind the rules and treat you as their prey.Don’t be prey.