Earlier this month, at the French EthCC conference, Vitalik Buterin made a warning view that seems a bit alarmist, “If Ethereum cannot truly achieve decentralization, it will face an existential crisis in the future.”

To this end, he proposed three key testing standards to measure whether a protocol has sustainable decentralization capabilities: Walk-Away Test, Insider Attack Test, and Trusted Base Test.

Among them, “exit test” is the most basic and important link, pointing to a core issue:If the project team is disbanded or the platform is lost, can users still safely withdraw assets and complete interactions?

What is “Exit Test”

In layman’s terms, the essence of exit testing is whether the project allows users to exit, withdraw assets, and interact on-chain when the development team is completely “lost”.

From this perspective, it is more like a bottom-up clause, not emphasizing the integrity of daily functions, but rather testing whether an agreement is truly “detrustworthy” under the most extreme conditions.

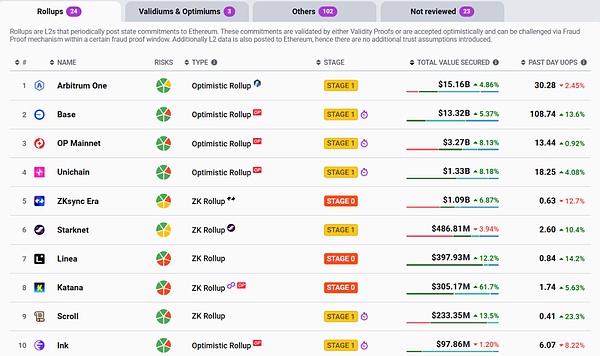

In fact, as early as 2022, Vitalik criticized most of Rollup’s Training Wheels architecture in his blog, bluntly saying that it relies on centralized operation and maintenance and manual intervention to ensure safety. Users who often use L2Beat should be very familiar with this. The homepage of its official website shows that there is a related key indicator – Stage:

This is an evaluation framework that divides Rollup into three decentralized stages, including“Stage 0” that relies entirely on centralized control, “Stage 1” that relies exclusively on limited dependencies and “Stage 2” that are fully decentralized.This also reflects Rollup’s reliance on assistive round manual intervention.

Source: L2Beat

One of the most core indicators in the evaluation stage isCan users complete the withdrawal of funds on their own without the cooperation of the operator?

This problem seems simple, but it is actually a fatal problem.

For example, for the current mainstream Rollups, although they have similar mechanism designs such as “escape pods”, a large number of projects still retain “upgradeable contracts” or even “super administrators” permissions. It seems to be an emergency design, but in fact it is also a window that may evolve into potential risks.

For example, the team can control the change address of the logical contract by signing multiple signs. Even if it is emphasized on the surface that it is not tampered with, as long as the backdoor exists, once malicious logic is injected into the upgrade contract, the user’s assets can be legally transferred.

This means that if user funds are frozen, it will be difficult to bypass the project party’s recovery, and the real exit test requires the complete elimination of dependency and intervention paths.Ensure that users can operate independently and control independently at any time. Even if the core team disappears or the platform suddenly closes, users must still have complete control and assets will not be locked or held hostage by third parties.

In short, exit testing is the touchstone to test whether a protocol can be truly decentralized. It is not only about anti-censorship capabilities, but whether users still have asset sovereignty when facing extreme situations.

The end of decentralization is “exit capability”

Why BTC and ETH are the first choice for new users and institutions to enter.

Because even without Satoshi Nakamoto and Vitalik, Bitcoin and Ethereum can still operate smoothly. Objectively speaking, for incremental users or institutional players, the most core Web3 entry decision consideration is nothing more than “Can I take my money at any time?”

Exit testing is the direct answer to this question. This is the “last mile” of blockchain’s decentralization.It is also a practical test of the concept of “Not your keys, not your coins”.

After all, if a user must rely on a certain front-end interface or a development team to withdraw assets or interact, then it is essentially a centralized trust relationship, and the real agreement to exit the test,Even if all nodes are offline and all operation personnel are running away, users can still use on-chain tools and third-party front-end to complete operations independently.

This is not only a technical issue, but also an implementation of the Web3 concept.

It is precisely because of this that Vitalik has repeatedly emphasized that many seemingly decentralized DeFi or L2 projects actually containCentralized channels such as upgrade keys, backdoor logic, and freezing mechanism.Once these mechanisms are abused, user assets will be completely controlled by others.

Exit testing is exactly what it takes to check whether these mechanisms exist and requires them to be completely stripped.This protocol is truly trustworthy only if the user’s exit path does not depend on either party.

“Exit Test”, decentralization moves towards reality

And if we understand it from a different perspective, we will actually find that although “exit testing” is the core evaluation standard for Ethereum, especially Rollup security design, it has been widely practiced in other fields of Web3:

Taking wallets as an example, as the core tool of asset management, they must have a high degree of security and transparency, which includes the randomness of mnemonics and private key generation (true random number generator), firmware secure open source and other key factors. Mainstream Web3 wallets (such as imToken, etc.) also almost all allow export of private keys/mnemonics, and users can easily migrate assets to any wallet software or hardware device.

It can be said that this is a natural “exit design”:Users do not need to trust the wallet company itself to control their funds forever.Let users no longer be just “experts” of Web3 product services, but the “owner” who truly possesses asset sovereignty.

From this perspective, the three core tests proposed by Vitalik this time are actually a complete closed loop:

-

Exit Test: Ensure that users can redeem themselves after the project is stopped.

-

Internal attack test: Whether the system can resist internal evil or coordinated attacks by developers.

-

Trusted computing base test: Whether the amount of code that users need to trust is small enough and whether it is auditable.

Together, these three tests constitute the decentralized “basic framework” for Ethereum’s long-term sustainable development, truly achieving “Don’t Trust, Verify”.

To put it bluntly, the Web3 world has no “trust” that requires trust, which is essentially derived from verifiability. Only through transparent mathematics and algorithms can users feel at ease at any time, and they don’t have to worry about external factors such as the moral integrity of the project team.

As Vitalik finally said:

“If we can’t do this, Ethereum will eventually become a memory of the times for a generation, like many things that were once briefly brilliant but eventually relegated to mediocrity, forgotten by history.”