Author: Tanay Ved, Source: CoinMetrics, Compiler: Shaw Bitcoin Vision

Key takeaways

-

Tokenized stocks are still in their infancy (market cap is less than $1 billion), but they represent a huge opportunity relative to the global equity market of approximately $145 trillion.

-

High-throughput, low-cost blockchain infrastructure, clearer securities guidance and the growing participation of fintech companies, exchanges and decentralized finance (DeFi) protocols are driving compliant issuance and adoption.

-

From native issuance and custody structures, to synthetic or derivative exposures, a variety of models are emerging in the equity tokenization space.

-

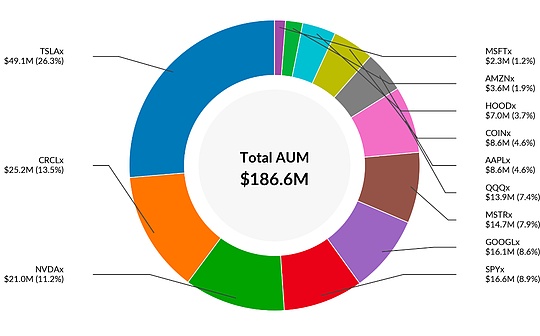

xStocks on Solana is still in its early stages, but has shown significant growth momentum, with assets under management (AUM) growing approximately 9x since launch to approximately $186 million, and the number of active wallets and transactions on the chain also increasing.

Introduction

Tokenization, the digital representation of real-world assets and securities on public blockchains, has become one of the most important structural trends in the convergence of traditional finance and cryptocurrencies.Although tokenization is still in its early stages of adoption, the idea of “tokenizing all assets” has gained significant momentum in 2025.What started out as putting the U.S. dollar on-chain has now expanded to move a variety of financial instruments onto the blockchain, spanning everything from currencies and commodities like gold to private credit and money market funds.

Source: CoinMetrics Real World Assets (RWA) Report

Equity tokenization is the next frontier in this multi-year shift.Programmability, 24/7 diverse access, composability, and instant settlement remain strong value propositions in attracting these assets to the blockchain.Increased regulatory transparency, coupled with the increasing maturity of blockchain infrastructure, is creating avenues for compliant and scalable equity issuance and circulation on-chain.

The recent acquisition of Backed (the issuer of xStocks) by Kraken, Robinhood’s launch of equity tokens in Europe, Galaxy’s tokenization of its Class A common stock, and ongoing regulatory discussions have all highlighted the momentum of bringing capital markets to the blockchain.

In this article, we will explore the current state of equity tokenization on-chain, outlining the current landscape, key players, and new approaches emerging in the market.Subsequently, we will focus on the hosting model behind Backed xStocks and its early application on Solana as revealed by on-chain data.

Tokenized Equities: Market Landscape, Growth Drivers, and Emerging Models

Tokenized equities remain a small but rapidly growing segment within the broader real-world asset (RWA) ecosystem.Current estimates put the market at about $500 million to $750 million, far smaller than stablecoins, money market funds and tokenized Treasury bonds.The current size of tokenized stocks is minuscule relative to the global stock market of approximately $145 trillion.Even a penetration rate of only 0.1% to 1% can translate into hundreds of billions or even more than trillions of dollars in potential on-chain stock value.

There are many factors driving the growth of this vertical:

-

Technology and infrastructure maturity: High-throughput, low-fee blockchains like Solana, Layer-2 rollups (L2), and scaling advancements on Ethereum now support near-instant, low-cost transfers.

-

regulatory clarity: Clearer guidelines around tokenized securities, disclosures and custody frameworks could reduce friction by facilitating the compliant issuance and trading of tokenized shares.

-

Integration and distribution: Integration and distribution through exchanges such as Kraken and Bybit, and composability with DeFi protocols and oracle infrastructure create the necessary building blocks for on-chain issuance, transferability, and utility (for use as collateral, earning yield, or providing liquidity).

Source: CoinMetrics Network Data Pro

Together, these developments form an emerging architecture: institutions that issue and underwrite financial products (such as BlackRock and Backed), infrastructure that provides product distribution and utility functions (exchanges, DeFi protocols, and oracle networks), and settlement channels that provide execution environments (Ethereum, Solana, and other Layer 2 networks).

Currently, issuance models range from fully collateralized issuances to synthetic or derivative exposures.The following table lists these modes:

Backed xStocks: Stock tokenization based on Solana

In June of this year, Backed Finance launched xStocks on the Solana network, listing more than 60 U.S. stocks and exchange-traded funds (ETFs), including Apple (AAPL), Nvidia (NVDA), Tesla (TSLA) and the S&P 500 Index Fund (SPY), in the form of freely transferable SPL tokens.Exchanges such as Kraken, Bybit, and Gate.io have also listed these assets, providing spot and futures trading for non-U.S. user groups around the world.Since its launch, xStocks’ assets under management (AUM) have grown more than 9 times to approximately $186 million.

Source: Coin Metrics Network Data Pro and Google Finance

xStocks operates on a fully collateralized escrow model.They are issued by Backed Assets (JE) Limited, a Jersey-based special purpose vehicle (SPV) owned by Switzerland-based Backed Finance AG.Each token is tied to a listed stock or ETF at a 1:1 ratio.Underlying shares are purchased through regulated brokers and held in segregated accounts with qualified custodians in Switzerland and the United States, ensuring that each token issuance is backed by an equal amount of collateral.

For example, this TSLAx fact sheet provides the information behind the tokenization of Tesla (TSLA) stock.Tesla currently has the highest AUM ($49 million), backed by 107,000 tokens.Corporate actions such as dividends and stock splits are reflected by rebalancing the token supply, allowing the token to continue to track its underlying asset.

Source: TSLAx Support Fact Sheet

Once xStocks are issued, they will operate similarly to other transferable on-chain assets.They can be transferred between wallets, settled almost instantly, and integrated directly into Solana’s DeFi ecosystem.This makes xStocks accessible 24/7, supports fractional ownership, and can be used in combination with lending markets, automated market makers, and trading platforms such as Kamino Finance, Raydium and Jupiter.

While still in its early stages, xStocks primarily serves international users who face barriers when accessing U.S. stocks, while also benefiting from on-chain transferability and settlement capabilities.

Application of xStocks on Solana

Having outlined the tokenized stock landscape and the workings behind xStocks, we now explore the use of tokenized stocks on exchanges and the Solana blockchain.

Exchange activity shows early liquidity formation.Spot and futures trading volumes remain low and concentrated on a few popular stock symbols, such as TSLAx, NVDAX and CRCLX, indicating that market participation is still dominated by retail investors and speculative activities.November futures trading volume exceeded $1.2 billion as investors positioned themselves around Nvidia and Tesla’s third-quarter earnings, coinciding with a spike in the VIX volatility index.

Source: CoinMetrics Market Data Feed

On-chain, the number of monthly active wallets interacting with xStock SPL grew significantly after launch, reaching approximately 175,000 in July and stabilizing between 80,000 and 100,000 in the fall.TSLA, NVDA, CRCL and SPY account for approximately 58% of the total number of active wallets, indicating that users are mainly concentrated on a few popular stocks.This reflects a shift in user behavior from initial exploration to continued on-chain usage, with wallets holding, transferring or deploying these assets to DeFi platforms.

Source: CoinMetrics Network Data Pro

Monthly transaction volumes show a similar pattern.After a surge in user registrations in early July, transaction volume returned to normal, remaining in the range of 400,000 to 700,000 transactions, and grew again in November.Calculated by the number of active wallets, this equates to approximately 6 to 10 transactions per wallet per month, indicating that xStocks is increasing in circulation frequency rather than being left idle for long periods of time.

Source: CoinMetrics Network Data Pro

Transfer volume data provides more context: Daily transfer volumes for the three largest xStock tickers (accounting for about 46% of active wallets) typically range from $10 million to $20 million, with cumulative transfer volume since September exceeding $650 million.

Conclusion

xStocks demonstrates how tokenized stocks can move from concept to reality when compliant issuance, technology maturity and infrastructure integration are aligned.Currently, the application of tokenized stocks is still in its infancy and concentrated in a few companies, but fully collateralized products, 24/7 on-chain settlement, and growing support for centralized exchanges (CEX) and DeFi all indicate the possible future direction of on-chain stock markets.

At the same time, significant obstacles remain in the field.Regulatory measures remain the biggest constraint, with tokenized shares falling squarely within the securities framework, which vary across jurisdictions.The maturity of the market structure is another constraint.Lack of liquidity, out-of-hours volatility, and limitations of tracker-based products all pose challenges to scaling.And, as with any on-chain asset, operational risks ranging from custody to smart contract reliability will impact participation.

xStocks shows an early look at what tokenized public market assets might look like in practice.It has gained early but growing traction, with growing demand for global market access, and future development dependent on regulatory clarity, deeper liquidity and more mature around-the-clock trading infrastructure.