Author: Tanay Ved, Source: Coin Metrics, Compiled by: Shaw Bitchain Vision

Key Points

-

Tokenized versions of ETH (such as WETH, LST, and LRT) enable ERC-20 compatibility, higher interoperability, and higher on-chain capital efficiency.

-

About 24% of ETH is staking through Lido, and stETH and its encapsulated form wstETH have become a widely used form of DeFi collateral and are often used in recycle strategies to improve returns.

-

The pricing and reward mechanisms of these tokens vary, some adopt a rebalancing design, while the packaged versions increase value as the exchange rate with ETH increases.

-

As these assets expand, monitoring validator queues, secondary market liquidity, and LST’s premium/discount on ETH will become very important in assessing redemption and liquidity risks.

Introduction

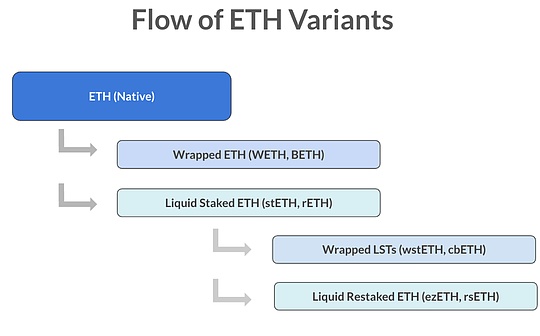

As the Layer-1 blockchain, Ethereum’s value proposition goes far beyond digital currencies.Its programmability enables assets to be utilized in a more efficient way, such as ensuring network security, acting as income and collateral assets in its on-chain ecosystem.To improve the usability and composability of ETH in these scenarios, various “variants” or tokenized versions of ETH came into being..

fromWrapped ETH that provides ERC-20 compatibility, to liquid staking tokens (LSTs) that provide staking income and transferable, and other token variants that provide additional income and utility.These tokenized ETH forms have become an important part of Ethereum infrastructure, unlocking interoperability and capital efficiency.But as they become more layered and intertwined in the ecosystem, they will have a significant impact on liquidity, anchoring stability and redemption dynamics.

In this report, we will dissect ETH tokenized versions and explain why they appear.Afterwards, we will focus on liquid staking tokens, analyze their pricing mechanisms, reward structures and utility, and evaluate liquidity status and risks affecting their stability.

Tokenized ETH Ecosystem

At present, Ethereum assets mainly come in the following forms:Native ETH, encapsulated ETH, liquid staking ETH (LST) and liquid restaking ETH (LRT).While these variants may increase complexity, they emerge to address previous restrictions, improve liquidity, composability, and acquire new earnings opportunities on the chain.

Different tokenization performance of ETH and its mutual relationship

Encapsulated ETH (WETH)

As a native token for Ethereum, ETH is crucial in paying transaction fees, compensating validators to ensure network security, and acting as a medium of exchange.But because it is incompatible with ERC-20, it has limited applications in early DeFi.This led to the birth of encapsulated ETH (WETH), an ERC-20 version of ETH.WETH quickly became a core component of decentralized exchanges, liquidity pools, and lending agreements such as Uniswap and Aave, where it acts as a core trading pair and collateral assets.By 2021, WETH’s supply will exceed 8 million, becoming the main tokenized form of ETH.

Liquid staking tokens (LST) and their encapsulated versions

Ethereum’s transition to the Proof of Stake (PoS) mechanism brings new opportunities.Prior to Shapella upgrade, the pledged ETH was locked on the beacon chain, which actually lacked liquidity.Lido’s liquid staking tokens (LSTs) such as stETH solve this problem by pledging verifiers on behalf of users and issuing transferable claims on pledged ETH.

They are able to accumulate returns while maintaining liquidity, which drives rapid adoption of lending agreements and liquidity pools.Packaged versions like wstETH convert Rebase tokens into fixed ERC-20 tokens that are more suitable for integration.LST and its encapsulated versions have replaced WETH and become the mainstream tokenized form of ETH.

Lido has about $10 billion in encapsulated staking ETH (wstETH) is locked in the DeFi lending protocol on the Ethereum main network, which highlights its role as a core collateral asset.In practice, users usually deposit LST to borrow ETH or stablecoins, and then recycle the proceeds to purchase more stETH through a “cycle” strategy, thereby amplifying the pledge income.It also supports the treasury of lending and re-pled, combining pledge rewards with collateral utility to improve capital efficiency.As demand for tokenized and earning assets continues to grow, as LST shows, they are likely to play a central role in the DeFi market.

The following table outlines the different versions of tokenized ETH:

Liquid staked tokens (LST)

Pricing and reward mechanisms

While all liquid staking tokens (LSTs) represent subscription rights for ETH, their transaction prices vary depending on their design and how the staking rewards are calculated.Rebase tokens such as Lido’s stETH, whose structure is designed to keep close to the price to ETH by increasing user balance over time.Encapsulated LSTs such as wstETH or Coinbase’s cbETH, whose design is compatible with the ERC-20 protocol, keep the balance fixed and increase value through the continuous increase in exchange rate with ETH.

As shown above, Lido’s stETH is close to the trading price of the underlying asset ETH, while wstETH and Coinbase’s cbETH have a premium.Packaged LSTs are also prone to price misalignment during market pressure, low liquidity or operational changes, which may affect market perception and cause premiums to decline as demand changes.

Price comparison between DEX and CEX

stETH can be traded on decentralized exchanges such as Curve and on centralized exchanges such as OKX, Bybit and Deribit.Prices are usually consistent, and arbitrage activity narrows the spread, but stressful events can lead to temporary market disconnection.During the May 2022 Terra/Luna crash, stETH on Curve fell to about 0.935 ETH (6.5% deviation), triggering chain liquidation and capital losses for institutions like Three Arrows Capital that have used stETH for a leverage cycle strategy.Since then, the dependence on a single trading platform has decreased, and the distribution of the price discovery mechanism between DEX and CEX is more balanced.

Redemption and liquidity

There are two main ways for stakeholders to redeem ETH: through Ethereum’s validator system, or through secondary centralized and decentralized exchange markets..The main redemption method is through Ethereum’s in-and-out queues that control the traffic that validators join and leave the network.These queues are controlled by churn limit, which means that only a fixed number of validators can enter or exit each cycle (epoch) (approximately 6.4 minutes).The queue length is expressed in the number of validators, ETH or time, which reflects both the pledge demand and the redemption pressure.

As stakers make profits after ETH rises and some cycle strategies are lifted, the number of ETHs in the exit queue has recently exceeded 900,000 ETHs (about 33,000 validators).As of September 8, the number of ETH in the exit queue has dropped to about 660,000 ETH (about 20,000 validators).During the same period, the number of ETHs entering the queue also exceeded 900,000, which shows that the demand for staking after Pectra was upgraded is strong and the average effective balance is higher.

How liquidity is LST?

Liquidity is an important factor in LST (and LRT) because users must rely on the secondary market for redemption., especially when the exit queue becomes longer.These redemptions are usually carried out through on-chain or off-chain trading venues where LST can be redeemed for ETH or WETH.These centralized exchanges (CEX) and decentralized exchanges (DEX) markets can achieve efficient arbitrage, but decoupling may occur more frequently when validators exit the queue becomes longer and have insufficient liquidity.

As mentioned above, the liquidity of LSTs like Lido’s stETH is more dispersed across platforms.Although most of stETH liquidity was initially concentrated in Curve’s stETH/ETH pool, it later gradually expanded to other DEXs and CEXs such as Balancer.The stETH-ETH spot markets on exchanges such as Deribit, Bybit and OKX have liquidity of approximately US$4.6 million, with a volatility of within ±2% of the mid-price (buy price $1.6 million / sell price $3 million).

in conclusion

From encapsulated tokens to liquid staking tokens,Various tokenized versions of ETH are now at the heart of Ethereum infrastructure and have also gained widespread attention in PoS ecosystems such as Solana.Encapsulated tokens solved the early composability problems, while liquid staking tokens (LST) and liquid restaking tokens (LRT) further improved ETH’s capital efficiency and composability.Meanwhile, their recovery and past chaos have re-raised concerns about liquidity, redemption and pricing risks that may spread.

With new funding pools deployed on-chain, new opportunities for earnings and interoperability are emerging from digital asset treasury reserves to potential pledged Ethereum ETFs (the SEC has recently clarified liquid staking tokens).Meanwhile, as tokenized and earning assets continue to expand in size and become more popular throughout the ecosystem, liquidity and redemption dynamics will be crucial.