Jessy, bitchain vision

TIA, which once had a ten-fold increase in the bull market in early 2024, has now fallen below the price when it was launched. As of press time, the price was 1.62U, falling by more than 90% from the highest point of 20U.As the former leader of modular blockchain, TIA is now deeply involved in negative public opinion such as the sell-off of the founder and internal management issues.

The fall of the former star TIA token is not just a symbol of the decline of modular blockchain, a track.The fall of a leading track event that was very popular last year is just a superficial phenomenon.But the deeper fact is that the once lively narratives in the currency circle are gradually falsified.

On one side is the stock market carnival where the Nasdaq hit a new high, and on the other side is the collapse of the narrative that was once popular in the currency circle and the plunge in the price of the currency.The traditional currency circle narrative can no longer be played, and the industry has come to a time for real implementation and application.

From glory to fall

TIA, full name Celestia, is one of the most popular modular blockchain projects from the end of 2023 to the beginning of 2024.In that little bull market in early 2024, TIA tokens soared from single digits after airdrop to a $20 high, with the vision of combining Cosmos’ sovereign interoperability zone with aggregation-centric Ethereum with shared security.

However, starting from the second half of 2024, with the decline in market popularity and the slow progress of project ecology, CelesTIA’s governance and team problems gradually surfaced.The most controversial thing is the question of its collective cash out of top leaders.Twitter user @0xCircusLover revealed that as early as early October 2024, all C-level executives of CelesTIA completed unlocking and began to sell tokens on a large scale. Co-founder Mustafa was even pointed out that he sold more than $25 million in tokens off the market and then quietly moved to Dubai.

At the same time, CelesTIA’s marketing operations also suffered a backlash.KOL @ayyyeandy, who once stood for TIA, was revealed to have charged a considerable promotion fee.Although David Hoffman, co-founder of media platform Bankless, frequently recommends TIA, he is inconsistent on the key issue of “whether to hold coins”, which further triggers the community to question “whether the project is just a marketing product that is manipulated by capital.”

The deeper internal rift comes from management, and the former head of developer relations Yaz Khoury was fired for suspected sexual harassment, causing a public relations storm.CelesTIA was revealed to have bought out its rival Abstract for seven figures and forced it to withdraw from its partnership with EigenLayer.This type of “exclusive merger and acquisition” is quite controversial, and it also exposes the team’s anxiety on its expansion path.

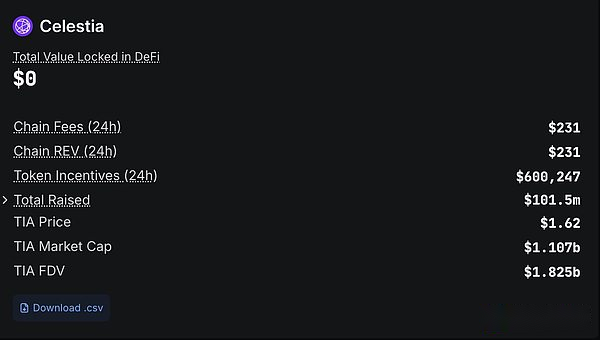

As currency prices collapse and community trust is on the verge of collapse, co-founder John Adler proposed a radical governance model of “governance is proof” in early 2025, advocating the replacement of the traditional proof of stake mechanism through off-chain governance voting to cope with the continuous inflationary pressure.However, before this disruptive proposal was implemented, the fact that the team executives cashed out was exposed one after another, which made the community generally believe that this was a governance guise aimed at “stabilizing prices and covering up problems.”As of press time, its price ratio has fallen by more than 90% at a high point.The on-chain activity is also terrible. According to defilama data, its on-chain Gas revenue was only $231 in the past 24 hours.

Behind the Fall of TIA, the Crypto Industry Narrative Collapse

However, the destruction of TIA is not just a failure of a project and token. It is a clear view of the new narrative of the entire crypto industry.

In the past cycle, modularization, AI Agnet, DePIN, GameFi, NFT, etc. have all blown up one huge bubble after another, ushering in rounds of collective carnival between capital and retail investors.But in 2025, we have ushered in the collective destruction of the past narrative, and the altcoins are everywhere.

Similar to TIA, the leaders of various tracks that were once popular and popular with capital, such as WorldCoin and Helium, have quickly accumulated a large amount of traffic and the surge in currency prices in the short term, following the narrative trend.But it just cools down quickly after a wave of heat.

The fall of celebrity tokens at these levels, including TIA, reflects a deeper crisis in the crypto industry: the industry lacks real technological innovation and user implementation, and narrative and trust will be consumed and diluted again and again.After modularization, there will be no new narratives at the public chain level.Looking at the industry nowadays, there are still some other tracks of voice: most projects combining AI and blockchain are at the concept level, while RWA is not just a regulatory issue, but also a profound question of “is it real demand”.

The past trends are all falsified one by one and are quickly forgotten by people. At the same time, the traditional financial market is constantly coming. Whether it is the crypto-compliance-related stocks of the US stock market or Hong Kong stocks, such as stablecoins and compliance exchanges, they have ushered in continuous rises.

On the one hand, there is the lack of native crypto innovation and the plunge in currency prices, and on the other hand, the compliance crypto projects of Hong Kong and US stocks are popular among capital and the market.Some people think this is a sign that the industry is over, but the author believes that this is actually a warning to all project parties that only true technological innovation and application implementation can create real value.The old way of telling stories, fighting for traffic, pulling the market and selling again can’t continue.Like Web2 projects, the current Web3 projects are committed to implementing them.