Source: C labs encryption observation

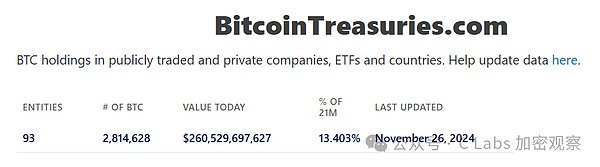

As of November 26, 2024, 93 large -headed institutions held more than 2.8 million Bitcoin, worth 260 billion US dollars, and had accounted for 13.4%of the total Bitcoin.

After playing like this, Bitcoin will be fired by these institutions?

According to business classification, the head holding of Bitcoin rank as follows:

The first -ranking industry is ETF, 5.97% of Bitcoin already holds Bitcoin

The ETFs holding the position of the position are all in the United States, so most ETFs were built in 2024.

Among them, Berlaide has won the 40%market share of the entire Bitcoin ETF industry. It holds nearly 500,000 Bitcoin and is the largest buyer in Bitcoin this year.

The second -ranking industry is governments from all over the country:

The first place is the United States, holding about 1%of Bitcoin.If the federal reserves are established in the future, the proportion of positions may increase.

According to reports in 2022, the Chinese government also holds 194,000 Bitcoin, but some data said that many Bitcoin may have been sold for 190,000 Bitcoin in China in the past two years?

There are more than 40,000 Bitcoin in Ukraine who are fighting, which can be ranked fourth in the governments of various countries. It seems that the Ukrainian government is still very eye -catching.

The German government cleared Bitcoin in the middle of this year, and SB, which had made decisions, may now shoot thighs.

The third -ranking industry is a group of listed companies:

The first is the famous micro -strategy company, holding 386,700 Bitcoin, more than the U.S. government.

It is interesting that Tesla ranks fourth in this list, holding 9720 Bitcoin, second only to the mining Mara and Roit, surpassing Coinbase.

Major private companies also hold more than 300,000 Bitcoin. These companies are mainly the encrypted industry:

The number one Block.one was originally made of EOS. As a result, I made a lot of money with the BTC.

Relatively speaking, there are not many Bitcoin held by major mining companies, and the number one Marathon is only more than 30,000 Bitcoin.

The major mines are less than 70,000, and the mines are getting weaker and weaker than the price of Bitcoin ~