Author: arndxt; Source: X, @arndxt_xo; Compilation: Shaw bitchain vision

The biggest structural revelation is that cryptocurrencies will not be decoupled from the macro.

The timing and scale of liquidity rotation, the direction of interest rates at the Federal Reserve and the institutional adoption model will determine how the cycle evolves.

Unlike 2021, the upcoming altcoin season (if it does appear) will be slower, more selective and more institutionally focused.

If the Fed provides liquidity through interest rate cuts and bond issuances, while institutional adoption continues to increase, 2026 could be the biggest risk cycle since 1999-2000, and cryptocurrencies will benefit from it, albeit more robust and less explosive.

1. Fed policy differences and market liquidity

In 1999, the Fed raised interest rates by 175 basis points, while the stock market climbed to its peak in 2000.Now, forward markets expect interest rates to be significantly lowered: a rate cut of 150 basis points by the end of 2026.If achieved, it will mean an environment where liquidity is increased rather than liquidity consumption.

The market environment in 2026 may be similar to the risk appetite pattern in 1999/2000, but the interest rate trend is the opposite.If this is the case, then 2026 may be the “upgraded version of 1999/2000”.

2. New background of the cryptocurrency market (compared to 2021)

Comparing the current with the previous major market cycle:

-

Stricter capital discipline: Higher interest rates and sustained inflation force investors to take more selective risk-taking measures.

-

Will not repeat the surge in liquidity during the COVID-19 pandemic: In the absence of M2 surge, adoption and distribution must become the driving force for growth.

-

Market size enlarges ten times: A larger market capitalization base means deeper liquidity, but there is less chance of obtaining an excess return of 50-100 times.

-

Institutional liquidity: With the consolidation of mainstream and institutional adoption, capital flows are more stable, which is conducive to the slow rotation and integration of assets rather than the violent rotation between assets.

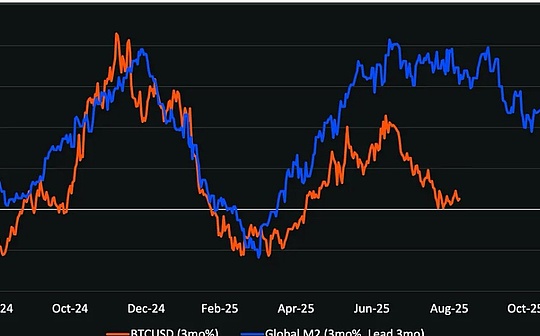

3. Bitcoin’s lag and liquidity transmission

Bitcoin’s relative liquidity performance lags because new liquidity is absorbed by upstream short-term Treasury bonds and money markets.Cryptocurrencies are at the farthest end of the risk curve and can only benefit if liquidity flows downstream.

A catalyst for excellent performance of cryptocurrencies:

-

Bank loan expansion (ISM index > 50).

-

Money market funds flow out of money market after interest rate cuts.

-

U.S. Treasury bonds issue long-term bonds to lower long-term interest rates.

-

The weakening of the US dollar eases global financing pressure.

When these factors are unlocked, cryptocurrencies usually rise later in the economic cycle, later than stocks and gold.

4. Risks facing the benchmark situation

Despite this optimistic liquidity framework, there are still some potential risks:

-

Long-term interest rates rise (caused by geopolitical pressure).

-

The strengthening of the dollar has led to a tightening of global liquidity.

-

Bank lending is weak or credit conditions are tightening.

-

Liquidity stagnates in money market funds, rather than shifting to risky assets.

The next cycle will be defined more by structural integration of cryptocurrencies in global capital markets than speculative liquidity shocks.

As institutional capital inflows, prudent risk taking, and policy-driven liquidity shifts tend to align, 2026 may mark the relevance of cryptocurrencies’ cycle from boom to bust to system.