Author: Anthony Pompliano, Founder and CEO of Professional Capital Management; Compilation; Shaw Bitchain Vision

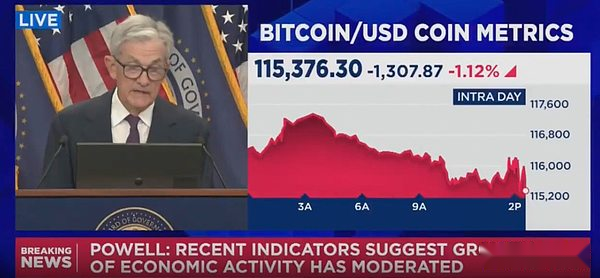

The Fed cut interest rates by 25 basis points as expected yesterday. Chairman Powell then held a press conference to share information that people had known online for months.

“In the short term, inflation faces upward risks and employment faces downward risks,” Powell told us.

Powell’s behavior throughout the press conference seemed to be frustrated.He didn’t seem to be excited about attending the press conference, nor was he enthusiastic about the challenges he faced.

Powell’s behavior throughout the press conference seemed to be frustrated.He didn’t seem to be excited about attending the press conference, nor was he enthusiastic about the challenges he faced.

One important reason why the Fed is now in its current dilemma is that they have shifted from “data dependence” in the past few years to recent economic forecasts.Instead of simply scrutinizing data and managing monetary policy based on current measures, the Fed decides to participate in the prediction game, which is expected to lead to high inflation levels.

As we know now, and as I predicted from the beginning, tariffs are not the factor that leads to inflation.The high inflation that the Fed believes will never happen.This means that their predictions are wrong, and the monetary policy stance of maintaining high interest rates for a long time is also wrong.

But the situation inside the Fed is much more complicated than it seems on the surface.The Fed’s directors have huge differences on what level the current interest rate should be at.Heather Long, chief economist at Navy Federal, explained:

“It’s crazy. Look at the forecasts of 19 Fed officials for the remainder of 2025. A chart alone shows tensions within the Fed.

One director wants a rate hike, six directors believe the Fed should keep interest rates unchanged, two directors favor a rate cut, nine directors favor a rate cut twice, and one director (probably Trump’s latest appointment Stephen Milan) hopes to make a rate cut equivalent to five times by the end of the year.We will likely cut interest rates twice.Once in October, once in December.But you can see the struggles in the future…”

Think about how crazy these things are.Yesterday some people advocated raising interest rates, and some people advocated hikes five times before the end of the year.Not only do people have different opinions on the number of interest rate cuts, but they cannot even reach an agreement on whether to raise or cut interest rates.

This highlights the problem of people-led monetary policy.Because people are not good at making complex decisions, it is impossible for individuals to manage the cost of capital successfully.Add to that we commissioned a committee to do it, and you can see why this has become even more difficult.

Committee management can certainly lead to wrong decisions.

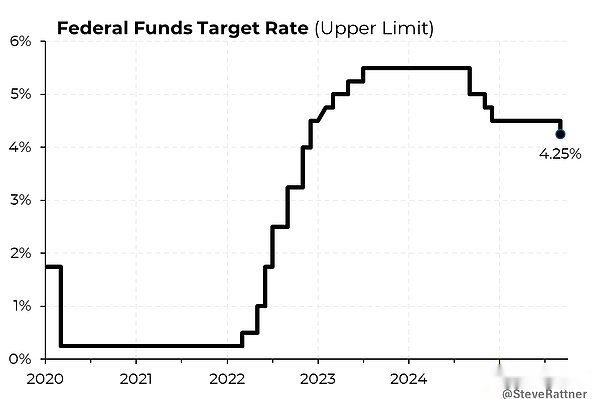

But if that’s not bad enough, take a look at this interest rate chart since 2020.We have experienced various changes.How should people plan their lives?

If the cost of capital falls from 2% to 0% in five or six years, soars to more than 5%, and finally falls back to 4%, then it is really difficult to survive in this world.It’s simply crazy fluctuations, and this fluctuation is really unnecessary.

If the cost of capital falls from 2% to 0% in five or six years, soars to more than 5%, and finally falls back to 4%, then it is really difficult to survive in this world.It’s simply crazy fluctuations, and this fluctuation is really unnecessary.

Bitcoin’s monetary policy was formulated in 2009 and has never deviated from its established monetary policy for more than 15 years.In my opinion, the Fed can learn some lessons from Bitcoin.

Finally, remember the 25 basis point rate cut in 1998, which helped boost the crazy rise of tech stocks during the Internet bubble.

The current situation is surprisingly similar.The Fed cuts interest rates during the AI-related innovation boom.If the Fed cut interest rates several times this year as yesterday said, then we should expect a sharp rise in the stock market.

The Fed is slow to move.Yesterday they were timid and only cut interest rates by 25 basis points.But for investors, it doesn’t matter in the end.Everything is rising, so just keep your assets and enjoy the rise.