Author: Kevin, Movemaker researcher; Source: X, @MovemakerCN

Latin America is undergoing a financial infrastructure revolution driven by currency failure.This article provides a panoramic analysis of the stablecoin market in the region based on macroeconomic data, on-chain behavior analysis and regulatory policy texts from 2024 to 2025.The study found that the Latin American market has surpassed the early passive dollarization stage and is undergoing a deep transformation towards Web3 financial infrastructure.

At the macro level, Argentina’s 178% inflation rate and Brazil’s $300 billion crypto trading volume constitute the dual background of stablecoins as a survival tool and an efficiency tool.At the micro level, the market is giving birth to a new species-Crypto Neobank.Compared to traditional fintech giants like Nubank, Crypto Neobank is filling the huge vacuum between traditional banks and pure crypto speculation by leveraging zero-rate networks like Tether-powered Plasma and DeFi yields.This report points out that the next alpha opportunity in the Latin American crypto market lies in how Web3 infrastructure can leverage this $1.5 trillion transaction volume to replicate and surpass the growth miracle of traditional financial technology.

1. Macro narrative reconstruction

To understand the uniqueness of Latin American markets, one must abandon the “technological innovation theory” from a North American or European perspective.In Latin America, the explosion of stablecoins is an inevitable outcome of macroeconomic structural imbalances.The core driving forces here are survival and efficiency, and the intervention of Web3 technology is transforming this passive survival need into active financial upgrades.

1.1 Currency failure and loss of value storage function

Inflation is the strongest catalyst for the crypto-dollar process in Latin America.Argentina and Venezuela are prime examples of this phenomenon.

Despite the Milai government’s aggressive economic therapy, Argentina’s annual inflation rate remains high at 178% between 2024 and 2025, with the peso depreciating 51.6% against the dollar in 12 months.In this environment, stablecoins are no longer investments, but de facto units of account.On-chain data shows that Argentina’s stablecoin trading volume accounts for 61.8%, far exceeding the global average.Market demand for stablecoins shows extremely high real-time price elasticity: monthly stablecoin purchases by exchanges surge to over $10 million every time the exchange rate falls below key psychological levels.

In Venezuela, as the value of the bolivar continues to evaporate, Tether has penetrated microeconomic activities such as supermarket shopping and real estate transactions.Data shows that there is a strong negative correlation between the country’s fiat currency exchange rate and cryptocurrency reception, and stablecoins provide a parallel financial system that is not interfered with by government monetary policies.

1.2 Bank exclusion and financial vacuum for 122 million people

In addition to fighting inflation, financial exclusion is another major pain point.122 million adults in Latin America (26% of the population) are unbanked.This large group has been shut out of the traditional banking system due to minimum balance requirements, cumbersome compliance documentation, and geographic isolation.

This is the soil for the rise of new banks.Nubank’s success proves this logic: Through its branchless, low-fee mobile banking model, Nubank captured 122 million users in just ten years, reached a market value of $70 billion, and covered 60% of Brazil’s adult population.

However, Crypto Neobank is making a second upgrade to this logic.While Nubank has solved the accessibility problem, the accounts it offers are still dominated by local fiat currencies, and savings yields tend to underperform inflation.In contrast, Web3 new banks do not require a banking license to provide accounts based on USD stablecoins, and through integration with DeFi protocols, they can provide USD-based annualized returns of 8% to 10%, which is fatally attractive to users in an inflationary economy.

1.3 Cost reduction and efficiency improvement revolution in the remittance economy

Latin America is one of the world’s largest recipients of remittances, receiving more than $160 billion annually.Traditional cross-border remittances typically charge a 5% to 6% fee and take several days to settle.That means nearly $10 billion in wealth is lost in fees each year.

Bitso has processed more than $6.5 billion in remittances, accounting for 10% of the world’s largest single remittance corridor, the U.S.-Mexico corridor.The cost of blockchain-based cross-border transfers can be reduced to a dollar or even a few cents, and settlement times are shortened from 3 to 5 days to seconds.This hundred-fold improvement in efficiency constitutes a dimensionality reduction blow to the traditional financial system.

2. Market depth and on-chain behavior

Data from 2024 to 2025 shows that Latin America has formed a unique Latin American model in cryptocurrency adoption: high frequency, large amounts, and highly institutionalized.

2.1 Transaction volume and growth resilience

According to consolidated data, Latin America recorded nearly $1.5 trillion in cryptocurrency trading volume between July 2022 and June 2025, a year-on-year increase of 42.5%.Notably, Latin America’s growth baseline remains solid even amid global market volatility.In December 2024, monthly trading volumes in the region surged to a record $87.7 billion.This shows that the growth of the Latin American market does not simply follow the beta returns of the global bull market cycle, but has an endogenous logic of rigid demand.

2.2 Brazil’s institutional hegemony and Argentina’s retail fanaticism

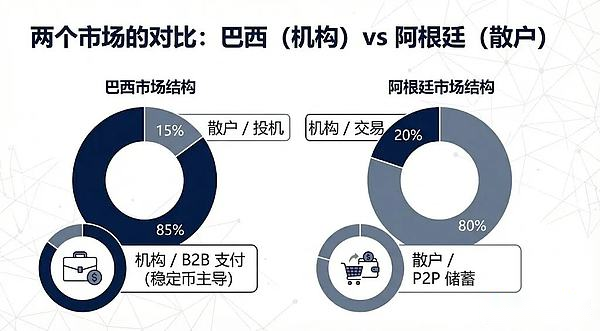

The market structures of various countries show significant differences:

Brazil is the undisputed leader in the region, receiving approximately $318.8 billion in crypto assets, accounting for nearly a third of the region’s total.Data from Brazil’s central bank surprisingly shows that approximately 90% of the country’s cryptocurrency flows are conducted through stablecoins.This extremely high ratio reveals the high degree of institutionalization of the Brazilian market – stablecoins are mainly used for inter-business payments, cross-border settlements and liquidity transfers, rather than retail speculation.

Argentina ranks second with approximately $91.1 billion to $93.9 billion in transaction volume.Unlike Brazil, Argentina’s growth has primarily come from the retail side, reflecting ordinary people’s use of crypto dollarization as a way to combat inflation on a daily basis.

2.3 Platform preference: dominance of centralized exchanges

Latin American users are highly dependent on centralized exchanges.Data shows that approximately 68.7% of trading activity occurs on centralized exchanges, the second-highest proportion in the world.

This phenomenon has important strategic significance for the Web3 project to enter Latin America.Borrowing a boat to go to sea is the best strategy.Since local exchanges such as Mercado Bitcoin and Bitso have compliant legal currency channels and deep user trust, Crypto Neobank should not try to directly compete with them in the legal currency deposit and withdrawal business, but should penetrate their huge user base through cooperation.

3. Asset evolution

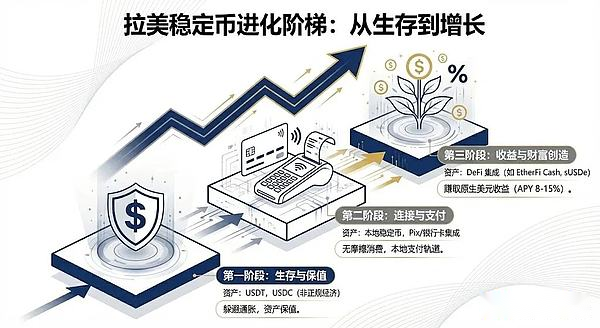

The Latin American market presents a pattern of coexistence of global stablecoins and local innovative assets, and is experiencing an intergenerational leap from holding to maintain value to holding to increase value.

3.1 The duo pattern of Tether and USDC

With its first-mover advantage and deep liquidity, Tether remains the hard currency in Latin America’s peer-to-peer markets and informal economy.In the over-the-counter markets in Venezuela and Argentina, Tether is the absolute unit of pricing.Brazilian tax data also shows that Tether accounts for about two-thirds of declared transaction volume.Its censorship resistance and popularity make it a top choice for circumventing capital controls.

USDC is gaining ground through the compliance path.Circle’s cooperation with giants such as Mercado Pago and Bitso makes it the first choice for institutional settlement.Bitso reported that by the end of 2024, USDC had become the platform’s most purchased asset, accounting for 24%, surpassing Bitcoin.

3.2 The bridging role of local legal stablecoins

From 2024 to 2025, stablecoins anchored to local legal currencies in Latin America will begin to emerge, aiming to solve the friction between local payment systems and blockchains.

The launch of Meli Dólar in Brazil by e-commerce giant Mercado Libre is a milestone.Through Mercado Pago, it is embedded into the daily shopping of tens of millions of users and used as a credit card cash rebate carrier, greatly lowering the user threshold.In addition, the stablecoins anchored to the peso and real issued by Num Finance mainly serve cross-exchange arbitrage and enterprise-level DeFi operations, helping local enterprises manage liquidity on the chain without taking on exchange rate risks.

3.3 Trend Sudden Change: Integration of Interest-earning Assets and DeFi

This is the next alpha opportunity in the Latin American market.USD accounts offered by traditional banks in Latin America often come with extremely low interest rates.And Web3 new banks are redefining savings by integrating DeFi protocols.

Take EtherFi, for example, a DeFi protocol that leveraged its billions of dollars in total locked value to launch a credit card product.Users can mortgage crypto assets to earn income while spending with their cards.This model allows users to borrow and consume without selling assets, which not only retains exposure to rising assets but also solves liquidity problems.

In countries with high inflation, the 10% to 15% native yield offered by synthetic USD stablecoins such as USDe is extremely attractive.Compared to the real deposits offered by Nubank, the 10% annualized USD-based yield is a dimensionality-reducing blow to traditional savings products.

4. Differences in national directions

The political and economic environments of Latin American countries are vastly different, leading to completely different development paths for stablecoins.

4.1 Brazil: a duo of compliance and innovation

Brazil is the most mature and compliant market in Latin America.Drex, the digital currency project of the Brazilian central bank, suffered a strategic adjustment in 2025 and switched to focusing on the wholesale end, which left a huge retail market space for private stablecoins.

In the same year, Brazil implemented a unified crypto tax rate and clarified the foreign exchange regulatory status of stablecoins.While this increases costs, it also gives the industry legitimacy.Homegrown innovation project Neobankless is a prime example of this trend.It is built on Solana, but the front-end completely abstracts the blockchain complexity and integrates directly with the Brazilian national payment system PIX.Users deposit reals, and the background automatically converts them to USDC to earn interest.This “Web2 experience, Web3 backend” model directly challenges the user habits of traditional financial technology.

4.2 Argentina: Experimental Ground for Liberalization

Although the registration system for virtual asset service providers established by the Milais government increased the compliance threshold, it essentially acquiesced to the currency competitive status of US dollar stablecoins.The asset formalization plan has brought a large number of gray market stablecoins to the surface.

Lemon Cash solves the “last mile” payment challenge by issuing crypto debit cards.Users earn income by holding USDC and converting it into pesos only at the moment of swiping their card.This model is extremely sticky in a high-inflation environment because it minimizes the time that fiat currency is held.

4.3 Mexico and Venezuela: Polarization

Due to the Fintech Law and central bank restrictions, Mexico has formed a pattern of isolation between banks and crypto companies.Companies such as Bitso therefore vigorously develop business-to-business business, using stablecoins as an intermediary bridge to optimize cross-border fund transfers between the United States and Mexico and bypass the inefficiencies of the traditional banking system.

In Venezuela, Tether has even become a settlement tool for oil exports amid the restoration of sanctions.Among the private sector, Binance’s peer-to-peer trading is still the lifeline for obtaining foreign exchange, and the market completely voted with its feet to choose the private U.S. dollar stablecoin instead of the failed official petrocoin.

5. From traditional finance to Crypto Neobank

The Latin American market is experiencing a critical turning point in the evolution from traditional financial technology to Crypto Neobank.This is not only an upgrade of technology, but also an intergenerational leap in business models.

5.1 Valuation Gap and Alpha Opportunities

Currently, Nubank has a market capitalization of approximately US$70 billion and Revolut is valued at US$75 billion, proving the commercial viability of digital banks in Latin America.By comparison, the entire Web3 neobank racetrack has a combined valuation of less than $5 billion, or just 7% of Nubank’s market capitalization.

This is a huge value depression.If Crypto Neobank can capture even 10% of Nubank’s market share, using a better unit economic model, its valuation will have room for a 10 to 30 times increase.

5.2 Next-generation infrastructure: zero-rating revolution

One of the biggest barriers to the adoption of crypto payments is gas fees.Plasma and its flagship product, Plasma One, deliver breakthroughs.As a blockchain officially powered by Tether, Plasma enables zero gas fees for Tether transfers.This removes the biggest psychological and financial barriers for users to pay with cryptocurrencies.

Data that total locked value exceeded $5 billion within 20 days of launch proves that when the infrastructure directly provides bank-level services, the speed of capital inflow is astonishing.This vertical integration model of “infrastructure + new banks” may become the mainstream in the future.

5.3 Dimensionality reduction of business models

Crypto Neobank has a triple moat compared to traditional banks:

-

settlement speed: From 3 to 5 days with SWIFT to seconds with blockchain.

-

Account currency: Upgrade from a devalued local fiat currency to an inflation-resistant USD stablecoin.

-

Source of income: From earning deposit and loan interest rate differentials to allowing users to share the native income of the DeFi protocol.

For Latin American users, this is not only a better experience, but also a necessity for asset preservation.

6. Challenges, Strategies and Endgame Predictions

6.1 Challenges and Breakout Strategies

Despite the promising outlook, banks in Mexico and Colombia are still closing accounts of crypto businesses due to compliance fears.In addition, regulatory fragmentation in Latin America is severe, and compliance costs for cross-border operations are extremely high.

Targeting the Latin American market, Web3 projects need to follow a specific winner’s playbook:

-

Brazil first: Given that Brazil accounts for 31% of Latin America’s crypto trading volume and has a well-established payment system, it must be made a priority battleground.

-

Niche first: Don’t try to be everyone’s bank right from the start.The path to success is to first occupy a subdivided community and then spread.

-

viral marketing: 90% of Nubank’s growth comes from word of mouth.Crypto Neobank should use on-chain incentives to achieve low-cost fission in social networks such as WhatsApp.

6.2 Market forecast

Based on the above analysis, we make the following predictions for the development of stablecoins in the short and medium term:

-

Private stablecoins replace central bank digital currencies: Given the retreat of Brazil’s Drex on the retail side, privately issued compliant stablecoins will in fact assume the role of digital fiat currencies.

-

Mainstreaming interest-earning assets: Stablecoins that do not generate interest may face competition from interest-bearing assets such as tokenized U.S. Treasuries.Latin American users will increasingly be inclined to hold assets that can both protect against inflation and generate income.

-

market stratification: The market will be divided into two camps: one is the highly compliant, bank-integrated whitelist market, and the other is the gray peer-to-peer market that is gradually shrinking but still exists.

Conclusion

The stablecoin market in Latin America is the most cutting-edge experimental ground for global financial technology.Here, stablecoins are not a nice-to-have technology, but a necessity to provide timely help.From a digital lifebuoy in the hands of Argentines to a cross-border settlement tool in the hands of Brazilian financial giants, stablecoins are reshaping the financial blood vessels of this continent.

With the implementation of the regulatory framework in 2025 and the rise of new species Crypto Neobank, Latin America is expected to become the first region in the world to achieve large-scale commercialization of stablecoins.For investors, the current window of opportunity is only 12 to 18 months. Whoever can use the Web3 track to replicate Nubank’s user experience before 2026 will become the next billion-dollar giant.The game has begun, and Latin America is that untapped gold mine.