The golden age of wool-pullers is over.

In two years, Hyperliquid’s market share soared from 0.3% to 66%, defeating dYdX with a simple and crude promise:97% of transaction fees to buy back tokens.It is no longer a matter of completing tasks on Galaxy to get airdrops, but currency holders directly sharing the real benefits.

When Uniswap started fee sharing and Aave launched the buyback plan, the entire DeFi ecosystem was undergoing a historic transformation from “spending money to buy volume” to “value accumulation”.The era of Token Economics 2.0 has arrived, and the rules of the game have been completely rewritten.

While we are still lamenting the glory of dYdX, Hyperliquid has quietly completed a perfect “usurpation”.

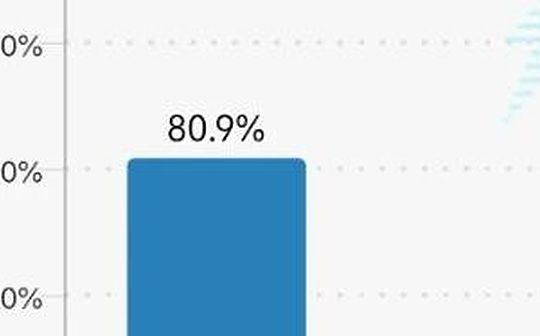

In just two years, Hyperliquid has skyrocketed from a market share of 0.3% to a peak of 66%, and currently maintains a dominant market share of 64.8%.The former king, dYdX, saw its market share plummet from 73% to only 4.61%.

This is not just a simple market competition, but also a landmark event in the evolution of token economics from 1.0 to 2.0.

The rise of Hyperliquid: More than just a technological revolution

Let’s first take a look at the results Hyperliquid has delivered.Transaction volume will surge from US$21 billion in 2023 to US$570 billion in 2024, an increase of 25.3 times.Daily trading volume has stabilized between US$15 billion and US$22 billion, peaking at US$22 billion.The number of users has also increased ninefold, from 31,000 users to 300,000 users.

Behind these numbers is a complete dual innovation system of technology + economics.

Technological Innovation: Implementation of Binance on the Chain

Hyperliquid’s technical advantages are truly impressive.It uses an independent Hyper BFT consensus mechanism to achieve extremely fast processing capabilities of 100,000 orders/second, while maintaining a fully on-chain order book model.Most importantly, it achieves sub-second execution speed, truly achieving a user experience close to that of a centralized exchange.

But what really makes Hyperliquid stand out is its revolutionary tokenomics design.

The decline of dYdX: Why is technological advantage not enough?

Looking back at history, dYdX was once one of the few projects with both excellent products and token economics.Unlike Uniswap, which gives income to Uniswap Labs, dYdX allows token holders to actually start making money after the v4 version – earning income by staking dYdX tokens.

From an architectural perspective, dYdX has always been at the forefront of technology.The V3 version uses StarkWare’s StarkEx, and the V4 version becomes the only perpetual contract DEX with an independent application chain, fully controlling its own technology stack.

Xiao He is also defeated: the price of an independent chain

But success is also Xiao He, failure is also Xiao He.dYdX’s technical superiority eventually became its baggage.

The first is misjudgment of migration timing.The timing of migrating V4 to the Cosmos ecosystem is extremely delicate.At that time, dYdX was already the leader, and they may have had the mentality of “I can do whatever I want”, but I didn’t expect that Hyperliquid was rising strongly.

The second is the fatal injury of user friction.An independent technology stack brings autonomy, but it also brings huge user friction.Users need to adapt to the new network, and in a highly competitive market, even just changing wallets can cause users to lose.

Finally, there is the comparison between unlocking pressure and currency issuance expectations.While Hyperliquid still has strong expectations for issuing tokens, dYdX is facing pressure to unlock tokens.In December 2023, dYdX tokens worth $500 million were unlocked, causing huge selling pressure.

GMX: The wisdom of a thousand-year-old man

It is worth mentioning that GMX, the “second child of the millennium”.Although it has never become the leader, GMX’s market position remains solid even amid Hyperliquid’s explosive growth:

-

Average daily trading volume: $244 million

-

Cumulative trading volume: nearly $300 billion

-

TVL: $578 million

The stability of GMX proves that in a rapidly changing industry, sound operations also have its value.

Tokenomics 1.0: Incentive-driven endless loop

The traditional 1.0 model is essentially an incentive-driven growth model.The project side relies too much on token incentives to attract users. In fact, it uses token “buying volume” and transaction volume, similar to Didi’s early subsidy war.But the problem is that every token issued is a “debt” for the project side.

In this model, tokens are reduced to pure reward tools.Users regard tokens as “5 yuan picked up on the ground”, with no holding value and only the urge to liquidate.Once the incentives stop, users will immediately lose, forming a vicious cycle in which users need to be continuously incentivized, users continue to leave, diluting the value of the token, and requiring more incentives.

Reflections on the woolen era

This model gave birth to the culture of “rolling with wool”.Task platforms such as Galaxy and TaskOn have become a place for project parties to buy traffic. User loyalty is extremely low, and they will go to whoever offers the most incentives. In the end, the conversion rate is dismal, and a conversion rate of a few tenths of a percent has become the norm.

A real case illustrates the problem: through cooperation with Linear, a project increased Twitter to 100,000 followers overnight, but in the end very few users actually converted.A large amount of marketing investment is ultimately just a flash in the pan and cannot form a real user base.

Tokenomics 2.0: A new paradigm for value accumulation

The core of the 2.0 model is to shift from incentive-drivenvalue capture driver.

First of all, there must be product market fit (PMF) as a prerequisite, including sustainable cash flow, not relying solely on financing funds for repurchase, and the need for real user value creation.

In terms of value distribution, there are two main methods: the passive type is that the project party repurchases to promote the increase in value, and the active type is to allocate value to active participants (such as pledgers).This shift ensures that the token value is tied to the actual performance of the project, rather than relying on endless incentive investments.

A perfect demonstration of Hyperliquid

Hyperliquid’s token economics are textbook-level: 97% of transaction fees are used to repurchase HYPE tokens, and the repurchase fund exceeds US$1 billion, driving a monthly increase of 65%, once hitting a record high of US$42.

The subtlety of this design lies in the direct value transmission.For passive holders, you can just sit back and relax after buying it, and the project party is responsible for pushing up the value.More importantly, this buyback is based on real income rather than inflationary rewards, ensuring the support of real cash flow.

In terms of supply and demand balance, a large number of repurchases have caused a shortage of circulation, and prices will naturally rise when demand remains unchanged.In terms of sustainability, income comes from actual transaction fees. DeFi naturally generates cash flow and does not rely on inflation to dilute the value of holders.

Three value distribution models in the DeFi 2.0 era

In the current DeFi ecosystem, we can observe three main value distribution models:

1. Cost sharing model

Representative projects: Uniswap, SushiSwap

Uniswap passed a proposal on its forum to start allocating a certain percentage of fees to the protocol.After the proposal was passed, the UNI token surged 65% to over $12.

SushiSwap implements a 50% platform transaction fee allocation and combines multiple income streams such as DEX transaction fees, aggregator fees and perpetual DEX fees to provide generous returns for 4-year lock-in participants.

2. Token repurchase model

Representative projects: Hyperliquid, Aave, Jupiter, dYdX

Aave’s $1 million weekly buybacks lasted for more than six months, and more than $24 million has been invested, driving the token price up 40%

50% of Jupiter’s operating income repurchases JUP tokens, locked for three years, with an annual repurchase capacity of approximately US$250 million.

DYDX25% agreement fee is used for monthly repurchase

3. Real income model

Representative projects: Aave Umbrella, MakerDAO

Aave’s new system provides 6% USDC income for the underlying aToken, plus an additional 4% security income, directly raising the rate of return to more than 10%.

MakerDAO supports a 5% DAI savings interest rate through physical assets, providing sustainable real returns.

Pledge Mechanism: The Art of Interest Binding

The core reason why staking has become an important mechanism in the 2.0 era is thatInterest binding:

1. Additional commitments

-

Staking usually has a lock-up period (7 days for Ethereum, 3 days for Solana)

-

Provides stronger project commitment than LP

2. Actively participate in incentives

-

Stakeholders are more likely to perform ecologically valuable activities

-

Reward and punishment mechanisms ensure shared goals

3. Circulation lock

-

Reduce market selling pressure

-

Stable token prices

Human morality is floating to some extent.If you rely purely on moral restraint, the success rate may be only 20%; but if “you don’t have money if you do bad things”, the success rate can reach 80%.

The staking mechanism cleverly takes advantage of this human characteristic to ensure network security and participation through economic incentives.

Two Strategies for Value Allocation

Strategy One: Token Rewards

Reward tokens directly to qualified token holders, such as Ethereum staking:

-

Stake ETH to get ETH rewards

-

With slashing (punishment) mechanism

-

Encourage positive contributions to the ecosystem

Strategy 2: Service fee discount

Offer fee reductions or refunds to token holders:

-

1inch gas refund plan

-

Binance’s Comprehensive Currency Holding Offers

-

New project airdrop priority

Binance is a typical example of the combination of two strategies: holding BNB can not only obtain handling fee reductions, but also participate in new currency mining, obtain various airdrops, etc.

From “grabbing depositors” to a virtuous cycle

Today’s DeFi projects are increasingly like banks competing for depositors:

-

Send oil, salt, and shopping coupons

-

Provide high yields to attract funds

-

Retain users through real revenue

The core of the 2.0 model is to establish a healthy value closed loop:

-

Projects provide real value

→Users are willing to pay to use

-

User usage generates revenue

→The project has funds to buy back or distribute dividends

-

Token holders receive benefits

→More willing to hold for the long term

-

Token value rises steadily

→ Attract more users to participate

This model avoids the vicious cycle of the 1.0 era and forms a sustainable positive spiral.

Thoughts from the project side

Before considering TGE, project parties need to answer several questions honestly:

-

Already have a PMF?

Does product market fit already exist?Still need to search?

-

What is the value of the token?

It can’t just be an empty concept of “governance tokens”

-

How to distribute value sustainably?

You cannot rely solely on financing funds as incentives

Core principle: successfully bind token holders to the project

-

Projects make money → Token holders make money

-

Project development → Token value increase

-

User growth → everyone benefits

Pitfalls to avoid:

-

Overly complex token mechanism

-

Governance tokens lacking practical application scenarios

-

Unsustainable promise of high returns

Implications for investors

How to evaluate 2.0 projects

Look at the sources of income:

-

Is there sustainable cash flow?

-

Is the revenue model clear?

-

Is the growth healthy?

Look at value distribution:

-

How do token holders benefit?

-

Is the distribution mechanism sustainable?

-

Is there a long-term locking mechanism?

Look at the competitive moat:

-

Are the technical advantages deep enough?

-

Are there any clear advantages to the user experience?

-

Are network effects taking shape?

We are witnessing a major paradigm shift in the history of cryptocurrencies.

From Bitcoin’s value storage, to Ethereum’s smart contract platform, to DeFi’s financial innovation, every paradigm shift has redefined the way value is created in this industry.

Tokenomics 2.0 represents the mature transition of crypto projects from “technical experiments” to “commercial entities”.Projects are no longer just about issuing coins to make money, but like traditional enterprises:

-

Create real value

-

Get sustainable income

-

Share profits with shareholders (token holders)

This shift is extremely healthy for the industry:

-

Project parties are more responsible: they must truly create value to succeed

-

Investors are more rational: Fundamental analysis becomes more important

-

Users benefit more: get better products and services

Although this means that there may be fewer opportunities to “get rich overnight”, the long-term development of the entire industry will be more stable and sustainable.

For project parties who want to succeed in this new era, Hyperliquid provides a perfect template: using 97% of the fee to buy back, using real income to support the value of the token, and using a simple and direct mechanism to benefit all participants.

This isn’t just a successful business model, it’s a sure path for cryptocurrencies to reach mainstream adoption.

What do you think?