Author: ian.btc | workhorse Source: X, @0xWorkhorse Compilation: Shaw bitchain vision

In the field of decentralized finance (DeFi), oracles are the backbone of the entire infrastructure.They determine the speed, accuracy, credibility and scalability of smart contracts interacting with real-world data.Chainlink is a proven leader with a good track record; Python Network is a challenger, emphasizing first-party data.The two represent two different methods to solve the “oracle problem”.

In my research content, oracles are a topic that is frequently discussed because they have an indispensable position in this field – without the support of oracles, many mechanisms cannot operate normally.

In turn, I think it is of great significance to have a deep understanding of the working principles, specific functions and main players of the oracle.

You will see a lot of controversial remarks on social media about “Orpollo War” or “LINK versus PYTH dispute”.However, the reality is that these two projects adopt different perspectives of solution to the same problem, which precisely reflects the diversity of the field.Because of this, they can work together to give full play to their unique advantages, bring innovative solutions to our booming industry and open up new development space.

Next, let’s explore how it works in detail.

What does an oracle actually do?

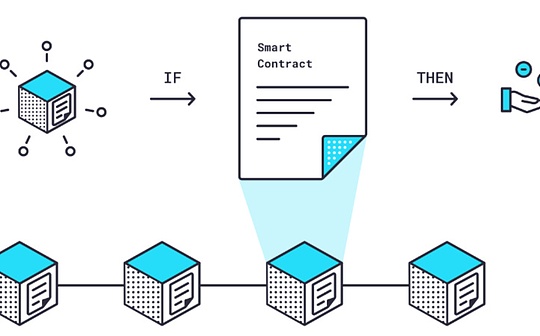

Essentially, oracles are the bridge between blockchain and the real world.

Smart contracts—automatic code that powers DeFi—are essentially isolated for security reasons.They cannot directly obtain external data such as stock prices, weather forecasts, or election results, or they may face the risk of being manipulated or centralized.

This is what oracles do: they acquire, verify and pass off-chain data to on-chain applications in a trustworthy way.

Oracles can be regarded as “data messengers”.DeFi lending protocols like Aave require real-time asset prices to determine collateral value and prevent under-collateralized loans.Without the oracle, it would not be able to know if ETH fell 10% overnight.Oracles solve this problem by aggregating data from multiple sources, applying a consensus mechanism to filter inaccurate information, and pushing the verified information into (or pulling it into) contracts.

Let’s briefly list some key features:

-

Data transmission: Provide price, message or calculation results

-

verify: Ensure data integrity through decentralization and encryption technologies

-

Scalability: Handle high-frequency updates in volatile markets without blocking blockchain

Essentially, oracles implement “hybrid smart contracts”, combining on-chain logic with off-chain reality, thus unlocking various use cases from perpetual transactions to insurance claims.

Technical level: push and pull

Chainlink mainly adopts push mode, and its decentralized node operator network continues to publish data on the chain.Data updates are triggered by deviations (such as price changes exceeding a specific threshold) or fixed time intervals to ensure continuous availability.However, this can also lead to unnecessary on-chain transactions and higher costs during low active periods.

Recent improvements, such as Chainlink Functions, have introduced more on-demand (like pull) features for custom computing, allowing developers to get data only or perform off-chain calculations when needed.This undoubtedly helps alleviate some inefficiency problems.To this end, Chainlink data streams further narrow the latency gap and provide sub-second updates for high-frequency applications.

In contrast, Python Network adopts a pull-based model: price data is aggregated off-chain and published on-chain only when the protocol or user requests.This on-demand approach, coupled with sub-second latency (typically 300 to 400 milliseconds, can be as low as 1 millisecond for high-frequency needs through Python Lazer), makes it extremely efficient in real-time applications such as perpetual transactions or AI-powered proxying.Python’s Express Relay further optimizes this by allowing institutions to deliver data directly based on auctions, reducing latency and improving accuracy in volatile markets.In the volatile market, Python’s pull model can be updated up to 3.33 times per second, exceeding the speed of bias-based push systems.

Pushing is like a radio station, which is constantly broadcasting regardless of whether someone listens or not.Pulling is more like a podcast, downloaded/played only when someone wants to listen.

The push mode performs well in active and ready scenarios (such as insurance claims, automatic settlement, etc.).The pull mode can reduce waste and have better scalability for high throughput requirements, but the protocol requires proactive requests.It really depends on the needs (and preferences) of the project itself and when and how it needs to get (or receive) the data.

Where does the data come from?

Chainlink collects data from a wide range of sources—including exchange APIs (such as Coinbase and Kraken), aggregators (such as CoinMarketCap and CoinGecko), and even non-financial data such as weather or sports scores.The node operator submits the input data and then derives the median price through a consensus mechanism, emphasizing decentralization to reduce the risk of manipulation.This broad source supports more than 2,000 data sources, including recent real-time stocks such as Apple (AAPL) and Microsoft (MSFT), making Chainlink widely applicable in finance, gaming, insurance and other fields.

Python gets data directly from first-party providers—including more than 120 institutions including Jane Street, Susquehanna, Chicago Options Exchange (CBOE) and Gemini.The aggregation process is performed off-chain, and each data source contains confidence intervals to improve transparency in data quality and volatility.Python currently offers more than 1,600 real-time data sources, including more than 750 stocks, more than 50 physical assets (forex, metals), U.S. Treasury rates, and more than 100 exchange-traded funds (ETFs), as well as index preview data like the FTSE 100.

During a period of large fluctuations in Bitcoin prices, Python’s first-party model provides a P99 percentile latency lower than the major exchanges’ API.Meanwhile, Chainlink’s broader source base ensures redundancy—the median remains stable even when some providers fail.Python’s TVS (total guaranteed value) is more diversified (Solana is only 61%), while Chainlink’s TVS is more concentrated (97% on Ethereum), reducing single-chain risk.

Python’s model provides speed and accuracy, but trust focuses on less (albeit with higher quality) sources.Chainlink’s diversity increases resilience, but may introduce slight delays during extreme market volatility.

Who uses which and why?

Chainlink has integrated on more than 50 chains, including Ethereum, Binance Smart Chain, Polygon, Optimism, Arbitrum, Avalanche and Base.Its Cross-chain Interoperability Protocol (CCIP) supports messaging, token transfer and cross-chain settlement, and works with partners such as Swift and JPMorgan to ensure the security of tokenized assets.By mid-2025, Chainlink has contributed to more than $24 trillion in transaction value.

Python supports over 100 chains—from Solana and Aptos to Base, TON, Sei, Monad, Berachain and HyperEVM—and new data sources are available on-the-fly on all chains thanks to their pull architecture.

Some use case examples:

-

Aave: Rely on the lending market health status data provided by Chainlink to prevent bad debt chain reactions.

-

Ethena: Use Python to maintain the price accuracy of stablecoins in volatile transactions.

-

Swift pilot: Use Chainlink’s CCIP to achieve cross-bank settlement.

-

Drift Protocol: Use Python to implement second-level perpetual contract market updates (it is still exploring the use of Chainlink to obtain RWA data, which is great).

Some protocols use both techniques, and I think that’s exactly what’s particularly interesting.Chainlink is used for cross-chain messaging (CCIP) + Python is used for ultra-fast price information flow.For example, Solana’s Kamino Finance uses Chainlink to achieve revenue and cross-chain capabilities, while using Python to achieve precise pricing in the lending market.

Python has a wider chain coverage, but Chainlink has deeper interoperability tools in established networks and has strong institutional links in the hybrid finance space.

To this end, Chainlink’s tool diversity makes it ideal for non-financial Web3 applications (gaming, insurance, NFT) and institutional bridges.Meanwhile, Python focuses on financial-grade DeFi, positioning itself as the data pillar for transactions, lending and RWA, and its accelerated growth poses a challenge to incumbent companies.

You can see (at least in my opinion), there is a very convincing element of teamwork here, which makes me ask: Why not use both?

Summarize

This topic is like a profound field of exploration. Although this article is not short, I still have a lot of content to discuss about these two, and it is not an exaggeration to write thousands of words.

I am very optimistic about the prospect of using both to meet specific needs.After all, the advantages of better products are self-evident.

In my opinion,There is no absolute winner in oracle, the key is whether it is adapted or not.

Chainlink is a trustworthy “Swiss Army Knife” in the DeFi field, which is both versatile and robust.Python is a precision tool focusing on speed and high precision in the financial field.In my opinion, the coordination between the two is of great significance.

With new demands in tokenized RWA, AI proxy, and real-time finance, we may see hybrid adoption models becoming the regular choice: That is, use Chainlink to achieve wide and stable coverage, and use Python to meet application scenarios where the speed requirements are extremely high and the difference in milliseconds is of great interest.At least, I expect to see such applications more common.