After ten years of birth and establishing market dominance, Ethereum is facing a profound debate about its core identity.

The key to this “Soul Battle” is: Should Ethereum’s future become a high-performance execution layer that directly competes with emerging rivals, or should it consolidate its unique position as the world’s most secure and decentralized settlement layer to serve the booming Layer 2 ecosystem on it.

Layer 2 refers to an off-chain network, system or technology based on the underlying blockchain (usually also known as Layer 1), with the purpose of extending the underlying blockchain network.Relevant data shows that Layer 2 transactions account for 85%, but large amounts of funds are still mainly left on the Ethereum main network.

Faced with this contradiction, at the recent EthCC conference held in Cannes, many founders, CEOs and important builders of the Ethereum ecosystem shared their views with the crypto industry media Cointelegraph, including Tomasz Stańczak, co-executive director of the Ethereum Foundation (EF), Sandeep Nailwal, co-founder of Polygon, and Jerome de Tychey, president of Ethereum France.

Tomasz Stańczak said unifying the ecosystem, improving interoperability and improving user experience have become the top priorities in the past 18 months; Marc Boiron, CEO of Polygon Labs, warned that trying to compete with new generation public chains such as Solana is “dangerous” in terms of execution speed.

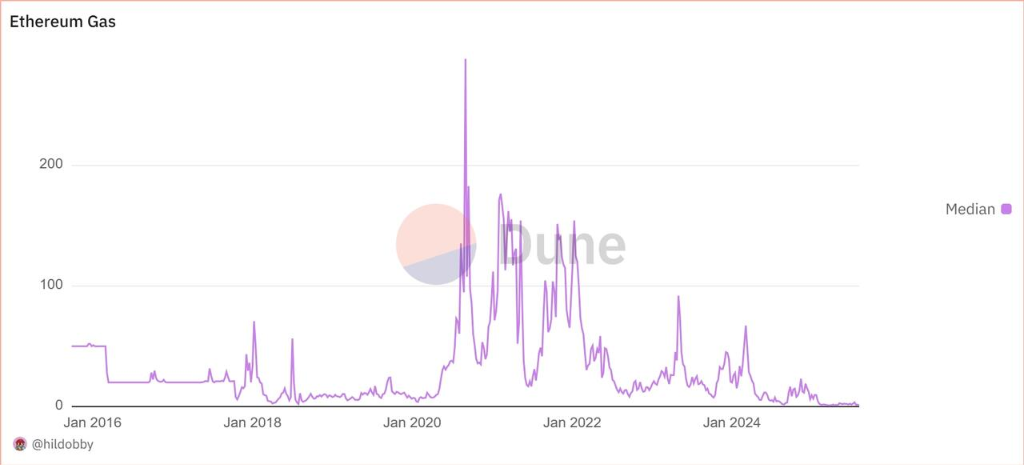

Dune Analytics co-founder Fredrik Haga pointed out that since the introduction of Blobs in March 2024, the fees for Layer 2 to settle the mainnet have been reduced to nearly zero, which is a technical breakthrough, but an economic setback for Layer 1 validators.

Despite the fierce internal debate, the market signal shows strong confidence.BlackRock, the world’s largest asset management company, is tokenizing assets on Ethereum, and more than 90% of real-world asset (RWA) tokenization projects choose to build on Ethereum.

This shows that the market may have given the answer to Ethereum’s “soul” with actions: an irreplaceable global settlement layer.

The cost of scalability

From 2015 to the present, Ethereum’s evolution has been full of trade-offs.

From Proof of Work (PoW) to Proof of Stake (PoS), Ethereum has successfully implemented a transformation of consensus algorithms, fundamentally changing the way protocols work.

However, with the surge in users and applications, the performance bottlenecks of their underlying chains are becoming increasingly prominent.To solve this problem, the community adopted a Layer 2-centric expansion roadmap, shifting transaction execution to an independent Layer 2 network.

This strategy has achieved optimization of scale, speed and cost through encryption technology innovations such as ZK-proofs.In particular, the “Blobs” feature introduced by the Dencun upgrade in 2024 has caused Layer 2’s transaction fees to plummet by 90%.

This technical victory puts pressure on the incentive income of Layer 1 validators.

Data shows that although 85% of transactions currently occur on Layer 2, 85% of the amount of funds remains in Layer 1.

The foundation’s balancing technique

Faced with the complex dynamics of the ecosystem, the Ethereum Foundation (EF) is trying to play the role of a balancer.

After the organizational structure was adjusted in 2025, the new team led by co-executive directors Tomasz Stańczak and Hsiao-Wei Wang are fully committed to advancing a unified ecological vision.

The Pectra upgrade, which was launched in May this year, is the latest manifestation of this effort.

The Pectra upgrade includes 11 Ethereum Improvement Proposals (EIPs) aimed at further improving scalability, user experience and staking efficiency.

Stańczak said that over the past 18 months, the foundation’s top priorities have been addressing the issues of liquidity uniformity, interoperability and improving user experience:

“The focus now is on interoperability, tools and standards, making all the chains around Ethereum feel like a single ecosystem where users can naturally transfer assets between them.”

Ethereum France Chairman Jerome de Tychey added that the future success of the agreement depends on finding a balance between prioritizing the development of the Layer 1 mechanism and maintaining a symbiotic relationship with Layer 2.

He believes that the community is focusing on both the sustainability of Layer 1 and the security of Layer 2 and the user experience, which is a positive signal that Ethereum is becoming easier to use.

Competition or focus?

This debate on the future of Ethereum ultimately boils down to a strategic choice: Should we directly compete with high-performance public chains such as Solana, SUI and Aptos at the execution level, or should we focus on our own core advantages?

Polygon Labs CEO Marc Boiron gave a clear warning about this.He believes that if Ethereum is over-invested in the competition of the execution layer, it is likely to be “surpassed” by opponents who have focused on it from the beginning.

“It is dangerous to try to overcompetitively in execution,” he said.

Polygon co-founder Sandeep Nailwal’s view is more direct, and he believes that Ethereum’s core value proposition has always been a “highly decentralized, anti-sovereign censorship, and permissionless settlement layer.”

He concluded:

“Ethereum was dragged into the execution competition, and that was not its strong point. If Ethereum could play to its strengths and focus on being the best settlement layer, we already had enough network effects and motivation to build the entire Web3 world around it.”

How to go in the next decade?

Despite the constant criticism over the past year, discussions at the EthCC conference generally convey optimism about the future of Ethereum.

This optimism is not derived from fanaticism, but based on real utility and on-chain indicators.

The strongest evidence comes from institutional adoption – more than 90% of real-world assets (RWA) tokenization choices are conducted on Ethereum.

Asset management giant BlackRock has tokenized its securities products on Ethereum, and Robinhood also announced the launch of its Ethereum-based Layer 2 network during the conference, with the goal of directly targeting RWA and securities tokenization.

These actions clearly show that large traditional financial institutions value Ethereum’s security and decentralized characteristics as the settlement layer rather than simply trading speed.

“DeFi (decentralized finance) will surely dominate the global market, and this will happen on Ethereum,” asserted Stańczak of the Ethereum Foundation.

Jerome de Tychey said more sharply:

“Everything else is a ghost train heading in the wrong direction.”

This seems to imply that Ethereum’s position as an anchor of trust has reached a consensus in the market regardless of internal debate.