Author: f(gautham), co-founder of polynomial; compiled by AIMan@Bitchain Vision

On May 22, 2025, a hacker stole $223 million from Sui.

Then, something unprecedented happened.

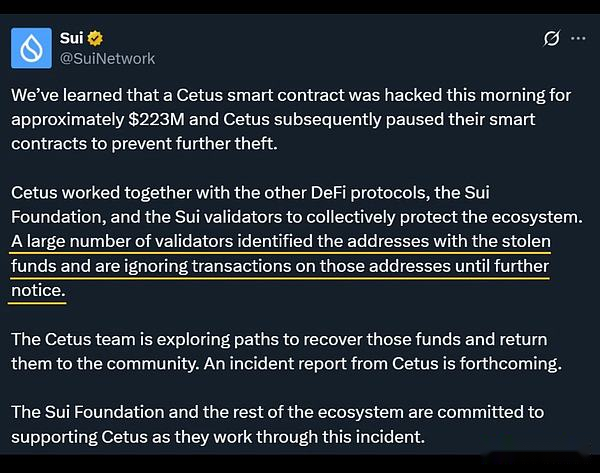

Sui validator actually banned him from entering Sui blockchain networkand frozen his funds while he ran away.

This completely overturns our perception of “decentralized” blockchain.

Here is this bizarre story.

1. Hacker attack

This hacking attack is very cruel.This guy squeezed Cetus’ liquidity pool dry, just like his own home.

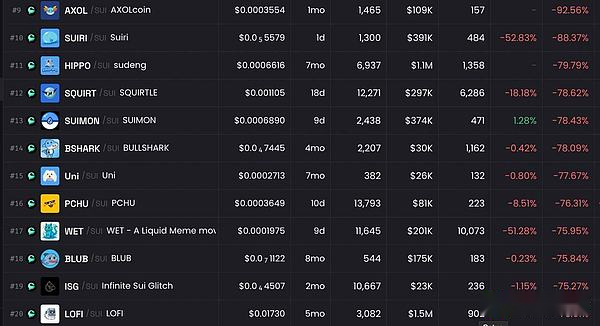

$223 million disappeared within a few hours.SUI memecoins plummeted by 75%.USDC is decoupled to zero on the chain.All swaps failed.The holder of the currency cannot even stop the loss.It was simply a massacre.

But things started to get interesting.

2. Hackers transfer funds

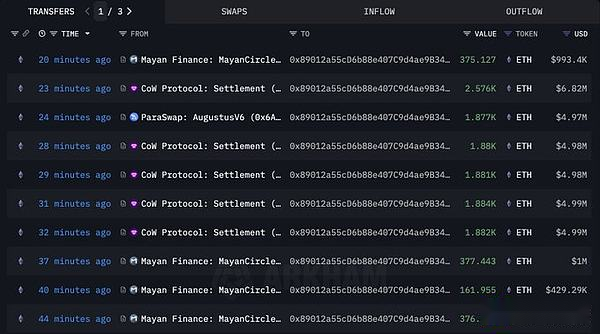

The hackers think they are unstoppable.He bridged the funds to Ethereum and began to convert them into ETH, and has transferred more than $60 million to Ethereum.

Typical escape route.It should have ended here.only……

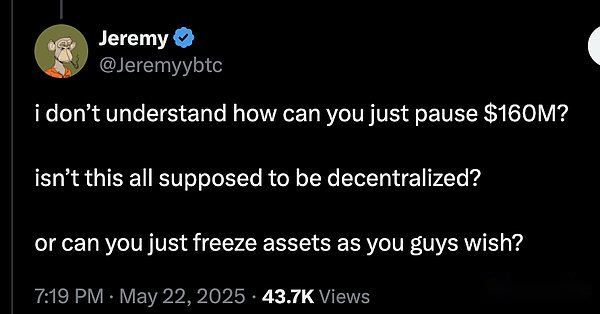

3. Sui freezes hacker wallet

Sui Verifiers have other plans.

They directly banned hackers’ wallets from entering the Sui L1 network.Frozen $162 million in transactions.The remaining stolen funds?Being imprisoned in digital prison.

No consensus is required for the court.No lengthy legal process is required.The validator just needs to say “no”.

Wait, can they really do it?This is what surprised everyone.

Yes, Sui validators can collectively reject transactions from specific wallets in extreme cases.This is not automatic and requires extensive validator consensus.But it did happen, and it was real-time.

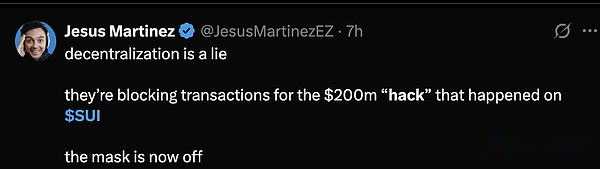

4. The cryptocurrency world is in division

Someone said, “If they can freeze funds, is this really decentralized?”

Some say, “They saved $162 million from being permanently stolen.”

Both sides have reasonable views.

But what’s important: This completely changes the assumptions about Layer-1 security.

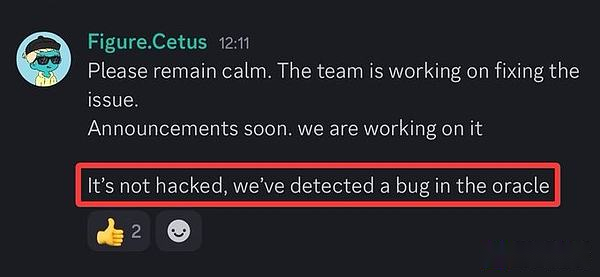

5. Hacker attacks and team response details

The details are not clear yet and no official incident reports have been received.

Known information: Hackers control the liquidity pool priced in SUI and systematically drain it.Cetus initially called it a “oracle vulnerability”, but the complete exploitation method remains unclear.

Cetus’ reaction is truly impressive:

-

Suspend the contract immediately to prevent further theft

-

Work with Sui Foundation and Verifiers

-

Tag hacker accounts across the ecosystem

-

Work with professional anti-cybercrime organizations

-

Providing professional damage controls with white hat settlement terms.

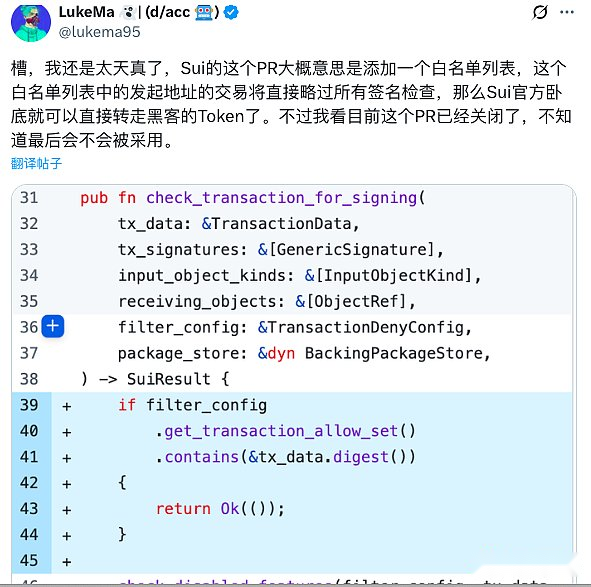

The Sui team said thatMost validators agree to ignore any transactions that hacker wallet addresses, and released a PR that requires each validator to deploy patch code so that they can take away $160 million stolen by hackers through unsigned transactions.

6. How to evaluate

Sui’s validator coordination is very fast.In traditional finance, it takes weeks to freeze stolen funds.And here?It only takes a few hours.

Do you think this is a good emergency response or a centralized problem depends on your perspective.

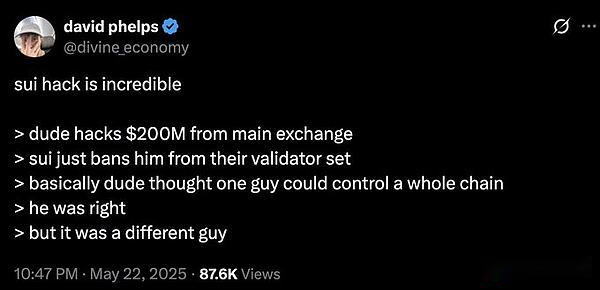

7.Hacker’s Error

I thought one person could control the entire chain.His judgment of control is correct, but his judgment of who has control is wrong.

It turned out that the problem was not his, but the joint efforts of the validators.

Collective power is greater than personal attacks.

8. What’s next?

Cetus is negotiating with the hacker to return funds.

Relevant legal measures have been initiated.

A complete incident report is about to be released.

But the real question is: Will other L1s adopt similar emergency mechanisms?