1. Rise of force: USD1 expands rapidly

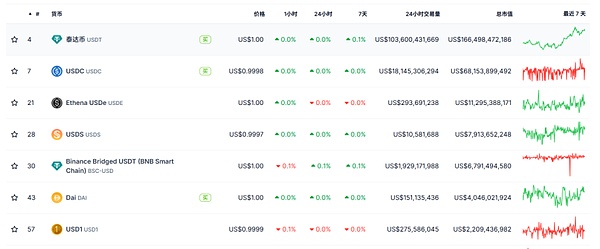

Earlier this year, WLF announced its first plan to launch the USD1, a stablecoin for institutions.USD1 anchors the dollar value at a ratio of 1:1. The asset reserves are composed of cash, US Treasury bonds and equivalents. The asset custodian is BitGo. The accounting firm Crowe LLP issues a monthly reserve forensic report. The industry generally believes that it has high transparency and credibility.In early March this year, USD1 was officially issued, with a supply of US$3.5 million at the time of issuance. As of now, its market value has exceeded US$2.7 billion, ranking seventh in stablecoins.

(Figure 1: Stablecoin market value ranking. Source: coingecko)

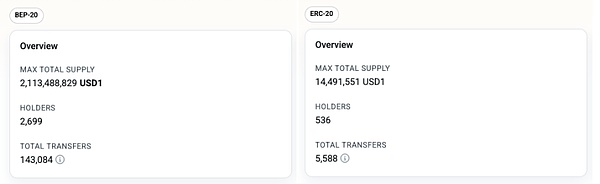

USD1 has attracted much attention since its birth and has risen rapidly in recent months with its background advantages.USD1 is almost entirely released on the BNB chain.According to BscScan data, the supply of USD1 issued on the BNB chain reached US$2.1 billion, accounting for more than 99% of its total circulation. According to Etherscan data, the Ethereum version was only US$14.5 million. Subsequently, various public chains with a large proportion of transactions, such as Tron, launched USD1 to meet the capital needs on the chain.In just a few months, USD1 has been online on mainstream exchanges such as Binance, Bitget, Bybit, etc., quickly entering multiple on-chain ecosystems.

(Figure 2: Comparison of BNB Chain (BEP-20) with USD1 on Ethereum (ERC-20). Source: BscScan, Etherscan)

The rapid expansion of USD1 cannot be separated from the support of major exchanges.Binance was the first to launch USD1 in April. PancakeSwap cooperated with the activity to increase exposure, and related memecoin quickly swept the market. For example, $B that exceeded $400M in ten days triggered another wave of small climax on the BNB chain.Bitget and Bybit successively launched USD1 in June and July, and launched airdrop and reward plans, further opening up liquidity and user portals.

2. Political Elements: Off-State Controversy in USD1

While paying attention to USD1 product design, users also have a strong interest in USD1’s political background.As we all know, USD1 comes from WIF, and behind WIF is the Trump family at its peak.Therefore, one of the biggest features of USD1 is its deep binding with the Trump family, which may also explain from the side why USD1 has such strong market mobilization capabilities, and even allows Abu Dhabi investment fund MGX to choose to use about USD1 to invest in Binance.The resources of the Trump family, coupled with the endorsement of international capital, allowed USD1 to gain a different growth environment from most stablecoins from the beginning.

However, as the circulation of USD1 surges, more and more people and even politicians have begun to question whether the Trump family is using their political status to seek commercial benefits for themselves.For example, several senators on the U.S. Senate Banking Committee have sent open letters to regulators asking for a review of USD1 compliance and potential conflicts of interest, believing that the independence of regulators may be hit hard if the presidential family profits directly from the stablecoin business.

In fact, this concern is not groundless. The sensational memecoin $TRUMP in January this year has caused similar doubts.At that time, the token was believed to be possible to bypass campaign fund regulation and become an important channel for the Trump family to obtain opaque benefits and even political bribes.Although USD1 and Trump are very different in positioning and nature, there is a similar core question: whether the Trump family is gaining additional political or economic advantages through the cryptocurrency market.Some media pointed out that the cooperation between USD1 and Binance may have more exchanges of interests. After all, Binance has faced long-term scrutiny from US regulators, and Binance has performed particularly positively in the promotion and application of USD1.The outside world is generally worried that this practice will make stablecoins a rent-seeking tool for politicians, further increasing the difficulty of supervision and undermining social fairness.

At present, the US Congress is already promoting the implementation of new stablecoin laws and more crypto asset regulatory rules. Whether USD1 can successfully acquire and maintain its compliance status will directly affect its long-term development.Especially in the context of a bipartisan game, some lawmakers may propose special restrictions on the operation of crypto assets by President Trump’s family. USD1, as the “leading bird”, faces certain political uncertainty and compliance risks.

Despite several controversies, USD1 still provides crypto asset investors with more optional trading media and creates a more convenient market environment, which is increasingly favored by investors.